Artisan Mid Cap Value Fund Q1 2024 Commentary

Richard Drury

Investing Environment

US equity markets reached new all-time highs in Q1 supported by a resilient US economy, a general trend of disinflation and an acceleration in corporate profits growth. Given mostly benign economic data offering little indication that a recession is near, interest rate markets pared back the number of expected Federal Reserve rate cuts in 2024. The Russell Midcap® Value Index rose 8.23%, continuing the strong rally that began in late October of last year.

Broad-based strength across sectors and leadership from cyclicals— industrials, energy and financials—may suggest investors’ focus has shifted toward drivers of revenue growth rather than a potential decrease in the cost of capital, which has been a major driver of stocks, especially high-growth technology issues. The three previously noted cyclical sectors led the way in Q1 with double-digit gains, while the communication services and real estate sectors were weakest, each finishing down.

The market’s move higher has been an unusually smooth one. In Q1, the Russell Midcap® Value Index experienced only five down days of one percent or greater. Over the five-year period from 2019 to 2023, the average quarter has had twice that number. There are plenty of risks that could upset the apple cart, whether geopolitical or macroeconomic. The ongoing conflicts in the Middle East and Ukraine continue to rage, and inflation—though trending lower—remains above the Federal Reserve’s 2% target. Markets have shown relatively little concern, however. Earnings—the bedrock of business values— are growing soundly once again, and the recession that many predicted would have started by now has yet to emerge.

Performance Discussion

The portfolio participated in the market advance but trailed the Russell Midcap® Value Index. Underperformance was largely driven by our divergent sector positioning, particularly our above-benchmark weighting in communication services and lower weighting in industrials. Additionally, our holdings in the industrials sector, which is a hodgepodge of industries running the gamut from machinery and airlines to professional services, also trailed those in the index. On the positive side, our information technology, real estate and consumer staples holdings outperformed.

In the industrials sector, we had two detractors: CAE and U-Haul (UHAL). CAE is an aerospace and defense company providing pilot training via either the sale of full flight simulators or third-party training services. When we established our position in CAE in May 2022, the business was still recovering from the impacts from COVID. Lack of investor interest offered us an attractive entry point to purchase a high-quality business that was well positioned in a growing industry having high barriers to entry. Over its history, the company has transformed itself from a flight simulator equipment maker to primarily a services company with a high share of recurring revenues. Though the civil business is growing well on positive commercial traffic trends, disappointing margins in the defense segment continue to weigh on investor sentiment. Management now expects defense margins to remain mid single digits versus prior expectations of an inflection in the second half of the year, citing legacy low-margin contracts and delays in new program awards. While progress on margins has been disappointing, CAE remains a good business, and the valuation is compelling on both an absolute basis and relative to the broader market as it now sells for just 11X normalized EBITA.

U-Haul owns and operates the largest fleet of rental trucks for the DIY mover and is the third-largest self-storage operator in North America. The stock has been digesting the huge move it made in the last two months of 2023, when it surged nearly 50%. U-Haul’s demand is closely tied to the housing market, and higher interest rates and home prices have been near-term headwinds for housing activity and mobility. Even so, U-Haul has long been a steady and growing business offering attractive returns on reinvested capital. From a financial perspective, the company does employ leverage; however, it is conservatively capitalized and generates strong owner earnings, resulting in a strong financial profile. The stock also sells for an undemanding valuation (~15X P/E).

Cable One (CABO), a small cable company operating in rural US markets, was our biggest detractor in Q1. Shares have remained weak due to concerns about competition from wireless providers and depressed subscriber growth, driven in part by fewer residential moves in a frozen US housing market. Broadband subscriber additions picked up in the latest quarter, but increased promotions and discounting reduced average revenue per subscriber, and an end to the ACP (Affordable Connectivity Program) accepting new enrollees creates an additional headwind to growing subscribers. While wireless companies are entering new markets, 5G is not currently competitive with cable’s download speeds, and based on the physics of wireless data delivery, 5G is unlikely to be competitive with cable for many years, if ever. Cable continues to have a competitive advantage with respect to network speeds, reliability and capital intensity. Despite recent growth challenges, free cash flow conversion remains solid, and the valuation is highly attractive, having a free cash flow yield of ~12% and selling below our estimate of 8X normalized earnings. We like the cable business in general due to its high recurring revenue, pricing power and healthy operating leverage.

Our top Q1 contributors were Vontier (VNT), nVent Electric (NVT) and Corebridge Financial (CRBG). Vontier is a provider of fuel dispensing and related software and services to retail and commercial gas stations. At the time of our initial purchase in Q2 2022, the stock was weak for a few reasons. First, an upgrade cycle to EMV, a new payment technology, pulled forward sales into 2021, resulting in a sharper-than-expected hit to 2022–2023 sales. Sentiment was also weak due to supply chain disruptions, concerns about fuel consumption amid higher gas prices in the early months of the Ukraine war and longer term fears regarding electric vehicle market share growth. With these issues easing as of late and the stock selling cheaply, shares have turned higher on steady results and the prospect for better earnings growth driven by market share wins in mobility technologies (e.g., cloud payments software), cost savings and capital allocation (i.e., share buybacks, M&A). In addition to its cheap valuation, we are attracted to its free cash flow generation, high returns on capital, relatively asset-light business model and strong positioning in an industry that benefits from regulatory-driven demand.

nVent Electric provides electrical connections and protection solutions. These are mission-critical elements in commercial electrical and mechanical systems and civil infrastructure. nVent has shown consistent and steady growth since the pandemic, having reported 12 consecutive quarters of year-over-year sales growth supported by the secular tailwinds of electrification, sustainability and digitalization. Growth has come from a combination of volumes and pricing, with the company successfully offsetting inflation with pricing. Due to the low cost of its products relative to a project and high failure costs for customers, nVent has good pricing power and sustainable margins. In the recent quarter, the company’s data centers business (~14% of sales) was a standout, growing 20% year over year, as the acceleration in artificial intelligence infrastructure investments has created increased demand for the company’s liquid cooling solutions. Though nVent is no longer selling as cheaply as when it first drew our interest, the stock still sells at a lower P/E multiple than the S&P 500® Index despite better earnings growth.

Corebridge, a life insurance and retirement solutions company, was previously a unit of AIG and a September 2022 IPO. AIG still owns ~51% of the company following its recent secondary sale in November 2023, equaling 9.1% of shares outstanding. Since adding Corebridge to the portfolio in Q1 2023, it’s been among our top performers as the “higher for longer” interest rate environment has driven an increase in spread income. Our investment thesis has been that Corebridge would benefit from the current interest rate environment following ZIRP (zero interest rate policy) and would also have plenty of room to improve its competitive position and wring out efficiencies to improve ROE now that it is a standalone entity that is no longer part of a large inefficient and capital-constrained parent. Even after recent stock price gains, Corebridge yields 3.2% on its dividend, with a double-digit free cash flow yield. In addition to Corebridge’s regular dividend, the company paid two special dividends in 2023 totaling $1.78, which is 7.6% on the March quarter- ending stock price. Besides dividends, we expect free cash flow will be used to ensure holding company liquidity, retire diluted shares and support modest growth expectations.

Portfolio Activity

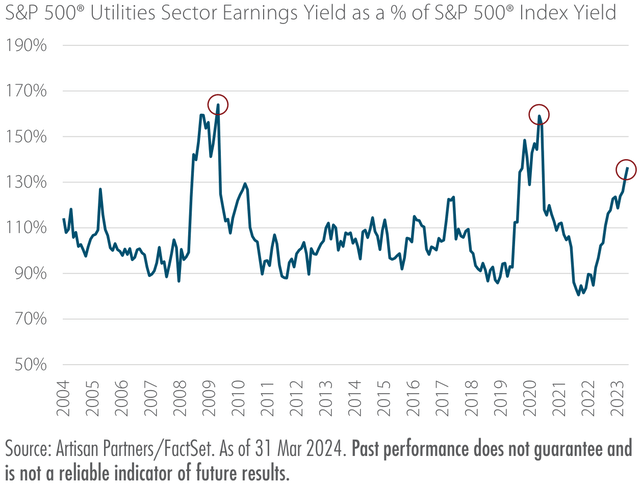

As the market has been grinding higher and higher, it likely comes as no surprise that value investors like us haven’t been very active in terms of new purchases. In Q1, we added two names to the portfolio: Alliant Energy (LNT) and LKQ. Alliant Energy is a US-regulated electricity and natural gas utility operating in the Midwest. We haven’t had much exposure to utilities in recent years as valuations and business quality were more compelling elsewhere, but as the sector has lagged significantly over the past year, leading to an above-average earnings yield relative to the broader market (Exhibit 1), we’re starting to find more opportunity.

Exhibit 1: Utilities Sector: Mispriced Yield

As a group, utilities have been out of favor for a few reasons. The interest rate environment has made bonds more appealing, and higher inflation has increased labor, equipment and commodities costs while also raising utilities’ costs of capital. Utility companies can pass on a lot of their costs to customers; however, rates are regulated, and regulators have strived to limit the rise in customers’ utility bills, which have already experienced large increases in the post-COVID inflationary period. Consequently, utilities haven’t been able to increase their ROEs as recent rates cases have gone against them.

Alliant Energy serves approximately 995,000 electric and 425,000 natural gas customers through two public utility subsidiaries, Interstate Power and Light (operates in Iowa) and Wisconsin Power and Light. Despite little change in the company’s regulatory or operating environments, the stock has retrenched over the past year, and it now trades for about 16X P/E compared to an average of 18X over the past 10 years and has a 3.6% dividend yield. The company continues to invest in rate base, and a positive outcome on its current rate case in September could give it a boost.

LKQ is the dominant player in salvage/aftermarket collision parts distribution in North America, with over 70% market share. Roughly 85%–90% of collision repairs are paid for by insurers, which value low- cost parts and quick repair turnarounds to minimize claims costs.

LKQ’s low prices, distribution scale and industry-leading parts availability make it an attractive supplier for DRP (direct repair program)-affiliated collision repair shops that represent an increasingly large portion of the industry. Over the last decade, LKQ has also become the largest mechanical parts distributor in Europe. As is the case in North America, independent European mechanics value LKQ’s reliable distribution and competitive pricing. The European business has improved operationally over the last five years as LKQ has focused on the integration of its various acquisitions to drive margin and free cash flow improvements. LKQ operates in end markets with limited cyclicality as 90% of revenues are tied to non- discretionary spending and reliably has strong free cash flow generation. The company also meets our requirement for a sound financial condition as its debt load is manageable at 2X EBITDA due to its attractive free cash flow. At 12X P/E, shares trade at a distinct discount to their historical 10-year average of 14X and are also cheaper relative to LKQ’s auto parts retailer peers, which arguably have similar long-term growth profiles.

We didn’t exit any holdings this quarter, but in keeping with our valuation discipline we trimmed our investments in a few winners, including Marriott International (MAR), Corebridge Financial and Fifth Third Bancorp (FITB).

Perspective

With market-cap weighted indices hitting new highs and the S&P 500® Index (SP500, SPX) selling for 23X (FY1) earnings, value-conscious investors—a group in which we proudly admit to being members—may feel some trepidation regarding forward return expectations for the asset class. However, we believe it would be a mistake to focus solely on the S&P 500® Index, which has become increasingly concentrated among a few mega-cap stocks, and in our view, no longer represents the diverse opportunity set that exists within our value investment universe. As we’ve noted in prior letters and on our blog Artisancanvas.com, value is historically cheap. Aside from the pandemic years of 2020 to 2021, mid-cap value hasn’t been this cheap relative to mid-cap growth since the aftermath of the tech bubble.

The Russell Midcap® Value Index trades for 16.5X FY1 estimated earnings. The Russell Midcap® Growth Index trades at 28.9X FY1 estimates. The average and median valuation spreads between these indices have been 9.7 and 6.6 percentage points over the past 26 years. Today, it’s 12.4 percentage points. We don’t know if the valuation premium for growth stocks will revert in a year or over the next 10, but we do know that the current spread positions value stocks favorably from here.