Amneal Pharmaceuticals (AMRX): A fundamentally undervalued company by most measures.

aria j/iStock via Getty Images

Investment overview

I last met Amneal Pharmaceuticals (New York Stock Exchange: AMRX) discussed Seeking Alpha in a post published in March 2022. I give the stock a “buy” rating. At the time, Amneal stock was trading at $4 per share and had fallen to $1.3 per share. After rising through the end of May this year, a strong run continued throughout the second half of 2023, with the stock exceeding $5 per share, up more than 20% since I mentioned it.

On a final note, I discussed how privately held Amneal merged in 2017 with California-based generic drug specialist Impax Laboratories to create the fifth-largest generic drug company in the United States.

Amneal’s founders, brothers Chirag and Chintu Patel, have stepped down from day-to-day management of the company, led by former Allergan CEO Rob Stewart. However, management has promised EBITDA of approximately $700 million in the first year following the merger. That didn’t materialize, and the company announced losses of ~$(200 million) and ~$(600 million) in 2018 and 2019, sending the stock down from a post-merger high of ~$24 to a low of ~$4.

The Patel brothers changed their roles from co-chairman to co-CEO in 2019 following the resignations of CEO Stewart and Chairman Paul Visaro, who had originally negotiated the merger. From 2019, the brothers recorded revenue of $1.63 billion, $1.99 billion, and $2.1 billion from 2020, 2021, and 2022, respectively, and net profit of $91.1 million, $10.6 million, and $2.0 million. I did. (130m).

In 2019, Amneal purchased a 65% stake in Kentucky-based AvKARE, which provides pharmaceutical, medical and surgical products and services primarily to government agencies, for approximately $220 million and a 98% stake in Kashiv Specialty Pharmaceuticals, a provider of drug delivery platforms. % was purchased. , for approximately $70 million in 2021, to strengthen its product offering while developing a new biosimilars business and pipeline of branded medicines.

The past 18 months haven’t been smooth sailing for business or executives, but overall, 2023 has seen far more progress than setbacks.

Amneal performance in 2023 – bad in the first half, good in the second half

When I last covered Amneal in March of last year, the company was reporting FY22 revenue of $2.15 billion to $2.25 billion, adjusted EBITDA of $540 million to $560 million, and adjusted earnings per share (“EPS”). EPS was expected to be between $0.8 and $0.85. Same as 2021.

However, in March 2023, Amneal reported FY22 net revenue of $2.21 billion, adjusted EBITDA of $514 million, adjusted diluted EPS of $0.68, GAAP net loss of $130 million, and GAAP EPS of $0.86.

In short, Amneal missed its own targets and probably missed market expectations and guidance for FY23 (net income of $2.25 billion to $2.35 billion and adjusted EBITDA of $500 million to $530 million). no see. While 2022 revenue is improving, 2022 EBITDA may raise questions about whether 2023 guidance is achievable.

There was more bad news for the company in late February when the FDA raised numerous issues with one of its manufacturing plants in India, and in July the FDA declined to approve its Parkinson’s drug candidate. “) Outline the safety concerns. The drug is an oral formulation of carbidopa/levodopa with sustained-release properties and was expected to have peak sales of $500 million.

Nonetheless, the second quarter sparked a strong start with revenue of $599 million and non-GAAP EPS of $0.19 and upward revision of FY23 guidance to $2.3 billion to $2.4 billion in revenue and $0.45 to $0.55 EPS. Second half.

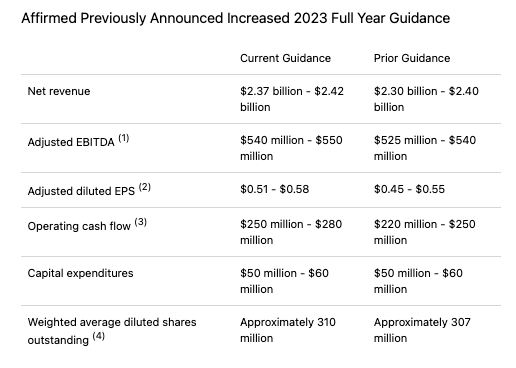

When Amneal announced its third quarter results in early November, it once again raised its FY23 guidance as shown below.

Amneal FY23 Guidance (Amneal 3rd quarter performance press release)

The improving financial position has clearly made a difference when it comes to Amneal’s share price performance over the past few months. This is neatly reflected in Chirag Patel’s opening statement on his third quarter earnings call.

We had a very strong quarter with revenue of $620 million, up 14% year-over-year, Adjusted EBITDA of $154 million, up 22%, and Adjusted EPS of $0.19, up 36%. We saw growth in all three business segments and reduced net leverage to 4.6x.

Strong double-digit revenue growth, >20% EBITDA growth, and >35% EPS growth are numbers that the market will almost inevitably look upon favorably, regardless of the company or industry, and given some standard ratios, price-to-sales (if guidance is met) is At ~0.7x and less than 10x forward price to (non-GAAP) earnings, we can conclude that these low ratios support stock price appreciation.

Debt is a potential problem. As of the third quarter, long-term debt was $2.6 billion and current liabilities were $761 million, but current assets of $1.46 billion offset some of that, and the burden could increase as long as EBITDA growth continues. We plan to continue reducing it.

Overall improvements paint a promising picture for 2024 and beyond

I wrote in my final note that the twin CEOs’ focus and determination was one of the aspects of Amneal’s business that impressed me most and gave me confidence that the company could move forward and increase value under their leadership.

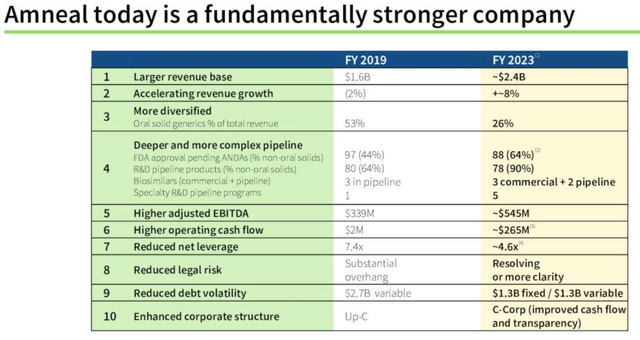

This theory will certainly get a big test in 2023 as the share price plummets into delisting territory, but the positive changes to Amneal’s business in 2019 and now seem to be becoming more and more clear. For example, take a look at the slides below from the third quarter earnings presentation. :

Amneal – Business Transformation (3rd quarter performance presentation)

Revenues are up 50% and growing at a healthy rate of 8% per year, we are more diversified, EBITDA is up 60%, our corporate structure has become more shareholder-friendly, cash flow has changed, and our bottom line has increased. Leverage has decreased.

The company’s three business segments are generics; “Approximately 260 product families encompassing a broad range of dosage forms and delivery systems,” Specialty “engages in the development, promotion, sales and distribution,” according to its latest quarterly report/10Q filing. “Proprietary Brand Drugs” and AvKare. Generic sales increased 12% in the third quarter compared to the same period last year, while AvKare sales increased 25% and specialty products sales increased 9%.

Amneal ambitions by sector (Amneal Q3 presentation)

As you can see above, management has detailed plans and forecasts for each segment, and overall, shareholders should expect high single-year growth in the coming years, with plenty of positive news as each segment implements its expansion plans. It should be able to flow out.

The third quarter earnings call was full of positive developments. Injectable manufacturing capacity has doubled thanks to two new sites coming online. There are 35 injectables on the market, with 25 more planned for launch. The three biosimilar products released to date are expected to achieve sales of $60 million this year, and Avastin biosimilar Allimsys has already secured a 6% market share in just three quarters of its launch. In China, two products have been approved, and setbacks for Parkinson’s disease candidates are being resolved, with approval promised in 2024.

Within generics, there are 88 Abbreviated New Drug Applications (“ANDAs”) pending with the FDA and 78 pipeline products. There are 10 injectable drugs approved this year. Management has identified four “value creation pillars”: increased diversification, strong financial performance, cash generation and deleveraging. It’s hard to argue that the company isn’t making progress on all four of these fronts.

Concluding Thoughts – It has taken time for Amneal’s valuation to grow. We hope to see valuations accelerate in 2024.

Clearly, the handing over of Amneal’s business to the M&A-focused generic business in 2017 caused fundamental problems with the overall business model, turning what had been a profitable and well-run business into a failed business. However, one positive point is that Amneal has been listed. It will. The Patel brothers, who have wrestled to regain control of day-to-day operations, are showing signs of making the business what shareholders have always wanted. Growing, profitable, diversified and without excessive debt.

The fact that Amneal isn’t very profitable on a GAAP basis, it still has high levels of debt (4.6 leverage still remains a potential red flag), and the fact that it faces a number of challenges that jeopardize its stock price in 2023. means that Amneal is not out of the woods. But it is still a forest.

It won’t take much time for the market to start selling Amneal stock again. A second approval rejection for a Parkinson’s drug, missed revenue, disappointing FY24 guidance when it arrives, and more.

Nonetheless, improvements are noticeable in almost every aspect of Amneal’s business, and as long as this continues, we expect that at some point the market will admit that it still values Amneal as a lackluster business even as it begins to thrive and adapt. Valuation accordingly.

Like Amneal, the list of healthcare companies with 2022 revenues between $2 billion and $3 billion includes life sciences company Waters Corporation (WAT), medical device specialist DexCom (DXCM), West Pharmaceutical Services ( WST), and R&D specialist Clarivate (CLVT). , equipment manufacturer Bruker Corporation (BRKR) has a market cap valuation of $17 billion, $45 billion, $25 billion, $5 billion, and $9.4 billion, respectively.

While every business faces unique challenges and circumstances, the fact that all five of these companies are currently valued at between 3x and 25x Amneal’s valuation is where Amneal has become a profitable business, at least from an adjusted EBITDA perspective. – Accelerating cash flow, high-single-digit revenue growth forecasts, and dozens of new product launches with triple-digit million revenue potential lead us to believe that Amneal’s valuation could see a significant upgrade.

I don’t rule out more declines in 2024, but if I were to cover Amneal again in the next 18 months, I would expect the stock to have realized much more substantial gains than the 20% achieved between March 2022 and today. It tilts downward. In my opinion, the numbers and tangible business success speak too loudly in the market to be ignored any longer.