AI stocks in the S&P 500 are showing outstanding performance not only in the ‘Magnificent Seven’ but also in 2024.

It’s not just the top seven companies in the S&P 500 that are benefiting from the stock market frenzy surrounding artificial intelligence, according to Bespoke Investment Group.

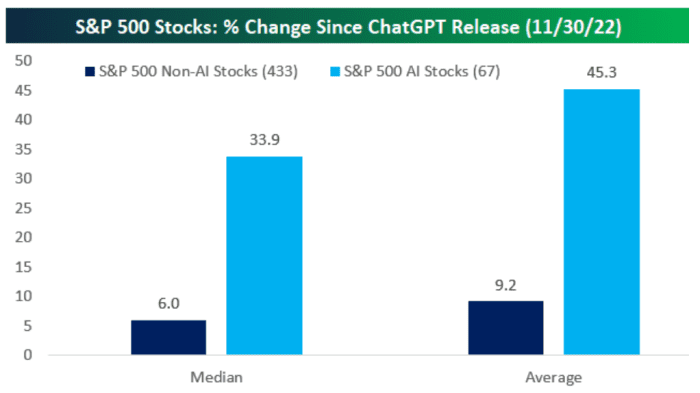

Bespoke said in an emailed note Tuesday that 67 AI-related stocks in the S&P 500 have surged an average of 45.3% since late November 2022, when “the first version of ChatGPT was released to the public.” “The remaining 433 non-AI stocks in the S&P 500 rose only 9.2% over the same period.”

BESPOKE Investment Group Notes were emailed in February. 20th, 2024

Nvidia Corporation NVDA,

The chipmaker, which has profited handsomely from investor enthusiasm for AI, is scheduled to report fourth-quarter results after U.S. stock markets close on Wednesday. The company’s massive market value of about $1.8 trillion makes it the highest weighting in the S&P 500, and its rise last year was driven by a group of seven megacap technology stocks.

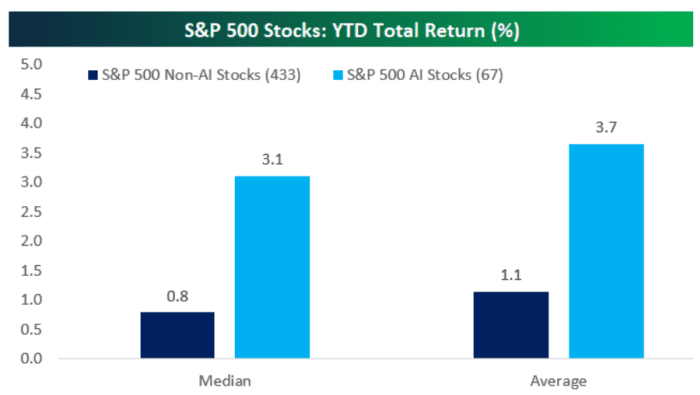

“AI stocks continue to attract most of the attention of the investment world,” Bespoke said. “Year to date, the average S&P 500 AI stock is up 3.7%, while non-AI stocks are up 1.1%,” the company said.

BESPOKE Investment Group Notes were emailed in February. 20th, 2024

Nvidia’s stock was down about 6% Tuesday afternoon. But despite the decline, the stock has surged more than 37% this year, according to FactSet data.

Technology sector of the S&P 500 XX:SP500.45,

Shares that include Nvidia are up more than 5% so far in 2024 as of Tuesday afternoon trading.

Meanwhile, shares of the Roundhill Magnificent Seven ETF MAGS are held by Microsoft Corp. MSFT,

Apple Inc. AAPL,

NVIDIA, Amazon.com Inc. AMZN,

Facebook parent company Meta Platforms Inc. META,

Google parent company Alphabet Inc. GOOGL,

exorcism,

and Tesla Inc. TSLA,

— It’s up nearly 8% so far this year, according to FactSet data.

The S&P 500 has been declining over the same period and is up about 4% in 2024.

Five of the “Magnificent Seven” stocks rose this year, with Nvidia leading the way. As of 2024, only Apple and Tesla are in deficit.

Besides the Magnificent Seven, “some of the most widely followed large AI stocks” include Advanced Micro Devices Inc. AMD,

Service Now Now Co., Ltd.

AVGO, Broadcom Inc.;

Intuitive Surgical Co., Ltd. ISRG,

Salesforce CRM,

and Intel Corp. INTC,

Bespoke notes that while Intel is down this year, the other six companies have outperformed the S&P 500 so far in 2024.

But on Friday, the 67 AI-related stocks in the S&P 500 tracked by Bespoke “took a breather” and fell an average of 1.3%, while “non-AI stocks” fell just 0.3%.

U.S. stocks fell Tuesday after a three-day weekend commemorating Presidents’ Day on Monday. In afternoon trading Tuesday, the S&P 500 SPX was down 0.8%, the Dow Jones Industrial Average DJIA was down 0.2% and the tech-heavy Nasdaq Composite COMP was down 1.3%, according to FactSet data.

read: BofA says higher interest rates are needed to burst the AI ’baby bubble’ in stocks.