Australian nickel producers struggle with oversupply By Reuters

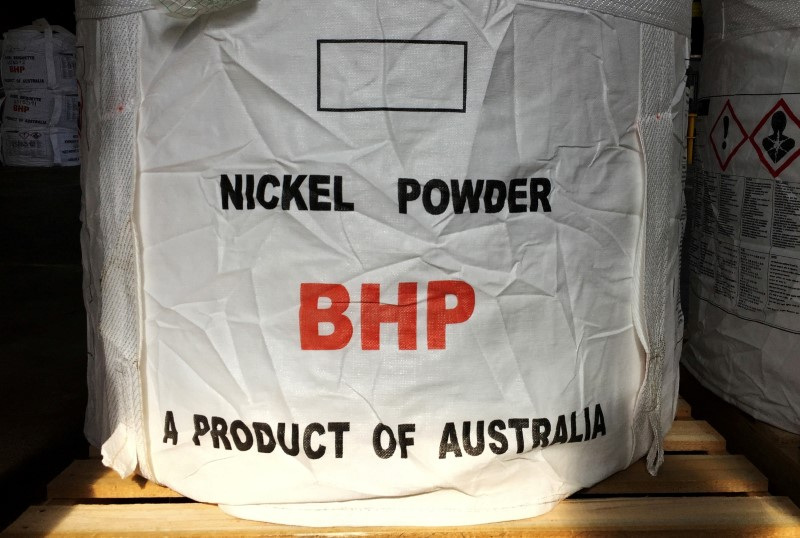

© Reuters. FILE PHOTO: A tonne of nickel powder manufactured by BHP Group lies in a warehouse at the Nickel West division, south of Perth, Australia, August 2, 2019. The photo was taken on August 2, 2019. REUTERS/Melanie Burton/file photo

MELBOURNE (Reuters) – Australian nickel producers have been hit by a plunge in nickel prices over the past year due to increased supplies from Indonesia, leading to mine closures, production cuts and depreciation in recent months.

Australia is the world’s fifth-largest nickel miner and refiner, with BHP Group (NYSE:) leading the production.

The steps taken by nickel producers and developers to overcome the slump are as follows.

* Canada’s First Quantum Minerals (OTC:) said on Monday it would cut jobs and production at its Ravensthorpe mine in Australia due to a “significant” decline in prices that is expected to last for three years.

* Panorama Resources began autonomous operation in December. On Jan. 8, administrators said operations at the Savannah nickel project would be suspended “because near-term operational and financial improvement is unlikely.” The project is still for sale.

* Battery materials producer IGO said in a January 31 report that it expects an additional impairment of about A$1 billion for the 2023 financial year, when it reported additional impairments for its Cosmos nickel project in December.

* BHP, the world’s largest listed miner, is assessing options for a major smelter renewal and mine expansion in Australia while building the West Musgrave mine, acquired in its $6.4 billion acquisition of Oz Minerals.