Autodesk: Current Environment Is Too Messy (NASDAQ:ADSK)

Paradis Kitsiri Cool

Autodesk (Nasdaq: ADSK) There are many signs of a good business. AutoCAD is the industry standard for design, drafting, detailing, and visualization software for architects and a variety of engineering professions.

Infrastructure spending should be a continued tailwind. Autodesk. The global infrastructure outlook is $2.5 trillion is invested in global infrastructure every year.. As long as the global economy continues to grow, the need for new and updated infrastructure will remain.

For reference, AutoCAD has benefited from significant growth since its launch in 1982, making it several years older than Microsoft’s (MSFT) Windows.

Although competition exists in some form in every industry, AutoCAD does not pose a serious threat to our largest and most professional customers. AutoCAD costs $1,975 per user per year, which optically seems like a very small tax on businesses. Naturally, smaller customers with tighter budgets can choose something cheaper. software. BRICSCAD has been mentioned A potential alternative to AutoCAD, it costs about $1,600 per year. Third-party market share tracking sites aren’t always accurate, but they can give you a good idea. this one BricsCAD’s market share in computer-aided design is considered basically non-existent compared to AutoCAD. This is likely to accurately reflect market conditions.

Autodesk has some other interesting businesses. Additional products in the core Architecture, Engineering and Construction segment include Revit, a 3D modeling software often used in conjunction with 2D modeling in AutoCAD. There is also Autodesk Build, which competes with Procore Technologies (PCOR) in the construction management space. Other Autodesk segments include manufacturing, highlighted by Fusion 360, a manufacturing design tool. Autodesk also has a media and entertainment division centered on visual effects software Maya.

Capital Allocation:

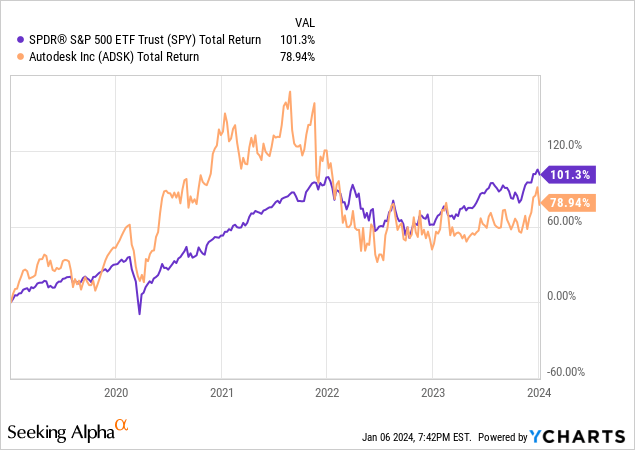

In the long run, Autodesk beats the market, but not in the past five years. The stock hasn’t been out of range for the past few years.

Investors appear to have expressed considerable dissatisfaction with Autodesk management, and what they believe is a lack of clarity around its capital allocation policy.

Turning to capital allocation. We are actively managing capital within our framework. Our strategy is underpinned by disciplined and focused capital deployment throughout the economic cycle. We remain vigilant during this time of macroeconomic uncertainty.

As you heard Andrew, we continue to invest organically and through acquisitions in our capabilities and services and the cloud and platform services that support them. We purchased approximately 500,000 shares for approximately $112 million at an average price of approximately $206 per share. We will continue to offset dilution in our stock-based compensation programs to opportunistically accelerate repurchases when reasonable.

In my opinion, there really isn’t a clear framework for how Autodesk deploys its capital. Autodesk executives also claim to manage their business according to the arbitrary Rule of 40. This indicates that earnings growth plus free cash flow margin must be greater than 40. Revenue growth is a very poor measure of the quality of any business. As mentioned above, management plans to invest through acquisitions that accelerate the pace of growth without adding value.

Autodesk’s free cash flow includes significant stock-based compensation. It is difficult to charge executives with the excessive stock-based compensation costs that are prevalent throughout the software industry. However, this has a significant impact on the tangible value created for shareholders. Autodesk has earned $544 million in stock-based compensation year to date, which makes a big difference in value growth at a run rate of $725 million.

Off-setting dilution is also a fairly arbitrary policy. And any free cash flow used in offsetting dilution is free cash flow that is not accrued to shareholders.

evaluation:

A company with a competitive advantage as strong as Autodesk but with questionable capital allocation policies is difficult to value. Discount rates and exit multiples are influenced by the durability of the business. If your business is built sustainably, it will eventually return all of your free cash flow and more. There are no impending barriers to Autodesk’s growth, so it should command a premium.

Historically, Autodesk’s business has been influenced by cyclical construction markets. We hope to flatten the curve by moving to a SaaS model. However, we have not experienced a significant construction downturn since this transition occurred, so it remains to be seen. This can cause negative pressure in the drain.

The midpoint of Autodesk’s free cash flow guidance for this fiscal year is $1.23 billion. As noted in the current run rate, $725 million is in the form of stock-based compensation. Free cash flow was expected to decline approximately 40% this year as the business transitioned to multi-year billing, but is expected to return to a 35% free cash flow margin within the next five years. Given that the company is using a significant portion of its free cash flow to offset dilution, valuation should take this into account.

If investors expect interest rates to remain stable and remove stock-based compensation from free cash flow, margins fall closer to 25%. At an exit multiple of 25x, in line with the 10-year Treasury yield and where other durable companies trade, Autodesk returns mid-single digits at its current stock price. The industry is in a state of excitement following rumors of ANSS being sold. Ansys is already trading at a large premium to Autodesk, which frankly feels quite excessive.

Not considering stock-based compensation or allowing for higher multiples can scale the model to produce low double-digit returns. Due to the noise in the numbers and lack of clarity in communication, Autodesk is a difficult product to own in the current environment.