ARWK: Cryptocurrency beneficiary in ’23, bullish momentum in ’24 (NYSEARCA:ARKW)

multinational

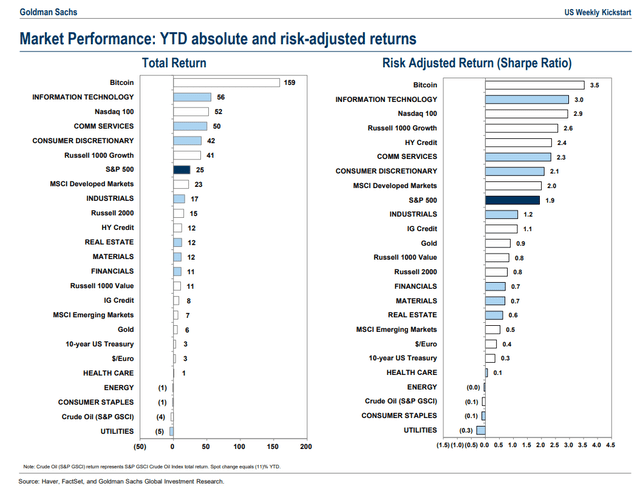

2023 has been an incredible year for everything related to technology and cryptocurrency. Funds that focus on investing in these niche markets have reaped big profits, but have also enjoyed some volatility along the way. Nonetheless, the best performers were Bitcoin and the information technology sector. Returns and risk-adjusted returns, according to Goldman Sachs. Overall, the most important cryptocurrency rose by $17,000 to around $42,000 by the end of December, while the S&P 500’s IT sector was the leading sector, up more than 50%. These two areas are the core of One Internet Fund.

ARK Next Generation Internet ETF (NYSEARCA:ARKW). Featuring high valuations, this ETF claims to be a solid investment for momentum investors in 2023.

Best Technology of 2023: Bitcoin and Technology

Goldman Sachs

According to publisherARKW An actively managed ETF that, under normal circumstances, seeks long-term capital growth by investing primarily (at least 80% of assets) in domestic and U.S. publicly traded foreign equity securities of companies that relate to the Fund’s investment theme: Generation Internet. The Issuer believes that the companies included in this ETF are focused on transforming their technology infrastructure to the cloud to enable mobile and Internet-based products and services, new payment methods, big data, artificial intelligence, the Internet of Things and social media.

ARKW has grown in size since I first reviewed the ETF in mid-2023. Although it currently has total assets under management of approximately $1.8 billion, the growth-focused fund dividend. ARKW is also expensive considering its high annual price. cost ratio It is 0.87%. Still, the stock price momentum Together with the broader stock market, they are looking very strong after an incredible rally off the late October lows. I’ll go into more detail about the important price levels to look for later in this article. liquidity It’s mixed with ARKW. With an average daily volume of over 250,000 shares and a 30-day average bid/ask spread of 8 basis points, we recommend using limit orders during slow periods of the trading day to avoid false fills.

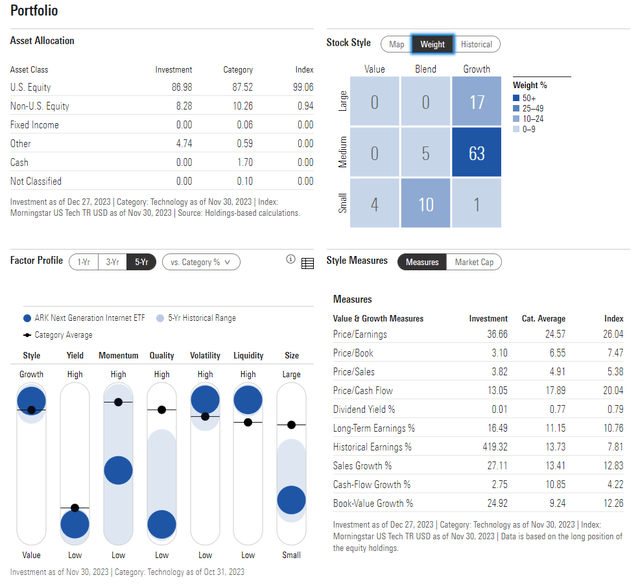

A closer look at the portfolio shows that Morningstar’s 1-Star Neutral-rated fund is on the far right of the style box, indicating a high allocation to growth stocks. Only 4% of the allocation is considered valuable. Moreover, more than three-quarters of ARKW are small and mid-cap stocks, which adds to the potential risk. Value investors are likely to avoid the ETF given its high price-to-earnings multiple of 37x and its sales price benchmark of nearly 4. However, considering its long-term EPS growth rate of over 16%, it has the earnings to back it up. High price.

ARKW: Portfolios and Factor Profiles

dawn of fame

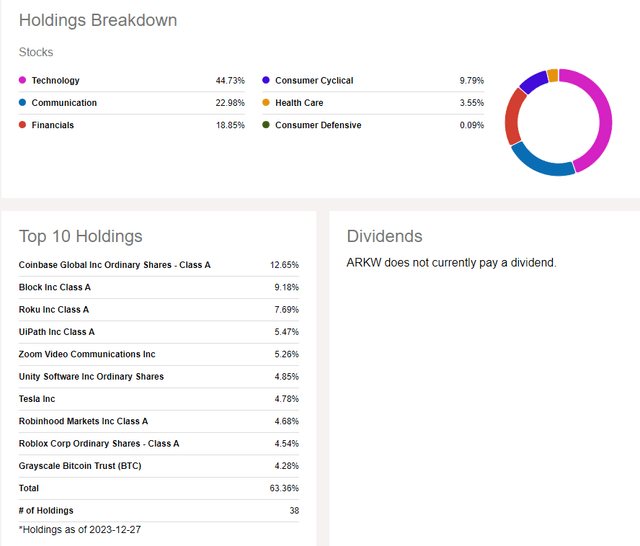

Prospective investors should acknowledge that ARKW is quite concentrated. It’s primarily a technology and partly a fintech fund. More than two-thirds of the portfolio is in the IT or telecommunications services sector. Of the 11 market sectors, the fund holds stocks in only six of them. Moreover, since the top 10 positions make up the top 63% of the portfolio, it is important to monitor fundamental and technical conditions using Coinbase (COIN), Block (SQ), and Roku (ROKU).

ARKW: Breakdown by holdings and sectors

pursue alpha

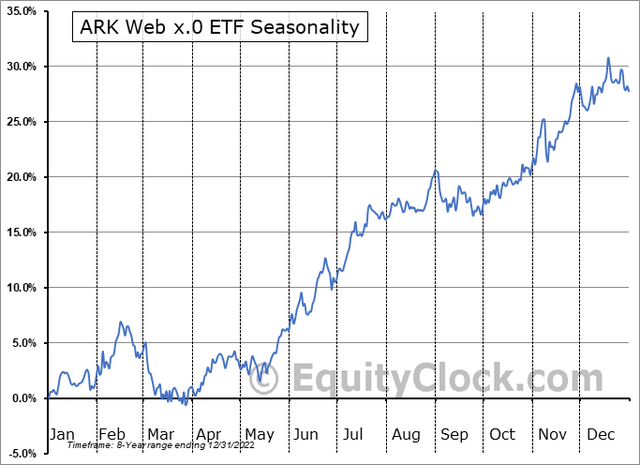

Seasonally, ARKW tends to start the year strong, rising more than 5% by mid-February, before experiencing some volatility in the second half of the first quarter. stock clock. Nonetheless, the fund has a very strong performance, but severe losses of over 80% in the 2021-2022 bear market have left many investors with significant losses.

ARKW: Bullish trend at the beginning of the year, volatility at the end of the first quarter

stock clock

technical take

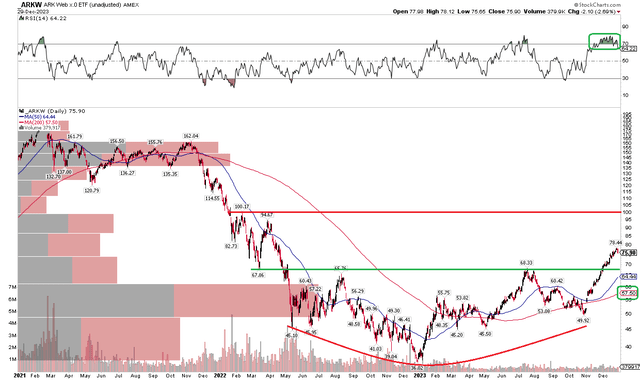

I last July highlighted A major bullish reversal signature occurs in ARKW. In fact, the ETF has generally rallied in the second half of 2023, but a material decline occurred with support at the high $40s, providing a favorable entry point. In the chart below, note that the top $60 is the main resistance level. That point was the dividing line between a long-term bearish and bullish reversal pattern. The fund was finally launched just a few weeks ago, and is marked with a bullish bullish measure moving price target of $100, based on the height of a bullish round bottom reversal pattern that hit a low of $36 at the transition from 2022 to 2023. A $32 high is added above the $68 breakout point and the $100 target is achieved.

Also look at the long-term 200-day moving average. It has a positive slope, indicating that bulls dominate. I also like that the stock is breaking out of technical overbought conditions, as evidenced by the RSI momentum oscillator at the top of the graph.

For now, a long position with a stop below about $65 appears to be a favorable risk-reward play with a target in the low $90s.

ARKW: Breakout bullish, target $100, support $68

stockcharts.com

conclusion

We once again emphasize our Buy rating on ARKW. I believe the fund’s momentum is high. today, ranked no. Four of the 83 ETFs in the Seeking Alpha subclass are expected to see further gains in 2024.