AVUV: Increased Risk for This Best-Performing Small-Cap Value ETF (NYSEARCA:AVUV)

Evelyn Fogleman

investment thesis

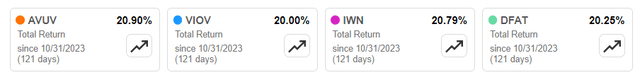

This article explains why I decided to downgrade. Avantis U.S. Small Cap Value ETF (NYSEARCA:AVUV) on hold. AVUV’s revenue and earnings growth rates have declined since our last review. Despite being in November 2023, the forward P/E has increased and the component is already up 25% compared to the previous year. To be clear, AVUV is a great small-cap value ETF, and there aren’t many better options. However, we do not recommend adding your position at this time, and we will explain why in more detail below.

AVUV Overview

Strategy discussion

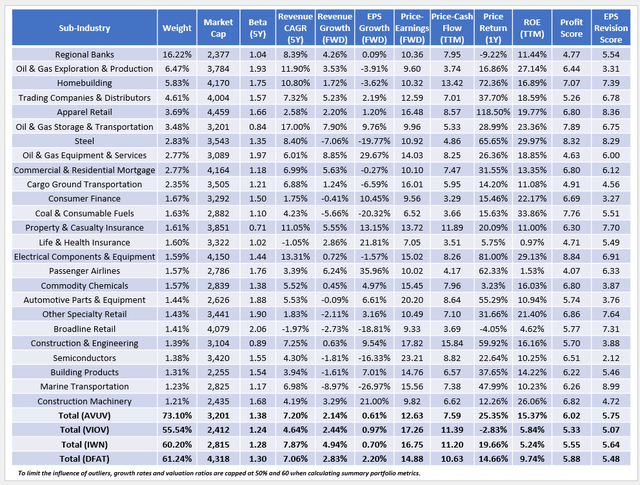

AVUV uses a proprietary approach to select profitable small-cap stocks that trade at low valuations. The primary measure used is operating cash adjusted to book value, which takes into account the company’s reported and estimated book value. When creating a portfolio, AVUV’s managers also take into account: Past performance of the stock, liquidity, liquidity, taxes, governance and diversification. Turnover is typically in the 20-25% range, so although it is technically an actively managed fund, trading activity is similar to that of the Vanguard Small Cap 600 Value ETF (Ⅶ). Other peer companies analyzed today include the iShares Russell 2000 Value ETF (great) and Dimensional US Targeted Value ETF (DFAT), contrasted below.

pursue alpha

AVUV is less than five years old and already has $10.05 billion in assets under management. This is much more than VIOV and about the same as IWN and DFAT. The 0.25% expense ratio is competitive so it’s not a big consideration. Deciding which one is superior will depend on each fund’s performance track record and fundamentals.

Performance

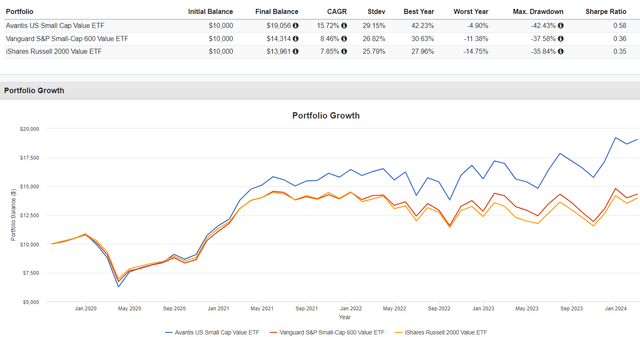

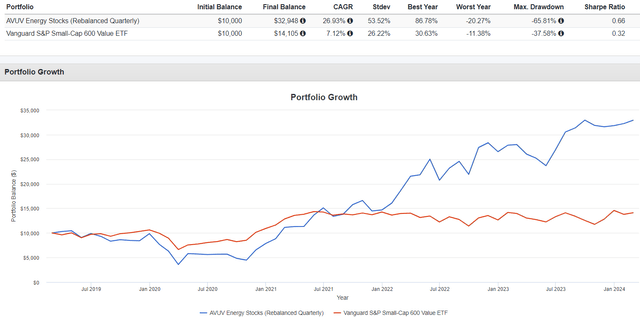

The following table shows how AVUV has significantly outperformed VIOV and IWN since February 2019. The annualized return of 15.72% was better than 7.26% and 7.87%, which was more than enough to offset the fund’s high standard deviation. AVUV’s 29.15% figure is on the high side, and as we’ll cover below, its 1.38 5-year beta, driven by several oil and gas and homebuilding securities, can be detrimental in a market downturn. AVUV’s low portfolio turnover suggests that managers operate with high confidence and are therefore unlikely to act quickly.

Portfolio Visualization Tool

There isn’t much decline activity to examine, but AVUV lost 42.43% in Q1 2020, compared to 37.58% and 35.84% for VIOV and IWN. AVUV ended 2020 up 6.39%, better than DFAT’s 2.28% return. Discussed here. DFAT was converted only for mutual funds on June 14, 2021, so portfolio visualization tools do not provide this information.

AVUV analysis

Sector exposure and top 10 holdings

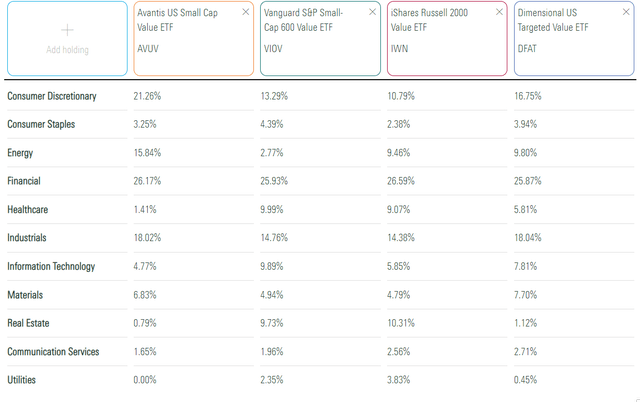

AVUV’s sector exposures are listed below along with VIOV, IWN, and DFAT. While all four ETFs are overweighted the financial sector at about 26%, AVUV differentiates itself by allocating 16% to energy stocks.

dawn of fame

AVUV’s top 10 holdings (9% of the total portfolio) are: Abercrombie & Fitch (Abercrombie & Fitch) holds approximately 750 stocks.ANF) accounts for the largest proportion, less than 1%. The difference between average market capitalization and weighted average market capitalization ($1.67 billion vs. $3.2 billion) is worth noting, indicating that larger companies tend to receive higher weighting. This is likely the result of managers preferring profitability, which is positively correlated with size.

Avantis

AVUV Fundamentals by Sub-Industry

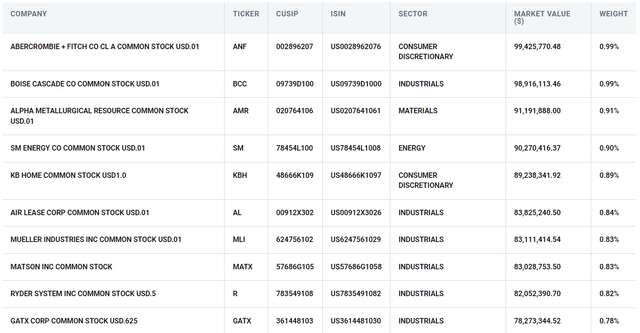

The following table highlights selected fundamental indicators for the top 25 sub-industries of AVUV (73.10% of the total). These figures show that although each company has a well-diversified portfolio, its portfolio is much less diverse than its peers.

sunday investor

I made four observations:

1. AVUV allocated 16.22% to 209 regional banks, which may raise concerns for some readers. Nonetheless, AVUV’s selection is on slightly better footing than its passive peers. This is evidenced by the ROA of 1.12% compared to 0.79% and 0.99% for VIOV and IWN. Remember that community banks are highly volatile, their AVUV was down last year, and the component had a price-to-earnings ratio of -9.22%. Moreover, this choice only resulted in an increase of 10.10%. Including dividendsThe past three years are what makes this a potentially good value stock, but 16.22% is a lot of exposure.

2. Four months ago, AVUV had annual revenue and earnings per share growth of 6.01% and 3.05%. These figures are currently 2.14% and 0.61%, so growth is slowing. AVUV also trades at a slightly higher forward valuation (12.63x vs. 11.23x), and it is difficult to reconcile this change with the fund’s superior returns since the November review shown below.

Portfolio Visualization Tool

AVUV is not unique in this respect. Earnings growth for VIOV, IWN, and DFAT fell 2-4%, while forward P/Es rose 1-2 points. These changes should put the entire small-cap value sector under caution, and current shareholders may want to consider taking profits or pausing to build positions.

3. AVUV maintains a slight advantage over DFAT in terms of profitability. This is evidenced by its 6.09/10 Earnings Score calculated using Seeking Alpha Factor Grades. Community banks are a significant barrier (4.77/10), but so are several energy sub-industries. To gain insight into AVUV’s selection process, I backtested AVUV’s energy stocks over the past five years and found them. 65.81% decrease It recovered rapidly from May 2019 to March 2020.

Portfolio Visualization Tool

This chart indicates that AVUV managers primarily consider data from the past few years and do not evaluate how their selections have performed during periods of high market stress. Additionally, AVUV’s 16% exposure to energy stocks may be too much, as energy prices typically drive inflation and it is difficult to see inflation spiking again as it did in 2022.

4. Despite worsening fundamentals, AVUV still looks relatively strong compared to its peers, largely due to its Forward P/E of 12.63x. I also calculated a harmonic weighted average P/E of 10.23x, which is consistent with Morningstar’s approach. So a big discount helps offset weak sales and earnings growth prospects.

investment recommendation

After careful consideration, we have decided to downgrade AVUV to ‘Hold’. The ETF has had a strong run over the past four months, but its fundamentals have now deteriorated further and risks remain high, particularly due to its significant exposure to regional banks and energy. AVUV’s portfolio turnover is generally low and managers operate with high confidence, so their composition is unlikely to change significantly.

AVUV is not a “sell” as many other small-cap value companies have similar issues, and while it’s not as cheap as it used to be, its 12.63x forward P/E is one of the best in the sector. Assuming you still want some small-cap value exposure, the Avantis US Small Cap Value ETF is still a good choice, but we don’t support adding one at this time. Thanks for reading. We look forward to hearing from you below.