Ahold Delhaize: High single-digit free cash flow yield for a defensive stock (ADRNY).

hispanic

introduction

I previously covered Ahold Delhaize ( OTCQX:ADRNY ) in late 2021, arguing that maintaining strong operating margins would be key to closing the valuation gap with its US peers. Position in stocks.

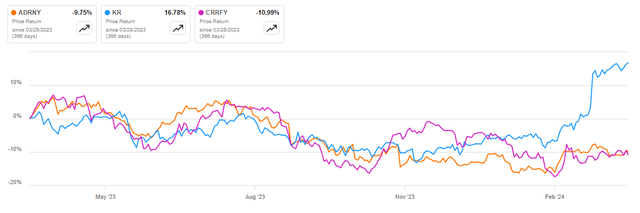

Over the past year, European grocery retailers like Ahold Delhaize and Carrefour ( OTCPK:CRRFY ) have underperformed their U.S. rivals like Kroger ( KR ).

Ahold Delhaize, Carrefour and Kroger over the past year (Look for alpha)

This has left its European peers trading at higher free cash flow yields, and we believe this will create buying opportunities for stocks like Ahold Delhaize despite expectations of slightly lower free cash flow across the grocery sector in 2024.

Company Overview

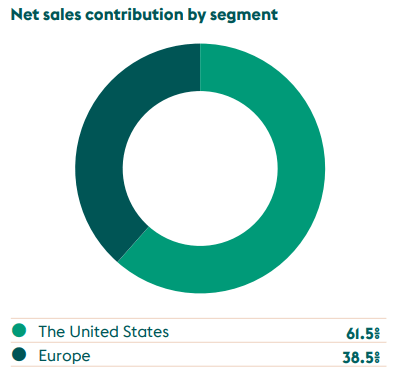

You can access all Ahold Delhaize investor resources here. Ahold Delhaize, which operates a variety of store brands, generated 61.5% of its sales in 2023. In the United States, Europe accounts for 38.5% of the company’s sales.

Sales division (Ahold Delhaize 2023 Annual Report)

From a profitability perspective, the importance of US sales is much greater, accounting for 69.5% of underlying operating profit compared to Europe’s 30.5% contribution.

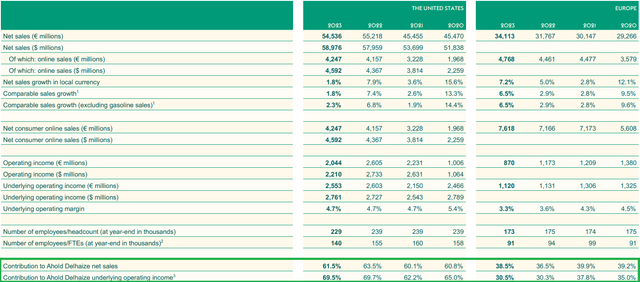

Segment Reporting (Ahold Delhaize 2023 Annual Report)

Looking at the data above, we can see that sales growth was higher in the United States during the period 2020-2022. Growth shifts to Europe 2023 – Comparable sales in Europe grew 6.5% in 2023, while in the U.S. they grew 1.8%.

Operation Overview

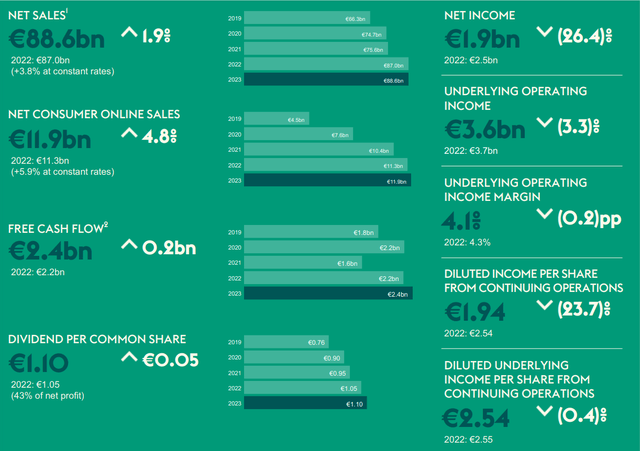

In 2023, Ahold Delhaize has grown. sales 1.9% Y/Y (2022: +15.1% with help from inflation and foreign exchange). underlying operating profit It decreased by 3.3% in 2023, which was influenced by a 0.2% Y/Y decline to 4.1% in 2023. operating profit margin. Thanks to the buyback of shares worth 1 billion euros in 2023 Basic earnings per share At €2.54 per share, it was only 0.4% lower than the previous year.

Operational Performance Highlights (Ahold Delhaize 2023 Annual Report)

free cash flow In 2023 it amounted to €2.4 billion (2022: €2.2 billion), an increase due to lower capital expenditures.

Outlook to 2024

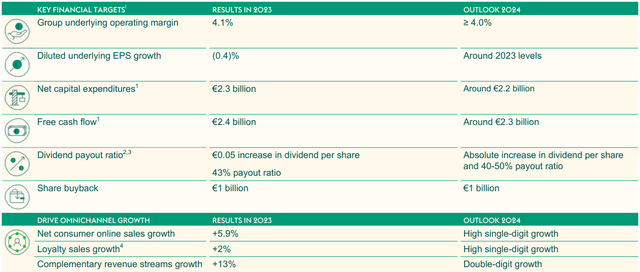

Ahold Delhaize expects flat results in 2024, with similar operating margins, earnings per share and slightly lower free cash flow of €2.3 billion.

Ahold Delhaize 2024 Outlook (Ahold Delhaize 2023 Annual Report)

capital structure

Ahold Delhaize continues to use moderate leverage in its funding profile, with net debt of €14.3 billion at end-2023, down 1% year-on-year compared to a market capitalization of €26.4 billion. Moreover, €10.5 billion of the debt is related to lease liabilities, further limiting the financial impact on the company.

The average interest cost of debt was 5.9% in 2023 (2022: 6.4%), driven by a decline in euro coupon issuance. The company spent €1 billion on share buybacks in 2023, with a similar allocation planned for 2024.

Comparison with Carrefour

Compared to Carrefour, Ahold Delhaize recorded lower sales growth and lower free cash flow in 2023, which were offset by higher operating margins and greater leverage.

| Metrics\Company | Ahold Delhaize | Carrefour |

| Free cash flow yield to market capitalization, March 2024 | 9.1% | 14.6% |

| Sales Growth 2023 | 1.9% | 10.4% |

| Operating Profit Margin % (Basic) | 4.1% | 2.7% |

| Net Debt to Enterprise Value Ratio | 35% | 19% |

Source: Author’s calculations based on company disclosures.

Carrefour benefited from lower taxes, restructuring and working capital changes in its 2023 free cash flow, but the gap in free cash flow yield compared to Ahold Delhaize is quite large. So, I think Carrefour is the better choice at the moment. Especially if you don’t mind the French retailer’s exposure to emerging markets.

Comparison with Kroger

Compared to Kroger, Ahold Delhaize outperforms in terms of free cash flow yield, sales growth, and margins, all offset by higher leverage.

| Metrics\Company | Ahold Delhaize | hook |

| Free cash flow yield to market capitalization, March 2024 | 9.1% | 7.8% |

| Sales Growth 2023 | 1.9% | 1.2% |

| Operating profit margin % (basic) | 4.1% | 3.3% |

| Net Debt to Enterprise Value Ratio | 35% | 21% |

Source: Author’s calculations based on company disclosures.

Overall, Ahold Delhaize’s sales have grown faster than Kroger’s due to Kroger’s European exposure, but Ahold Delhaize boasts stronger free cash flow returns and higher margins, making it appear to be the better choice of the two companies.

danger

The main risk facing Ahold Delhaize is the erosion of its dominant operating margin position. Although it has already fallen from 4.3% to 4.1% in 2023, it is still high compared to peers such as Carrefour and Kroger. Achieving performance beyond 2023 is therefore essential for the stock to maintain healthy free cash flow generation.

conclusion

Ahold Delhaize results are little changed in 2023 and more changes are expected in 2024. Stability is good for defensive stocks, and Ahold Delhaize certainly checks all the boxes. The key is whether the company can handle the decline in operating profit margin, which is a key differentiating factor compared to its peers.

Comparisons with competitors such as Carrefour and Kroger have yielded mixed results. Ahold Delhaize was found to be cheaper compared to Kroger but more expensive than Carrefour. Nonetheless, I think Ahold Delhaize will continue to perform well in key U.S. markets and ultimately achieve a higher valuation. For investors who don’t mind greater emerging market exposure, Carrefour may be a better choice.

With stock indices hitting record highs, it may be a good idea to consider defensive stocks like Ahold Delhaize. I expect the company to return to free cash flow growth starting in 2025, which will complement its already attractive free cash flow yield. As a result, I rate the stock a Buy.

Thanks for reading.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.