Analysts see spot Ethereum ETF fueling bull market.

Eric, a cryptocurrency analyst, Believe Ethereum (ETH) could surge to $20,000 in the upcoming bull market. The possible launch of a spot Ethereum exchange-traded fund (ETF) in the U.S. could fuel this rally, the analyst said.

Up to $20,000 in Ethereum

In his post on X, Eric cited Ethereum’s historical tendency to mirror Bitcoin (BTC), albeit with a one-cycle delay. During the previous bull market, the analyst noted that Bitcoin surged 22-fold from $3,100 to $69,000. So, if Ethereum follows a similar trajectory, reaching $20,000 would be a realistic possibility.

As the analyst pointed out, Ethereum’s recent bear market bottom of $880 in 2022, estimated using the 22x growth rate seen in BTC, would result in a price of the coin of $19,360. However, the analyst believes that Ethereum will surpass expectations, hitting a base price of $20,000, a psychological round figure to be monitored closely.

Supporting this prediction is the potential approval of a spot Ethereum ETF. Like the spot Bitcoin ETF, this approval will attract institutional investors and significantly boost Ethereum price and liquidity. Institutional investors can gain exposure to Ethereum through these complex derivatives without the complexities of trading or storing the coins directly.

While optimism remains, the U.S. Securities and Exchange Commission (SEC) will likely follow the same path it took before approving the first branch of the Bitcoin ETF in January. For context, the draconian agency has not approved a spot Bitcoin ETF in over a decade, citing risks of market manipulation and lack of proper monitoring tools.

Will the US SEC approve a spot Ethereum ETF?

However, a recent statement from global bank Standard Chartered revealed that the US SEC is likely to approve the first spot Ethereum ETF in May 2023. The bank added that ETH price will trade around $4,000 by then. General market optimism.

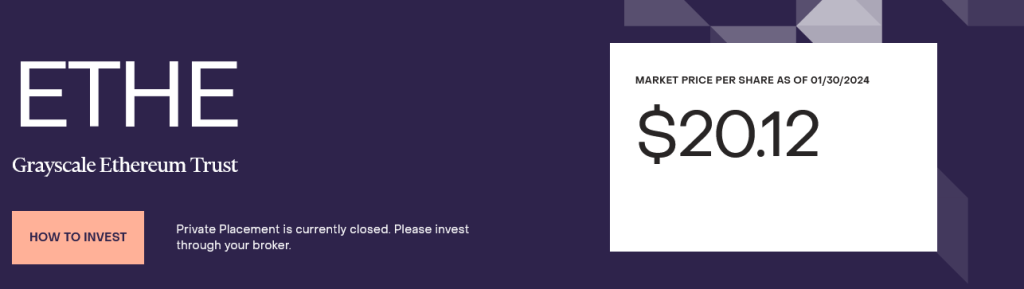

The bank notes that these expectations are further compounded by the agency’s failure to classify ETH as a security. At the same time, Grayscale Investments, which issues Grayscale Ethereum Trusts (ETHE), is looking to convert this product into an ETF. As of January 30, each stock was trading for about $20.

Previously, Grayscale won a fight against the US SEC’s claim to block Bitcoin trusts from being converted into ETFs. This victory sets the ball rolling for final approval of the first Bitcoin ETF in the United States.

Additionally, the fact that an Ethereum futures ETF was recently approved and listed on the Chicago Mercantile Exchange is a net positive and paves the way for a potential listing in May 2024.

Featured image from Canva, chart from TradingView

Disclaimer: This article is provided for educational purposes only. This does not represent NewsBTC’s opinion on whether to buy, sell or hold any investment, and of course investing carries risks. We recommend that you do your own research before making any investment decisions. Your use of the information provided on this website is entirely at your own risk.