Amboss CEO talks about lightning about the growth of Bitcoin Lightning Network, Tether (USDT).

founder: Jesse Shrader and Anthony PotDevin

Established date: March 2021

Headquarters location: Nashville, Tennessee

Number of employees: 10

Website: https://amboss.tech/

Public or individual? Private

Jesse Shrader thinks this will be an important year in the lightning network.

When the price of Bitcoin rises and Tether (USDT) rises to lightning, SHRADER claims that more and more business and institutions will start seeing the lightning for the next year.

And his company, Amboss, is prepared to make this vision a reality.

Shrader told Bitcoin Magazine, “We want to expand Bitcoin into a payment system and use lightning. “We want to make lightning a high efficiency and high -performance system.

Through a series of tools and services developed by SHRADER and AMBOSS teams, they are ready to board the next agency user on the world’s largest licensed payment network. In particular, USDT runs in lightning.

What AMBOSS does

Amboss uses the Lightning Network to provide an intelligent payment infrastructure for digital payment.

“We provide insights to people who need to do to increase payment efficiency in the network.

To achieve this, we provide a lot of products and services.

The most notable of these is Amboss Space. Amboss Space is a Lightning Network Explorer that uses machine learning to help users search or connect information to all nodes in the network.

In addition to analytical software, AMBOSS provides customers with tools and services to help improve lightning liquidity conditions.

One of those services is Magma Marketplace, and users can buy and sell liquidity in the Lightning Network. Magma can provide liquidity without giving up Bitcoin’s custody.

The other is Hydro, the expansion of magma. This software allows users to automate liquidity purchases to guarantee the success of payments better.

(AMBOSS also provides Reflex, a regulation compliance suite for business customers with a duty to report AML.)

The analysis software and tools of Amboss are built for mass transactions and can be easily made to lightning.

SHRADER said, “We measure the business ability you pay as a simulation. “We will help you to see how many networks you can actually reach when a company attempts to pay.”

Lightning

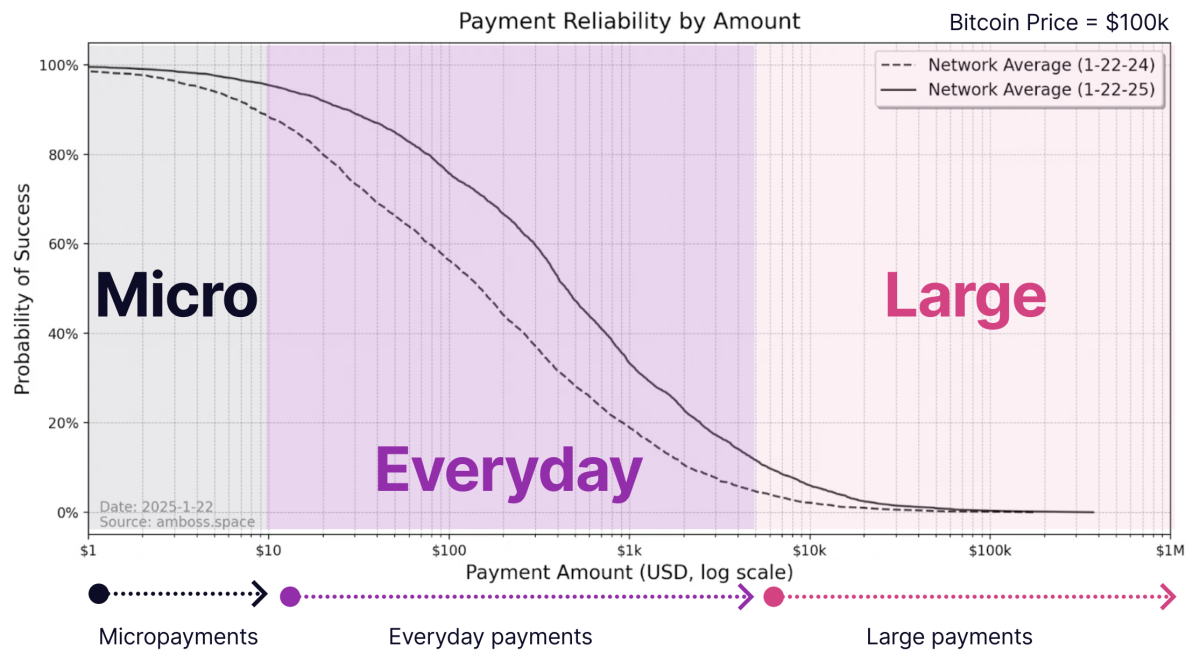

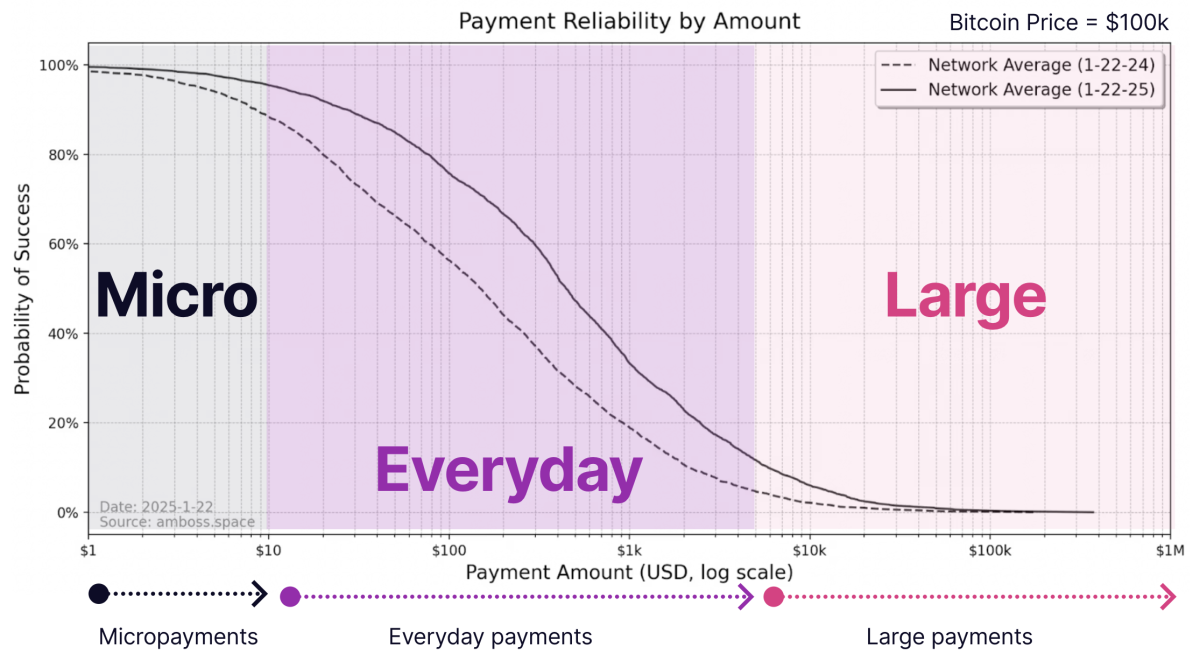

Schradar is optimistic about the growth of lightning. Every day, the user relies on a network and sends more than a small payment.

Shrader said, “We have successfully handled everyday payments for lightning. “We are trying to further improve the function of the network, focusing on decentralization.”

Payments larger than $ 4,000 are still difficult to handle. Shrader explained that more capital is needed to make bigger payments.

However, he noted that the recent increase in bitcoin prices has helped to make it easier to deal with bigger payments.

SHRADER said, “Recently, the price of bitcoin has increased and the ability to settle all Lightning channels has increased. “It’s like getting a larger pipe because the channel is displayed.”

And Shrader is optimistic about this large pipe that allows more throughput, but I think Tether (USDT) ‘s lightning will attract more fluidity to the network.

Tethers on lightning (USDT)

At the end of last month, Lightning Labs announced that the USDT is bringing USDT to Bitcoin and Lightning Network through the Taproot Assets Protocol.

This upgrade allows Bitcoin service providers to integrate and accept USDT more easily.

Shrader said, “What is very clear is that tethers is suitable for the product market.

“Last year, I paid a $ 10 trillion payment exceeding the Visa and Master Card.”

“It is very clear that the world wants US dollars.”

Prague, Shrader, acknowledged that many hard -line bitcoins have problems with USDT in Bitcoin and Lightning, and they are identified by high evaluation of Bitcoin’s SOUND MONEY qualities.

At the same time, he believes that the advantage of USDT in lightning is clearly surpassing the disadvantages of Lightning because he does not understand what Bitcoin is or is willing to understand volatility.

“Many people haven’t taken orange pills yet, and they have understood the advantages of Bitcoin,” he explained.

“I think Bitcoin is an amazing tool, and I want to bring it to many people as much as possible. However, there are many problems with traditional payments, and Bitcoin has a very safe and gratitude system, and this system wants to bring it to the world. ”

“Bitcoin’s price behavior is good for me, but many people are afraid of volatility. If there is an asset with very low volatility, such as USDT, it is now a great victory in a very safe and unbelievable rail. ”

The problem of USDT resolved in lightning

Shrader was called the first Bitcoin -related conference Microstrategy as “a lightning for companies.” At this meeting, companies began to pay Bitcoin’s employees through lightning. I didn’t fully realize the problem at the time.

SHRADER said, “What employees realized was that everyone in 1099, which had to be submitted to employees, was a bustling. “And there was a lot of regulatory overhead costs they had to compete.”

Shrader not only can pay USDT employees for lightning, but also reduces some of the opposing risks related to bank use, as well as reducing accounting and regulatory headaches.

Shrader said, “Our salary has been used to pass through Silicon Valley Bank.

“And at some point, the salary provider contacted me to regenerate the salary in mid -month after attempting to pay the staff. I lost a half -month runway. This is because Silicon Valley Bank went bankrupt. ”

“So if you can go to Bitcoin and Lightning to avoid the risk of the financial system, I mean that I am in a much better place.”

(Author’s Note: When using USDT, some opponents still exist. Tethers must trust the actual US dollar and support tokenized products.)

danger

Shrader mentioned some of the USDT risks for Bitcoin and lightning, but I didn’t worry about them.

Shrader said, “There is a risk of MEV when there is an asset other than the basic asset of the blockchain is traded as a chain. “But Bitcoin already has a western inscription that already creates other assets, so there is already a problem.”

He also did not seem blurry when the USDT for one of the chains was raised by raising the danger of Bitcoin fork, and he did not think there was a greater economic node like Coinbase on the Bitcoin network. If you decide to support Bitcoin, Bitcoin’s Bitcoin ETF, Bitcoin’s “tether fork” can include other upgrades that can harm Bitcoin for a long time. run.

Shrader said, “Bitcoin consensus is not determined by Bitcoin’s custody, so important businesses such as Coinbase can support various changes or initiatives, but they do not guarantee that the protocol change will be affected.

Instead of focusing on dangers related to Bitcoin’s USDT, Shrader is the opposite.

SHRADER said, “What’s more interesting is probably an opportunity to unlock in places with actual profits about Bitcoin itself.

“All nodes can be transported from both USDT and Bitcoin, so you can exchange bitcoins by default in lightning, so you can send Bitcoin from one lightning channel and get USDT from other lightning channels.”

“Create a USDT invoice and pay it as a BTC.

2025: Lightning Year

In his last idea, he shared two main reasons for 2025 to be the year of lightning in 2025.

The first is that catching Bitcoin no longer needs to use lightning.

“We had to have Bitcoin first if we wanted to switch to lightning by this year. This is a big barrier. (Shrader is relatively easy and common to access USDT, adding to a response to subsequent questions other than the United States.)

“The Bitcoin -only market for payment is small. But this year we have removed the barriers, and consumers can pay for other assets, USDT. “There is already a big market.”

(Shrader pointed out that Bitcoin still benefits because USDT is converted into bitcoin as USDT crosses lightning while running from lightning.)

SHRADER also mentioned that Lightning users will only pay a part of the amount paid for trading fees using traditional financial rails.

Shrader said, “We are supplying less than 0.5%liquidity.

“As a large payment card network user, I pay 4%for all payment processing, and I don’t get money for a few days after the payment is made.”

“Payment fees are almost 10 times reduced by lightning.”

Considering the point of SHRADER, it is difficult to imagine that 2025 will not be a big harm for lightning.