Australian Bitcoin miner Iris has set a hash rate target of 20EH/s as mining in the US falters.

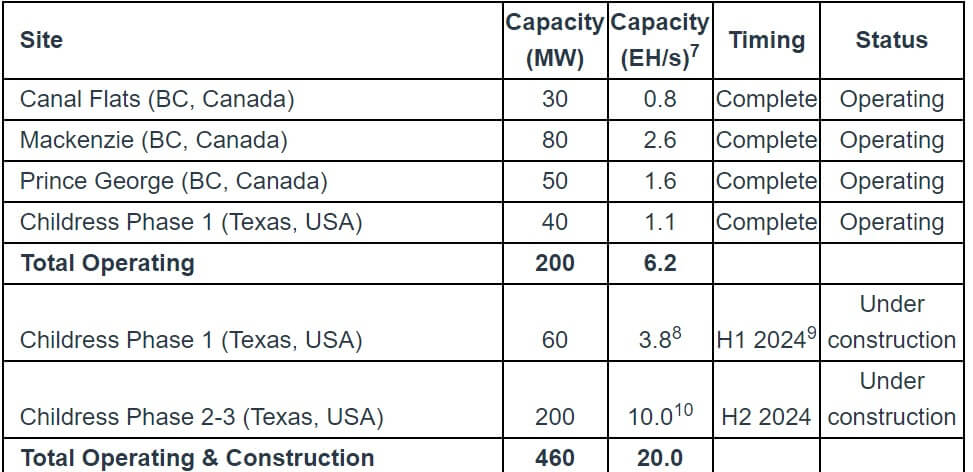

Australian Bitcoin mining company Iris Energy has ambitious plans to boost its hash rate to 20 exahashes per second (EH/s) by later this year, as detailed in a February 7 update. Announced.

To achieve this important milestone, Iris reached an agreement with Bitmain to secure 10 EH/s of the new T21 miner at a fixed rate of $14/TH/s. The contract includes 1 EH/s for immediate additional miner purchases and grants an option to purchase 9 EH/s of miners exercisable at the end of the year.

Meanwhile, Iris will need to significantly increase its operating capacity by 222% to achieve its target hash rate, which will position it as the leading BTC mining company in realized hash rate, surpassing competitors such as RIot Platforms, Marathon Digital, and Core Scientific. It will. Per data from themenermag.

As of February 6, Iris had already boosted its operating capacity to 6.2 EH/s from 2.2 EH/s in November 2023, boasting a mining efficiency of 24.8 J/TH (joule per terahash) throughout January.

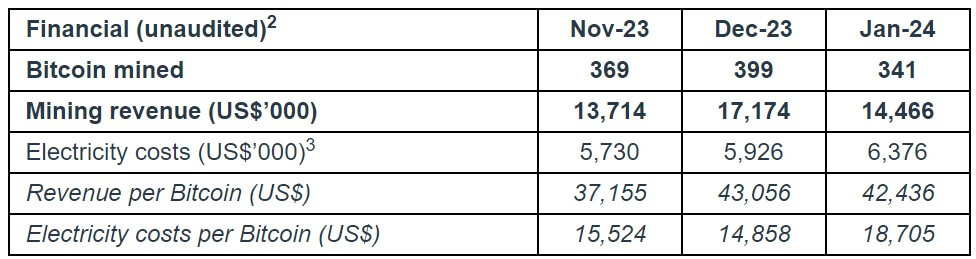

BTC production decline

Despite Iris’ ambitious goals for the year, miner Bitcoin production fell 15% in January to 341 BTC. The decline in revenue was primarily due to lower network transaction fees, higher electricity costs, and lower market volatility at one of our mining centers.

“The increase in electricity costs per Bitcoin mine ($18.7,000 in December vs. $14.9,000 in December) is primarily due to lower network transaction fees, higher electricity prices, and reduced market volatility in Childress,” Iris said. explained.

This decline in Bitcoin production mirrors trends observed among other major US-based BTC miners.

Marathon Digital reported a 42% monthly decline in Bitcoin production, citing temporary outages such as weather-related issues and equipment failures that led to site outages. As a result, only 1,084 BTC was mined in January, down from 1,853 BTC in December.

Riot’s platform’s monthly Bitcoin production also decreased from 619 BTC in December 2023 to 520 BTC in January. CEO Jason Les said the decline was due to the company’s efforts to stabilize the grid by reducing energy usage amid heightened demand for power due to extreme cold weather in Texas.

Core Scientific, which recently relisted on Nasdaq, recorded a decline in its Bitcoin production in January. Despite the increase in active hashrate, the company’s monthly production decreased from 1,177 BTC in December to 1,027 BTC in January, representing a notable decline despite strong performance throughout 2023.