American Water Works: A Company With Growth Potential And A Reasonable Valuation

Repair of urban communications. Replacement of water pipes, repair and reconstruction of heating mains. Hot and cold water pipe laid in trench. Sergey Pakulin/iStock via Getty Images

Investment Thesis

American Water Works (NYSE:AWK) is a company with good growth prospects in my opinion, as much of the US drinking water and wastewater systems are un-privatized. The company is the largest in its field and therefore has the advantage of economies of scale for further growth. In addition, AWK is currently quite reasonably valued as its share price has fallen significantly over the past 2 years. AWK has successfully implemented its growth strategy in the past. The company is well managed. This allows for continued success to be expected.

Business Overview

The company operates in two business segments, which are Regulated Businesses and Others.

Regulated businesses include various AWK subsidiaries that provide water and wastewater services in 14 states. The customer base is wide. This includes residential, commercial, industrial, government agencies, and fire departments. In total, there are 3.4 million active customers in the segment’s water and wastewater network. The Regulated Business segment generated $3.505 million in sales in 2022, representing approximately 92% of the company’s total revenue. AWK generates approximately half of its sales from two states, New Jersey and Pennsylvania. Another distinctive feature of this business segment is that the share of wastewater compared to water service is quite small. For example, the wastewater portion of the segment’s sales revenue in 2022 was $242 million. This is a total of only 6.9% of the entire segment’s sales revenue. There is considerable room for growth here. Part of AWK’s growth strategy is to acquire wastewater service providers in areas where it has water customers.

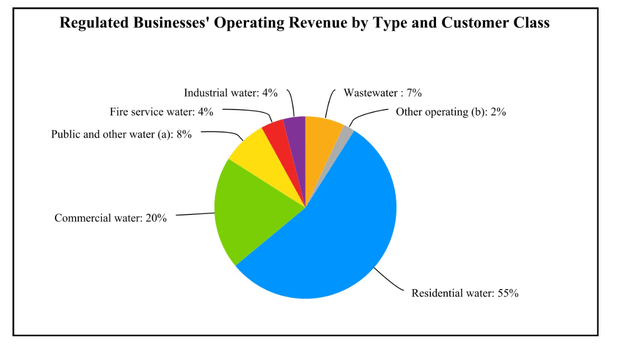

Private customers make up the largest part of the customer base. The remaining customer types are shown in the diagram below.

AWK revenue based on customer base ( Annual Report 2022)

The Company’s second business segment is the Military Services Group (MSG), the results of which are reported under the name of the “Others” segment. The share of this segment is small, making up only 8% of sales. MSG provides water and wastewater services to 18 US military bases under 50-year contracts. The average remaining contract term is 40 years. Most of these contracts are subject to annual settlement or early termination. MSG’s competitors in servicing military bases are American States Water Company (AWR) and Veolia Environnement S.A. (OTCPK:VEOEY).

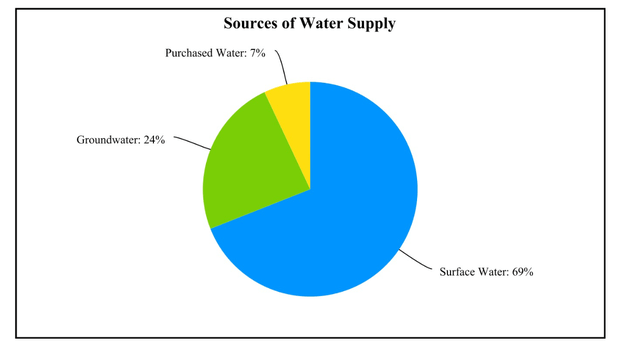

The main source of water supply for AWK is surface water. In second place is groundwater. Surface water typically requires a fair amount of treatment before use.

AWK: Sources of Water Supply (Annual Report 2022)

A Look at Long-Term Past Performance

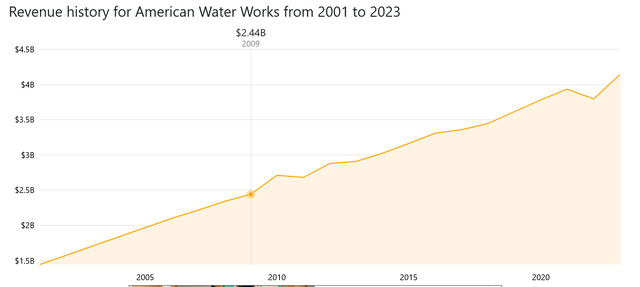

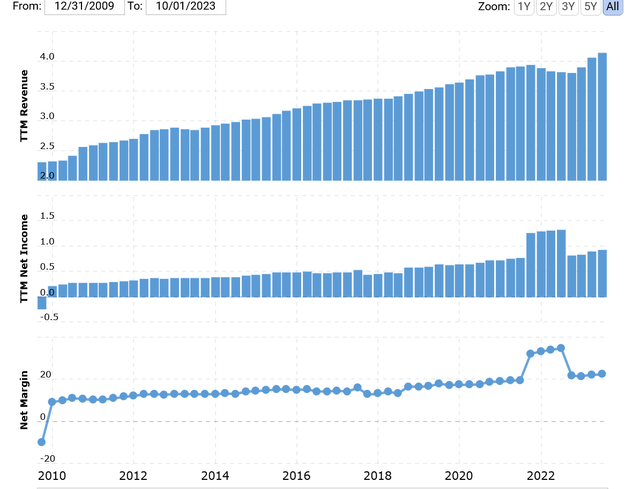

How successful has AWK been in the past over an extended period of time? Let’s look at some key indicators below. First, sales.

AWK-s revenue 2001-2023 (companiesmarketcap)

Sales have consistently increased over the years. In 2001 it was $1.43 billion and in 2023 (TTM) $4.13 billion. This gives an average annual growth rate of 4.93%. In the last decade, the CAGR has slowed down to 3.21%. In the last five years, its growth has been only 2.72% per year. (2019 sales were $3.61 billion). Thus, sales growth has clearly slowed down over the years. But sales growth is only one of the metrics. Let’s take a look at the profit.

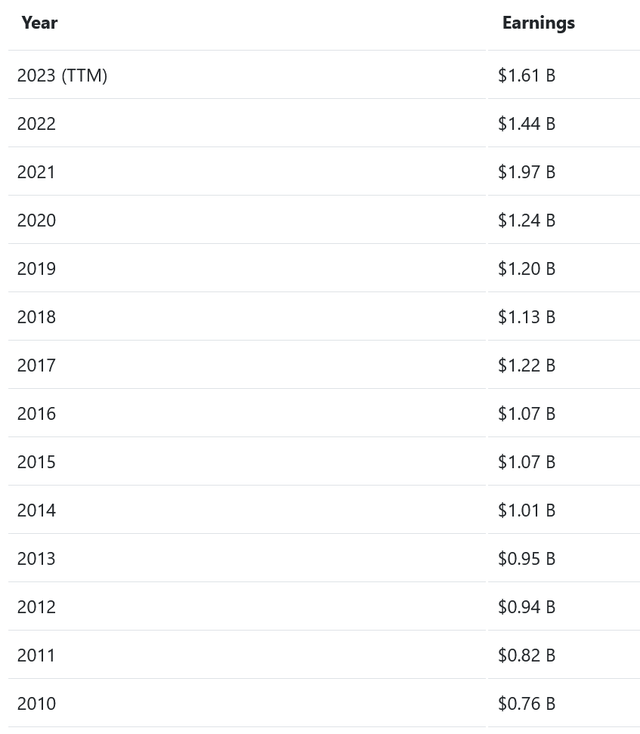

In order to get a longer overview, I will use the data from 2010 as a basis here.

AWK-s earnings 2010-2023 (companiesmarketcap)

From 2010 to date, the CAGR of earnings has been 5.50%. The CAGR of earnings over the last decade has been 4.77%. However, the CAGR of the last 5 years is slightly higher: 6.05%.

The above shows that for many years, AWK’s profit growth has been faster than sales growth. I think that this kind of profit growth cannot be sustainable for a very long time. The company does have an ambitious long-term capital spending plan that would increase capital spending for new acquisitions by an average of approximately 8% per year. The implementation of this plan would probably make it possible to increase both sales and profits in the future at a faster pace than before. However, what is key is the price at which new companies are acquired. If new acquisitions can be made wisely and economically, I think it is possible that the company’s profits will grow faster.

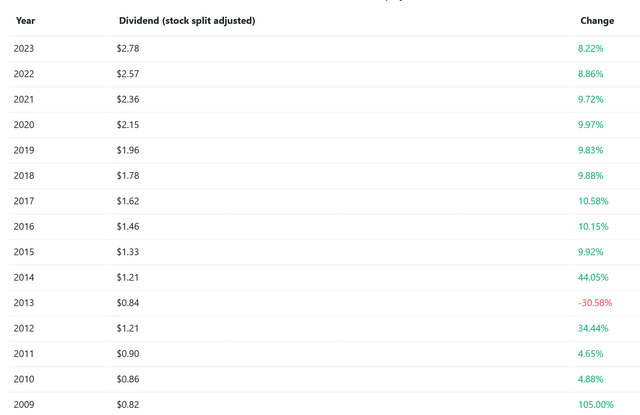

American Water Works’ dividend growth has been faster than earnings growth for a long time. Over the past 15 years, the company’s dividends have grown by an average of 8.47% per year.

AWK-s dividend history 2009-2023 (companiesmarketcap)

This raises questions about the sustainability of dividend growth at the same pace. For this purpose, company profits should grow at least at the same pace as dividends in the future. For most investors, however, AWK is primarily a dividend stock. Current developments rather predict a decrease in the dividend growth rate to 4-5%.

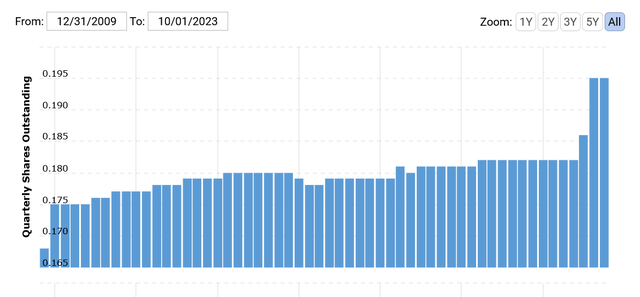

Number of Shares and Change in Net Margin

AWK has not been very active in share buybacks. Rather, the number of shares in the company has increased over the years. This has especially happened in the last year. If at the end of 2022, AWK had 182 million shares, by now there are already 195 million of them. For the investor, this means profit dilution. This further reduces the relatively slow growth in earnings per share.

AWK-s Shares Outstanding 2009-2023 (macrotrends.net)

American Water Works has been operating more and more efficiently every year. This is shown by the change in the company’s net margin over a longer period.

AWK-s net margin 2010-2023 (macrotrends.net)

In 2010, AWK’s net margin was 10%. Gradually improving, it has reached 22% today. This shows effective management and cost efficiency. Margin improvement also explains, in my opinion, why the company’s profits have grown faster than sales over a longer period. Could AWK’s net margin improve further in the future? This is possible if cost efficiency improves. Competing companies include companies with even higher net margins. For example, York Water (YORW), whose net margin has been over 30% for several years. I think the continued improvement in margins will play an important role in AWK’s continued earnings growth. Due to the fairly large debt load of this company, it is not possible to make new acquisitions by further increasing the debt load. While there are many opportunities for acquisitions in the US water and wastewater sector, AWK needs to do so smartly and cost-effectively. In my opinion, a significant increase in the debt burden will not have a significant effect here.

Financial Health

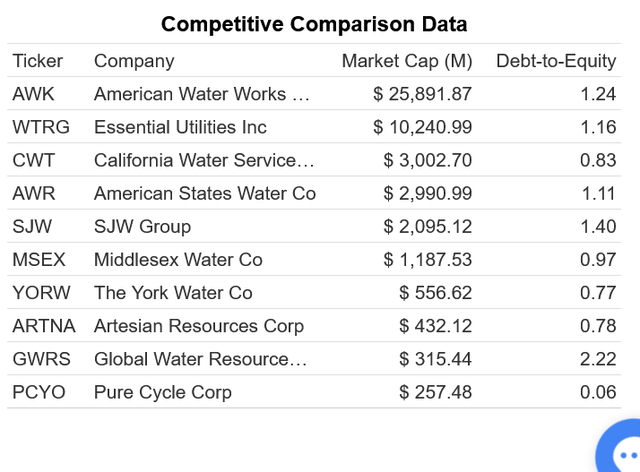

The debt/equity ratio of American Water Works in the 3rd quarter was 1.24. Meanwhile, Short-Term Debt & Capital Lease Obligation was $492 million, Long-Term Debt & Capital Lease Obligation $11,772 million, and Total Stockholders Equity $9,897 million. Is the debt/equity ratio of 1.24 high or low? AWK’s median debt/equity ratio over the past 10 years is 1.43 From that perspective, the current rate is perhaps a bit low. But let’s compare AWK’s debt/equity ratio with other water infrastructure companies.

Debt/Equity comparison data (gurufocus.com)

Of the 10 companies in the table above, AWK’s debt/equity ratio ranks third. According to this, it can be said that it has a rather high debt load among similar companies. Looking more broadly, the Utilities-Regulated industry has a debt/equity median of 0.86. American Water Works’ 1.24 significantly exceeds it. Also in absolute terms, AWK’s long-term debt has increased significantly over the past decade. Whereas the debt has grown at a slightly faster pace than the company’s equity. The average annual growth rate of equity since 2013 has been 6.94% The average annual growth of long-term debt in the same period has been 7.59%.

| Year | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 |

| Long-Term Debt | 5230 | 5442 | 5875 | 5759 | 6497 | 7575 | 8643 | 9332 | 10343 |

| Total Common Equity | 4727 | 4915 | 5049 | 5218 | 5385 | 5864 | 6121 | 6454 | 7298 |

| Year | 2022 | Last Report |

| Long-Term Debt | 10929 | 11701 |

| Total Common Equity | 7693 | 9897 |

AWK-s Long-Term Debt and Total Common Equity 2013-2023 In Millions of USD source: Seeking Alpha

Considering the above, I think that AWK’s debt load is a bit high at the moment, especially compared to the competitors. Therefore, it is probably not reasonable to increase it significantly in order to acquire new companies faster.

3Q Results

The results for the 3rd quarter of 2023 somewhat exceeded expectations. Sales were $1.17 billion vs. forecast $1.14 billion. EPS was $1.66. It beat the forecast by $ 0.01.

The 3rd quarter of the year is traditionally influenced by climatic conditions. Water consumption usually increases during the summer period, which is beneficial for AWK sales. This year, quarterly earnings per share were $0.11 higher due to favorable weather conditions. On the other hand, there are also years with a lot of precipitation, when the need for water consumption in the external environment decreases. For example, in Q2 2022, EPS decreased by $0.06 due to climate reasons. In the long run, however, this will not significantly change the company’s profits, as some states have implemented compensation agreements to compensate for climate conditions.

Future Guidance and 2023 Acquisitions

In the presentation of the 3rd quarter Earnings Call, the company also gives several interesting future forecasts. A long-term average annual profit growth of 7-9% is offered. Against the backdrop of past EPS CAGR of 4-6%, this seems rather too optimistic. However, if profit margins can continue to improve, EPS CAGR can also improve significantly.

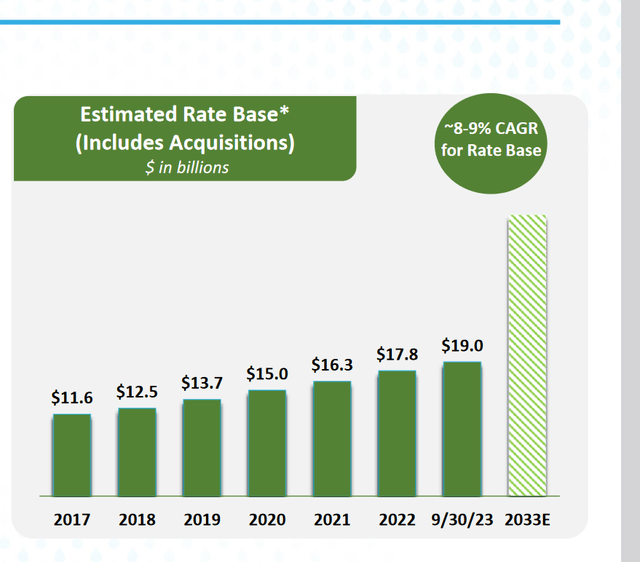

Rate Base should grow by 8-9% annually. It also includes the contribution of the acquired companies.

AWK-s Rate Base 2017-2023 (3-rd Quarter Earnings Call Presentation)

Is it realistic to expect an 8-9% annual growth in the base rate? Let’s take a look at the corresponding rate for the period 2017-2023. The CAGR for the said period is 7.30%. I think that if acquisitions are included, an 8-9% CAGR could be quite realistic.

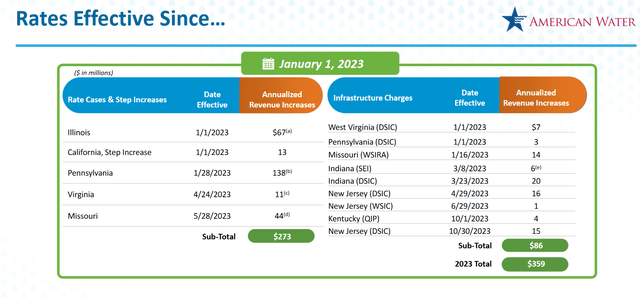

One of the company’s goals is to grow its customer base by 2% per year in the following years. In addition, a long-term annual dividend growth of 7-9% is foreseen. At approximately the same pace, AWK’s dividends have grown over the past 15 years as well. Thus, such dividend growth could be considered realistic. The table below shows the extent to which the change in base rates affects AWK sales.

Effect of rate change on AWK revenue (Q3 Earnings Call Presentation)

As can be seen, AWK sales in 2023 have increased by $359 million due to the change in water service price base rates. The company’s TTM sales were $4.133 billion. $359 million is 8.68% of it. This is at the same rate as the projected increase in base rates over a longer period.

Comparison With Competitors

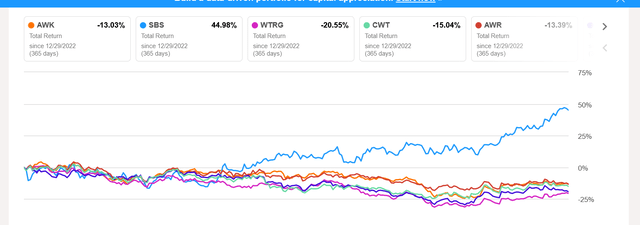

Over the past year, most water infrastructure companies have shown negative total returns. AWK is the second best out of the 6-member group under consideration. The chart below also considers corporate dividends for returns.

Total return of water infrastructure companies in the last year (Seeking Alpha)

| Company | AWK | SBS | WTRG | CWT | AWR | SJW |

| 1 Year Return | -13.03% | 44.98% | -20.55% | -15.04% | -13.39% | -19.18% |

source: Seeking Alpha

The only company with a positive return was Companhia de Saneamento Básico do Estado de São Paulo – SABESP (SBS). It is a water infrastructure company operating in Brazil.

In terms of valuation, AWK is the most expensive company in the comparison group if we take the P/E (FWD) ratio as the basis.

| Company | AWK | SBS | WTRG | CWT | AWR | SJW |

| P/E GAAP (FWD) | 27.41 | 16.49 | 19.95 | 27.95 | 25.19 | 24.36 |

source: Seeking Alpha

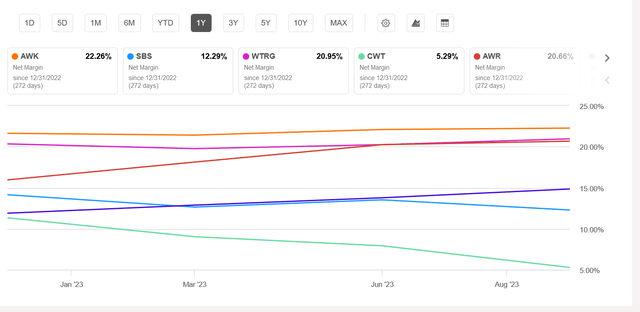

Next, let’s compare the net margins of the companies.

Net margin of water infrastructure companies in the last year (Seeking Alpha)

| Company | AWK | SBS | WTRG | CWT | AWR | SJW |

| Net Income Margin TTM | 22.26% | 12.29% | 20.05% | 5.29% | 20.66% | 14.85% |

source: Seeking Alpha

AWK has the highest net margin of the group under review, which testifies to the efficiency of this company.

Seasonality Map

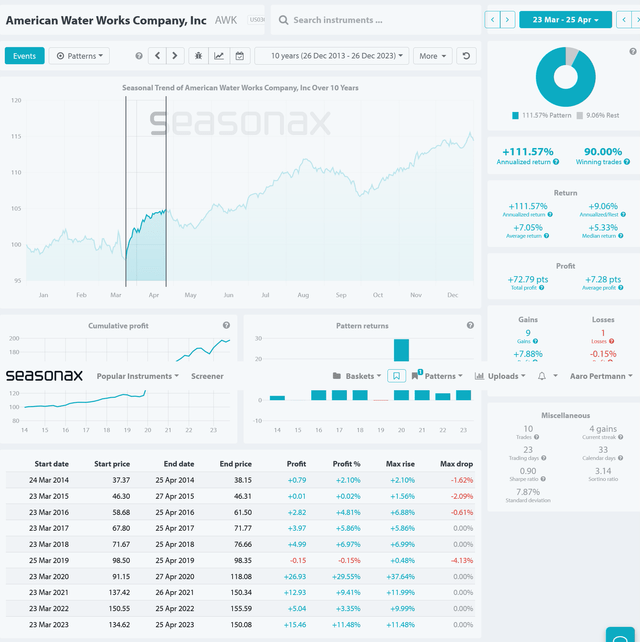

Stock traders may be interested in the American Water Works seasonality map. The chart below provides an overview of which calendar months and days would be optimal to buy and sell AWK shares.

AWK-s seasonality map (seasonax.com)

As can be seen from this map, the period from March 23 to April 25 has been one of the most productive periods for AWK stock over the past 10 years. By buying the company’s stock on March 23 and selling it on April 25, the annualized return on the transaction would be 111.57%. There would be 90% winning trades, or 9 out of 10. The average return on one trade was 7.05%.

Another period with good returns for AWK stock was between May 19 to August 14. By buying this stock on May 19 and selling on August 14, the annualized return over the past decade would have been 43.23%. In all 10 years, you would have made profitable trades. The average yield of the trade would have been 8.95%.

Valuation

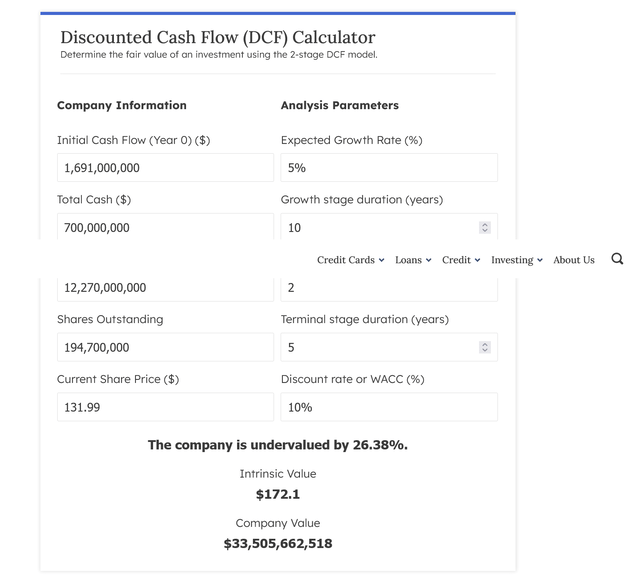

Let’s first determine AWK’s valuation using the discounted cash flow method.

AWK valuation based on the DCF method (finmasters)

I used a conservative 5% as the expected growth rate since American Water Works’ long-term EPS CAGR has been 5.50%. The company itself forecasts a future EPS CAGR of 7-9% in the longer term. I used 10% as the discount rate, given the relatively high current interest rates. The following data are used in the calculation: Initial Cash Flow of $1.691 billion, Total Cash of $700 million, Total Debt of $12.270 billion, Shares Outstanding of 194.7 million and Current Share Price of $131.99. According to this estimate, the fair value of AWK stock is $172.1 and this means that it is undervalued by 26.38%.

Let’s take a look at relative valuation metrics next. As mentioned above, AWK is one of the companies with a higher P/E ratio among its competitors.

| Year | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 |

| P/E ratio | 16.51 | 18.06 | 18.30 | 20.37 | 20.55 | 22.47 | 27.52 | 38.32 | 28.82 |

| 2019 | 2020 | 2021 | 2022 | 2023 |

| 35.81 | 39.18 | 27.21 | 33.83 | 27.27 |

AWK-s P/E ratio 2010-2023 source: roic.ai

American Water Works’ 2010-2023 average P/E ratio is 26.73. The company’s FWD P/E ratio is 27.37. In light of this, AWK is a little overvalued. However, the average P/E ratio of the last decade is 30.09. Compared to the last decade, the current price is a bit cheap.

Based on the discounted cash flow method, AWK is quite significantly undervalued. I consider the discounted cash flow method to be a bit more objective, provided of course that realistic growth and discount rates are used in the data.

Risks

Providing water and wastewater services is one of the most stable businesses because regardless of the general state of the economy, people still need these services. However, there are some risks in this area as well.

Sometimes a company is unable to obtain the necessary water service price increase from regulators, even though it has met the conditions necessary to apply for it. It may also happen that the decisions of the regulators come only after a long delay. In this case, the capital expenditures will not pay for themselves and the company will not achieve the desired profit growth.

Another risk factor is the quality of the supplied water. If it doesn’t meet the requirements, large fines can follow and the company will suffer a loss of reputation.

Due to drought or other natural conditions, the company may not be able to ensure adequate water supply in some areas. This may result in reduced sales or fines.

Wastewater is a separate field. Although currently, the share of wastewater in AWK’s business is small, it may increase in the future. Tightening the regulations related to the collection and treatment of wastewater can lead to significant additional costs for the company. This in turn can reduce AWK’s profits.

The Bottom Line

American Water Works is, in my view, reasonably valued at this point. Although the company’s long-term profit growth data has been modest, the profit growth of recent years and the rate of growth of water service base rates allow us to consider an average profit growth per share of 7-9% in the following years as realistic. One of AWK’s advantages is economies of scale, as it is the largest company in its field in the US market. This allows it to operate efficiently and further improve profit margins over time. Since this company’s debt load is high compared to its competitors, a significant increase in debt could, in my opinion, worsen its financial health. However, I am bullish on AWK and rate it a Buy.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.