Airbnb Stock: Travel Will Never Go Out of Style (NASDAQ:ABNB)

Goodboy Picture Company/E+ via Getty Images

So far in 2024, investors have again adopted a long-term mindset, investing heavily in technology stocks with wide open futures. AI (and Nvidia (NVDA) in particular) is one of the biggest beneficiaries of this situation. But it’s not the only play that has room for expansion.

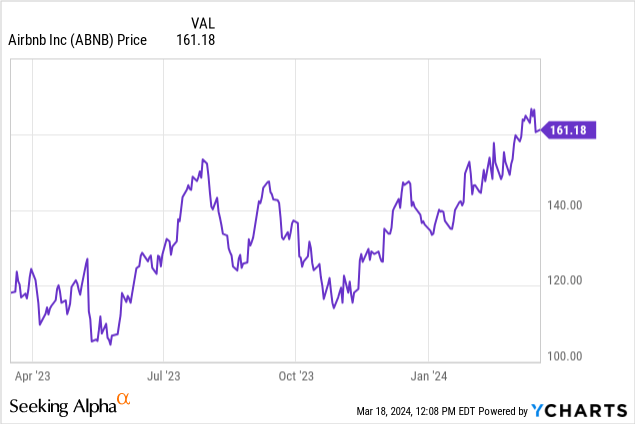

There’s no better place than Airbnb (NASDAQ:ABNB) for another long-term purchase with deep potential. The travel platform’s shares are already up about 20% year to date, with profits rising since the company’s mid-February earnings report. Nonetheless, I continue to think Airbnb will enjoy further upside through the end of the year.

Continuous platform improvements support long-term growth catalysts

I last wrote a bullish opinion piece on Airbnb in December, when the stock was trading close to $140 per share. I enjoyed meaningful benefits Since then, but I remain optimistic I’m very pleased with the potential for more upside for this stock.

In just a few years since its debut, Airbnb has gone from a disruptor in the travel industry to a true mainstay. The world seems to have adapted to Airbnb coexisting peacefully alongside hotels. While the latter emphasizes luxury, service, and amenities, Airbnb caters more to savvy, neighborhood-oriented, and budget-oriented travelers.

At the same time, Airbnb continues to adjust its platform based on user feedback. For example, much of the traveler community was fed up with exorbitant cleaning fees on the Airbnb platform, which many hosts used as an invisible pricing tool. Airbnb has since adopted the ‘total price’ option, which displays the price after taxes and fees, which many users appreciate.

The company has also made it easier for hosts to do business. We’ve launched a ‘Similar Listings’ tool to help hosts properly compare their homes to other listings in the area. This has improved the pricing efficiency of the Airbnb platform, benefiting both hosts and customers.

And while it’s not a lever currently being discussed, I think there’s still more room for Airbnb to experiment with its own pricing policies. The company currently earns 17% of total bookings (3% from hosts and 14% from guests). Although that’s relatively high, given that there are no true competitors with Airbnb’s scale and brand recognition, the company can still squeeze out a few percentage points to increase adoption without meaningfully alienating its customer base.

Here’s why I’m bullish on Airbnb for the long term:

- Airbnb’s service portfolio continues to expand beyond just a lodging platform. Airbnb continues to foster innovation to create additional revenue opportunities. Examples of these include “Experiences,” which offers local activities with local guides, and “Airbnb Rooms,” which offers affordable rooms in homes, in keeping with the company’s original couch-surfing ethos.

-

When staying longer, you choose your share of both travel and rental expenses. With many companies announcing permanent remote or hybrid work structures, many workers have seized the opportunity to work from anywhere by becoming digital nomads. Airbnb is increasingly booking long-term stays of 28 days or more. This trend will see Airbnb capture not only travel demand but also essentially “rental” budgets from digital nomads. This trend is causing average trip lengths to increase significantly.

-

Even after COVID-19, travel demand remains hot. Travelers are still making up for lost vacations since the pandemic, and while consumers appear to have curbed spending in several categories, their desire to spend on experiences hasn’t waned.

-

Opportunity to compete with OTA giants in providing hotels with a new listings platform. Hotels are essential marketing tools, but they’ve always been under pressure from Expedia (EXPE) and Booking (BKNG), which charge hefty commissions. Airbnb already allows boutique hotels to list on its platform for a fee. Over time, Airbnb may compete for a smaller portion of its business to take a larger share from OTAs.

-

Keep profitability in mind. Shortly after the pandemic struck, Airbnb laid off about 20% of its staff. Although hiring continues for now, this profit-driven mindset and the fact that Airbnb is structurally leaner than it was before the pandemic has helped the company achieve significant profitability gains.

Stay here for a long time. Airbnb’s fourth-quarter results demonstrated the resilience of the company’s growth trajectory, and it remains a good buy for the remainder of 2024.

Q4 Downloads

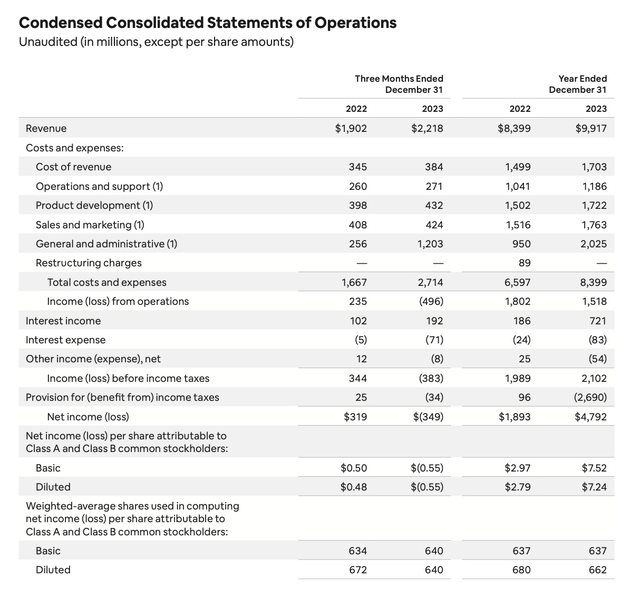

Now, let’s take a closer look at Airbnb’s latest quarterly results. The fourth quarter performance summary is below.

Airbnb Q4 Results (Airbnb Q4 Shareholder Letter)

Airbnb’s revenue increased 17% year-over-year to $2.22 billion, well ahead of Wall Street’s expectations of $2.16 billion (+13% Y/Y). In constant currency terms, Airbnb’s revenue would have fallen 14% year-over-year as Airbnb benefited from a stronger dollar.

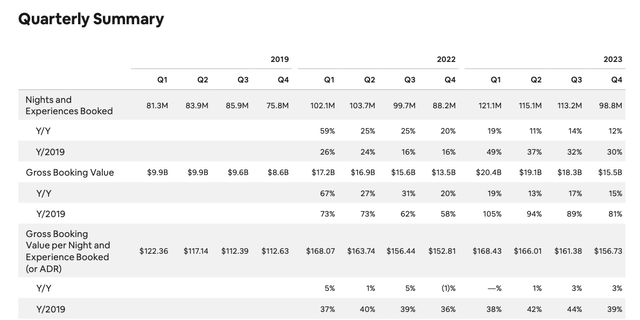

Booked nights are up 12% year over year and remain up 30% compared to the pre-pandemic quarter. At the same time, the average daily rate (ADR) continued to rise to $156.73, the company’s fourth quarter record.

Airbnb Trends Indicators (Airbnb Q4 Shareholder Letter)

In terms of regional trends, Airbnb made a significant point that travel to and from Asia continues to rebound. The number of accommodations and experiences booked in Asia increased 22% in the fourth quarter compared to the same period last year. At the same time, China’s economic recovery continues, with Airbnb bookings increasing in the world’s most populous country. 90%/year.

Latin America also continues to be another growth star, with bookings up 22% year-on-year. The company is also welcoming travelers from the region, with bookings from Chile, Peru and Ecuador more than doubling compared to pre-pandemic periods.

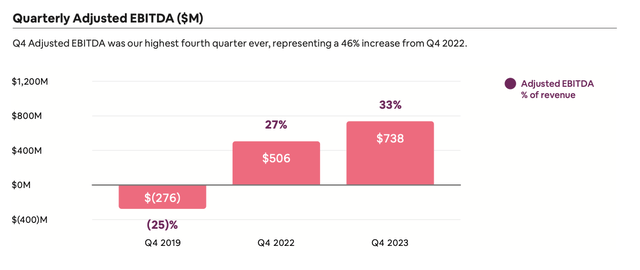

I also like the fact that Airbnb continues to drive tremendous profitability expansion. Adjusted EBITDA soared. $738 million, a 46% increase compared to the same period last year; It recorded a margin of a whopping 33%.

Airbnb Adjusted EBITDA (Airbnb Q4 Shareholder Letter)

Risks and Key Implications

Of course, Airbnb is not without risks, and the biggest risk is that local regulations are constantly evolving. However, Airbnb knows that no single city accounts for more than 2% of all bookings.

All in all, I continue to see the company experiencing significant tailwinds. We expect the 2024 Paris Olympics to be another key driver of growth (the Olympics have always put pressure on hotel availability, and the influx of Airbnb supply is the perfect sponge for this demand). And we expect continued margin growth. Stay here for a long time.