Armada Hoffler Properties: 7% Dividend Yield with Strong Coverage (NYSE:AHH)

Dennis Stanney Jr.

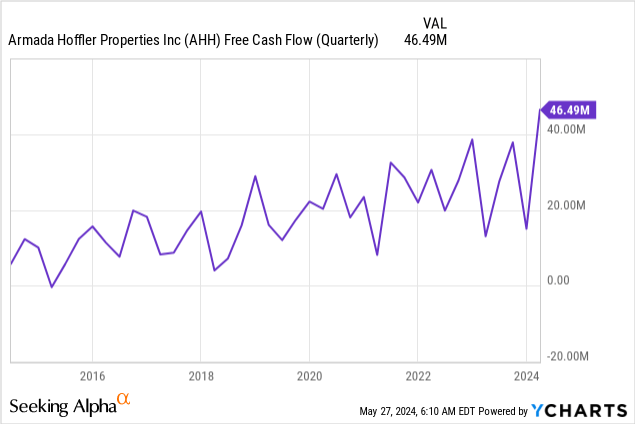

Armada Hoffler Properties (New York Stock Exchange: Ahhh) is one of the best investment opportunities in the equity REIT sector. The REIT is currently trading at a multiple of 9.14x, at $1.21 to $1.27, the midpoint of its guidance for normalized funds from operations (“NFFO”). This represents growth of up to 3 cents compared to NFFO in fiscal 2024. $1.24 per share If realized in 2023, the midpoint would imply flat year-on-year growth. Seeking Alpha REIT B+ rating Compare to REIT peers.

pursue alpha

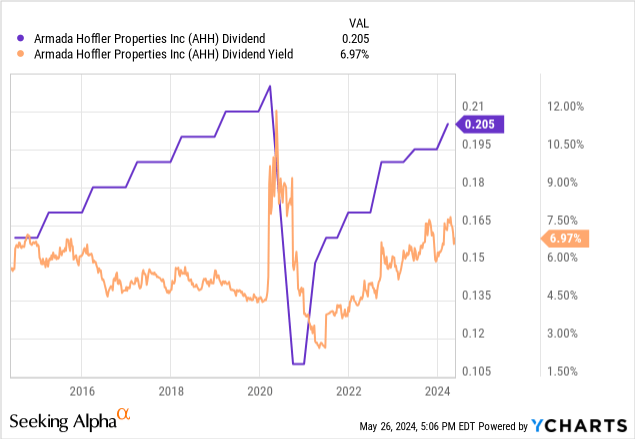

Commons is down 8% so far this year, taking into account the impact of the pandemic and pushing its dividend yield to near-record levels. AHH last declared a quarterly cash dividend of $0.205 per share, an increase of 5.1%, or $0.82 per share, compared to the previous quarter. The annual dividend yield is 7.2%. The increase comes in the face of a dividend winter for equity REITs strained by the dual impact of the Federal Reserve’s response to inflation and market instability in commercial real estate.

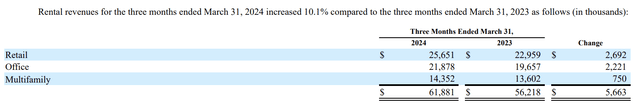

AHH is a diversified real estate asset REIT with a portfolio divided into retail, office, and multifamily properties. Retail constitutes the largest rental revenue segment at 41.4% of $61.88 million in rental revenue in the first quarter of fiscal 2024. Offices accounted for 35.3%, and multi-households accounted for 21.2%. First-quarter rental revenue increased 10.1% year-over-year, and AHH recorded first-quarter NFFO of $0.33 per share, up 3 cents year-over-year. This diversification has been bittersweet, with the REIT’s current multiples strongly reflecting deep market uncertainty about the future of office real estate. AHH has risen since our last coverage, but the upside is still significant based on the low multiple and decent prospects for NFFO growth. What you prefer (NYSE:AHH.PR.A) remained flat.

Armada Hoffler Properties Fiscal 2024 First Quarter Form 10-Q

Share and NFFO Growth

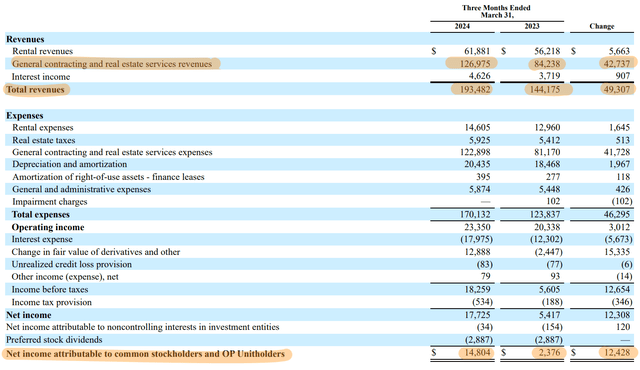

First quarter total revenue was $193.48 million, up 34.2% year-over-year for AHH and well ahead of consensus. This comes as AHH’s weighted average portfolio occupancy rate decreased sequentially to 94.7% from 96.1% in the fourth quarter. The decline follows a 270 basis point decline in retail occupancy from 97.4% to 94.7%. Office occupancy was 93.6%, down from 95.3%, and multifamily occupancy was 95.1%, down from 95.5%. So, despite the overall decline, the REIT’s construction business performed strongly relative to its $343 million backlog.

Armada Hoffler Properties Fiscal 2024 First Quarter Form 10-Q

Commercial lease renewal spreads increased 11.5% on a GAAP basis and 3.7% on a cash basis during the first quarter, and AHH generated total real estate net operating income (“NOI”) of $41.35 million. This represents a 9.26% increase from NOI of $37.85 million a year ago. AHH expects full-year NOI in 2024 to be between $166.6 million and $171 million. The REIT also closed 21 lease renewals and three new leases during the first quarter, spanning 115,549 net leasable square feet. Critically, AHH is covering its increased dividend by 151%, or a payout ratio of 66%, leaving the door open for another near-term increase.

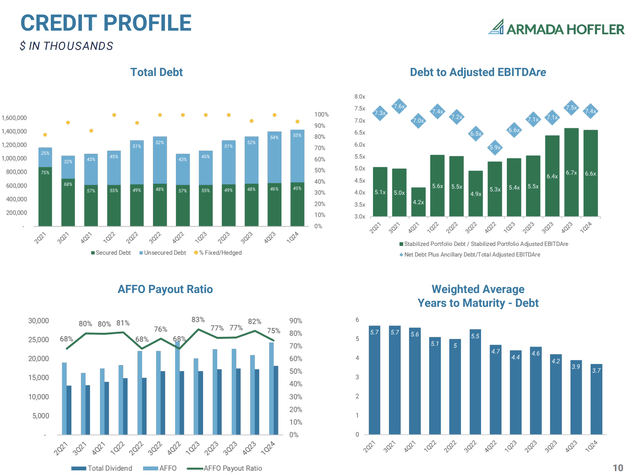

Credit Profile, Liquidity and the Federal Reserve

Armada Hoffler Properties Fiscal 2024 First Quarter Supplement

At the end of the first quarter, AHH’s total debt was $1.4 billion, about 90% of which was hedged with fixed rates or interest rate swaps. Although total debt has been increasing since the fourth quarter of 2022, AHH’s net debt to total adjusted EBITDAre decreased sequentially from 7.5x to 7.4x during the first quarter. The total debt to business value is approximately 54%. The REIT’s leverage is showing some signs of stress, with its weighted average years to maturity of debt continuing to decline, with the leverage ratio exceeding management’s 40% target.

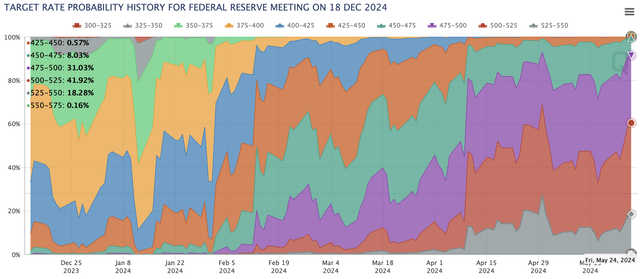

AHH’s low multiple and high dividend yield are a function of the stock market, which has taken a toll on REITs over the years. This sentiment is likely to change with interest rate cuts, with AHH well-positioned to see multiples expand due to its strong coverage and high dividend yield. REITs have been one of the worst-performing sectors since the federal funds rate was raised to its highest level in 22 years from 5.25% to 5.50%. Additionally, initial dovish expectations of at least three rate cuts in early 2024 have fallen to a single rate cut at the upcoming FOMC meeting in November or December, according to the CME FedWatch Tool.

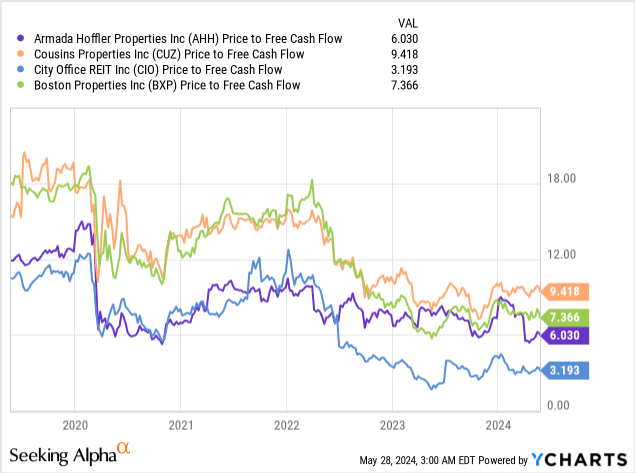

AHH’s office occupancy rate is well above the occupancy rate implied by the national office vacancy rate of 18.8% at the end of April. This ratio increased 210 basis points year-on-year. REITs are sensitive to the federal funds rate due to the significant leverage they use to finance asset purchases. Therefore, they have positive duration risk. We can see this in the decline in price-to-free cash flow for each office REIT since early 2022, when the Federal Reserve’s fight against inflation began.

CME FedWatch Tool

Office REIT discounts reflect this zeitgeist. It is unclear at what point this will stabilize against increased office-to-residential conversions and a collapse in new office construction. AHH’s diversified portfolio, very safe dividends, and high occupancy rates mean the REIT deserves a higher multiple compared to NFFO. This will likely only happen after the Federal Reserve begins cutting interest rates. This reassessment schedule is expected to occur in late 2024 and early 2025, with the FedWatch Took price for this period showing the highest likelihood of a rate cut. This will be the baseline scenario if inflation falls again, and in the worst-case scenario, interest rate cuts will keep investors away in the uncertain period beyond 2025.