Alpha Transform Artificial Intelligence Index (AAI), based on the Alvara Protocol ERC-7621 token standard, announces the first performance metric for a high-performance AI token

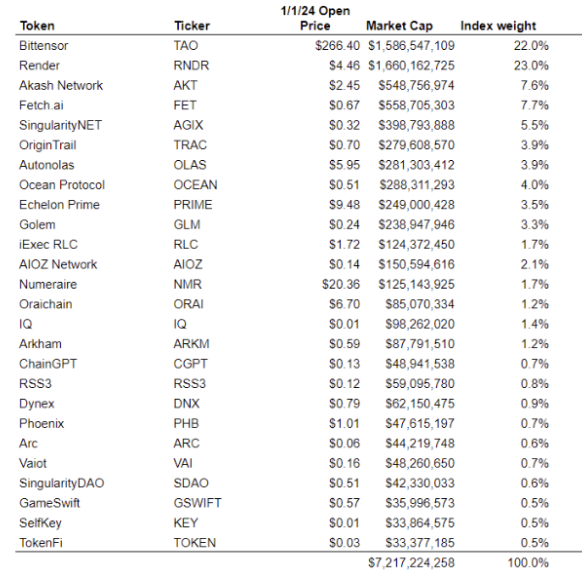

AAI aims to become the benchmark in the cryptocurrency AI sector. AAI measures the performance of leading AI tokens against rigorous criteria and features 20-30 tokens selected based on market capitalization, trading volume, and presence on reputable exchanges. To be included, tokens must have a minimum market capitalization of $20 million, an average daily trading volume of more than $500,000, and be listed on a recognized Tier 1 or Tier 2 exchange.

By the end of January, AAI had outperformed both stocks and the broader cryptocurrency market, closing at 112.1, driven by Bittensor’s 76% return, which was partially driven by support from Vitalik Buterin. In February, adjustments included new weights and the addition of four tokens, keeping the index at 30 components.

“While much of the focus in early 2024 has been on the approval of a BTC ETF and the rise of the BTC price itself to near all-time highs, AAI shows there may be more reason to be optimistic about its performance. Enzo Villani, CEO of Alpha Transform Holdings, said: “There are a number of major tokens involved in the emerging cryptocurrency AI sector.”

The Alvara ERC-7621 token standard that guides AAI leverages the Ethereum blockchain to provide unprecedented flexibility and innovation in money management, transcending the boundaries between cryptocurrency and traditional finance. In accordance with ERC-7621, all transactions and fund performance are visible to all, promoting trust, transparency and merit-based management, and reducing volatility while enabling instant diversification through the pooling of multiple crypto assets.

Alpha Transformation Research Information

Active investment in the blockchain economy.™

Alpha Transform Research is provided by Alpha Sigma Capital Advisors, LLC, investment manager of Alpha Blockchain/Web3 Fund and Alpha Liquid Fund. Alpha Sigma Capital’s (ASC) investment fund focuses on emerging blockchain companies that are successfully building user bases, demonstrating real-world use of decentralized ecosystems, and moving blockchain technology toward mass adoption. ASC focuses on companies that leverage blockchain technology to provide added value in fields such as fintech, AI, supply chain, and healthcare. Sign up to receive the research here: www.alphasigma.fund/research.

About Alpha Transform Holdings

Alpha Transform Holdings (ATH) is a digital asset organization dedicated to leading the blockchain-based future of Web3. With deep knowledge and expertise, we invest and advise innovative companies and decentralized projects leveraging blockchain technology to revolutionize traditional industries such as financial services, healthcare, media and entertainment, etc. We are known for working closely with our portfolio companies to create value while providing detailed research into growing blockchain initiatives that generate significant returns. Our mission is simple. Accelerating the mass adoption of distributed ledger technology through investments that deliver impactful solutions with long-term sustainability. Our vision is an open, connected world powered by secure, decentralized systems so that everyone can benefit from the new technological economy. https://www.alphatransform.io/

disclaimer

This is for informational purposes only. This is not investment advice. Other than disclosures relating to Alpha Transform Holdings (ATH) and Alpha Sigma Capital (ASC), this information is based on current publicly available information that we believe to be reliable, but do not represent that it is accurate or complete. that. The information, opinions, estimates and projections contained herein speak only as of the date hereof and are subject to change without notice. We strive to update information as appropriate.

Any forecasts contained herein are for illustrative purposes only and should not be relied upon as advice or construed as recommendations. The prices of cryptocurrency assets may rise or fall, sometimes rapidly or unpredictably, due to broader market changes or changes in a company’s financial condition. Past performance is not a guide to future performance, future returns are not guaranteed and you may incur a loss of original capital. Exchange rate fluctuations may negatively affect the value, price or returns of certain investments. We and our affiliates, officers, directors and employees, other than stock and credit analysts, from time to time hold long or short positions in any of the securities or derivatives mentioned, act as principals and purchase or sell such securities or derivatives. do. In this press release.

The information on which this information is based has been obtained from sources we believe to be reliable, including the Company’s financial statements filed with regulatory authorities, the Company’s website, the Company’s white papers, PitchBook, and other sources. Although Alpha Sigma Capital obtains data, statistics and information from sources it believes to be reliable, Alpha Sigma Capital does not perform an audit or seek independent verification of the data, statistics and information it receives.

Unless otherwise provided in a separate agreement, Alpha Sigma Capital makes no representation that the Content satisfies any applicable presentation and/or disclosure standards in the jurisdiction in which the Recipient is located. Alpha Sigma Capital and its officers, directors and employees will not be liable for any trading decisions, damages or other losses arising out of or in connection with any information, data, analysis or opinions within the report.

Cryptocurrencies and/or digital currencies involve significant risk, are speculative in nature, and may not perform as expected. Many digital currency platforms are not subject to regulatory oversight, unlike regulated exchanges. Some platforms may commingle customer assets in shared accounts and provide inadequate custody, which may impact whether and how investors can withdraw their currency or undergo money laundering. Digital currencies can be vulnerable to significant volatility and price fluctuations, as well as hacking and cyber fraud.

15.png)