Asset Class Scoreboard: December 2023

Olivier Le Moal

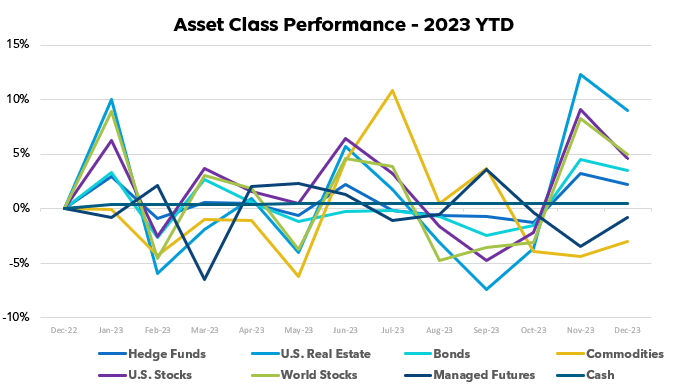

Looking at 2023 performance results across asset classes, it is clear that the ongoing macroeconomic transition this year has presented significant challenges to capital markets. Continued inflationary pressures and central bank tightening have created headwinds for several sectors. period.

While stocks have maintained significant year-to-date gains, significant monthly volatility has been witnessed as geopolitical and economic uncertainty shifts investor sentiment. Real estate also experienced significant fluctuations in housing market sensitivity due to changes in monetary policy.

Volatility was noticeable, with the average exceeding 25, compared to the historical standard of VIX, which was close to 20. Monthly returns have fluctuated widely, reflecting changes in sentiment towards growth and prices globally.

Bonds have faced continued pressure as yields have risen sharply, depressing total returns. Commodities have fluctuated significantly as demand expectations change as recession risks wax and wane.

Although not immune to swing, alternative strategies are The benefits of diversification during periods of heightened uncertainty.

Looking ahead to 2024, diversification into uncorrelated assets and investment approaches appears prudent, given that questions remain about the trajectory of prices and growth.

Strategies that incorporate the flexibility to dynamically change risk exposures, such as using futures and options, can provide portfolio advantages in navigating the unknown conditions that typically accompany macroeconomic transitions.

Overall, 2023 highlights both the opportunities and risks inherent in investing across market cycles, while also highlighting the value of prudent diversification and risk management to achieve steady long-term capital appreciation. We hope that the new year will bring greater stability and prosperity to all market participants.

Past performance is not indicative of future results.

Past performance is not indicative of future results.

source:

Managed Futures = SocGen CTA Index

Cash = Annual interest rate equivalent to 13 weeks of U.S. T-Bill interest/12, YTD is the sum of monthly amounts.

Bonds = Vanguard Total Bond Market ETF (BND)

Hedge Fund = IQ Hedge Multi-Strategy Tracker ETF (QAI)

Product = iShares S&P GSCI Commodity Index Trust ETF (GSG)

Real Estate = iShares U.S. Real Estate ETF (IYR)

World stocks = iShares MSCI ACWI ex-US ETF (ACWX)

US stocks = SPDR S&P 500 ETF (SPY)

All ETF performance data in Y chart

disclaimer

The performance data displayed here is compiled from a variety of sources, including BarclayHedge, and is reported directly by the advisor. These performance figures should not be relied upon separately from the individual advisor’s public documents, which contain important information regarding the calculation methods used, whether the performance includes proprietary results, and other important footnotes to the advisor’s performance.

Benchmark index performance applies only to the constituents of that index and does not represent the full spectrum of possible investments within that asset class. Additionally, indicators such as survivors, self-reports, and instant records may have limitations and biases.

Managed futures accounts may be subject to significant management and advisory fees. The figures on this website include all of these fees, but accounts subject to these fees may need to make significant trading profits in the future to avoid depletion or depletion of their assets.

Investors interested in investing through managed futures programs (other than programs available only to qualified individuals as defined by CFTC Rule 4.7) must receive and sign a disclosure document in accordance with certain CFT rules. The disclosure documents include a complete description of the key risk factors and respective fees that CTA will charge to your account, as well as the overall performance of accounts managed by CTA over the most recent five years. Investors interested in investing in any of the programs on this website are encouraged to read the disclosure documents, including but not limited to performance information, carefully before investing in such programs.

Qualified investors, as defined in CFTC Rule 4.7, are interested in investing in programs that do not require disclosure documentation and are considered sophisticated enough to understand and interpret risks in accordance with the regulations. The accuracy and completeness of the performance information itself.

RCM receives a portion of the commodity brokerage fees you pay in connection with futures trading and/or a portion of the interest income you earn on account assets, if any. Listed managers may pay RCM a portion of the fees they receive from accounts introduced by RCM.

See full terms of use and risk disclaimers here.

original post

Editor’s note: The summary bullet points for this article were selected by Seeking Alpha editors.