Analysts think Ethereum will explode to $15,000 and cite a favorable technical composition.

Cryptocurrency analyst Elja on predict According to technical analysis, Ethereum (ETH) will reach a whopping $15,000 by 2025. The analyst claims that the current bearish sentiment in the cryptocurrency market is “temporary.”

Moreover, Elja points out that the second most valuable coin by market capitalization follows a similar fractal pattern that fueled major price gains prior to 2021.

Despite its current consolidation, is Ethereum ready to be torn apart?

Sharing a screen of the current ETH price movement, Elja said that most people in the cryptocurrency industry are short-sighted and only focus on immediate price movements. Analyst assessments require traders to look long-term to understand overall price patterns.

So far, Ethereum is under pressure, as is Bitcoin (BTC), and is struggling to break through immediate resistance levels. Looking at developments on the daily chart, ETH has returned to an important support level around $2,200. Notably, the coin is down 20% from its January 2024 high of around $2,700.

ETH is under pressure, at least in the short and medium term. As is, the coin follows the technical candlestick arrangement seen in Bitcoin.

The altcoin decline appears to have been triggered by events that occurred after the U.S. Securities and Exchange Commission (SEC) approved a spot Bitcoin ETF. Bitcoin, for example, fell from around $47,000 to less than $40,000 this week, putting pressure on altcoins including Ethereum.

Grayscale Investments has unloaded thousands of coins behind the Grayscale Bitcoin Trust (GBTC), according to on-chain data. Afterwards, there was a sell-off across Bitcoin and altcoins. The situation for Ethereum worsened after the US SEC decided to delay approving a spot Ethereum ETF.

While these developments have had a negative impact on sentiment, Elja believes they will not derail Ethereum’s long-term growth trajectory. In particular, the analyst notes that ETH is consolidating as a “healthy signal.”

ETH Rises to $15,000: Will Fundamentals and Technical Factors Help?

Elja added that consolidation in cryptocurrency prices could suggest whales are accumulating positions. Once this is over, ETH price could go higher. According to analysts’ charts, the coin will surpass $5,000-$15,000 in the next session.

In making this prediction, the analyst compared Ethereum price action to a fractal pattern that drove ETH from around $200 to $4,800 over a 15-month period from 2019 to 2021. Based on past price movements, Elja believes Ethereum is heading down a similar path. According to the analysis, the coin is likely to break past its highs in November 2021.

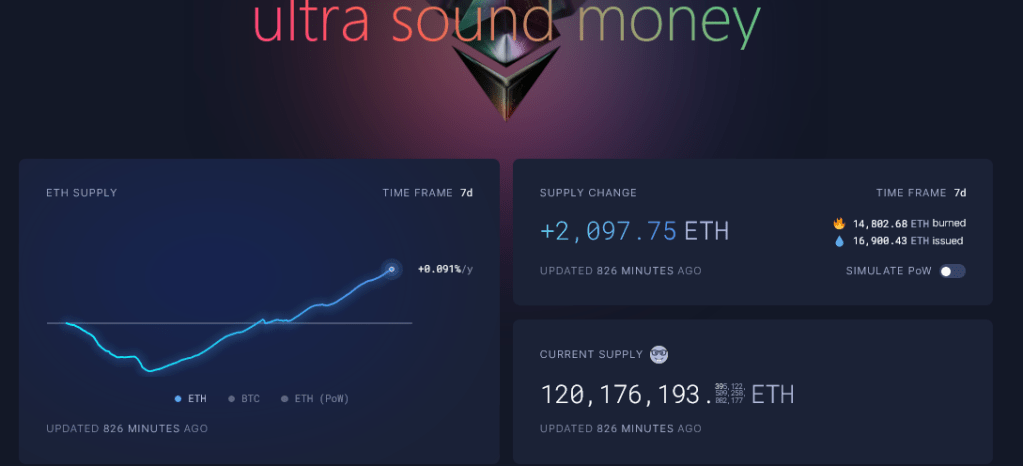

In addition to technical factors, ETH supporters also cite a decline in issuance rates. According to Ultrasound Money data, the network burned thousands of ETH, reducing the supply. Additionally, BlackRock CEO Larry Fink believes that Ethereum will become the best network for tokenizing real-world assets (RWA) in the coming years.

Featured image from Canva, chart from TradingView

Disclaimer: This article is provided for educational purposes only. This does not represent NewsBTC’s opinion on whether to buy, sell or hold any investment, and of course investing carries risks. We recommend that you do your own research before making any investment decisions. Your use of the information provided on this website is entirely at your own risk.