ANSYS: Rating upgraded after merger confirmation (NASDAQ:ANSS)

Sweet Bun Factory

ANSYS (NASDAQ:ANSS) is one of the first companies covered on Seeking Alpha, and this will likely be my last article about the company. The company officially announced its merger with Synopsis (SNPS) on January 16. this This came just a few weeks after I mentioned the possibility of: merger rate is low This gives it a fair value of $342. Now that you understand the details of the merger, you can better see the long-term benefits of owning ANSYS. The fair value of the stock as I updated it is $397.

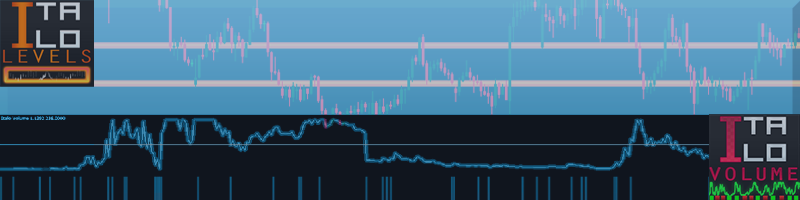

fair price assessment

The details of the merger are as follows: $197 in cash and 0.345 shares of SNPS stock for each ANSS share.

Therefore, all we need to evaluate is the price of the synopsis at the time of the merger. Currently, SNPS holds 152 million shares and ANSYS holds 87.02 million shares.. 87.02 million * 0.345 is 30.02 million shares, which is expected to dilute the number of SNPS shares by about 20%. In a bearish scenario where supply and demand for SNPS remain constant, SNPS would simply experience dilution, in which case the stock would fall from its current price of $590 to $492, making 0.345 shares worth $170 and a target price of $367.

Most likely not, but despite acquiring one of the biggest names in simulation, the size of the debt is likely to dampen investor interest.

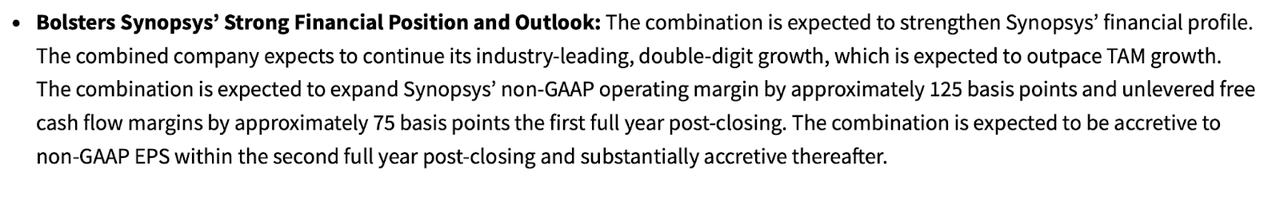

A more likely scenario would combine SNPS revenue (TTM) of $1.4 billion with ANSS revenue (TTM) of $520 million. SNPS has a P/E of 62.87 and an EPS of $9.3, while ANSS has a P/E of 50.92 and an EPS of $6.8. For simplicity, we can use 55 as the target P/E. This is on the low side as a comparable company, Cadence Design Systems (CDNS), is trading at a P/E of 76x. This shows that the expected EPS after the merger is $(1400+520)/182 shares (in millions), or $10.55. And if you multiply that by the target P/E of 55, you get $580 as the target price for Synopsys after the merger. this is Target price $397 Ansys, which is a 13% upside. Below, I explain why I am optimistic about Synopsys stock price even after the merger.

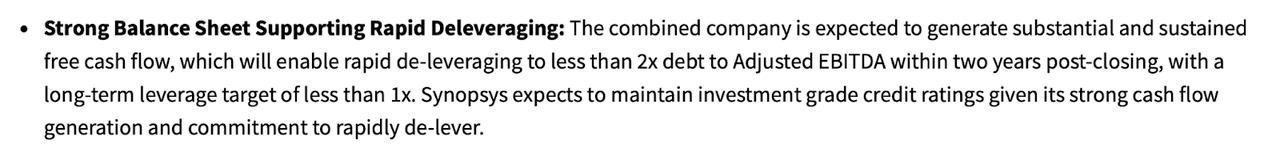

debt problem

In an article about my pessimistic view of the feasibility of a merger, I argued that a merger would either take on too much debt or dilute the stock too much. Synopsys chose a combination of the two.

Ansys

Let’s take a closer look. Since the two companies have already been working closely together since 2017, the merger itself is expected to proceed smoothly. In reality, it is believed that margins can be improved by reducing operating costs while maintaining sales levels. The two can continue business as usual, but the distribution of work between workers (less repetitive tasks) and sharing of computing power can be done more efficiently. This is where we expect to see margin growth. But for a company with $17 billion in cash burn, there was pessimism about recovery.

Ansys

However, these concerns were addressed on both sides. They projected that the merger would reduce debt to less than $5 billion, or double debt to EBITDA, within two years. It is important to recognize that the market in which the company operates is one of high margin and low debt software markets. Currently, Synopsys’ debt-to-EBITDA is 0.32 and ANSYS’s is 0.58. Nonetheless, the expected doubling of debt to EBITDA should be manageable. Looking at the outlook, it seems that the debt situation has improved a lot more than expected. Unless debt becomes a long-term burden, it should have minimal impact on investor interest and prospects for the sector.

Advantages of Merger

Clearly, ANSYS shareholders will likely pass on this deal because the price is quite good. However, I wonder exactly how much of an advantage ANSYS will give Synopsys over its competitors. ANSYS operates in the general simulation field, and Synopsys is in charge of semiconductor design simulation. Synopsys is quite optimistic about the market as AI drives increased demand for computing power, but ANSYS does not specialize in this space as much as Synopsys. Instead, ANSYS software is much more commonly used for things like stress testing, aerodynamics, etc. As a result, we are confident that ANSYS will continue to provide partnerships following the acquisition. Synopsys expects the merger to increase its Total Addressable Market (TAM) by 1.5x.

That’s right. Many aspects of physical simulation can be applied at the semiconductor level, and ANSYS already performs simulations for integrated circuits. We are not sure whether this acquisition will give Synopsys a significant silicon design advantage over its competitors. Instead, I believe this merger is much simpler and serves as an entry point for Synopsys into the general simulation market. Although there is criticism that it is now more important than ever to focus on chip design, the overall simulation market is expected to grow rapidly at an average annual rate of 12.4% until 2032.

My only concern at the moment is whether efforts to reduce debt will impact R&D in the silicon computing market in the near term. However, this seems unlikely, as we expect companies like AMD and NVIDIA to spend more to acquire the best simulation software, and Synopsys doesn’t need to be on its A-game to continue selling its software. There are no signs that Synopsys will lag behind its competitors, and the merger is expected to proceed smoothly.

conclusion

Now that the merger is imminent, we’ve updated our ANSYS price target to $397. It’s clear that most of my concerns have been considered or addressed, and I think the merger will be fairly straightforward. As a result, I am very confident in myself. purchase rating For stocks.