Ares Commercial Real Estate: Wait Your Turn (NYSE:ACRE)

Megapixel 8

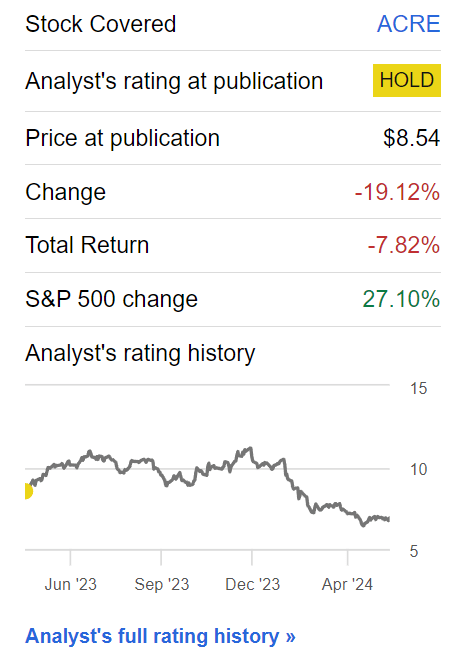

A year ago I founded Ares Commercial Real Estate (New York Stock Exchange: Acre), warned that the commercial real estate market is expected to weaken and the outlook for ACRE is negative. ACRE’s stock performance since my article It continues to lag the market, down 7.9% compared to the S&P 500’s 27% return (Figure 1).

Figure 1 – ACRE has lagged the market. (Look for alpha)

Now, a year later, I’m going to review whether my concerns about ACRE have been resolved and revisit my thesis on the stock.

Company Overview

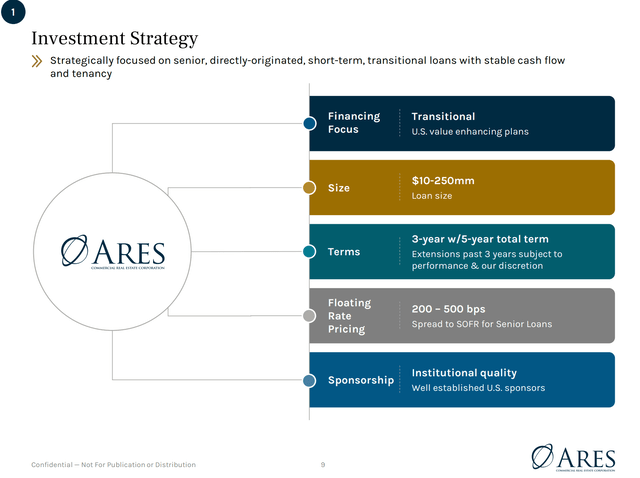

Ares Commercial Real Estate Corporation is a REIT focused on sourcing and investing in directly originating senior short-term commercial loans (Figure 2). ACRE tends to focus on loans between $10 million and $250 million with terms of three to five years.

Figure 2 – ACRE Investments strategy (ACRE Investor Briefing Session)

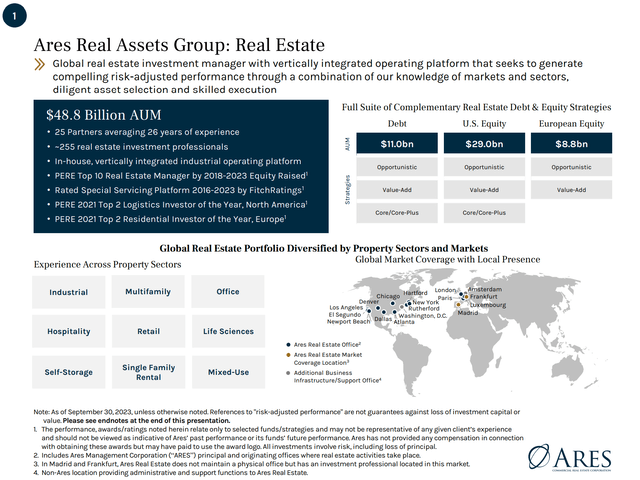

One of ACRE’s key strengths is that it is managed by Ares Capital Management, an alternative asset management giant with nearly $400 billion in AUM across a variety of sectors and strategies. Notably, Ares has a $49 billion real estate group that can help source and manage ACRE’s loans (Figure 3).

Figure 3 – ACRE is managed by Ares. (ACRE Investor Briefing Session)

huge credit loss

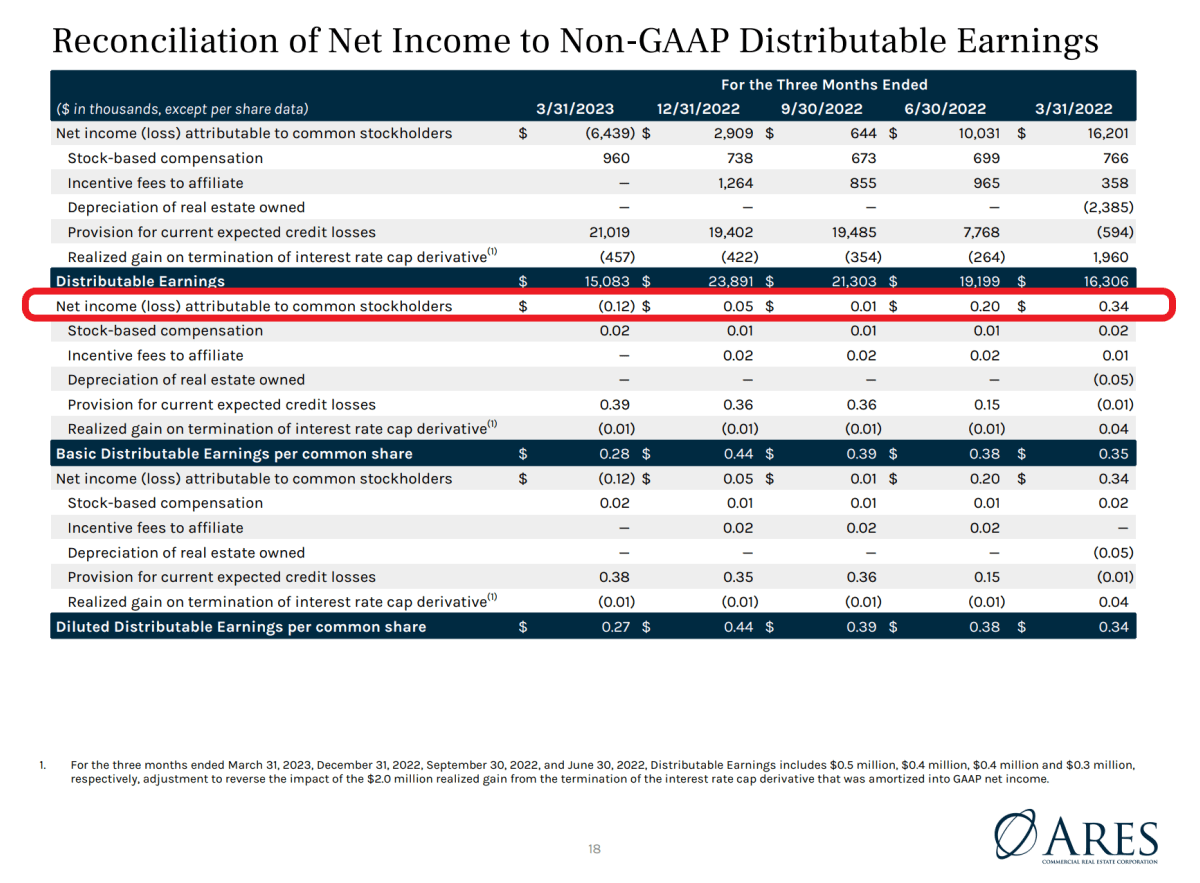

In my last article, I was primarily interested in ACRE’s worsening credit metrics. For example, in the first quarter of 2023, ACRE spent $0.38 per share in credit loss provisions, an 8.6% increase QoQ from the fourth quarter 2022 figure and a dramatic increase from the $0.01 per share launch in the first quarter of 2022. (Figure 4).

Figure 4 – ACRE Q1/23 Financial Summary (ACRE Investor Briefing Session)

Because ACRE has had to take significant losses on a number of certain loans (16% and 67%, respectively, on two loans in Chicago in the first quarter), ACRE’s current expected credit loss (“CECL”) provision of 4.0% of total loans has been reduced. I wondered if it was enough. 23).

In terms of general provisions, ACRE had provisions of $404 million for loans with a risk rating of 4 (a 7.4% reserve for ACRE’s second-worst internal rating) and only $30 million for loans with a risk rating of 3 or higher. About $18 million (1.1% reserve ratio).

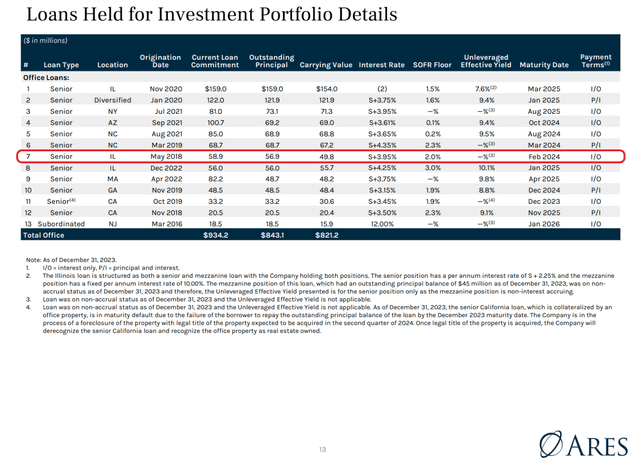

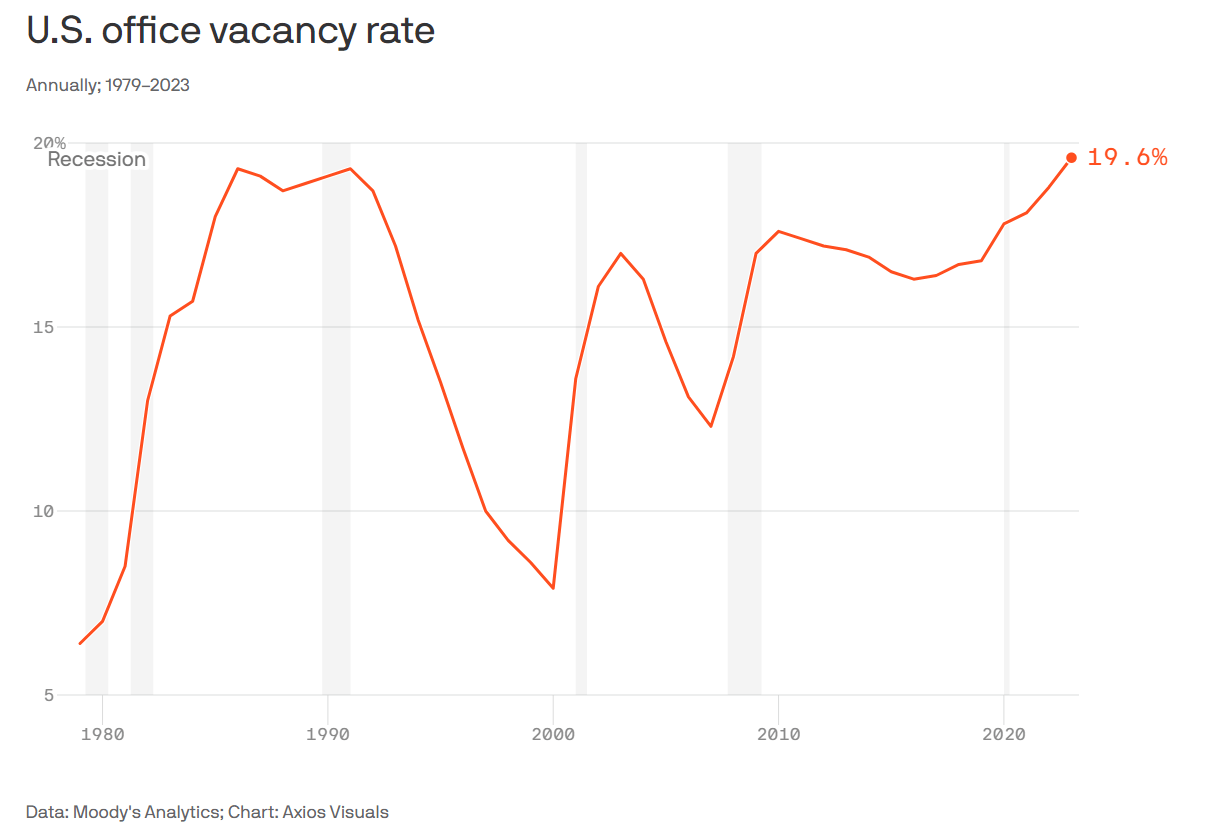

I was particularly concerned about ACRE’s $823 million in office loans as office real estate vacancies across the country soared due to work-from-home (WFH) policies.

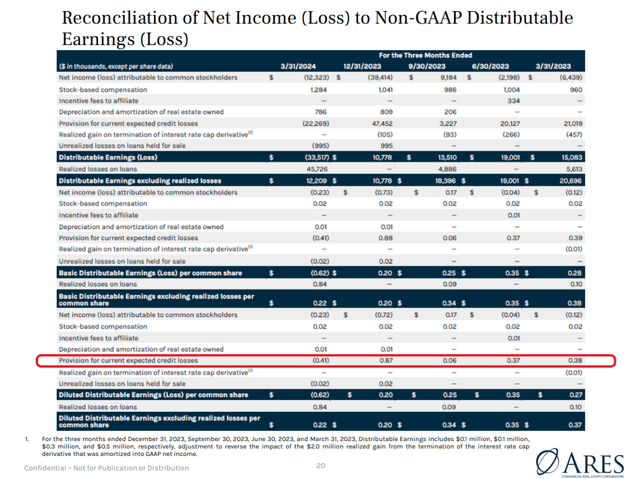

Unfortunately, my concerns turned out to be prescient, as ACRE would have to receive an additional $1.30 per share, or $70.8 million, from CECL provisions in 2023 (Figure 5).

Figure 5 – ACRE Q1/24 Financial Summary (ACRE Investor Briefing Session)

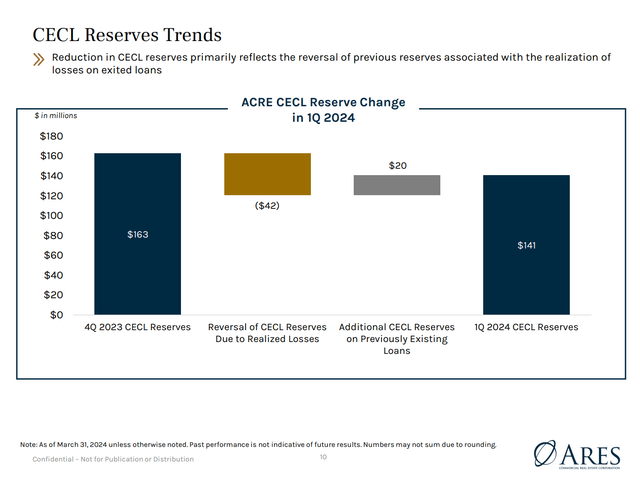

Additionally, provisions for CECL were negative $22 million, or -$0.41 per share, in 1Q24, but this was due to ACRE taking realized losses of $42 million on two terminated risk rating 5 loans and additional provisions in 1Q24. This is because an additional $20 million was added. (Figure 6).

Figure 6 – ACRE CECL Trends, Q1 2024 (ACRE Investor Briefing Session)

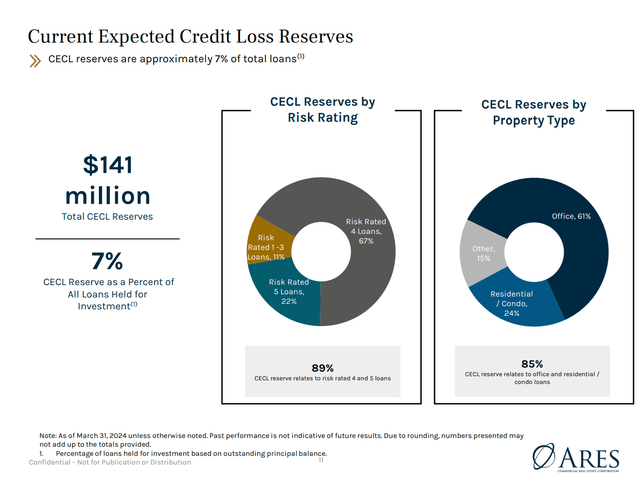

As I expected, most of ACRE’s current provisions for credit losses were related to ACRE’s office loan portfolio. As of March 31, 2024, ACRE had $141 million in CECL reserves, with 61% of CECL recorded in office properties, 24% in residential properties, and 15% in other properties (Figure 7).

Figure 7 – ACRE’s CECL is $141 million. (ACRE Investor Briefing Session)

ACRE’s loan book shrank to $2 billion as of 1Q24 ($2.2 billion as of 1Q23), but total CECL reserves increased to $141 million, or 7% of total loans.

Is a 7% CECL reserve sufficient?

As mentioned in the previous article “CRE loan losses are difficult to generalize because each property is unique and loan losses can vary.“It is therefore difficult to say whether 7% CECL holdings will be enough to determine a bottom.

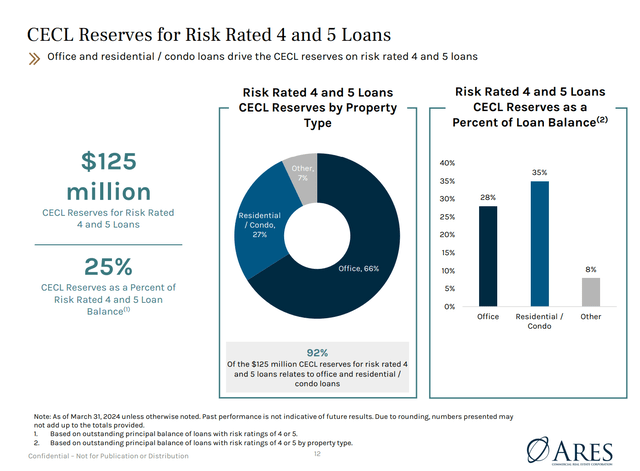

Looking at ACRE’s risk rating 4 and 5 loans, the company currently has $125 million in provisions, or 25% coverage, for these loans (Figure 8).

Figure 8 – ACRE has $125 million in CECL for R4 and R5 loans. (ACRE Investor Briefing Session)

However, as we saw with the realized losses in the quarter, ACRE provisions often fall short of actual losses in the event of default. For example, according to company disclosures, in March 2024, ACRE received discounted payments on a senior mortgage loan for an Illinois office property with an outstanding principal balance of $56.9 million, for which ACRE recognized a realized loss of $43.1 million. I did. loan (representing a repayment of only $13.8 million).

This example is particularly concerning because ACRE recently received a $49.8 million loan due December 31, 2023 (Loan #7 in Figure 9). So when the loan came due in February and the borrower defaulted, the net proceeds from the property short sale were only $13.8 million. This is significantly less than ACRE’s book value of $49.8 million!

Figure 9 – ACRE Office Loan, December 31, 2023 (ACRE Investor Briefing Session)

How many landmines are there in ACRE’s Risk Class 4 and 5 loans, and how many more of ACRE’s Risk Class 3 loans will be transferred to 4 and 5 in the coming quarters?

Flooding of office buildings trading at a fraction of their previous valuations.

The root of the problem is that commercial real estate valuations have remained in an artificial fantasy/fake world despite office vacancies soaring to record highs (Figure 10) and high interest rates driving up property cap rates. Since no transaction occurred, both lenders and borrowers were happy to mark down their holdings with small write-offs (like ACRE did for the $56.9 million loan) and prayed that the Federal Reserve would lower interest rates and bail them out.

Figure 10 – Office vacancy rates at record highs (Moody’s)

Unfortunately, after two years of rising interest rates, many of these short-term commercial mortgages are now approaching maturity, and lenders are seeing more and more defaults and short sales, such as ACRE’s problem loans.

As the floodgates opened, many office buildings sold for a fraction of their last trading value. For example, the Rosslyn/Xerox building in Washington, D.C., sold for just $25 million in January. This represents 17% of the last transaction price of $145 million in 2011. Tier 1 cities like New York are no exception, as Deutsche Bank recently did. 222 Broadway, which last sold for $500 million in 2014, is taking a $350 million loss. This realistic assessment is a wake-up call for lenders like ACRE, which has kept office loans on its balance sheet with only a few haircuts.

Dividend cuts to preserve capital

To preserve capital, ACRE recently reduced its distribution by 24% to $0.25 per quarter. This dividend cut will be particularly painful for many investors who have been ‘fishing for the bottom’ in ACRE stock, attracted by the company’s high 13%+ yield.

However, after the recent plunge in the stock price, ACRE is again posting a return of 14.9%. High yield should not be the only reason to purchase a security.

ACRE must survive. The valuation is interesting.

Although the macro environment appears to be unfavorable, ACRE will survive because it is relatively well managed and capitalized. Actually, ACRE’s valuation is starting to look interesting. ACRE is trading at $6.91 per share, or 0.62 times price-to-book value.

In fact, investors say ACRE does not trust the provisions it has booked on its loan book and has suffered an additional loss of $225 million, or $4.13 per share.

But for those brave souls out there who want to take the last option, I received this age-old warning from a mentor: “The last pick often ends up with stinky fingers.”.

Risks to ACRE

In my opinion, the main risk for ACRE is that many of ACRE’s loans are scheduled to come up for renewal in the next few quarters, at which time we will see whether ACRE has properly represented them on its books. I worry that ACRE will end up repeating many of the $56.9 million loan debacles in which it was overly optimistic about its holdings and ended up with huge realized losses.

On the other hand, ACRE traded at only 0.62x P/BV, which has already resulted in a lot of losses. If actual losses are better than feared, ACRE may bounce back from its poor financial results over the next few quarters.

conclusion

So far, my warnings to ACRE continue to have an effect as commercial real estate losses continue to pile up. As the office real estate market finally thaws, we are starting to see the reality of many office loans resulting in huge losses for lenders like ACRE.

ACRE appears to be trading cheaply with a P/BV of 0.62 and a yield of 14.9%, but I prefer to wait for real changes in the commercial real estate market before jumping in. It’s better to be safe than sorry.