Are you concerned about market concentration and high valuations? Consider small caps

Henrik 5000

If you are staying away from large-cap stocks due to high market concentration and high valuations, allocating to small-cap stocks may provide some peace of mind. Aside from focus and valuation considerations, there are several reasons why this might be possible. This is a good time to consider adding small cap stocks to your portfolio.

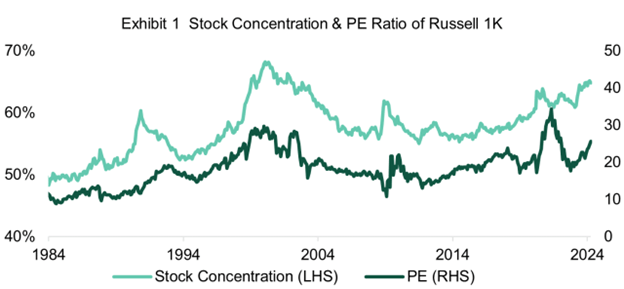

As the U.S. stock market hit an all-time high in June, the market concentration of large-cap stocks also reached a level not seen since the tech bubble.

As of May 31, the top 10% of companies in the overall market capitalization of the Russell 1000 Index accounted for approximately 66%. The stock market valuation of the Russell 1000 Index, which represents the top 1,000 U.S. companies by market capitalization, is also showing an upward trend. The index’s price-to-earnings (PE) ratio in May was 25.6, which ranks in the 92nd percentile for that ratio since launch.

Source: FactSet, Bloomberg, NTAM Global Asset Allocation Quantitative Survey. Data is from January 1980 to May 2024. Stock concentration is the percentage of total market capitalization of the top 10% largest companies in the Russell 1000 Index.

A more attractive basic

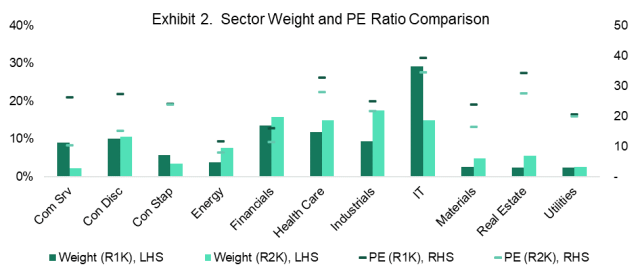

After decades of technological advancement, technology sectors such as Information Technology and Communication Services now account for more than 38% of the Russell 1000 Index’s total weight.

Valuations of large-cap companies in these sectors have risen on the back of strong growth expectations. In contrast, the sector weights and P/E ratio distributions of the Russell 2000 Index components (2,000 small-cap companies) are more moderate and normalized, as shown in Table 2.

Source: FactSet, Bloomberg, NTAM Global Asset Allocation Quantitative Survey. As of May 31, 2024.

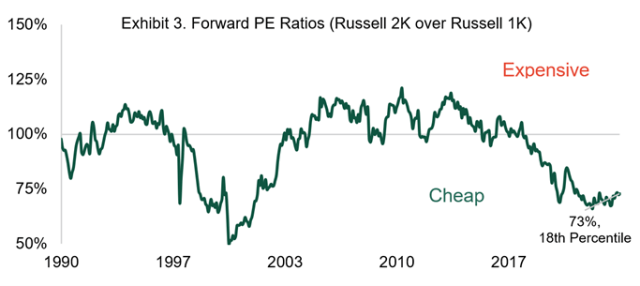

Relative to their own history, small-cap stocks are trading at a large discount to large-cap stocks. Figure 3 shows the forward P/E ratio of the Russell 2000 Index relative to the Russell 1000 Index since 1990.

As of May 31, the forward PER of small-cap stocks compared to large-cap stocks was 73%, meaning that small-cap stocks are currently trading at a 27% discount to large-cap stocks. This low valuation ratio ranks 18th.Day Percentiles for the last 35 years.

Source: FactSet, Bloomberg, NTAM Global Asset Allocation Quantitative Survey. Data is from March 1990 to May 2024. Excludes stocks with negative earnings.

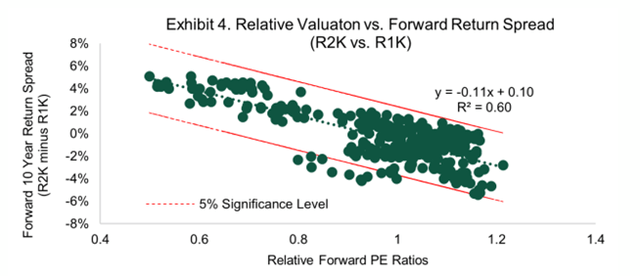

The valuation ratio of small and large stocks has predictive power regarding their future relative performance. In Exhibit 4, we created a scatterplot between forward P/E ratios and the spread of returns over the next 10 years for small-cap to large-cap stocks.

The slope of the trend line is -0.11. A negative slope, or beta coefficient, indicates that cheaper relative valuations may lead to better small-cap performance. Relative valuation explains 60% of the total variation in the 10-year forward yield spread. Given current historically low valuations, small-cap stocks are expected to outperform large-cap stocks over the next decade.

Source: FactSet, Bloomberg, NTAM Global Asset Allocation Quantitative Survey. Data is from March 1990 to May 2024. Forward PE excludes stocks with negative earnings.

Small-cap stocks do better when the economy recovers.

Small companies are younger companies with a less established business base than larger companies. Small-cap stocks are more sensitive to economic conditions and therefore have a greater correlation with economic cycles.

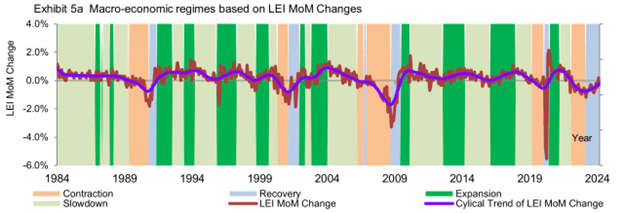

As the economy recovers and begins to expand, small-cap stocks tend to bounce back the most due to their more attractive valuations. Figures 5a and 5b show the average returns of small-cap and large-cap stocks over various economic cycles. Small-cap stocks outperformed large-cap stocks by an average of 66bps and 493bps during the recovery and expansion periods, respectively.

Sources (5a and 5b): FactSet, Bloomberg, NTAM Global Asset Allocation Quantitative Study. Data is from January 1984 to April 2024. The performance in Figure 5b is the average annual monthly return for the small (Russell 2K) and large (Russell 1K).

Our macroeconomic framework model suggests that we are currently in a recovery regime, given that month-on-month changes in key economic indicators remain negative but are trending upward. Small-cap stocks will outperform large-cap stocks when and after the economy is on its way to a full recovery.

Interest rates could be a tailwind for small-cap stocks

Small businesses do not have the same level of access to external debt financing as larger companies. They also rely more heavily on floating rate and short-term debt to finance their business operations.

When the U.S. Federal Reserve (Fed) tightened monetary policy by raising interest rates, small businesses faced significantly higher costs of capital, which could have a negative impact on their profitability. However, if the Federal Reserve begins to ease monetary conditions by cutting interest rates, small businesses will benefit more from improved credit conditions than larger companies.

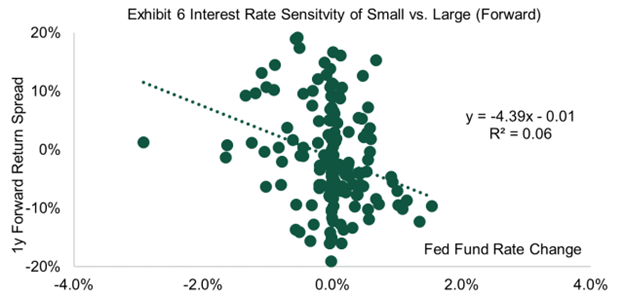

Figure 6 shows the interest rate sensitivity of the yield spread between small-cap and large-cap stocks to changes in the federal funds rate. In the scatterplot, the Y-axis is the one-year forward return spread between the Russell 2000 and the Russell 1000.

The x-axis shows the quarterly change in the effective federal funds rate. A negative regression beta historically indicates that lower interest rates have improved the future performance of small-cap stocks. The forward-based relationship is statistically significant with a t-stat of -3.1. This analysis provides empirical support that the Fed’s expected interest rate cuts are likely to be a tailwind for small-cap stocks.

Source: Bloomberg, NTAM Global Asset Allocation Quantitative Study. Quarterly data from January 1984 to May 2024.

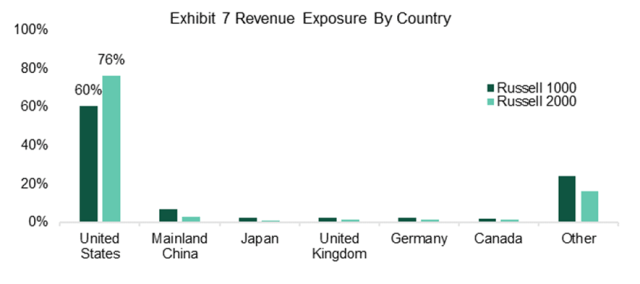

Small businesses can benefit from reshoring

According to an International Monetary Fund (IMF) research report, globalization has entered a new phase called ‘Slowbalization’. As geopolitical tensions rise, global trade openness indices have plateaued and many large multinational companies have begun to shift their supply chains back to domestic suppliers. This is likely to benefit small caps, which are more domestically focused than large caps.

Source: FactSet, Bloomberg, NTAM Global Asset Allocation Quantitative Survey. As of June 17, 2024.

main points

Investors’ concerns about large-cap stocks are increasing due to high market concentration and high stock values. Meanwhile, small-cap stocks appear undervalued despite their attractive fundamentals.

The current economic situation is favorable for a rebound in small-cap stocks. And reshoring will benefit America’s small businesses in the long run. All of these factors combine to make a compelling case for allocating a portion of your assets to small-cap stocks.

disclaimer: The content of this site should not be construed as investment advice, and the opinions expressed do not necessarily reflect the views of CFA Institute.

original post

Editor’s note: The summary bullet points for this article were selected by Seeking Alpha editors.