If we do the research, you can get alpha!

Get exclusive reports and key insights on airdrops, NFTs, and more! Subscribe to Alpha Reports now and enjoy the game!

Go to Alpha Report

The Apecoin ecosystem associated with the Bored Ape Yacht Club (BAYC) NFT collection is struggling. Despite the recent Bitcoin-led bullish trend in the cryptocurrency market, Apecoin ($APE) has failed to regain significant traction, with its price down 66% over the past 365 days and down 24% in 2024 alone.

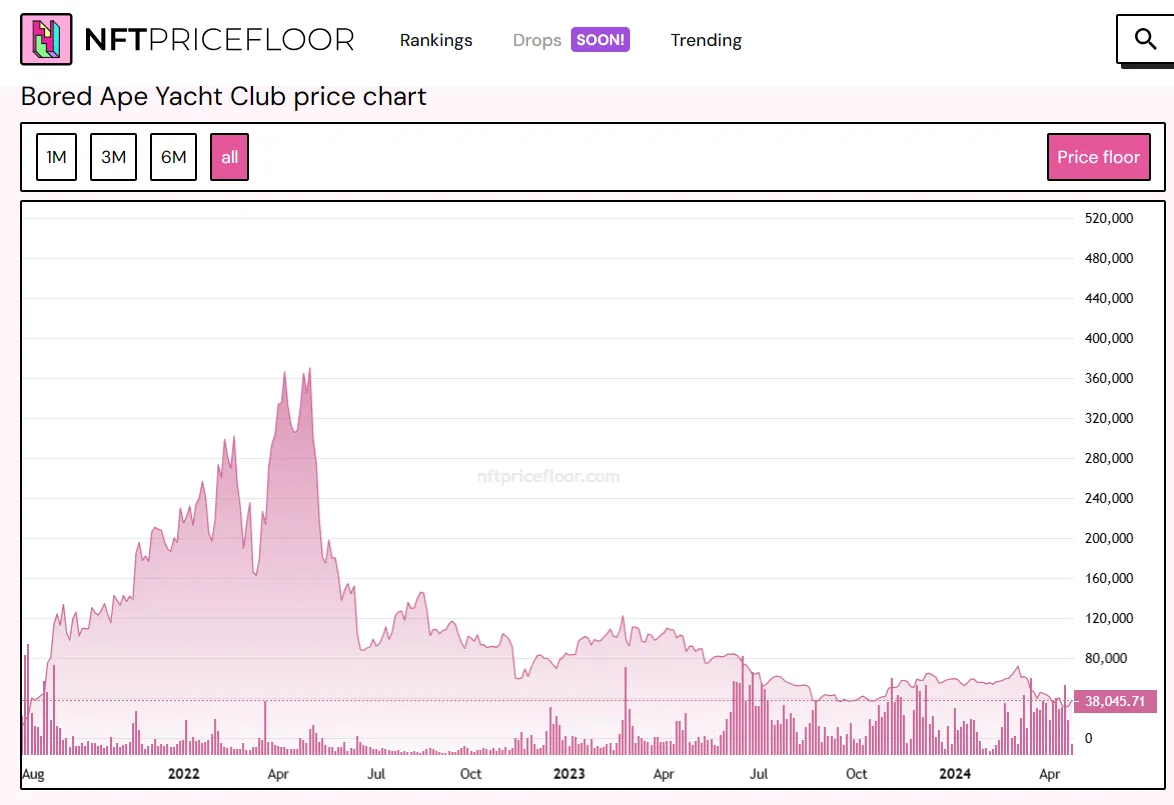

According to NFT Price Floor, the price floor for BAYC NFTs has been declining since last April, falling from a high of $369,000 to the current $38,000 per token.

But now there seems to be a ray of hope for Apecoin. After hitting an all-time low of $0.989 on April 13, the coin experienced a 35% recovery to reach its current price of $1.334. In the last 24 hours, Apecoin has surged 4.82% and is up 12.5% in the last 7 days. However, it is still down 27.93% over the past 30 days, with most of the crash occurring in early April.

Part of Apecoin’s recovery can be attributed to recent efforts by the Apecoin DAO to find new ways to drive engagement and increase use cases for the token.

One such initiative is AIP-397, an “NFT Launchpad” launch offering powered by Apecoin. The platform promotes the creation and trading of NFTs using Apecoin. The platform will introduce Puffles, a “user-friendly, code-free tool” that will allow people to mint NFTs on various blockchain networks using Apecoin instead of other cryptocurrencies.

However, this proposal does not seem to be gaining much traction, with only 30% of Apecoin holders supporting it as of this writing. Voting is open until May 1, 2024, with many members criticizing the proposal because of its lack of detail, making implementation difficult.

However, a separate proposal was enthusiastically approved. AIP-405 launches ApeSwap, a native ApeChain DEX where 50% of all fees will be returned to the ApeCoin DAO treasury. The plan has received over 80% approval, with an allocation of approximately 750,000 Apecoins, worth just over $1 million at current prices.

From a technical analysis perspective, Apecoin’s price action does not look promising. The coin has reached key volume territory from its lowest levels and the recent 35% surge could encourage swing traders to claim profits. Meanwhile, the coin is currently testing the EMA10 area below EMA55, which indicates that the price over the past 10 days is decelerating faster over time.

The Squeeze Momentum Indicator suggests that a bounce may be starting, but the Average Directional Index (ADX) at 36 shows that the bearish trend is still strong. The Relative Strength Indicator (RSI) shows that the coin is oversold, occupying 60% of trades in a downtrend.

If Apecoin remains weak, it could lose its recent 35% gain and retest all-time lows in the $1-$1.10 area. However, if it maintains momentum, it could surge another 35% until it tests resistance set by EMA55 at around $1.66.

Edited by Ryan Ozawa.