Adam Selipsky, CEO of AWS, Amazon’s main cloud computing platform, sees parallels between the hype surrounding AI and the rush of companies looking to capitalize on new technologies during the dot-com bubble of the 1990s.

“For example, if you went back to 1997 and asked, ‘Is the Internet underrated or overrated?’ I would argue that it was underrated,” he said. mad At the Harvard Business School conference over the weekend. “But if you ask, ‘Are the leading companies at the time dramatically overvalued?’ Yes, they were.”

He later went back to mass layoffs, saying “some of the AI companies at the center of the storm are massively overvalued.” The future of companies launching MVPs to show off their AI technology could be met with cold, hard reality, he explained.

“Once it goes into production, it can be very expensive,” he said.

Selipsky is not alone in his cautious outlook. Open AI is that much When you mention the word AI, everyone thinks, but COO Brad Lightcap said in a recent interview that the idea that AI “can bring real business change” is overblown.

“There is absolutely nothing we can do with AI to completely solve this problem,” he concluded. And for those more interested in open source AI, Emad Mostaque, developer of Stable Diffusion and CEO of Stability AI, describes himself as: It’s in the same camp as Selipsky and Lightcap. He believes AI could bring about what he calls “the biggest bubble in history.” ouch.

But bubble or not, Amazon could make a lot of money in a growing industry.

As one of the world’s largest cloud computing providers, AWS is a critical platform for AI developers who require massive computing power to build and run complex models. Despite the hype, Amazon is going all in and making big money selling the shovels that keep the AI gold rush going.

Last week, Amazon released its quarterly financial results. AI has been a solid part of the mix.

The company touted a new expansion of its engagement with Salesforce that will use AWS to “deepen data on AI integration” between the two companies. Health industry stalwart Merck, e-commerce retailer The Very Group, Japan’s Mitsubishi, South Korea’s LG and several other companies have joined the AI initiative.

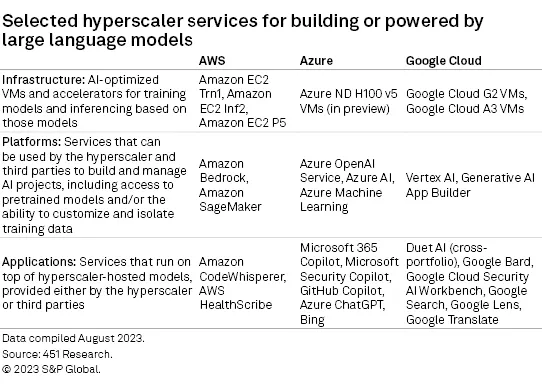

The computing infrastructure business is currently in a virtual oligopoly. Amazon, Microsoft, and Alphabet (Google) are the sources of choice when AI developers need cloud hyperscalers for model training. They dominate the market.

But AWS not only sells infrastructure, it also develops its own AI products.

The tech giant recently announced a $4 billion investment in Anthropic, the AI startup behind chatbot Claude. It is one of the biggest rivals challenging OpenAI’s ChatGPT. The company is also developing its own AI assistant, Q. The list of features so far includes an image generator and a proprietary large language model (LLM) that supports Alexa interactions based on user queries.

“New genAI features like Bedrock, Q, and Trainium are resonating with customers and are starting to reflect in our overall results,” Amazon CEO Andy Jassy said in the report.

Selipsky’s caution was paired with an acknowledgment of AI’s potential. “We believe that generative AI will be transformative,” he said. And independent analysts agree. AI businesses could add more than $4 trillion to the global economy, according to estimates by experts including McKinsey and JP Morgan.

As with all gold rushes, using AI may prove more profitable than chasing speculative claims. But in the case of Amazon, it doesn’t seem like a bad idea to dig yourself a hole, just in case.

Edited by Stacey Elliott.