Amazon Q4: 2023 Profit Surge Is Just The Beginning (NASDAQ:AMZN)

Andriy Onufriyenko/Moment via Getty Images

Introduction and Investment thesis

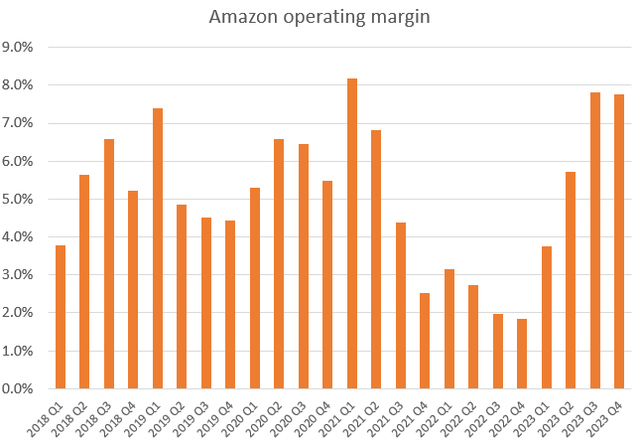

First, I’ve covered Amazon (NASDAQ:AMZN) on SA at the beginning of January last year (Amazon: My “Margin-Call”), where I took a deep dive into the company’s margin profile. I argued that the long-lasting decrease in the company’s operating margin should soon come to an end, which should support a steady increase in the share price throughout 2023. My margin-turnaround thesis centered around decreasing wage and cost inflation, the reorganization of the company’s distribution network and the steady growth of high margin businesses, like advertising or AWS. As quarters passed these improvements seemed to materialize leading Amazon to regain pre-pandemic peak operating margin levels of ~8%:

Created by author based on company fundamentals

Last time, I’ve covered the company at the end of November, where I discussed whether there could be further improvement in fundamentals from current impressive levels. I concluded that there is still a large runway for profits to increase in 2024 resulting from AWS growth reacceleration, increasing utilization of advertising assets and further improvement in retail margins. However, there were some important risk factors worth monitoring like meaningful slowdown in remaining performance obligations (RPO) or increasing transportation prices.

Beside the Q4 earnings release other key information also came to light since then, which make it worth revisiting my previous thesis and providing and update. Based on this, I feel more certain now than at the end of last year that the 2023 profit surge was just the beginning.

AWS re-loaded

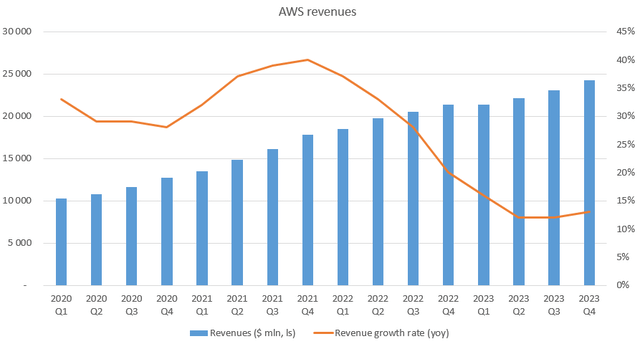

I believe the most important development over the recent months has been the topline growth reacceleration of the company’s cloud business. Several customers began to optimize their cloud spending over 2022 as the post-Covid spending surge suddenly met increasing inflationary costs, higher interest rates, and a generally uncertain economic environment. AWS revenue growth fell from 35-40% to 12% within 1-2 years significantly pressuring the company’s profit engine:

Created by author based on company fundamentals

Based on Q4 results it seems we can officially call an end to this steep slowdown as revenues in the segment managed to grow 13% yoy to $24.2 billion, a slight, but more important uptick from 12% yoy growth in the previous two quarters. I think this trend should continue in the upcoming quarters.

One key driver behind this could be the reacceleration of cloud migration projects, which based on management comments seemed to gain traction over the previous quarters:

“Similar to what we shared last quarter, we continue to see the diminishing impact of cost optimizations. And as these optimization slow down, we’re seeing more companies turning their attention to newer initiatives and reaccelerating existing migrations.” – Brian Olsavsky, CFO on Q4 earnings call

The reacceleration narrative is also supported by Gartner’s recently published forecast for 2024 worldwide public cloud end-user spending, which is set to reach $679 billion growing ~20% yoy after 18% growth in 2023. Among different segments infrastructure-as-a-service solutions are expected to grow at the fastest clip with 26.6%, which represent the core business of AWS.

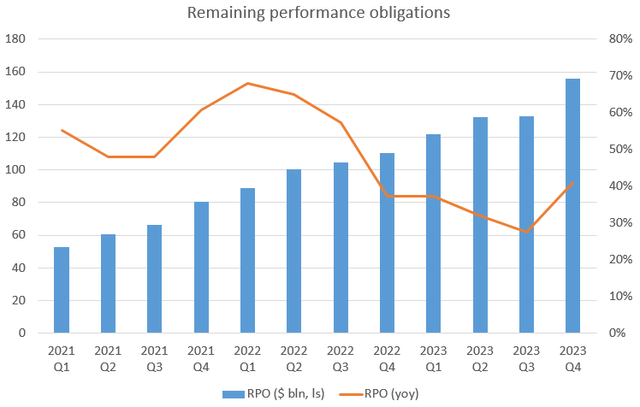

Looking at RPO at Amazon, which represents mostly AWS spending commitments confirms the turnaround story. As this hasn’t been exactly the case in Q3 where RPO stagnated sequentially, this is especially welcome news. RPO reached $155.7 billion for the end of 2023 growing almost $23 billion sequentially, resulting in a yoy growth rate of 41% yoy:

Created by author based on company fundamentals

This has been a significant jump from 28% yoy growth after Q3 signaling that customers began to significantly increase their commitments. As RPO is a good leading indicator of future revenues this could be regarded as a strong sign for continued topline growth reacceleration.

Besides the uptick in cloud migration workloads increasing customer interest in Amazon’s AI solutions should be the other important piece of the AWS reacceleration puzzle. Amazon’s custom chips for LLM training (Trainium, Trainium2) and inference (Inferentia) could be an important revenue stream over the upcoming years, even if currently Nvidia possesses the best and most comprehensive technology in this field.

The fact, that Anthropic, one of the most promising AI startups has committed to use Amazon’s chips in the development of its future foundation models is an important message to AWS customers. Even if Amazon invested billions into the company, it’s still a solid proof that its AI chips work. In the light of Graviton’s success (Amazon’s custom chip for servers) and the fact, that these chips are in development for many years I believe, they could be a valid alternative for customers who seek better price performance.

According to AMD’s CEO, Lisa Su the market for accelerated computing solutions in data centers could have reached around $50 billion in 2023, and they predict it will grow by a CAGR of 70% in the upcoming 4 years to reach over $400 billion. If only reaching a low single digit market share in 2024 it would already translate to few billions in additional revenues for AWS with substantial upside for the upcoming years. As AWS is still the largest cloud provider with its 31% market share, there is an enormous installed base where its AI chips could come handy.

Developed with easy migration from other solutions in mind I believe AWS AI chips will play an important role in the growth of AI-based solutions over the upcoming years. This could mirror the success of AWS Graviton chips, which managed to establish a strong position in data center servers in recent years with more than 50,000 AWS customers using them already.

Besides the chip business the fully managed gen AI foundry service of AWS, Amazon Bedrock should be the other main AI/ML-related revenue stream for the company over the upcoming years. The service provides customers access to foundation models from leading AI companies, which they can personalize afterwards. It became generally available to all customers at the end of September and is already used by thousands of AWS customers. According to management customer feedback has been great, but let’s be honest, what else would they say. Otherwise, no material quantitative details have been shared on the topic during the Q4 earnings call, so investors must wait until they can get a better glimpse on the business.

However, one thing seems to be sure, the upcoming quarters could be characterized by overcapacity in this part of the business. AWS, just like other hyperscalers, invests a lot in building out its hardware infrastructure (e.g.: buying GPUs form Nvidia), which supports the accelerated computing needs for training and running gen AI models. This comes with increased Capex, which will eventually result in increasing depreciation expense in the AWS business. I believe this will pressure AWS operating margin through 2024 to some extent as revenue growth from Amazon Bedrock and other AI/ML-based services won’t be able to offset increasing depreciation expense. Although this will be offset by the increase of the remaining useful life of AWS servers from 5 to 6 years, which increases quarterly operating income by roughly $1 billion, I believe it won’t be enough to prevent a decline in operating margin.

If we assume that AWS operating margin declines to 28% for 2024 from current ~30% levels and revenue grows by 17% as topline growth turnaround continues, AWS would reach an operating income of ~$30 billion, a ~$5 billion increase compared to 2023. With this, AWS could remain a strong growth pillar for Amazon throughout 2024, even amid increasing investments in new technologies.

North America segment catching up to AWS

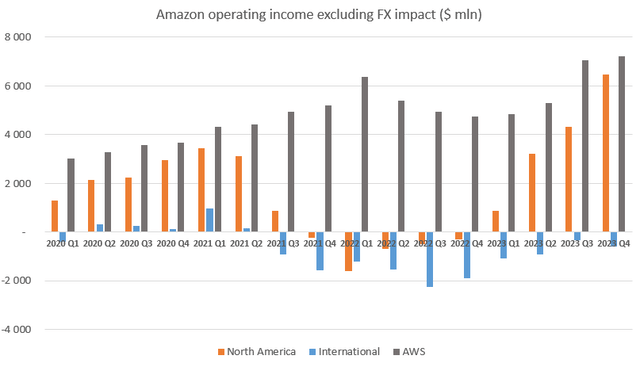

From a profit perspective the year of 2023 has been all about Amazon’s retail business, where operating margins showed significant improvement thanks to a successful overhaul of the company’s distribution network. According to management Amazon managed to decrease its cost-to-serve on a per unit basis globally in 2023, which was steadily increasing since 2019. What’s more, Amazon is not done yet and expects further cost improvements in 2024 partly resulting from increasing efficiencies in its inbound fulfillment infrastructure. This carries the opportunity for the North America segment to overtake AWS in operating income in 2024, which hasn’t happened for a very long time. Looking at recent quarterly dynamics we’re not far from this point:

Created by author based on company fundamentals

Thanks to increasing cost efficiencies in the retail business and continued strong topline growth North America segment operating income has been constantly rising for the past seven quarters. If this would continue in the same magnitude it could surpass AWS operating income in a few quarters.

An important development recently that could support this has been the introduction of ads on Amazon Prime Video at the end of January in the U.S., and at the beginning of February in the U.K. and Germany. Although Amazon plans to have fewer ads than competitors it could be still a multibillion-dollar business already this year. Those viewers who want to opt out can pay $2.99 a month to avoid ads, which adds up to ~$36/year. Approximately 70% of Amazon Prime subscribers (~160 million) use Prime Video, which puts the potential audience in the U.S. to ~112 million.

If we assume that the $36 annual opt-out fee has been determined based on the opportunity cost of subscribers not watching the ads (i.e.: Amazon is indifferent if you pay extra $36/year or you use the ad-supported version) it is easy to get a rough estimate how much money the company could make with this move. Multiplying $36 by 112 million results in ~$4 billion in additional revenues, only looking at the U.S. Calculating with an operating margin of 50% (Meta with its 40-50% operating margin is a good proxy) this would mean an additional $2 billion to the bottom line in 2024 for the North America segment.

In addition, Amazon is constantly working on utilizing its other streaming assets in advertising like Freevee, Fire TV or Twitch. A good example for this has been the recently launched Sponsored TV offering for advertisers, which is a unique self-service streaming TV ad solution. The average monthly audience of Sponsored TV assets is over 155 million, so this solution could bring in also billions in operating profits soon.

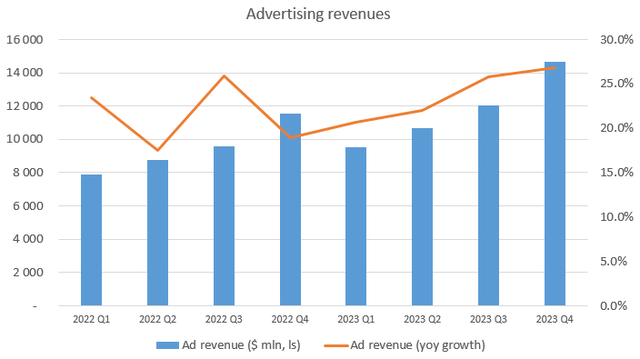

These new advertising features will be important extensions to Amazon’s sponsored ads, which currently make up the majority of total ad revenues. Even without them, advertising revenues are growing at an increasing pace reaching $14.65 billion in the Q4 quarter equaling a yoy growth rate of almost 27%:

Created by author based on company fundamentals

As the growth of advertising revenues outpaces the growth rate of total North America business, which is around 10-15% this forms a natural extension for margins in this segment. As new advertising features further increase this gap in the upcoming quarters, I believe there’s a real possibility that the North America segment will generate more operating income in 2024 than Amazon’s cloud business. With these two extraordinary profit engines in place Amazon is well positioned to increase its market value further.

Valuation and risk factors

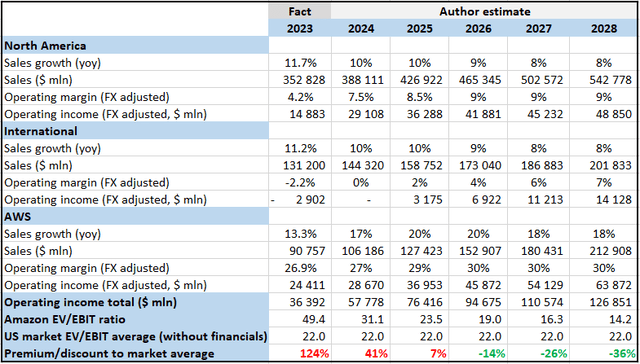

Based on recent developments I have updated my relative valuation framework for Amazon compared to my previous analysis at the end of November. I have increased the margin trajectory for both the North America and the International segments resulting from increasing share of advertising revenues and continued cost savings in the fulfillment network. Based on this I believe, the International segment reaches breakeven operating margin in 2024, while North America segment operating margin grows to 7.5% after reaching an already impressive 6.1% in Q4 2023.

For AWS operating margin I assumed a slight decrease for 2024 from 29-30% in recent quarters resulting from increased investments in accelerated computing infrastructure. Combined with 17% yoy sales growth for the business (assuming continued reacceleration throughout the year) this would result in an operating income of almost $29 billion. Meanwhile assuming a conservative 10% sales growth for the North America segment based on ecommerce market growth estimates would result in an operating income north of $29 billion, surpassing that of AWS slightly.

Based on these inputs my updated valuation framework looks as follows:

Created by author based on company fundamentals

Based on Amazon’s enterprise value of ~1.8 trillion shares trade at an EV/EBIT multiple of ~50 with 2023 operating income. Compared to the market average of 22 this seems a hefty premium for the first sight. However, resulting from a ~60% increase in operating income for 2024 the multiple would compress to 31.1 in one year when assuming constant share price leaving shares only 40% overvalued compared to the market average.

One year later, in 2025 the valuation gap would close, which would be very premature in my opinion as Amazon’s growth prospects would be still much better that time than the market average. This would require an ongoing valuation premium to exist, I believe a multiple of ~30 would be still realistic. In this case this would mean that Amazon’s shares outperform the general market by ~30% over the upcoming two years, which makes them still a good investment at current levels in my opinion.

Finally, it’s important to add that there are important risk factors, which could negatively influence my thesis. First, the turnaround in AWS topline growth is only in its early innings, there’s still need for more evidence that recent 12-13% yoy growth rates are not the new norm. Although the emerging need for AI/ML-based technologies increases the chances for a turnaround, there’s still a lot of uncertainty of how these could contribute to revenues over the upcoming years.

Another important risk factor for Amazon, especially for its retail and advertising business is a possible recession in the U.S., which has been voiced by economists for almost two years. Although retail sales have held up well recently signaling continued resilience of the U.S. consumer, and jobs growth continues to be impressive high interest rates should exert their effect on the economy. As the Fed doesn’t seem to rush in making its first step towards a rate cut cycle, the risk of a possible recession shouldn’t be underestimated even if things look rosy now.

Conclusion

After years of transforming its business Amazon closed 2023 finally on a strong note. This trend should continue into 2024 setting the stage for continued share price gains as valuation seems far from stretched at current levels. Developments in AI monetization and the utilization of streaming assets in advertising will be key factors to watch throughout 2024.