Are they buying or selling?

Ethereum whales have seen explosive activity recently, according to on-chain data. Here’s what these titans did.

Ethereum Whale Trading Hits Highest Since March

In a new post by X, market intelligence platform IntoTheBlock discussed how ETH whales have recently become active.

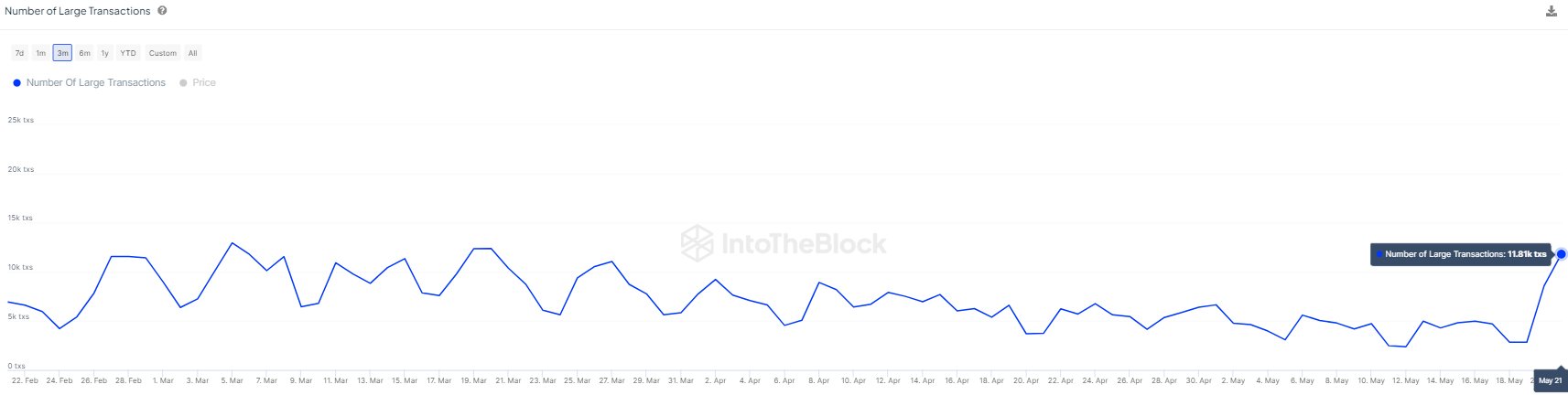

The on-chain metric of interest here is “large number of transactions.” According to the analytics firm, this indicator tracks the total number of Ethereum transactions worth more than $100,000 on the network.

Related Reading

These large transfers are relevant to these massive investors as typically only whale companies can make such large single transaction moves.

Therefore, a large transaction count indicator can tell you whether this cohort is currently active or not. The chart below shows the recent trend of this Ethereum indicator.

Looking at the graph, you can see that the number of large-scale transactions on Ethereum has recently increased dramatically. This suggests increased whale activity.

The whales came back to life after news broke that the ETH spot exchange-traded fund (ETF) could increase its chances of approval. The market hype led to a sharp rise in ETH, sending the price back to the $3,800 level.

With all this happening in the market, it is natural for these giant companies to reposition themselves. Because the volume of transactions in this cohort is quite large, if a large number of them occur together, they could be powerful enough to create a ripple effect in the market. Therefore, if the current high whale activity continues, ETH is likely to witness volatility soon.

However, the direction this volatility could take on Ethereum will depend on whether investors are buying or selling en masse. IntoTheBlock data also gave us a hint at this, as seen in the chart below for “Large Holder Netflow”.

This indicator measures the net amount of Ethereum flowing into or leaving the wallets of “large holders.” The analytics firm defines a large holder as someone who owns at least 0.1% of the total circulating asset supply.

Related Reading

The graph shows that large holders have been engaging in accumulation recently as netflow has been positive for them. So it appears that recent whale activity has included net buying.

It remains to be seen whether these giants will continue this trend going forward, potentially fueling a rally.

ETH price

As of this writing, Ethereum is trading at around $3,750, up more than 26% over the past week.

Unsplash.com, Featured image by Gabriel Dizzi from IntoTheBlock.com, Chart from TradingView.com