American Airlines Prices Are Similar to Pandemic Levels (NASDAQ:AAL)

alvin man

introduction

American Airlines, down more than 50% since 2019 (NASDAQ:AAL) Stock prices are falling. Although prices have not really rebounded since the COVID-19 pandemic, business is booming. So what is it? What is causing this disconnect and is now an opportunistic time to invest?

Booming operations, bursting inventory

Like many other airlines, American Airlines has seen its results recover to pre-pandemic levels, but its stock price hasn’t followed suit. Does this provide a good margin of safety to invest in, or does it risk seeing the market capitalization cut in half?

Current year and previous year performance

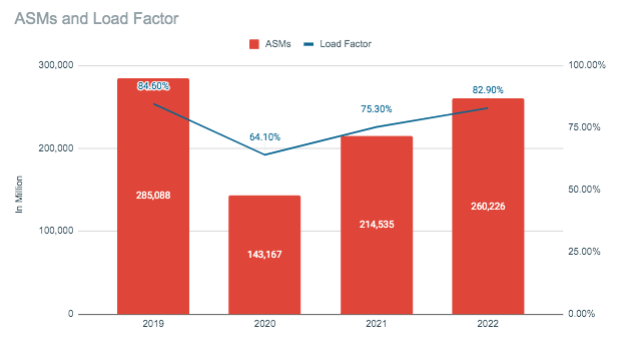

American Airlines ASM and load factor (SEC.gov)

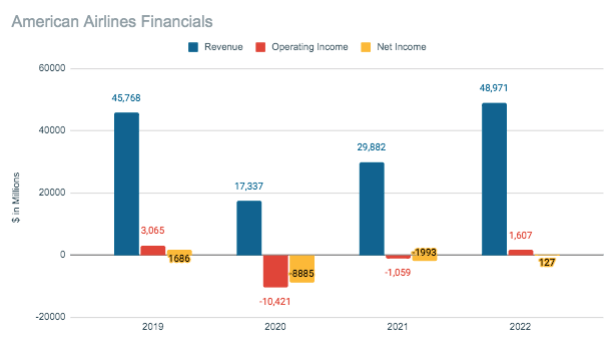

American Airlines has been back on track over the past three years. In 2022, the company recorded revenue 7% higher than before the pandemic. And if anyone remembers, 2019 was a very good year for this industry. There is currently strong demand for air travel, with ASMs remaining 9.5% below 2019 levels. The load factor is also at 83%, showing an overall healthy industrial environment.

american airlines finance (SEC.gov)

evaluation

Since 2020, the company’s stock price has fallen by half. The biggest decline was at the start of the pandemic, but it has stayed in this range since the rebound. So the market is now saying that this company is worth the same as it was during the pandemic.

Currently, American Airlines is trading around $13, and its 2023 EPS estimate is $2.37. Therefore, the forward P/E of the business is 5.5 times. I’ve always felt that the company deserves a lower multiple than its peers, primarily based on its weak balance sheet, but this valuation seems low.

Margin of safety or exposure to risk

The question now arises whether stocks have a margin of safety or whether risk is appropriately priced. The risks I hear are: rising labor costs over time, possible increases in fuel costs, and a possible recession.

Rising labor costs are by no means unique to this industry as collective bargaining agreements are renewed and renegotiated. Delta, Southwest, and United all saw significant increases in labor costs again this year. The same goes for fuel costs. Each of our U.S. competitors has felt the same high jet fuel prices over the past few years. Airfares have, on average, adjusted for this increase in spending as it affects the entire industry. For this reason, I view these risks as much more near-term risks.

Perhaps the final factor keeping stock prices low is expectations of a recession. Although it is inevitable, I am not one to try to predict such events. Fuel prices also tend to fall during recessions. That’s right. A recession should be reflected in prices, but to this level?

Overall, I think American Airlines is trading where it offers a decent margin of safety. Even if you add up the above risks, the company’s value will not increase to the same level as it did during the ongoing pandemic. That’s just absurd logic because no one flew in 2020 and demand is incredibly high right now. I think there’s easily a 10-15% margin of safety for this stock. American Airlines’ average P/E was around 7 to 9 times before the pandemic.

conclusion

Although American Airlines has some headwinds to deal with in the near term, the industry as a whole is feeling the same pressure. And with the onset of a recession, these higher costs have the potential to create a perfect storm. But nonetheless, this is not the same as what we have experienced during the pandemic, and our evaluation should not be the same. I think there is a significant margin of safety for this stock and the risks are slightly overestimated.