Advanced Durable Goods Shipments in April 2024: Mixed Signals

Luis Alvarez

The Census Bureau recently released its monthly advance report on shipping inventories and orders from durable goods manufacturers. This report, released at 8:30 AM on May 24, 2024, includes revised estimates of U.S. durable goods shipments for the month of April 2024. In this article We provide an in-depth analysis of the data just released and discuss its impact on the U.S. economy and financial asset prices.

According to the census, actual shipments of high-end durable goods (adjusted for inflation) increased +1.09%, representing a +0.68% acceleration from the previous month. In fact, shipments from advanced durable goods manufacturers increased +8.57% on a three-month annualized basis, well above the historical median (82nd percentile).

However, growth in Real Core durable goods shipments (excluding transportation) in particular actually decreased -0.52% on a three-month annualized basis (40th percentile). Additionally, excluding the defense industry, the leading index of new orders this month decreased by -0.64%. and transportation equipment.

Now the problem is: Should investors adjust their economic forecasts and/or investment strategies based on a thorough analysis of shipping data and initial market reaction to it?

The answer is never obvious. Investment success largely depends on finding hard-to-obtain information and/or insights that provide an informational and/or analytical edge. This requires both diligence and skill. Our methodology, which focuses on five key questions, helps you gain an edge when analyzing recently published economic reports.

-

Did anything surprise you?

-

What causes surprise?

-

Did that surprise change the macroeconomic outlook?

-

Is there anything in this report that was misunderstood or overlooked?

-

Has the initial market reaction created an actionable opportunity?

This article will address these questions while guiding readers through a four-step process. First, we will perform a comprehensive analysis of recently published reports. Second, we will update our macroeconomic outlook based on this analysis. Third, we will adjust investment evaluations for major asset classes. Finally, we will provide actionable insights so readers can leverage our analysis.

headline data

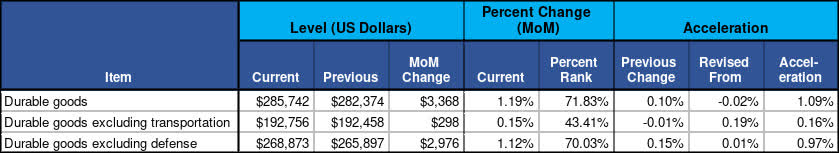

We begin our analysis by reviewing the headline data summarized in Figure 1. Readers are encouraged to note the percentile ranking of the rate of change (growth or contraction) and sequential momentum (acceleration or deceleration).

Figure 1: Change, acceleration, anticipation, surprise

Durable Goods Data Summary (Census and Investor Insights)

As shown in Figure 1, the nominal dollar value of advanced durable goods shipments (unadjusted for inflation) in April 2024 totaled $285.74 billion. Month-on-month change of +1.19% ranks in the 72nd percentile. This growth represented an acceleration of +1.09% month-on-month.

Deep dive into your data

This section of the report will guide readers through a comprehensive analysis of the latest advanced durable goods shipping data. The analysis is divided into three subsections. 1) Inflation impact analysis. 2) Rate and momentum of change of components. three). Attribution analysis. The goal of this section is to pinpoint the specific causes of major accelerations and uncover anything that may have been misunderstood or overlooked by market participants.

Price Matters: How Inflation and Deflation Affect Delivery of Luxury Durables

This subsection highlights the impact of price changes (inflation or deflation) on luxury durable goods delivery data. Any serious analysis must take this issue seriously, because price changes directly affect the quantity of goods and/or services that can be purchased for a certain amount of money.

Figure 2 shows manufacturing shipments in “current dollars” and “actual” terms. The “real” figure adjusts the nominal current dollar figure for changes in purchasing power due to inflation/(deflation).

Figure 2: Premium Durable Goods Shipments in Current Dollars, Adjusted for Inflation.

Inflation Adjustment to Nominal Durable Goods Shipment Data (Census and Investor Insights)

As shown in Figure 2, as of April, advanced durable goods in dollar terms are estimated to have grown +1.19% (72nd percentile) compared to the previous month. However, during the month prices increased by +0.10%, resulting in an increase of +1.09% (75th percentile) in real terms.

Actual rate of change and momentum in shipments of advanced durable goods

In this section, we break down luxury durable goods into their key components and scrutinize their annual growth rates over different time periods (1 month, 3 months, 6 months, and 12 months). The purpose of this analysis is twofold. Our first objective is to identify which components of retail sales are growing at a faster or slower rate than the overall aggregate. The second objective is to determine whether and to what extent growth rates accelerate or decelerate over different periods.

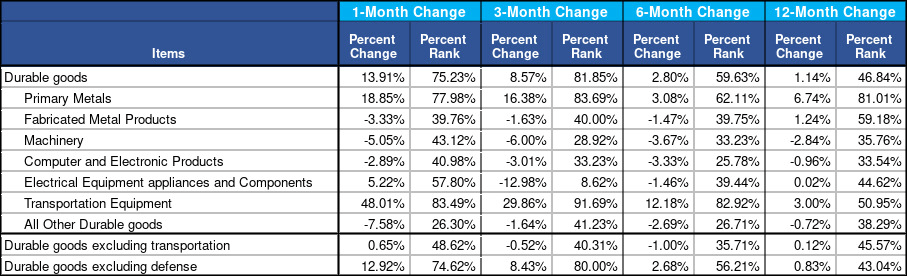

Figure 3: Annual growth rates of key components

Annual Trends in Actual Durable Goods Delivery Data (Census and Investor Insights)

The strength and momentum of overall growth. As shown in Figure 3, overall real premium durable goods manufacturers’ three-month annualized shipments (+8.57%) were well above the historical median (82nd percentile), in part due to high three-month annualized rates. Current month (+13.91%).

Differences in rates of change between categories. The volatile transportation equipment category grew rapidly on a real three-month average annual basis (+29.86%). Durable goods excluding transportation actually decreased by -0.52% (40th percentile) on a three-month annualized basis.

Attribution Analysis: Change and Acceleration in Actual Advanced Durable Goods Shipments

This section focuses on identifying which components of actual durable goods shipments are driving the month-on-month increase (contraction) and month-on-month acceleration (deceleration) in overall real durable goods shipment figures.

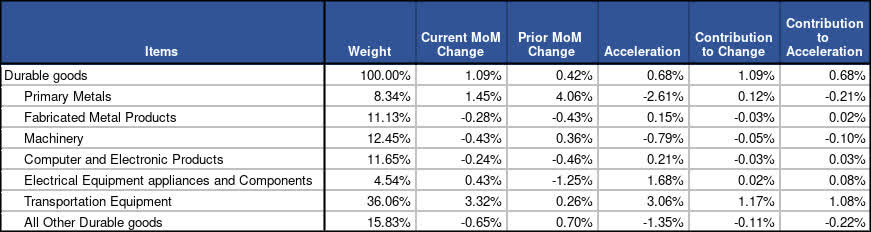

Figure 4: Real premium durable goods contribution to change and acceleration

Component contributions to actual durable goods delivery data (census and investor insights)

As shown in Figure 4, the month-on-month change in real durable goods shipments in April (+1.09%) increased by +0.68% compared to the previous month (+0.42%). This is caused almost entirely by transportation equipment. In fact, durable goods excluding transportation slowed by -0.40%, with the largest contributors to the slowdown being primary metals (+-0.21%) and all other durable goods (-0.22%).

US economic outlook

This section addresses the following questions: Based on the comprehensive analysis of Advanced Shipments data just released, what changes should you make to your macroeconomic forecasts and/or overall outlook for the U.S. economy?

The overall outlook for the current U.S. economy depends on whether the U.S. economy has a ‘soft landing’. How does the thorough analysis of the just-released luxury durable goods shipment data affect the analysis of this question?

Actual shipments of advanced durable goods in April increased well above the average (82nd percentile) over the past three months. However, a closer look at the data shows that these excess returns are almost entirely due to transportation equipment (primarily aircraft), a highly volatile category. Excluding transportation, manufacturers’ shipments have actually declined over the past three months, historically ranking in the 40th percentile. However, it should be noted that this performance has improved compared to the past three months.

Focusing on durable goods orders, which are considered a leading indicator of economic activity, the picture is distorted by the performance of the volatile transportation and non-cyclical defense sectors. On a monthly basis, our orders have exceeded our expectations for negative printing. However, new orders excluding transportation equipment and defense decreased by -0.64%. There was still some upward movement, but then there was contraction and deceleration.

Additionally, downward revisions to historical data have completely erased the positive impact of surprises in MoM orders data on Nowcast. In fact, the net impact on broadcasting as of three months has been negative. Moreover, almost all of the strength in the monthly orders data was due to defense orders, which recorded +15.2% MoM compared to -1.5% for non-defense industries.

So, when we look more closely at the data, both shipment and order data for durable goods are less optimistic than the headlines suggest. Nonetheless, the durable goods data does not appear to suggest a slowdown in durable goods activity that would depress overall U.S. economic growth. Overall, durable goods data is weak, but it is unlikely to have a significant negative impact on future U.S. economic growth projections.

Although April’s durable goods data is mixed, it is important to note that most economic activity indicators reported in April point towards a significant slowdown in economic activity.

If May’s economic data confirms a significant slowdown in U.S. economic growth, it could put the Fed in a very difficult situation. Unless inflation measures ease substantially, the Fed’s ability to support the economy by lowering interest rates will be extremely limited.

Most importantly, the risks to the inflation outlook, which could lead to severe financial tightening, are being underestimated. These include a potential oil price shock due to instability in the Middle East.

Therefore, we believe that financial markets are generally underprepared for the risk that financial conditions could tighten significantly in the second half of 2024 while the economy is slowing.

market outlook

U.S. Treasury yields rose slightly across the curve following the release of the durable goods shipments and orders report. Typically, signs that the economy is growing at an above-average rate with inflation overheating tend to raise concerns about inflation and the Fed’s path to interest rate cuts. With inflation that high, there is little justification for the Fed to cut interest rates as long as the economy is growing at an average or above-average rate.

In the medium term, we believe the stock market may face headwinds due to slowing economic growth and relatively tight financial conditions. However, we believe the biggest risk to the stock market is the prospect that a surge in oil prices (CL1:COM) could have a negative impact on growth and increase inflation.

It is our view that U.S. stock prices will be driven by Middle East news and other geopolitical developments for most of the second half of 2024.

In this regard, we expect a combination of tight oil market fundamentals and geopolitical events to trigger a major oil price shock that could push oil prices well above $100. Our recent article details the likelihood and severity of an oil shock this year.

concluding thoughts

Our investment group team has positioned portfolios in a way that takes a variety of risks into account. Above all, we are positioning our portfolio for the risk of a significant oil price shock, especially in the second half of 2024. Second, I think the risk of a serious slowdown in U.S. economic growth is increasing. Third, I believe that the current macroeconomic situation makes it highly likely that a U.S. recession will occur if oil prices surge significantly.

In this context, we believe that very special opportunities will emerge in the second half of 2024, starting between June and August.