AIG 2024 Outlook: Underwriting Improves Valuation (NYSE:AIG)

Dan Kitwood

American International Group (New York Stock Exchange: AIG) The stock has risen steadily since its April 2023 low following the regional financial crisis, rising more than 40% from its low. Write about your company in September, I rate AIG a Buy, arguing that the stock could rise to around $70 over the next 12 months. With the stock returning more than 14% since then and within 4% of our target price, now is a good time to reexamine the stock and consider expectations for 2024.

pursue alpha

In the company’s third quarter, it earned $1.62 in adjusted EPS, and the company’s adjusted book value was $78.17, up 3% from last year. However, consolidated results include financial information of consolidated subsidiaries. AIG is reducing its stake, but still owns a 52% stake in Corebridge Financial (CRBG).), a former retired division spun off through an IPO. That stake is now worth about $8 billion. When reviewing AIG’s financial position, we exclude the consolidated results of CRBG and instead independently evaluate AIG’s value and add back the market value of CRBG’s shares. For more information about Corebridge, which I evaluated for purchase, please read my article. article At the company since December. This stake is worth about $11 per share.

AIG, which now has a “Retirement” division within Corebridge, is now a property and casualty insurer that reports independent results to its “Casualty” reporting division. My bullish case for AIG is supported by continued improvement in underwriting quality as AIG withstands higher prices and moves away from more aggressive strategies. This went on and on.

General premiums increased 1% to $6.4 billion in the third quarter, and the company generated $611 million in underwriting revenue, up from $168 million last year, delivering a return on equity of 12.4%. Adjusted pre-tax income increased approximately 75% to $1.37 billion.

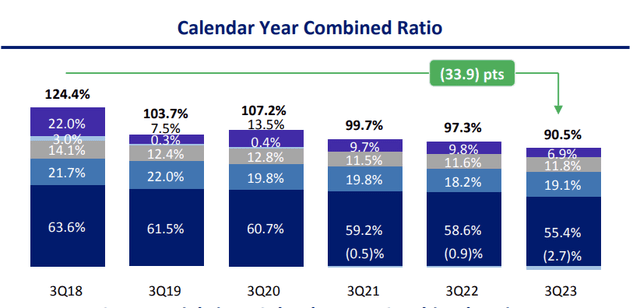

The company’s annual combined ratio was 90.5%, down from 97.3% last year. For reference, an insurer’s combined ratio represents the cost of insurance compared to premiums, and 100% represents the break-even point. So AIG is generating about 9.5% from an underwriting perspective. Some of this strength is due to favorable disaster outcomes, with losses of $367 million primarily related to the Hawaiian wildfires in 2022, compared to $556 million caused by Hurricane Ian. As you can see below, although the relatively quiet disaster environment favored results, AIG continued to lower its combined ratio.

AIG

Now, AIG continues to make progress in its underwriting, but results are not yet fully where desired. In North America, commercial business is leading the improvement with a combined ratio of 88.9%. There may be limited room for improvement here. However, although personal insurance continues to improve, losses still range from 116.4% to 113%. Although AIG’s business is concentrated in the more profitable commercial segment, gradually bringing its private businesses closer to breakeven could help AIG achieve truly strong underwriting margins.

Disaster losses now tend to be concentrated in the third quarter of the peak hurricane season. Cutting that down by 75% (to weight it equally across the year and provide a more accurate run-rate revenue picture), AIG generated about $880 million in underwriting revenue during the third quarter. Insurers also continually reassess existing reserves based on how their policies perform compared to actuarial expectations.

During the quarter, AIG made a favorable advance of $210 million over the previous year. In other words, the policy is performing better than expected. This is consistent with the company’s steady improvement in underwriting. This move makes us more comfortable with the company’s reserves and book value. However, such developments should not be considered part of the bottom line. Excluding that, this “run rate” general underwriting revenue of $670 million is consistent with the high end of the $2.6 billion to $2.8 billion range I used to value AIG.

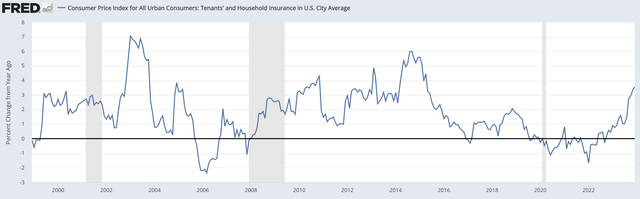

Importantly, we expect 2024 acquisition results to maintain at least the current level of momentum, even if product mix changes may slightly increase the incident year combined percentage of fourth quarter revenue. The reason we expect underwriting results in 2024 to be at least as good as 2023 (barring the unpredictable escalation of major disasters each year) is the inflation lag. Most premiums are set in 6 to 12 month increments. If repair costs rise quickly due to inflation, losses may be higher than modeled, and insurers will try to recoup these costs later through increased premiums. Inflation rose significantly in 2021-2022 and has now moderated. But premiums have lagged and are actually now at their highest level in a decade. The combination of higher premiums and lower inflation will help expand insurance margins in 2024.

St. Louis Federal Reserve Bank

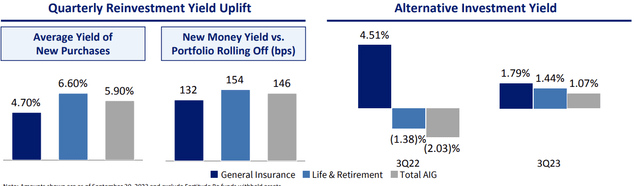

As AIG’s underwriting audits improve results, the rate increases and higher customer retention levels currently occurring will continue to support solid underwriting results. In addition, AIG has been a beneficiary of high interest rates, investing its $77 billion investment portfolio in high-yield securities. Investment income was $756 million, up from $582 million last year and consistent with my projected run rate of $3 billion.

AIG achieved this growth despite yielding only 1.8% for alternatives. Alternative investment returns often lag the S&P 500 by about a quarter, so expect another poor performance in the fourth quarter. The strong recovery seen in the stock market over the past two months will provide a tailwind to performance in the first and second quarters of 2024. The biggest driver of AIG investment returns is interest rates. AIG’s portfolio life span is 4.1 years, so a significant portion is rolled out and reinvested each year. The portfolio yield is 3.61%, so even if the Federal Reserve cuts rates several times this year, AIG will be able to reinvest its maturing bonds at higher yields.

As you can see below, in the third quarter, the property/casualty insurance sector purchased bonds at an average rate of 4.7%, about 132 basis points above maturing securities. Given these reinvestment spreads, we will continue to see positive reinvestment activity through 2024 unless the Fed cuts interest rates by more than 150 basis points. Although these tailwinds will slow, investment income should remain at least $750 per quarter in 2024, if not slightly higher.

AIG

AIG’s portfolio is also conservative, focusing on investment grade corporate and government securities and billions of dollars in cash equivalents. That means we have 5% of our commercial mortgage portfolio, and a third of this amount is in our offices. The office is an area I’m concerned about, but the ~1.7% weighting is quite low. Additionally, the weighted average loan-to-value ratio for commercial mortgages is 59%. That means real estate values could fall significantly before AIG starts to incur losses. Although these exposures should be monitored, they are not considered a significant risk.

Finally, AIG’s cost savings continued to decline, from $518 million last year to $421 million. In terms of its balance sheet, AIG has 26% debt to adjusted capital, and the insurance company is conservatively capitalized with a risk-based capital ratio of 465-475% (over 400% is the critical level here).

AIG’s holding company had $3.6 billion in liquidity as of September 30. This is a company that pays dividends and performs share buybacks, which are a key part of AIG’s value story. In the third quarter, repurchases amounted to $785 million. Share buybacks have reduced share count by 5.7% over the past year.

Now, after the end of the quarter, it has sold Validus for $3.3 billion in cash and $275 million in RenaissanceRe (RNR) stock. The specialist reinsurer was acquired to strengthen AIG’s underwriting expertise. On a stand-alone basis, the deal fell through as AIG acquired Validus for $5.6 billion in 2018. Now, AIG’s own acquisitions have improved dramatically since 2018. It’s hard to know whether these improvements can be linked to this deal.

Still, AIG’s parent company liquidity should be more than $6 billion when it reports fourth-quarter results. Bolstered by these proceeds, management plans to accelerate share buybacks in the fourth quarter and through 2024, aiming to reduce debt by completing $7.5 billion in share buybacks and reducing its share count by about 15%. The company would need to do about $1.5 billion in quarterly share buybacks, and factoring in these proceeds, continued sales of Corebridge stock, and dividends from the insurance company to the holding company would make it sustainable through 2024.

In fact, the stock’s strength during the fourth quarter may have helped boost AIG’s own purchases. This share repurchase program will help boost the stock price. In 2024, we continue to expect pre-tax earnings of $4.2 billion, with approximately $2.6 billion to $2.8 billion from acquisitions and approximately $3.1 billion from investment income (excluding corporate costs of $1.7 billion). Conservatively assuming 625 million shares at the end of 2024, this would imply earnings power of approximately $4.80 to $5 by the end of next year.

Interest rate earning companies, such as insurance companies, have seen their multiples compress as investors fear that lower interest rates will lead to a gradual decline in their profits. Given AIG’s four-year duration and reinvestment spread, this will not be a significant issue unless federal funds are cut below 3%. Nonetheless, this is expected to limit revenue multiples. At 12x, AIG is worth about $58 to $60 on a standalone basis. If you add back $11 of CRBG shares, you still get a fair value of about $70, or about 90% of book value.

With shares above $67, we believe most of the gains have been achieved in AIG, and we are moving the stock to a “hold” status as it is likely to deliver market-like returns. I think greater improvement in personal insurance underwriting is a major upside risk, while a more dramatic interest rate cut from the Federal Reserve is a downside risk. I believe investors will gain more from Corebridge, its publicly traded subsidiary, than from owning AIG. Corebridge has about a 20% upside potential from my $28-$30 price target.