Argentines have been buying Bitcoin and passing friendly legislation to combat inflation.

The following is an excerpt from the latest edition of Bitcoin Magazine Pro, Bitcoin Magazine’s premium markets newsletter. To be the first to get these insights and other on-chain Bitcoin market analysis delivered to your inbox, Subscribe now.

As Argentina’s economy struggles with record inflation, citizens are turning to Bitcoin as a way to protect their economic security.

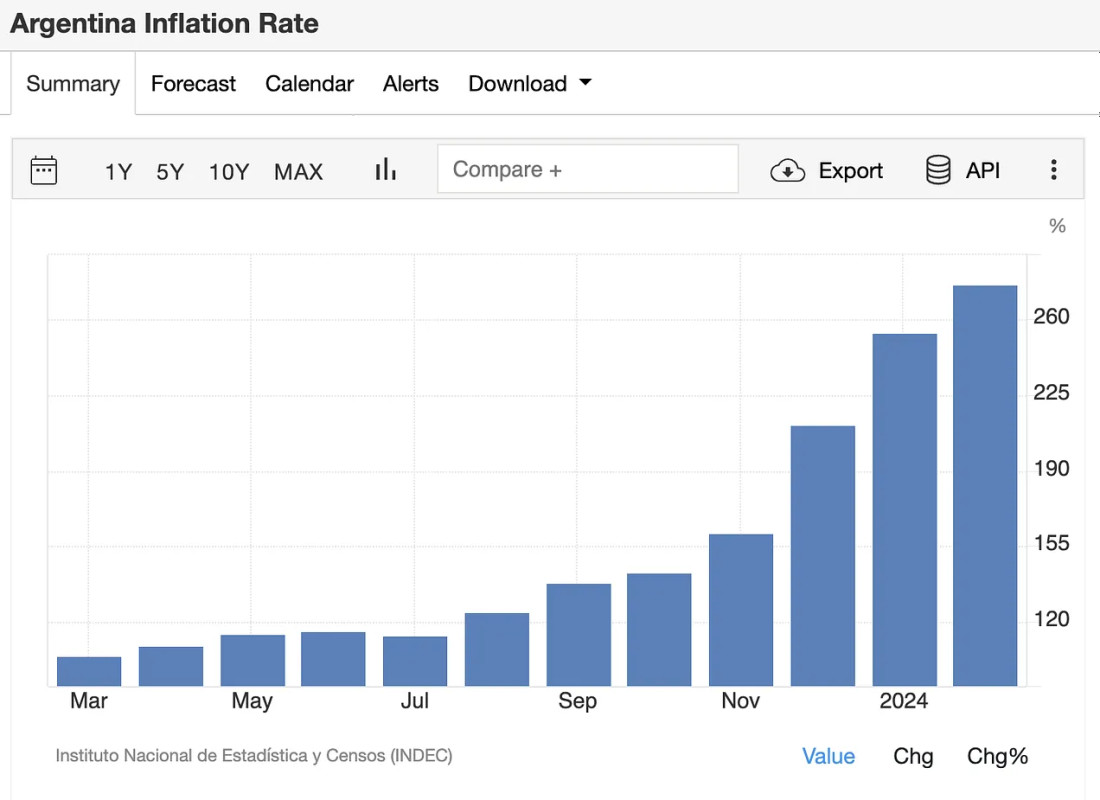

The Argentine Republic currently experiences one of the worst inflation rates in the world. The country’s economy has experienced low inflation of about 25% for decades. But the pandemic has steepened the decline to a point where it has had devastating effects. The inflation rate hit 70% in 2022 and reached 100% in February of the following year, but 2023 turned out to be a truly murderous year for the Argentine economy. The inflation rate topped the 200% mark last December when Bitcoin-friendly President Javier Milei first took office, and currently sits at an incredible 274%. These figures have seen the average citizen’s wages and savings virtually evaporate overnight, leaving people looking for more radical solutions to get their lives back on track.

In a particularly encouraging development, ordinary citizens are turning to Bitcoin in record numbers due to its classic use case as a store of value. Argentina, a country that already has high Bitcoin acceptance, has doubled down on the decentralized currency as the most popular local exchange reports its highest trading volume in 20 months. The exchange in question, Lemon Cash, claimed that Bitcoin transactions during the first week of March 2024 were more than double the average rate for all of 2023. Belo, another prominent exchange based in the country, reported a closer year-on-year increase. 10 times more. What is particularly interesting about the development is that Bitcoin is not only replacing the dollar, but also dollar-backed stablecoins, which have seen a 60-70% decline in trading volume. “Users decide to buy Bitcoin after seeing news that the currency is rising in value, while stablecoins are more practical and are used many times for transaction purposes as a means of making cross-border payments,” said Manuel Beaudroit, CEO of Belo.

Ironically, bloomberg Allegedly, some of President Maillay’s economic positions actually influenced the dollar-to-Bitcoin transition, but through unexpected and indirect means. The radical liberal began his administration with a series of far-reaching reforms aimed at taking control of the situation, reducing spending and breaking up or privatizing various state-owned enterprises. A particular goal of his administration so far has been to build a budget surplus for the federal government for a variety of reasons. Using these funds more carefully, achieving the goals in accordance with the agreement with the International Monetary Fund (IMF) and, of course, a positive trend in Argentina’s economic statistics. One element of this surplus policy was to establish similar reserves of U.S. dollars to reduce their domestic circulation. The exchange rate between the peso and the dollar has taken a serious hit, making the once popular store of value less attractive than the soaring Bitcoin.

Chainalytic’s report puts some hard numbers on this general trend. Argentina leads all of Latin America in terms of transaction volume and ranks second overall in terms of grassroots adoption. Representatives of Lemon Cash estimated in the report that the number of Argentines using Bitcoin or other digital currencies is around 5 million out of a population of 45 million! These impressive numbers should be viewed as a turning point of sorts, rather than simply the result of temporary economic misfortune. Bitcoin acceptance has been quietly growing for years, and now the crisis is providing a leap forward for Bitcoin to grow into Bitcoin. A completely mainstream fiat alternative. The rate of growth is so rapid that it is spawning unexpected industry “cousins” and has seen a five-fold increase in cryptocurrency-related fraud and phishing activity. Clearly, the market is full of newcomers to Bitcoin’s chaotic ecosystem.

In response to an increase in unsavory activities targeting new Bitcoin users, Argentina has begun passing some new regulations for the industry. The Senate unanimously passed a new bill in March that sets out new standards that virtual asset service providers must adhere to. These standards generally relate to a variety of consumer protection and anti-fraud precautions, and the country’s major securities agencies are expected to implement these new standards. The established Bitcoin community reacted with dismay to these new laws, fearing that they would lead to market consolidation. After all, while large operations have the resources to immediately comply with these new requirements, smaller startups may find it daunting. Nonetheless, lawmakers are working on a series of tax exemptions for digital asset holders, which could help alleviate this hostility.

But interestingly, President Miley did not attend these proceedings. The man has espoused some pro-Bitcoin views on the campaign trail and has a general economic philosophy that is consistent with Bitcoin’s core fundamental principles, but he has nonetheless had little public influence over many of Bitcoin’s developments. It wasn’t. Despite the fact that his own policies have incidentally led to a rise in Bitcoin, he has not made any public statements about the situation. Nonetheless, Milei has committed to a series of broad economic reforms and austerity measures, balancing global market confidence across multiple indicators with concerns about rising poverty. Milei succeeded in slowing soaring inflation to some extent, but at a heavy cost. Reduced government spending has left more citizens at risk. like Reuters Reportedly, the crisis is not over yet, with sales, activity and production all showing declines.

That said, Milei is likely to personally put Bitcoin on the back burner as he has a much higher priority on controlling the economy and mitigating the potential for social unrest. Despite these adversities, his general popularity remains, but controversial issues like Bitcoinization may simply be a fight he doesn’t want to start. When things calm down we can expect him to support Bitcoin once again, but nothing is certain. Still, despite his lack of direct Bitcoin-friendly plans, the legislature is still making positive moves of its own. It seems unlikely that Argentina will become actively hostile to Bitcoin in the face of Nigeria’s crackdown-like inflation amid a sluggish currency.

Ultimately, the future of Bitcoin in Argentina depends on Bitcoin users. The economic crisis drove the community to record-high adoption rates and Bitcoin was already a household name. Will this trend continue as the economy recovers? Will the nascent community of Bitcoin-related businesses and developers eventually transform into a dynamic and profitable industry? There are too many variables to say for sure. Nonetheless, Bitcoin is a turbulent market that was founded in the aftermath of the US economic crisis resulting from the 2008 crash. Communities around the world have demonstrated an innovative and enterprising spirit that can lead to success even in the most marginalized situations. That said, Bitcoin is on the rise globally and there is no reason to doubt that it will not continue to rise in Argentina as well.