Are financial conditions sending us important warning signs? | Exchange places with Tom Bowley

I have been saying for some time that short selling can mitigate overbought situations and, in some cases, negative divergence. I was looking for maybe 4-5%, but it’s really hard to predict the type and depth of selling we’ll see when a long-term bull market faces a downturn. Personally, I would be shocked if recent weakness turns into a bear market. I’m not saying it’s impossible, but key signs suggest it’s highly unlikely.

We have seen some downward moves of just 1-2% in the past and others that have extended up to 10%, such as last summer’s correction. I think returns will be strong, but a big pullback from the October 2023 lows may have produced some positive news. You’ve probably heard the Wall Street adage, “Buy on the rumor, sell on the news.” Well, that’s exactly what we saw on Friday with the major financial institutions reporting quarterly results on Friday morning. Zacks’ earnings numbers looked pretty good.

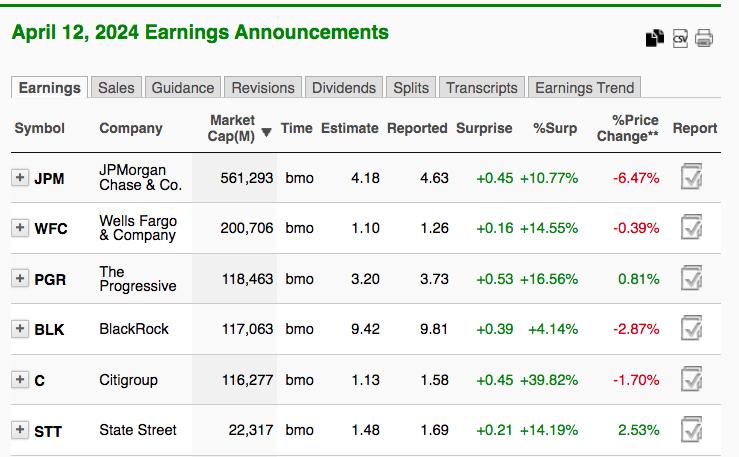

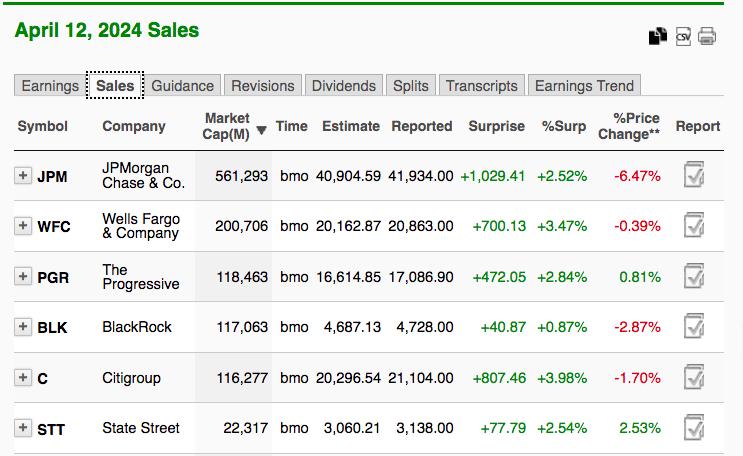

Reported EPS was significantly higher than estimates in all cases. In particular, Citigroup (C) blew away expectations, blowing estimates by almost 40%. All six companies saw a decline in sales.

Again, it was C that had the best return, almost 4% higher than expected. With these staggering numbers, it is now easy to see why the financial sector has performed so well.

But one thing that confuses many retail traders is that good results don’t always lead to higher stock prices. Check your quarterly profits price Reactions to these 6 stocks:

Is this type of market reaction justified after seeing these quarterly results? I don’t think so, but the stock market doesn’t care what I think. Market makers have a job to do. Building positions for institutional clients at our own expense. Short-term is not efficient. Pricing doesn’t do what you think it does. Then you get confused and think that financial stocks are dead. After a brief drop, they panic and sell, and after the market makers get all the shares they need, the financials gain strength again. This is what the stock market does. Short-term inefficiencies cause traders to give up, which creates supply for market makers to build inventory. Then rinse and repeat. As Yogi Berra said, “It’s déjà vu all over again!”

I discussed why this sell-off cannot be trusted in my latest EB Weekly Market Recap video, “Hot CPI Stokes Inflation Fears.” that much The long-term bull market remains perfectly intact. Please check it out and leave a comment. Also, if you haven’t already, please ‘Like’ the video and ‘Subscribe’ to our YouTube channel. This will help us build our YouTube community and we would truly appreciate it.

On Monday, April 15, I’ll be featuring another financial stock that’s ready to report stellar quarterly results. The company has been a tremendous leader among its peers and has come up with explosive reports ahead. If the financial sector reverses its current weakness, we wouldn’t be surprised if the market reacts very positively to the company’s report. To get this company and check out the charts, click here to subscribe to the free EB Digest newsletter. You don’t need a credit card to sign up for EB Digest, just your name and email address!

Happy trading!

tom

Tom Bowley is Chief Market Strategist at EarningsBeats.com, a company that provides a research and education platform for both investment professionals and individual investors. Tom writes a comprehensive Daily Market Report (DMR) to provide guidance to EB.com members each day the stock market is open. Tom has been providing technical expertise here at StockCharts.com since 2006 and also has a fundamental background in public accounting, giving him a unique blend of skills to approach the U.S. stock markets. Learn more