Ahead of the Market: 10 Things That Will Decide Tuesday’s D-Street Action

The blue-chip NSE Nifty 50 index was trading 0.05 per cent higher at 21,742 points, while the S&P BSE Sensex was trading 0.04 per cent higher at 72,272 points. Both indices rose about 0.5% each, hitting record highs in the afternoon session and trading higher at the close.

Here’s how analysts read the market pulse.

“Nifty remained volatile throughout the session as traders remained indecisive. On the hourly chart, Nifty closed on a positive note after falling below 20 DMA intraday. Going forward, a decisive decline below 21,650 could lead to a directional downturn. “A break above 21,750 at the upper end could push the index to higher levels,” said Rupak De, senior technical analyst at LKP Securities.

“The index needs to close decisively above 21,800 to recover the loss bias,” said Avdhut Bagkar of StoxBox. “An aggressive pullback of the 21,500 support could intensify selling pressure. Options data shows PE has surged to 21,700. ., with sighting records from 21,800 CE.”

That said, let’s take a look at some key indicators that suggest action on Tuesday.

american market

The U.S. stock market was also closed on Monday, Lunar New Year’s Day.

european stocks

Most European stock markets were closed on Monday for New Year’s Day.

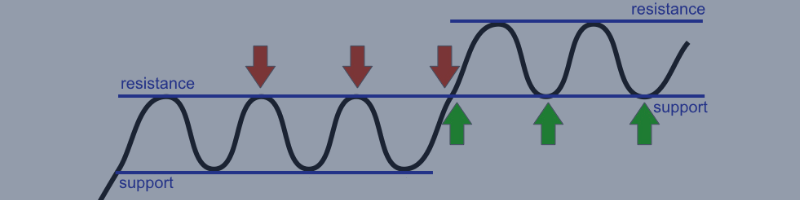

Tech View: High wave type candlestick

After hitting a new record on the first day of the year, Nifty rose 11 points on Monday, forming a high-wave candle pattern on the daily chart.

Positive chart patterns like higher highs and lows remain intact on the daily chart and Nifty is currently forming new higher highs in the sequence. A decisive move above the 21,850 level is expected to negate the current bearish effect and open up further upside in the near term. Immediate support lies at the 21,550 level, said Nagaraj Shetti of HDFC Securities.

Stocks with a bullish bias

Momentum indicator Moving Average Convergence Divergence (MACD) showed bullish trading on counters including Sun Pharma Advanced Research, Vodafone Idea, Fortis Healthcare, CESC, LIC and Ashok Leyland.

MACD is known to indicate a trend reversal in a traded security or index. When the MACD crosses above the signal line, it sends a bullish signal, indicating that the price of the security may rise and vice versa.

Stocks predict weakness ahead

MACD showed signs of weakness across counters including Century Plyboards, SBI Card, Info Edge, Indiamart Intermesh, L&T and Swan Energy. A bearish crossover in the MACD of this counter indicates that the downward journey has just begun.

Most Active Stocks by Value

HDFC Bank (Rs 1,211 crore), Tata Motors (Rs 995 crore), Adani Enterprises (Rs 844 crore), ICICI Bank (Rs 768 crore), SBI (Rs 534 crore), RIL (Rs 521 crore) and Wipro (Rs 521 crore). (crore) 485 crore) was one of the most active stocks on NSE in terms of value. The higher activity of a counter in terms of value can help identify which counters have the highest turnover for the day.

Most active stocks by trading volume

Tata Steel (Shares traded: 2.1 billion), Tata Motors (Shares traded: 1.2 billion), Coal India (Shares traded: 1.1 billion), Wipro (Shares traded: 100 billion), ITC (Shares traded: 93 lakh), SBI (Shares traded: 82 lakh) and NTPC (Shares traded: 80 crore) were among the most traded stocks in the NSE session.

Stocks showing interest in buying

Shares of Nestle India, Coal India, Wipro, Grasim Industries and Hindalco witnessed strong buying interest from market participants as they touched new 52-week highs, indicating bullish sentiment.

Stocks under selling pressure

No major stock hit a new 52-week low on Monday.

Sentiment Meter Favors Bulls

Overall, market breadth favored the bears, with 2,509 stocks closing in the green and 1,385 stocks closing lower.

(Disclaimer: Recommendations, suggestions, views and opinions provided by experts are their own and do not represent the views of The Economic Times.)