ARKF: Bullish Technology and Cryptocurrency Momentum to 2024

multinational

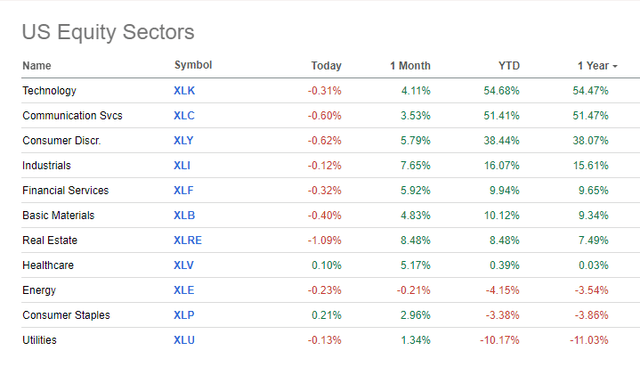

It’s been a stellar year for technology stocks. The information technology sector rose 55% in 2023. Only three S&P 500 sectors outperformed the overall index, along with the Communication Services and Consumer Discretionary sectors. Traditional bank stocks performed poorly. Local banking crisis in March 2023. Interestingly, intermediate-term Treasury bonds closed unchanged last year despite a volatile interest rate environment. As a result, cryptocurrencies and once-hot fintech startups were in turmoil before picking up steam by the end of the year.

I am ARK Fintech Innovation ETF (NYSEARCA:ARKF). Although valuations are high, technical momentum is strong after the year-end rally.

S&P 500 Sector Performance in 2023: Technology Shines, Financials Return +10%

pursue alpha

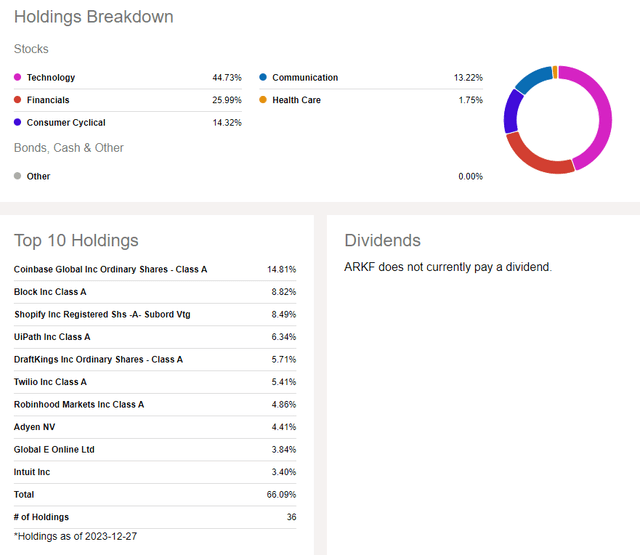

Ark Invest main ARKF is an actively managed ETF that seeks long-term growth of capital. it pursues Under normal circumstances, this investment objective is achieved by investing primarily (at least 80% of assets) in domestic and foreign equity securities of companies engaged in financial technology (“fintech”) innovation, which is the Fund’s investment theme.

ARKF is a mid-cap ETF with nearly $1.2 billion in assets under management and does not pay a dividend as of December 29, 2023. The stock’s momentum has been noticeably stronger over the past nine weeks, which is evidenced by the ARKF rankings. It ranks #1 out of 86 ETF subclasses, according to Seeking Alpha’s ETF Ratings. With a high annual expense ratio of 0.75%, this high-volatility fund is expensive and somewhat risky when assessing the standard deviation situation. Nonetheless, ARKF’s liquidity is solid, given the average daily trading volume of over 500,000 shares over the past three months and the average bid/ask spread of just 4 basis points.

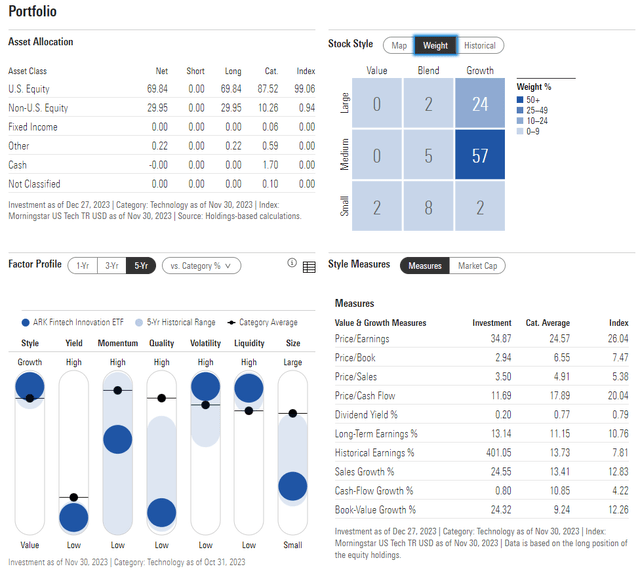

Looking closely at the portfolio, Morningstar’s 1-star, negative-rated ETFs appear to the right of the style box, indicating a growth-focused allocation. Only 2% of ARKF is considered value. Moreover, with nearly three-quarters of the portfolio classified as growth, there is a risk that a lower revaluation of some expensive holdings could lead to quick losses. The long-term earnings growth of ARKF’s holdings has been stellar, so the current price-to-earnings ratio of 35x isn’t particularly high as long as earnings growth continues.

Also consider that the ETF’s net asset value per share was roughly double what it was in early 2022, just before the historic Fed hiking cycle. We believe that the backdrop of falling policy interest rates around the world today is good news for fintech and cryptocurrency-related stocks.

ARKF: Portfolios and Factor Profiles

dawn of fame

Cathie Wood generally likes to focus on a small number of promising fintech leaders, regardless of which ARK Invest fund we investigate. In the case of ARKF, Coinbase (COIN), Block (SQ), and Shopify (SHOP) are major holdings. These three stocks make up 30% of ARKF’s overall portfolio, and the top 10 holdings make up about two-thirds of the fund. It is important to monitor the underlying corporate earnings trends of the largest positions as well as cryptocurrency-related events.

ARKF: Technology and Cryptocurrency Focused Portfolio

pursue alpha

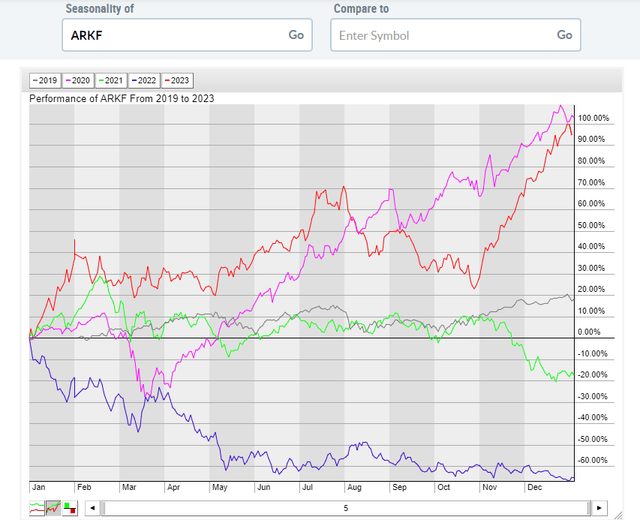

Seasonally, ARKF tends to bounce moderately from early January to mid-February, with occasional volatility until the end of the first quarter, according to historical trends. The ETF’s five-year performance history is solid, and annual gains were concentrated in the second quarter, with a rebound in the final two months of the year. In fact, the fintech fund has followed the script well since last summer.

ARKF: Mixed first quarter performance details

StockCharts.com

technical take

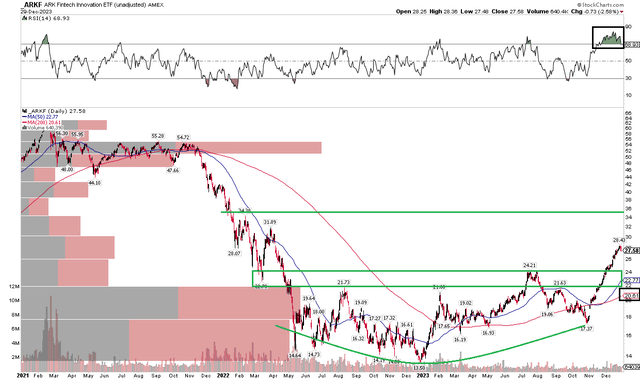

ARKF surprised bulls and bearers alike with a surge of more than 60% from late October through the first part of its vaunted Santa Claus rally period. As we head into the new year, we see several key technology price points for investors to keep an eye on. In the chart below, we can see that the ETF has risen above its previous resistance area between $21 and $24. Technologists like to see more precise support and resistance price ranges rather than broad ranges, but as long as ARKF stays above the mid-$20s, the bulls should remain in control. Still, the ETF could at first glance see some gains from here, as its long-term 200-day moving average is about $7 below its 2023 close. But take a look at the RSI momentum indicator at the top of the graph. It is currently easing overbought conditions, so it would not be surprising to see prices move further sideways.

$24 is the first support area, but we see upside resistance that could appear in the mid-$30s. Consider that ARKF failed to rally beyond that point in two attempts at a rally in early 2022. Moreover, there is also an upside-measured moving price target in the mid-$30s based on the round bottom formation over the past 18 months. Lastly, there isn’t a lot of stock trading in the low $20s to mid $40s. This air pocket gives bulls an opportunity to rally the fund further in 2024.

Overall, ARKF remains overbought and extended relative to the 200dma, but technically we see more bullish potential than bearish risk.

ARKF: Bullish breakout, mid-$30 target, near-term overbought condition.

StockCharts.com

conclusion

We assign a Buy rating to ARKF based on strong momentum and technical breakout. The ETF has upside potential into the mid-$30s as the cryptocurrency market continues to rebound after a prolonged bear market that is likely to wash out the weak.