AURA Coin and short-term profits

- Aura Finance, despite its recent rally, appears to have a strong bearish bias on higher time frames.

- The surge in dormant activity has caused concern for long-term holders.

Aura Finance (AURA) has recorded a gain of 26% over the last two days. Buying volume has increased in the short term and momentum has been strong on the daily time frame. This was accompanied by a strong rise for Bitcoin (BTC) on the price chart.

However, technical analysis shows that the long-term trend is not optimistic. On-chain indicators have also raised concerns about the sustainability of this rally. So the question is – can the AURA bulls maintain their trajectory of the past two days?

The market structure was invincible

Source: AURA/USDT on TradingView

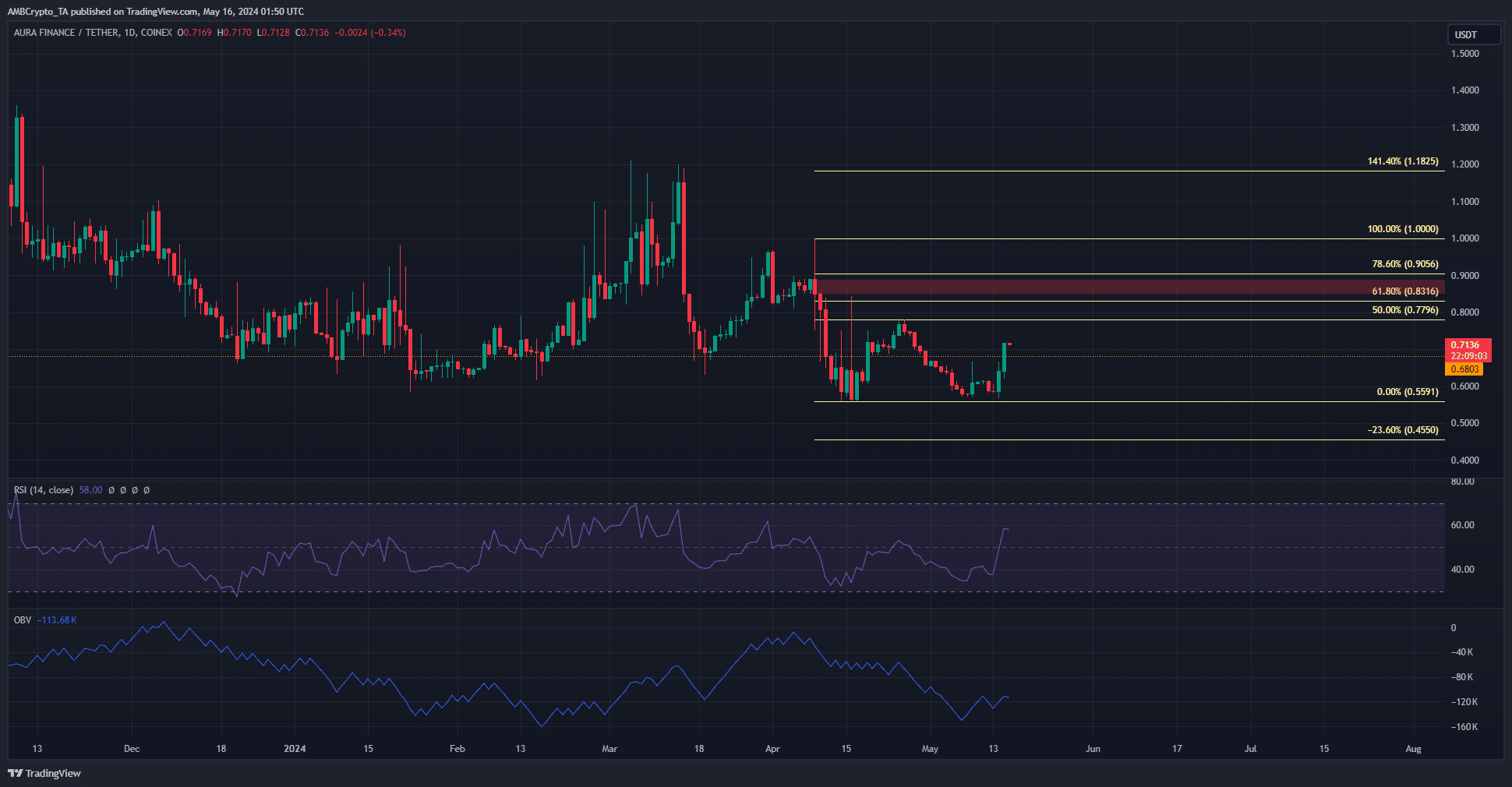

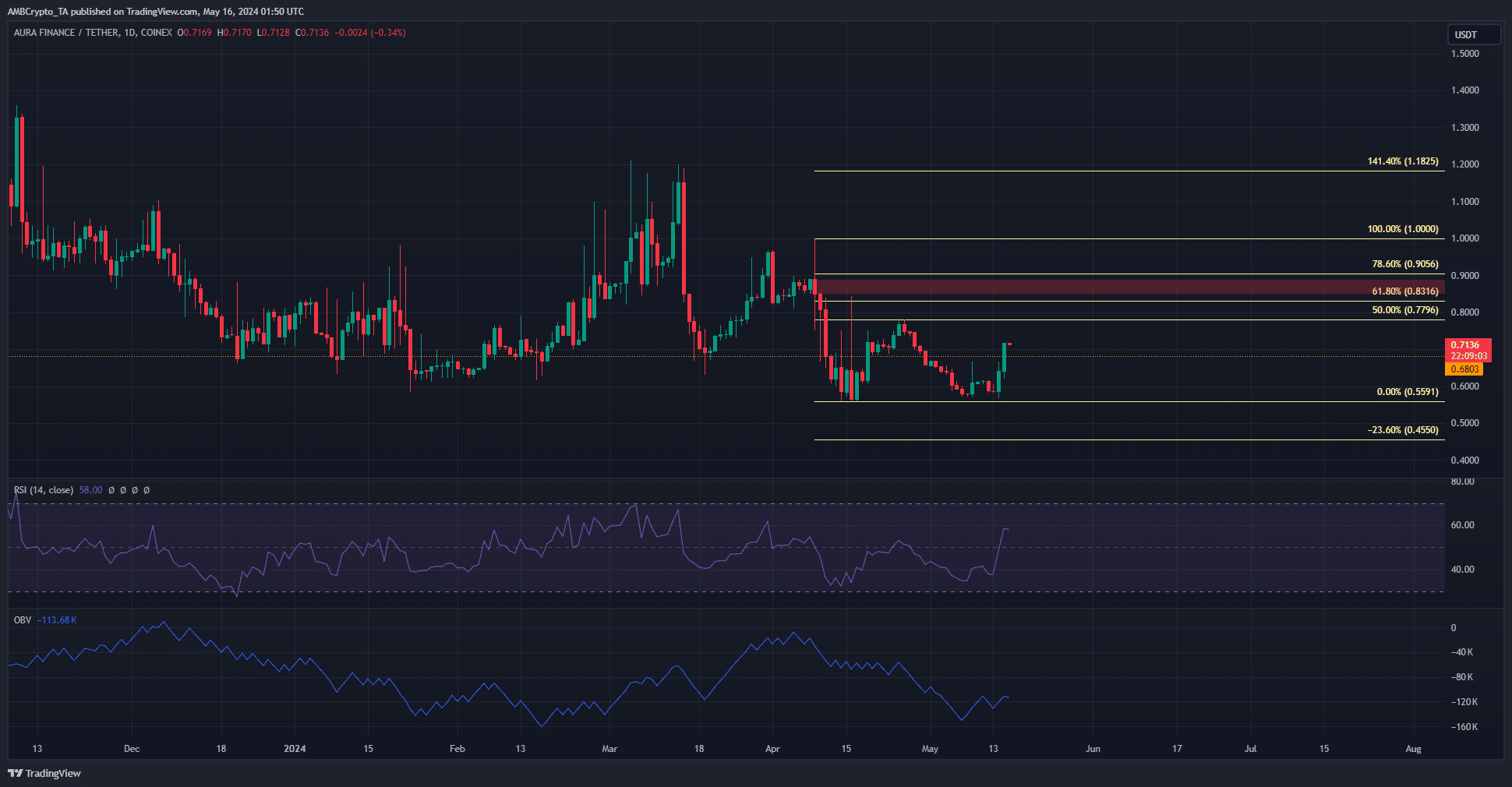

On the daily time frame, AURA has formed a series of lower highs since mid-March. The structure flipped bearish once again in the second week of March, falling below $0.68.

The altcoin is within this 1-day bearish structure. Although RSI is above the neutral 50 level, indicating bullish momentum, it is likely to continue to decline. The $0.83 and $0.9 Fibonacci retracement levels (light yellow) are expected to act as resistance and defeat the bulls.

The $0.85-$0.88 area (highlighted in red) also served as a technical resistance zone. OBV has risen over the past week but has not reached its April high. This is a sign that there is buying pressure, but not enough.

Is there a wave of sales just around the corner?

Source: Santiment

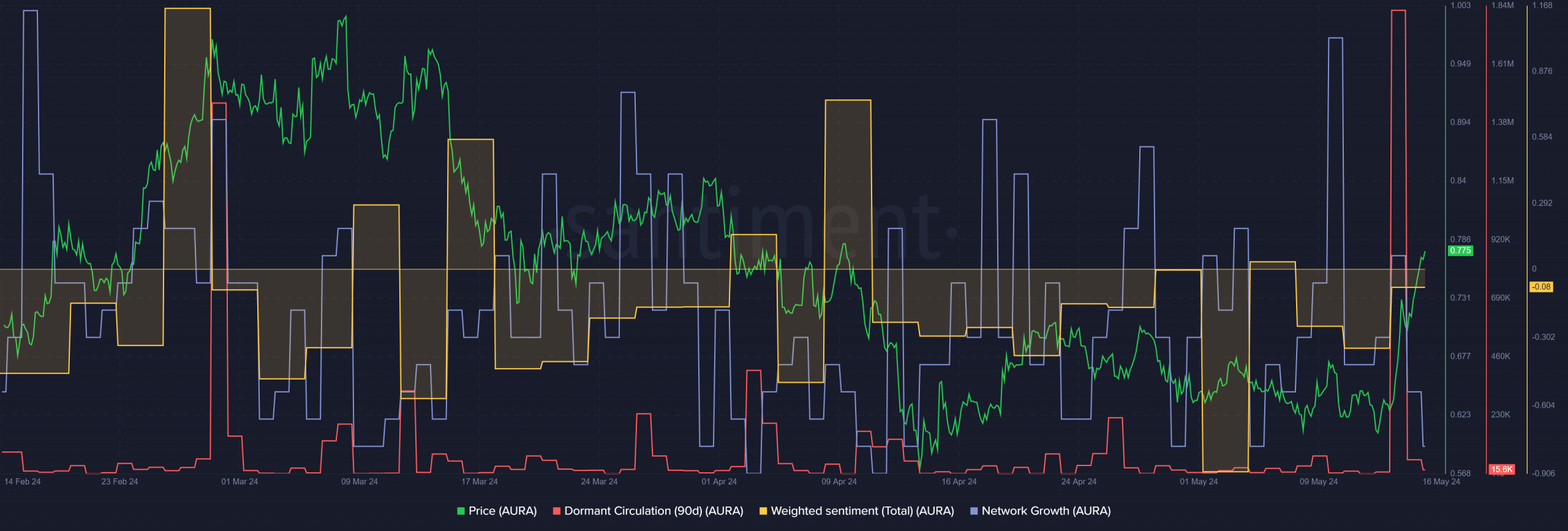

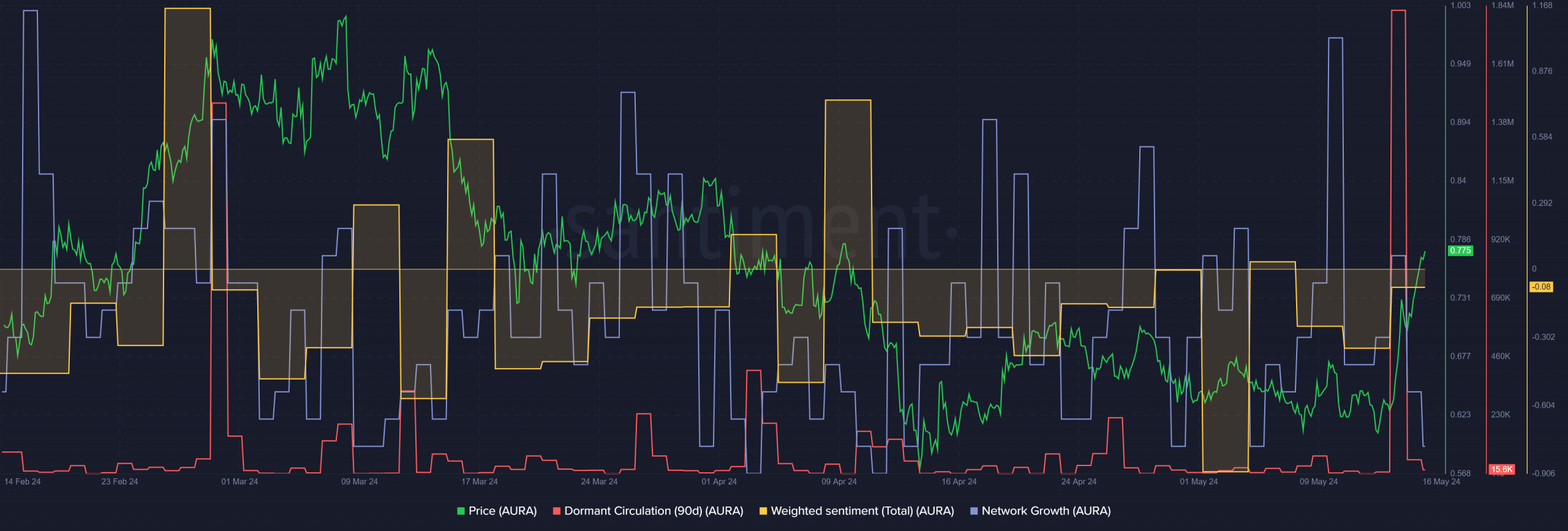

On-chain indicators were also not bullish for Aura Finance. Network growth has been consistent over the past two months, but since February the value has been below 20.

This means that fewer than 20 unique addresses have been created on the network each day since late February, which could be a depressing result for long-term investors.

Realistic or not, AURA’s market cap in BTC terms is:

While it has rallied nearly 30% over the past two days, the dormant circulation has recorded its biggest surge in the past three months. As expected, token movement surged. This is likely a sign of selling pressure for a near-term bounce.

Lastly, sentiment sentiment has also been negative over the past month, highlighting how little strength the bulls have.

Disclaimer: The information presented does not constitute financial, investment, trading, or any other type of advice and is solely the opinion of the author.

Source: https://ambcrypto.com/aura-coin-and-its-short-term-gains-why-its-26-spike-isnt-a-big-deal/