Airdrop Farming Guide & Strategy For Beginners & Experts

If this is your first time coming to our site, welcome! To our regular Airdrop Farming Savages, it’s good to see you again. Today, we’re here to discuss an elaborate airdrop farming guide & strategy, including tips.

We’re part of the airdrop class of ’17 and the BitcoinTalk Forums. So in 2018, we shared our knowledge and taught the newcomers how to earn crypto, which eventually got over 350k reads. And in 2021 when DeFi came to the scene, we showed over 200k users how to earn there.

Every landscape in crypto is rapidly changing, so we’re back with a full guide on airdrop farming for 2024 and 2025.

Airdrop season has started and everybody loves free crypto. If you dedicate time and effort towards farming, you can have a 6-figure year. No matter what capital you start with. If you are new to the wonderful world of airdrops, I suggest you have a glance at the biggest airdrops of 2023, to get the blood flowing and get you hyped up to study this blog.

Let’s dive in.

Warning: Understand The Risks of Airdrop Farming

Every layer in crypto comes with risks. Airdrop farming is no different.

First off, you have your own responsibility for security. Never share your private keys, don’t click random links, have funds on hardware wallets, don’t get hacked, and all that stuff.

But on top of that, you’re exposing yourself to new protocols and projects. Which comes with a risk in itself. Outside of CEX exchanges, often the biggest hacks in crypto are either bridges or layer-2 solutions.

Take that into consideration when you start airdrop farming. Reduce risks by spreading funds and working on your online security. You want to protect the free cryptocurrency you’re earning.

Basic Security Tips:

- 2FA on all accounts

- Hide your phone number everywhere to avoid SIM swaps

- Burner emails when signing up

- Don’t click links on Social Media or ads

- Dont download unverified software

- Use Hardware wallets for main funds

- Don’t FOMO, and trust no one

- Don’t keep large sums on exchanges/platforms

- If something feels off, take your time to verify before engaging, especially with lesser-known dApps.

1) The Easy Airdrops + Bonus Hunting

This first chapter is focused on beginners and our farmers who are low on capital. If you are more experienced, or have a decent wallet size to play with head over to the next chapter on wallets or even jump to the trading airdrops.

If you’re a brand new airdrop farmer, or if you are low on liquid. I suggest you start farming easy airdrops that don’t require funds. What they usually do require are some social media tasks to create some exposure and project awareness. You know the basic, follow & retweet kind of stuff. Or join a newsletter or Discord group. Often, these projects are in fundraising mode, product release, or just plain meme coins. Sometimes they are looking for users, so they want you to create an account or download a dApp.

Whatever they are, try to collect and start building your bankroll

Now, we’re not here to lie to your face and say you can become financially free by getting these easy airdrops. That’s just not the case. But it’s low-hanging fruit, collect some free $ here and there with some easy tasks. Keep stacking those small wins until you have some capital to farm the next few chapters of this blog.

Two Airdrops I’m farming that don’t require capital are Grass and Beoble.

Claim Your Bonus

Another tactic is to hunt for bonus rewards on Exchanges, Crypto Casinos (Rollbit), or Sports bookies (for example I’m farming Azuro by betting on Bookmaker). During promotions of these platforms, you can find profitable trades/bets. But you have to keep a close eye on the promotion. For example, an exchange can have a deposit bonus, deposit 10$ get 10$ for free. Collect all the bonuses on several exchanges and your $10 might be $200 in no time. This is obviously no slam dunk, but the road to riches is long my friend. A list of exchange bonus options will be shared in our third chapter.

You can farm these types of airdrops on multiple wallets and by creating several social media accounts you can join them multiple times. Find all the new airdrops listed on Airdrop Alert.

Pro Tips:

- Have several burner X accounts

- Have several burner Discord accounts

- Create burner email addresses

- Have several burner wallets

Follow us on X (170k), or Join Our Telegram (200k) for all the Airdrop Alert’s

2) Set up Your Wallet Farm

Our second chapter is focused on setting up your wallet farm which applies to beginners and experts.

What do I mean by wallet farm? Well to optimize your time, you should create several wallets on each chain you want to farm. Think about Ethereum (EVMs), Solana, Injective, SEI, Avalanche, or Bitcoin. Whichever chain you want there are several wallet options.

Why set up multiple? Joining an airdrop costs some time, the majority of that is getting to know a project and going through the steps the first time. Once you have learned how to do this, why not do it again on a second wallet, a third, a fourth, etc. This optimizes your time spent to farm one project or potential airdrop.

One thing to keep in mind, the best thing is to have no on-chain connections between your farming wallets. What do I mean by that? Well, don’t fund them all from the same wallet. Put the initial capital in the wallet from different sources (CEX or otherwise) and avoid transactions between them. Some projects filter out wallets that have previous connections.

Keep a low balance on the wallets, even when you’re done farming. We noticed the recently hyped Starknet Airdrop required wallets to have a few GWEI balances or they were eliminated from the free $STRK drop.

Wallet Airdrops

Some wallets have potential future retroactive airdrops coming, or they have a point system that translates to a future reward. We have a list of 7 wallets that are suitable for airdrop farming and different chains. I recommend checking it out.

Wallet Tips:

- Keep main funds in a hardware wallet

- Fund farming/burner wallets with minimum capital

- Have no on-chain connection

- Keep a low balance at all times

- Use a wallet that rewards u with points like Rabby or Rainbow

- Security is your main priority

- Don’t sign transactions you don’t understand

- User Wallet Guard or Pocket Universe as an extra layer of wallet security

3) Learn Basic Trading

If you have trading skills, there are plenty of airdrop farming options for you out there which we discuss in this chapter.

If you lack this skill set, it might be a good time to study trading fundamentals to create a solid trading strategy.

You don’t need to become a master trader. If you accomplish that you will be out on yacht parties in Dubai. No, we want you to learn basic support/resistance trading so you can get in “low risk, low reward” type trades. You are not aiming for a 50% gain on your trade, you’re farming an airdrop. Whether it’s based on trading volume or frequency.

Trade to Farm, Don’t Trade to Win.

Educate yourself on patterns on Investopedia, or Youtube. Or consider free trading courses like Baby Pips, which isn’t crypto-focused but a general free course for Technical Analysis and trading.

Once you are comfortable trading at a minimum of break-even levels, you can start farming DEX airdrops or clean CEX bonuses and enter Trading competitions.

Don’t forget to be active over time. Some potential airdrops can take months before distribution, make sure to keep your wallets active from time to time so it looks like you’re an actual human user, instead of a farmer who came in for a couple of trades and left. Long-term activity will also help your total volume to go up which can lead to a significant reward.

I’m personally farming LogX and Hyperliquid while trading.

Trading Farm Tips

- Low-risk trading strategy

- Sybil your wallets (Be your own referral)

- Complete a basic trading course

- Run up volume over time

- Read our trading content for trade set-ups

Dex Airdrops

You should be comfortable trading and have a general decent crypto knowledge understanding to farm Dex Airdrops. Potentially you need to switch chains, bridge funds, or being able to estimate the liquidity depth of the Dex. We have a list of 15 Dex Airdrops you can farm, so have a look if you are ready to trade! And anon, be safe with the leverage.

CEX Bonus Hunting

Frequently CEX’s will offer various trading competitions or reward programs for new listings. Keep an eye on our socials for the most important ones.

If you’re just getting started and want to farm some deposit bonuses and reward programs, here’s a short list of major exchanges you have to check out. The first 2 often list big airdrops on the first day so you will be smart setting up an account there to be ready to go when you need it. Recently we saw it with ZetaChain, PIXEL, and Jupiter.

- Bybit

- Binance

- MEXC

- OKX

- BingX

- Bidget

- Gate.io

- Bitmex

Remember, not your keys, not your coins. Don’t ever leave too many funds on a CEX, we all heard the MTgox and FTX horror stories.

4) Airdrop Farming by Being an Early User

This chapter is more dedicated to medium and experienced farmers. It pays to be early. We’ve seen it countless times, be an early user or beta tester and you receive a retroactive reward down the line. Some old examples are Uniswap, or the ENS airdrop. More recently, we saw Arbitrum and Optimism. Farmers who dedicated time and some capital here all reaped the benefits of it later.

There are a ton of Testnet Airdrops now that hint or rumor future airdrops. It’s pretty simple, as a testnet user we help test a platform. We risk our time and capital, and projects usually show their appreciation for it.

Usually, you want to test out all functionalities, which requires a little crypto know-how. If this is your first time in the ring, take your time and get used to it all. Make sure to swap, bridge, use faucets, register domains, add to liquidity pools, stake, unstake, vote, trade, and every other thing you can think of doing on the chain, do it!

Don’t forget to stay active over time and avoid on-chain wallet connections (like mentioned in our wallet section).

Airdrop Farming Testnet Tips:

- Use a specific wallet for testing purposes

- Test all platform’s core functionalities and stay active over time

- Have no on-chain connection

- Be active over time

- Run up volume over time

- Run up frequency over time (keep doing the same activities)

- Test all chain functionality

- Use the faucets to get native currency

Testnet Airdrops

Just this week we dedicated a blog to 7 different Testnet Airdrops, which you can read here. There are several more coming and active this year, so keep an eye on our DeFi section to catch them all.

5) Liquidity Provider

This chapter is only for the chads who have capital and liquidity available.

A solid option is liquidity pools. On a DEXs they allow token trading without centralized order books. Smart contracts manage trades, adjusting prices based on supply and demand. Contributors earn rewards proportional to their liquidity. New solutions require liquidity for traders to use it. Hench you get a nice yield when you add liquidity. The newer and smaller pools can offer 4-figure APR returns, while bigger pools might offer you between 5-15% APR.

While you earn this yield, a lot of projects will reward early liquidity providers with a retroactive airdrop. This is applicable with test stages, but also on mainnets.

I’m personally providing liquidity to DojoSwap at the moment, to earn some yield and farm their potential airdrop.

Another flavor of proving liquidity is lending. You can do this on cryptocurrencies or Non-fungible tokens (NFTs). This option provides a yield as well, as you earn interest on your loans. While several platforms give you airdrop opportunities.

If you don’t want the currency exposure, you can hedge your position. Example: If you need ETH to provide liquidity, but don’t want ETH exposure. Use Aave or a similar platform, deposit stablecoin as collateral and borrow ETH. This way you don’t have an actual ETH position. Similarly can be done with altcoins by shorting them.

You can also reuse your capital when using lending platforms. Example: You use stablecoin collateral to borrow ETH, then you use that ETH to borrow stablecoins. This way you are paying interest, but you are farming an airdrop.

LP Tips:

- Split between short-term and long-term

- Use a wallet farm

- Hedge exposure

- Sybil your wallets

- Reuse your capital

lending Airdrops

We listed 5 lending options for currencies, and 2 for NFTs in our blog last week. I personally focus a lot on NFT lending, not per se for airdrop farming but the yield is attractive and the airdrops are a bonus.

6) Lock Funds

Another chapter for farmers who have access to capital, and don’t mind locking it up for a few weeks or months.

Staking is a well-known term in crypto, and is used to earn a decent ROI. If you stake ETH you can earn 5% APR, which should be your bare minimum if you’re considering locking some funds.

Restaking enables users to secure multiple networks concurrently by staking identical tokens on the primary blockchain and other protocols. Despite the heightened risk of slashing, restakers enjoy augmented rewards for embracing this extra risk. This method, introduced by Eigenlayer, has grown immensely popular amongst airdrop farmers over the past few months.

Similar to providing liquidity, you can hedge your positions. In this scenario, you’re mostly locked for some time. So make sure to take that risk of opportunity cost in consideration.

I’m personally farming Blast, Puffer Finance (+ Eigenlayer), and some Celestia and Cosmos-related airdrops through Keplr Wallet.

Farming Tips:

- Use a wallet farm

- Hedge exposure

- Sybil your wallets

- Volume is Rewarded

Staking Restaking Airdrops

You will find 5 restaking and 6 staking airdrops in our blog of earlier this month.

7) Deepdive into Ecosystems

This chapter is relevant for everyone, whether you are a noob or a seasoned farmer.

One way to optimize your time, capital, and risk is to dive into an ecosystem. It’s much easier to track projects on one chain than it is to be an expert on all chains.

You also save time and cost sticking to 1 native currency. For example, if I own a decent-sized bag of $SOL, I might as well farm as many Solana ecosystem airdrops as I can. Or a new kid on the block, Blast, releases new projects and airdrops daily. We will have a blog with a list of that soon, as by now we listed 10 Blast Layer 2 airdrops in the past 10 weeks on AirdropAlert.com

Below is a short list of ecosystems you can study and take a pick of one or two. For the ones with a hyperlink we created a list and information on farming, the remaining are yet to come. But plenty of options on those chains are already listed on our site.

8) NFT Airdrops

This chapter is for all levels, but it requires capital.

Last bull market, NFT holders got rewarded with plenty of airdrops. If you minted a BAYC (by Yugalabs) for $200, within a year you would have received 6 figure airdrops by just holding it. Insane! NFT holders also enjoyed platform airdrops, in the likes of Blur, Looksrare, and more.

There is no guarantee that we see another airdrop frenzy for NFT holders this year. However, some projects have been airdropping their coins to holders of prominent collections. Pudgy Penguins got $7k worth of Dymension, while Tensorians (on Solana) got a similar amount. Azuki is rumoring their own coin and Airdrop this year and there are a lot more examples. Even the famous memecoin $BONK, airdropped significant amounts to the larger Solana NFT collection holders. More recently, ordinals have been receiving a ton of airdrop love. Obviously, holding an NFT brings its own set of risks. So only do this if you’re confident in this market niche.

NFT Trading & Holder Airdrops

In addition, platforms are rewarding you for volume and liquidity. Blur broke the internet by giving away hundreds of millions of $BLUR with their 2 airdrops last year. If you’re buying or trading NFTs, here are some NFT platforms airdropping to NFT trading volume soon:

Potential NFTs to hold for upcoming airdrops from own tokens or other projects (NFA of course)

As I trade and provide liquidity on NFTs myself. I personally hold some Yuga assets, including a BAYC. A Pudgy Penguin, Tensorian, Inscribed Pepe, and I sometimes Trade Azukis when we’re getting closer to a potential Azuki Coin. I farm a little Tensor and Blur.

Check our NFT Airdrop section for more and smaller opportunities if you like the JPEGs like I do.

9) Gaming Airdrops

This chapter is for everyone again, and you usually don’t need capital to join it. Play-to-Earn (P2E) or Play-to-Airdrop or popular terms, also known as GameFi. The First popular P2E game was Axie Infinity back in 2020. Hundreds of thousands of players were grinding this to earn $AXIE.

Some web3 games are token-gated, meaning you need to hold a specific NFT to participate. But lots of these P2E games are free to play, and you earn tokens while you do it. Either based on time, tasks, or results.

Today, we see countless gaming options to earn airdrops. In essence, you play a web3 game and earn a native token or result-based price. I got to claim 7400 $PIXEL (sold at $0.65) this week just for performing a few simple ingame tasks and a couple of referrals. Last year, 1 gamer earned an NFT for being the #1 spot of the game Dookey Dash (by Yugalabs), which he sold for 1000 ETH that same week. In the upcoming weeks, Yuga will start the Dookey Dash game again, this time it’s not token-gated. Rumors are that Yugalabs will add 1 Million Dollars to the prize pool (Edit: rumors are confirmed, 1M prize pool + Mutant Ape NFT.)

A couple of gaming airdrops you can check out are:

10) Start Your Own Channel/Group for Referrals

You should all skip this chapter, as we are shooting ourselves in the foot here. But it needs to be said, to help you maximize your income.

A ton of projects offer referral rewards, this applies to all the categories in this blog. While it’s fairly easy to share your referral link with a couple of friends. Most of them won’t sign up.

Then you might earn a little by signing up on your own referral links under burner wallets and accounts, aka sybilling. However, this will only earn you on the volume you provide yourself.

How to scale referrals? Easy, become an influencer. We’re not suggesting all of you become the next generation of TikTok stars. But you can share your airdrop farming knowledge on X, or start a small discord or Telegram group and slowly grow this while you earn, and your friends/followers earn as well.

Small warning note here, watch out for the tons of larps on social media pretending to be airdrop experts but mainly promoting the shit of the shit for payments.

Advise: Optimize Airdrop Farming with Airdrop Routes

We’re nearly at the end, and I’m impressed you made it this far!

This is a section, or skill you will develop over time. We rather work smart, than work hard, amirite?

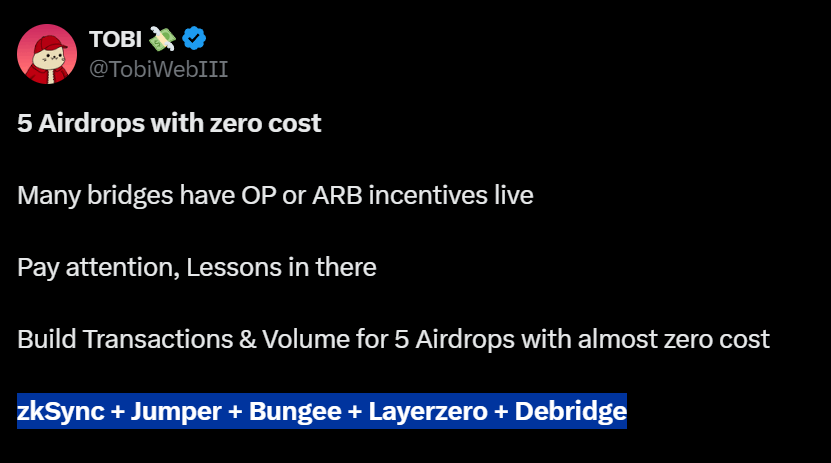

With Airdrops, you can find ways to optimize. Sometimes doing 1 task can qualify you for 2 or more airdrops. Other times, u need to bridge to a certain chain, but you find another exit route to spread airdrop qualifications.

An example is (click on the image to go to tweet):

Tobi is trying to minimize cost and time and cover 5 airdrops by doing a few tasks. In his tweet, he has a step-by-step description.

We’re considering adding more airdrop route content in the future. It’s very time-consuming, and we want to get it right. So we are looking into it. For now, the best tip we have is to search social media for airdrop routes if you’re considering farming a project or ecosystem.

Tip: Sell Your Airdrop on the Pre-Market

While it’s always exciting to wait for an airdrop and pray you hit the jackpot, there are ways to sell or hedge your allocation. This can significantly reduce the risk. Often new projects are quite fragile, and one bad tweet from a founder can reduce confidence which results in a lower price.

I use AVEO every week, as they often offer pre-market and perps for coins yet to be airdropped. You can short a position, to hedge while you wait for airdrop distribution. Or you can long it, if you’re confident in the project. I also expect an airdrop for AEVO, so I’m farming that while I hedge other airdrop positions.

Another option is Whales.Market. Not only do they offer pre-markets for coins, but you can even sell airdrop points. As the point system is the new and growing meta. It comes in handy to being able to dump your points when you need liquidity. I’ve sold some of my Friend Tech points at $1 per point. We still have no clue when these points ever convert to an actual airdrop, so getting a dollar per point seems reasonable.

Don’t Forget: Find Unclaimed Airdrops in Your Wallets

Last but not least. Have you ever checked your wallets to find unclaimed airdrops?

Usually, this is the case when you are a regular ETH or Solana user, and a project decides to retroactively reward you. However, you never heard of the project or airdrop, so logically you missed the claim.

Luckily there are sites for that. Check Bankless to find unclaimed airdrops. Who knows what you have missed and is still claimable. Just don’t pay for airdrop information that these types of sites might advertise. All airdrop info is free to find on AirdropAlert.com.

We hope you find some free money that you missed before.

Final Thoughts on Airdrop Farming

This blog became significantly longer than initially planned, but we wanted to be thorough. So there you have it, a complete guide to airdrop farming to earn free crypto. I sincerely hope this helps you in your journey to earn some crypto. It doesn’t matter if it’s a bull or bear market. We can always farm some airdrops!

We would appreciate a share on social media if you find this useful. Teach your friends how to start airdrop farming and you’re helping us get some exposure 🙏

If you want to shoot me a follow on my personal X account, I mostly post corny jokes, NFT shenanigans, Trading brags, and some occasional airdrop alpha. And of course, follow AirdropAlert on X to never miss airdrop opportunities again.