Axon Enterprise: My expectations are for performance improvement (AXON)

Douglas Rissing/iStock via Getty Images

Axon corporate investment thesis

Almost a year ago, in late May 2023, I wrote my first article about: Axon Enterprises, Inc. (Nasdaq:Axon). I was just as passionate about business models then as I am now. Seamlessly engage customers in the ecosystem with high switching costs and superior functionality.

Plus, I love the fact that we have a mission to save lives and make the world a better place. Axon also has strong barriers to entry that protect its profits, such as security certifications such as FedRAMP High Classification.

My only criticism at the time was that while the valuation was not cheap, the business model, growth opportunities and management execution were excellent. Therefore, my investment opinion at the time was ‘Hold’, which turned out to be too low for the S&P 500 (SPY).) returned only 19% during the period, while Axon returned 61% of outstanding payments.

Axon was a classic example of a company that turned out to be worth its seemingly high price tag. Because I believe the company’s quality and growth opportunities have continued to improve since last year, I am upgrading my rating at this time and will explain in the following paragraphs why I believe performance will improve next week.

Axon’s Amazing Returns

Find the Alpha Revenue tab

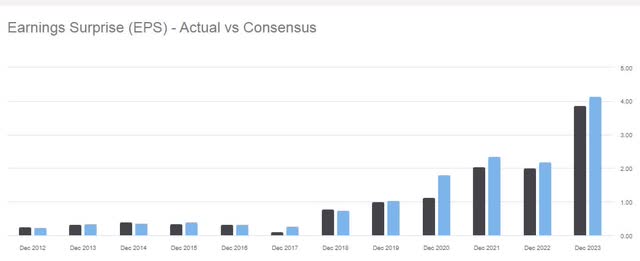

Over the past two years, Axon has beaten revenue estimates eight times out of five and EPS estimates seven out of eight times. And when it comes to year-end EPS, Axon has missed only three times in the past 12 years and has won every time since December 2019, as you can see in the chart above.

Therefore, the estimates tend to be conservative, so we can assume that the beat probability is higher than the failure probability. However, if you’re looking to increase your profits, you don’t want to rely solely on these statistics.

Another reason is that Taser gross margins declined last quarter due to one-time warranty costs for the Taser 7. However, it will return to its previous intensity this quarter.

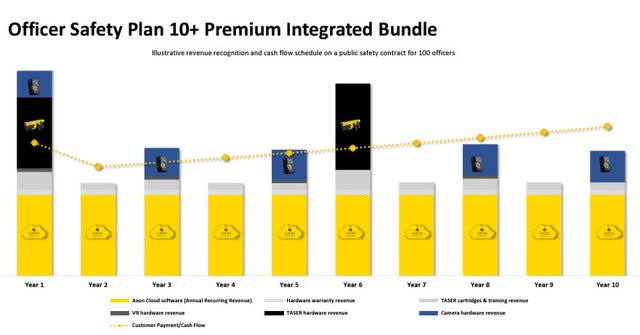

Axon Investor Presentation

Additionally, future revenue recognition for contracted revenue is expected to be close to the upper end of the 15-25% range. Because customers seem to be switching to the Taser 10 even though the replacement cycle is a little longer. And increasing hardware sales usually means we’re getting closer to the 25% point of the range. In general, the above 5-year interval seems to be the standard for Taser, but Taser 10 seems to be so good that customers want to upgrade sooner.

Axon Investor Presentation

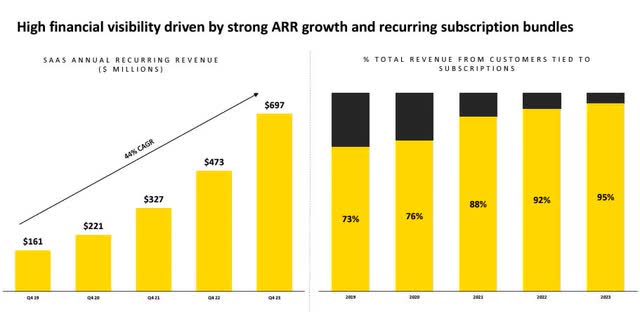

And the percentage of subscription revenue continues to grow, which is good for margins because it’s more cost-effective. In fact, the 44% CAGR in ARR since 2019 has undoubtedly played a large role in Axon’s success over the past few years.

Axon Investor Presentation

The decision to provide real-time monitoring, digital evidence management, and faster and partially automated reporting was a great move by management that perfectly anticipated the future and possibilities of AI, big data, and the cloud. And all of this increases security and saves time and money. This is a huge win for both customers and Axon.

What makes the Axon family so attractive is how they work together. Both cameras and Tasers capture evidence and data, which is then analyzed and evaluated, some of it automatically and in real time. Additionally, the Watch Me button provides you with a second set of eyes to help you analyze dangerous and unclear situations.

Axon’s Growth Opportunities

In February 2024, Axon acquired Fusus, a live video, data, and sensors company, which is expected to boost TAM and revenue in a relatively short period of time. Even more interesting, but less talked about at the moment, is the acquisition of Sky Hero. Sky Hero is probably one of the best drone manufacturers out there right now, and this could be a very strong addition to the drone and robotics space in the long run.

Axon Investor Presentation

Using drones and robots to make initial contact and investigate crime scenes could significantly reduce casualties. And this is also one of the tech sector’s plans to advance robotics.

Further growth is also expected in VR education and data-based learning, where generative AI can be put to good use. But beyond law enforcement, there are numerous opportunities for development in the commercial sector. Even hospitals and retail stores can use body cameras to optimize operations or enhance security.

Axon Investor Presentation

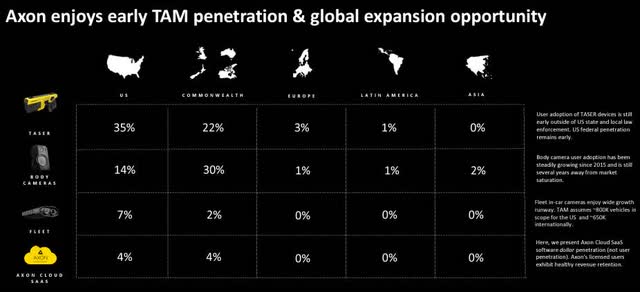

And if you look at the penetration of TAM in Europe, Latin America and Asia, there is still a large untapped market. Asia will be difficult because Chinese companies will probably prefer Chinese solutions. But I definitely see Europe and Latin America as future markets.

It’s also interesting to note that not only do nearly 17,000 customers of our subscription model have contracts for 5 years or longer, but as we mentioned in our last earnings call, many of our customers have contracts for 10 years or more. I think that speaks volumes about Axon’s tremendous competitive advantage.

Additionally, there are strong cross-sell and upsell opportunities, as well as drone and robotic products that will be of interest to existing customers in the future.

But the biggest driver in the Americas is probably digital evidence services, and overseas it’s probably early Tasers to attract customers into the ecosystem. For example, Cloud + Services revenue grew 52% last quarter.

danger

One of the risks that could have a big impact on the last earnings announcement is the possibility of relocating the headquarters. For example, Smith & Wesson (SWBI) also decided to relocate, which initially took a hit to its stock price and temporarily hit its bottom line due to the associated costs, among other things.

Therefore, this move could make Axon’s stock even more volatile than it currently is. But as long as the costs are temporary, volatility also brings opportunity.

Reverse DCF

author

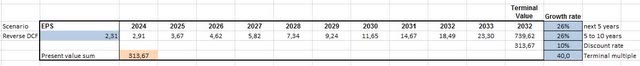

In my opinion, inverse or reverse DCF is always a good way to find out the market price. And with FY23 diluted EPS of $2.31, the market is currently pricing in 26% annual EPS growth.

The EPS growth rate over the past 5 years was 35.81% and over the past 10 years was 21.12%. Therefore, it would be reasonable to say that the current value of the stock is quite high as it is in the middle between these two values. A 75x P/E multiple may seem prohibitively high, but the price the market is valuing it at is relatively realistic.

conclusion

Axon is not as overvalued as many might think, given the quality of its business and future growth opportunities. Therefore, I think its value is relatively high.

Bundled ecosystems, barriers to entry, high switching costs, and high switching efforts are all believed to protect sales. And Europe and the UK still offer plenty of opportunities for growth through existing products and services. Now add drones and robotics and your current TAM is probably conservative.