Annaly Capital Management: High Yield Income and Catalysts (NYSE:NLY)

Philo

Annaly Capital Management Inc.New York Stock Exchange:NLY) Last week, the dividend was solidly covered by distributable profits in the second quarter. However, the mortgage real estate investment trust also suffered a slight decline in book value, but its second-quarter performance was solid. I see this investment theory continuing to be supported.

Annaly Capital Management’s net interest margin turned positive for the first time last year, and we think the mortgage trust could expand its net interest margin as the central bank looks set to cut short-term rates in 2024.

This could ultimately result in a higher margin of safety for Annaly Capital Management’s dividend, making the stock more attractive to investors seeking passive income.

My Evaluation History

Annaly Capital Management gave the stock a Buy rating in May. Net interest margin growth has improved significantly. With net interest margins back in positive territory in Q2/24 and central banks expected to take action on interest rates soon, Annaly Capital Management’s outlook is positive.

Portfolio, net interest margin and interest rate cuts

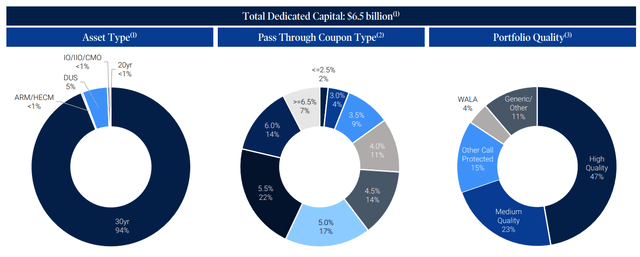

Annaly Capital Management is the world’s largest mortgage real estate investment trust with $90.3 billion of investable assets. The largest investment in the trust’s portfolio is Agency Mortgage Backed Securities, which grew 2% QoQ to $66 billion in total value in Q2, consisting primarily of 30-year fixed-rate mortgages. In addition to Agency Mortgage Backed Securities, the Mortgage Real Estate Investment Trust also owns residential credit assets and mortgage servicing rights.

These mortgage servicing rights are attractive from an investment perspective during periods of rising interest rates, as they tend to appreciate in value during such periods.

But the biggest asset is mortgage-backed securities, which are particularly attractive investments when interest rates are falling, because there is an inverse relationship between interest rates and the value of fixed-income investments like mortgage-backed securities.

Total dedicated capital (Analy Capital Management, Inc.)

Periods of high interest rates are economically damaging to mortgage real estate investment trusts that borrow money in the short term to invest in long-term mortgage securities. As a result, net interest margins during these periods are reduced (or even negative), putting downward pressure on book value and valuation.

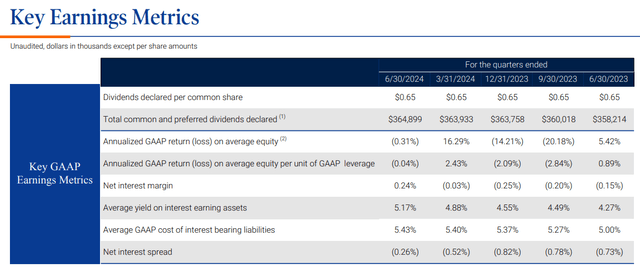

Annaly Capital Management’s net interest margin hit minus 0.25% in Q4 2023, but it bounced back to positive in the final quarter for the first time in a year. Annaly Capital Management’s net interest margin was 0.24% in Q2 2024, and with the central bank poised to cut short-term rates later this year, the mortgage trust could see additional gains here.

Annaly Capital Management sees the outlook as positive given the changing inflation trends and the reversal in NIM, despite the widening of agency mortgage-backed securities spreads in the second quarter as a headwind.

Key Earnings Indicators (Analy Capital Management, Inc.)

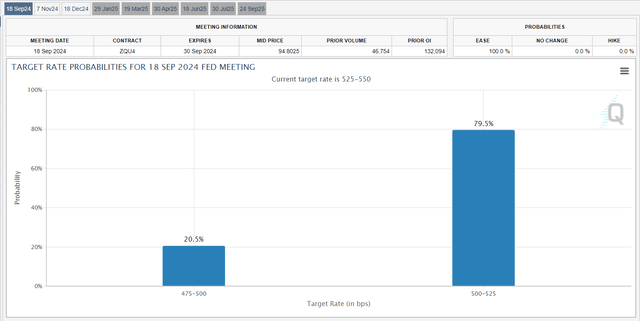

The market is looking for a near-term catalyst that could put mortgage trusts like Annaly Capital Management back on the map for passive income investors. According to the CME Fedwatch Tool, the central bank is expected to cut rates at its September meeting, which could provide a catalyst for a significant increase in Annaly Capital Management’s net interest margin. The odds of a 25 basis point rate cut in September have risen to 80%.

Target rate (CME FedWatch)

MSR Sales Forecast

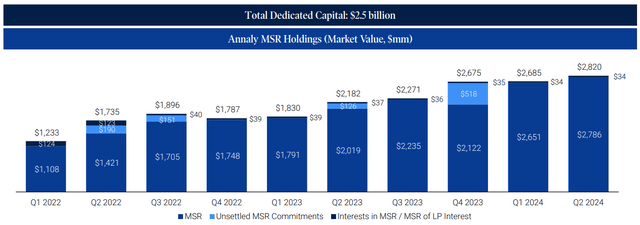

In addition to agency mortgage-backed securities, Annaly Capital Management has other investments such as Residential Credit and owns a $2.8 billion portfolio of mortgage servicing rights. These products are valuable to mortgage trusts in a rising interest rate environment because they increase valuation multiples.

In the second quarter, mortgage trusts benefited from higher MSR valuations, but with interest rate cuts looming, we believe investors will be looking at changes in investment strategies and the potential for mortgage foreclosure sales.

Specifically, Annaly Capital Management could sell the MSRs and allocate the proceeds of its investments to mortgage-backed securities that are likely to appreciate in value in a declining interest rate environment.

MSR Holdings (Analy Capital Management, Inc.)

Dividend payout ratio less than 100%

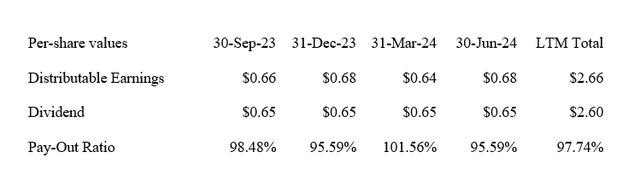

Annaly Capital Management earned its entire dividend of $0.65 from distributable income in the second quarter, after falling below 1 cent in the previous quarter. The mortgage trust’s 24-year dividend payout ratio for the second quarter was 96%, and the trust has covered its dividend with distributable income in three of the past four quarters.

Annaly Capital Management’s distributable income is primarily supported by the company’s substantial interest income from its Agency MBS portfolio. The trust’s GAAP interest income for Q224 was $1.18 billion, up 28% year-over-year. At the same time, Annaly Capital Management’s GAAP interest expense was $1.12 billion, up 18% year-over-year.

With interest rate cuts looming, these metrics could improve further (i.e. the trust’s interest expense could actually decrease), very likely increasing Annaly Capital Management’s margin of safety going forward.

With a 12-month dividend payout ratio of 98%, we believe the dividend has a reasonable margin of safety and do not expect a dividend cut in the short term. In fact, we expect more central bank support in the second half of the year as Annaly Capital Management’s net interest margin and coverage are expected to expand due to lower interest rates.

With Annaly Capital Management paying a dividend of $0.65 per share, shares of this mortgage real estate investment trust are giving shareholders a solid (and guaranteed) 13% yield, which is expected to be sustainable for the remainder of the year.

dividend (The author created the table using trust information)

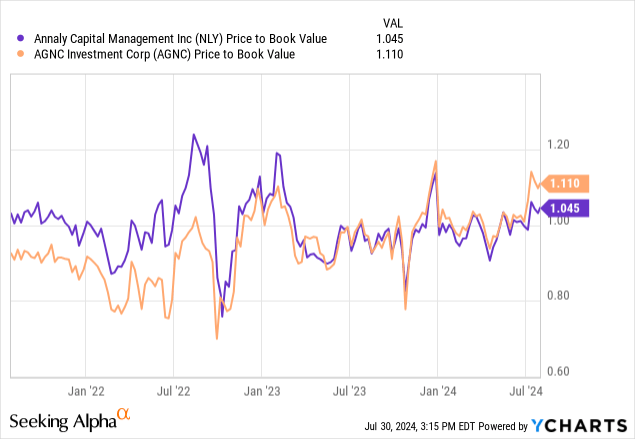

Premium vs Book Value

Annaly Capital Management’s share book value was $19.25 as of June 30, 2024, down 2.4% QoQ. The share price of $19.98 therefore reflects a 4% premium to book value.

AGNC Investment Corporation (AGNC)The Agency’s mortgage-backed securities business, which is exactly the same as Annaly Capital Management’s, is selling at an 11% premium to book value.

Annaly Capital Management also has the opportunity to sell mortgage servicing rights and invest the proceeds in mortgage-backed securities in a low interest rate environment, which would be a catalyst for increased interest income and potentially higher net interest margins.

Given that the central bank is ready to create a stimulus to lower borrowing costs and boost net interest margins, I think both Annaly Capital Management and AGNC Investments could be sold for 1.10x book value, which reflects NLY’s intrinsic value of $21.40.

Annaly Capital Management’s stock is cheaper than AGNC Investment Corp., so I think its 13% yield could be particularly attractive to passive income investors.

Why Investment Theory Might Not Work

Things could go wrong, and while the market currently prices in at least one rate cut in 2024, I think it’s possible that the central bank could decide to postpone relief measures in the form of lowering interest rates on mortgage-backed real estate investment trusts if consumer prices unexpectedly rise again.

If the central bank delays its rate cut schedule, Annaly Capital Management may not benefit from improved net interest margins (lower borrowing costs) and therefore may not be re-evaluated to intrinsic value.

My conclusion

Annaly Capital Management is selling at a premium to book value and is optimistic that the mortgage trust will deliver stronger financial performance going forward and its book value multiple will also increase.

With net interest margins returning to positive territory in the second quarter and central banks poised to cut short-term interest rates, we believe the outlook for net interest margin and book value growth is positive.

The stock is currently selling at a 3% premium, but the central bank could act as a catalyst to improve the economics of the mortgage trust, which would benefit the largest mortgage trust in the U.S. Buy.