Ahead of the Market: 10 Things That Will Decide Your Stock Trading Monday

The NSE Nifty 50 index surged to an intra-day high of 22,127 points before closing 0.72 per cent higher at 21,854 points due to selling pressure just before the close. The S&P BSE Sensex rose 0.61 per cent to 72,085.

Both benchmarks rose about 2% each this week to their highest this year, led by large-cap stocks such as Reliance Industries, which hit its highest since June 2022.

Here’s how analysts read the market pulse.

“Nifty crossed the 22,000 mark during the first half of Friday’s session, but has since formed a double top on the hourly chart. Resumption of the bullish trend will only happen with a clear breach of the double top, currently identified at around 22,125. Conversely, a break below the support level of 21,500 would It could indicate bearish momentum. In a breakout scenario above 22,150, Nifty could experience upward momentum and potentially touch levels above 22,500,” said Rupak De, senior technical analyst at LKP. stock.

Ajit Mishra, SVP, Technical Research, Religare Broking, said, “Nifty has retested all-time highs after two weeks of consolidation, but we believe it is too early to predict the next phase of the uptrend. Sustainability is needed for that. 22,150 heading towards 22,500+ Marching. Besides, consistent participation of banking majors is also important to maintain a steady trend, otherwise the range-bound trend will continue. Traders should focus more on stock selection and hold positions on both sides in the current scenario. ..”

That said, let’s take a look at some key indicators that suggest action on Monday.

US market closes sharply higher

U.S. stocks surged Friday and the S&P 500 hit a record high as solid earnings and an explosive January jobs report boosted confidence in the economy while lowering the likelihood that the Federal Reserve will cut interest rates any time soon. The rally capped a tumultuous week filled with high-profile earnings, the Federal Reserve’s interest rate decision and renewed anxiety about weakness in local banks. All three major U.S. stock indices recorded gains for four consecutive weeks.

European stocks close flat

European stocks were little changed on Friday as gains on positive corporate earnings offset hotter-than-expected U.S. employment data that dashed expectations of an imminent interest rate cut by the Federal Reserve. The pan-European STOXX 600 index was flat on the day and remained almost flat. It hit a two-year high earlier this week. Germany’s DAX 40 index closed 0.35% higher, hitting a record intraday high.

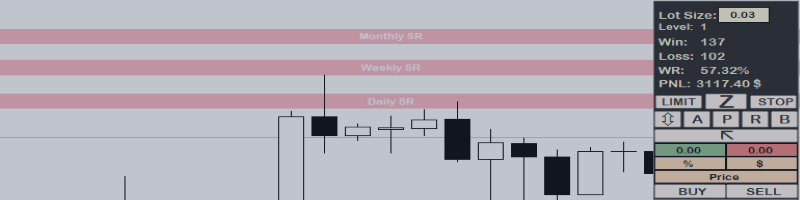

Tech View: Small Candles

On Friday, Nifty rose by 156 points and formed a small candle on the daily chart, but formed a bearish meteor-shaped candle on the daily chart.

Nifty’s short-term upward trend remains intact. However, the overall chart pattern suggests that high volatility is likely at new highs. Any attempts to rise from here may face strong resistance near the 22100-22200 level, which could lead to near-term weakness off the highs. Nagaraj Shetti of HDFC Securities said immediate support is at 21700 levels.

Stocks with a bullish bias:

Momentum indicator Moving Average Convergence Divergence (MACD) showed bullish trading on counters including Motherson Engineers India, Indian Oil Corporation, Abbott India, Aditya Birla Corporation, Redington and Adani Ports.

MACD is known to indicate a trend reversal in a traded security or index. When the MACD crosses above the signal line, it sends a bullish signal, indicating that the price of the security may rise and vice versa.

Stocks predict weakness ahead

MACD showed bearish signs on counters Ircon International, Linde India, SKF India, Godrej Industries, Grindwell Norton and Eris Lifesciences. A bearish crossover in the MACD of this counter indicates that it has just begun its downward journey.

Most Active Stocks by Value

HDFC Bank (Rs 3,279 crore), RIL (Rs 2,862 crore), L&T (Rs 2,576 crore), BPCL (Rs 2,126 crore), SBI (Rs 1,796 crore), ICICI Bank (Rs 1,532 crore) and Infosys (Rs 1,334 crore). ) has been one of the most active stocks on the NSE in terms of value. The higher activity of a counter in terms of value can help identify which counters have the highest turnover for the day.

Most active stocks by trading volume

Tata Steel (shares traded: 6.9 billion), BPCL (shares traded: 3.8 billion), Power Grid (shares traded: 3.4 billion), NTPC (shares traded: 3.2 billion), ONGC (shares traded: 300 million), SBI (shares traded: 300 million) ), Coal India (shares traded: 2.5 crore), etc. were among the most traded stocks in the NSE session.

Stocks showing interest in buying

Shares of Paytm, Sharda Cropchem and Vedant Fashions witnessed strong buying interest from market participants as they touched new 52-week highs, indicating an optimistic mood.

Stocks under selling pressure

Shares of Vedant Fashions and UPL hit 52-week lows, signaling bearish sentiment in the market.

Sentiment Meter Favors Bulls

Overall, market breadth favored the bulls. 1,998 stocks closed in the green and 1,845 stocks closed in the red.

(Disclaimer: Recommendations, suggestions, views and opinions provided by experts are their own and do not represent the views of The Economic Times.)

(You can now subscribe to ETMarkets WhatsApp channel)