AXT: Selloff Provides Buying Opportunity (NASDAQ:AXTI)

Tanaonte/iStock via Getty Images

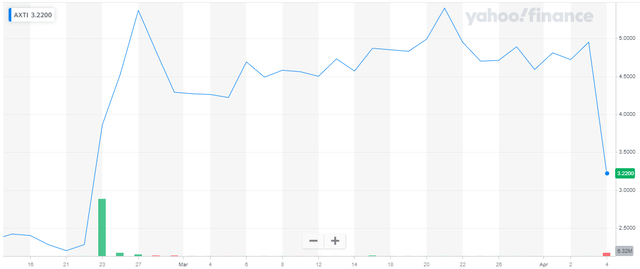

On Thursday, semiconductor substrate supplier AXT, Inc. or “AXT” (NASDAQ:AXTI) fell 35% after short-selling firm JCapital Research, or “JCapital”, released a damning report titled “AXTI may be on the verge of collapse.“:

JCapital research

The 38-page report contains numerous allegations, including: AI cleaning, environmental issues, Suspicious Insider Trading and tax evasionJCapital’s core thesis is that its Chinese wafer manufacturing subsidiary, Beijing Tongmei Xtal Technology Co., Ltd. Alternatively, it is based on the company’s possible failure to list “Tongmei” on the Shanghai STAR Market, which AXTI has been working on for more than three years now. :

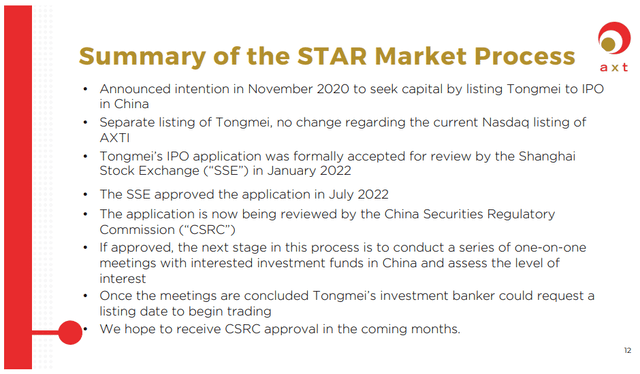

company presentation

According to a JCapital report,

AXTI raised about $49 million from private Chinese investors who it thought could cash out through the Shanghai IPO of AXTI’s main operating subsidiary. But now sales 48% of what was included in the IPO prospectus4 and operational issues plague AXTI’s China operations.

Collapsed sales and a number of operational problems have thwarted the Chinese subsidiary’s IPO attempt. This leaves Chinese investors out. They invested at a valuation of $673 million, more than three times the parent company’s current U.S. market value. A “gambler’s clause” in the IPO documents gives individual investors the right to demand that AXTI return $49 million. With unrestricted cash and short-term investments of $39.9 million as of December 31, 2023, short-term bank borrowings of $52.9 million, and limited operating cash flow, we believe AXTI will not be able to survive without significant dilutive equity issues in the United States.

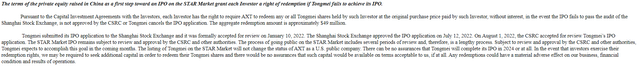

While this is certainly a valid concern, the company has never made a secret of its Tongwei investor redemption rights. In fact, this issue has been disclosed as a key risk factor in each company’s annual reports on Form 10-K filed in recent years.

2023 Annual Report on Form 10-K

It is also no secret that obstacles to listing on the STAR Market have increased.

More companies canceled or suspended their IPO applications last year than in the previous four years combined, as the Shanghai Stock Exchange set higher standards for listing applications under guidelines from the China Securities Regulatory Commission (CSRC).

According to the Financial Times,

Companies now have to not only generate revenue, but also spend hundreds of pages explaining how their technology is on par with or on par with industry leaders and whether their business model is sustainable before being cleared for an IPO.

This makes listing on the Star Market out of reach for many startups. Although the Council was originally launched with the intention of providing access to capital markets for companies with a high-risk profile.

Authorities hope increased regulatory scrutiny will help channel resources to the most qualified companies, but analysts have said such efforts could ultimately undermine innovation by denying funding opportunities to high-potential startups. .

The listing is still in the works, at least according to statements made by AXT management on a recent conference call (emphasized by the author).

This concludes our discussion of our quarterly financial results and, with respect to Tongmei, we turn to our plans to list our Chinese subsidiary, Tongmei, on the Shanghai Star Market. One open item needs to be resolved. It’s progressing slower than expected, but it’s progressing. We are confident that Tongmei remains an excellent listing candidate.

Essentially the same statements were made in the third quarter conference call, but the language in the second quarter 2023 conference call transcript appears to have made progress since the first quarter of 2023.

Let’s take a look at the company’s plan to list its Chinese subsidiary Tongmei on the Shanghai STAR Market. We are in the process of approval with the China Securities Regulatory Commission, known as CSRC. Immediately after the Lunar New Year, we were asked to solve two major problems, and we believe that they are almost solved. We are optimistic that we will receive CSRC approval in the coming months. We are excited to move to the next stage of the IPO process and believe Tongmei is an excellent candidate for this listing.

This certainly doesn’t sound like an IPO has happened.blocked“As claimed in the JCapital report.

Additionally, unless the Shanghai Stock Exchange or CSRC completely rejects it or Tongmei cancels its IPO application, Chinese private equity investors will not be able to exercise their current redemption rights from August 2022.

Chinese regulators appear willing to work with the company on its IPO application, so we think an outright rejection is unlikely at this point. This is especially true as business is showing signs of recovery after the last few quarters.

regulatory filings

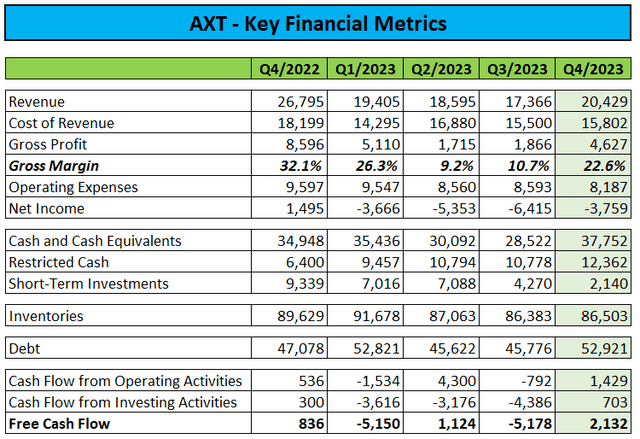

Six weeks ago, AXT reported sequentially improved fourth quarter 2023 results that far exceeded consensus expectations amid market recovery and AI-related demand claims (author’s emphasis):

In the fourth quarter We achieved 18% sequential revenue growth. Non-GAAP net income improved 43% sequentially. Although the overall demand environment remains somewhat weak, Orders for indium phosphide are increasing for both artificial intelligence (“AI”) and fiber optic applications.

Furthermore, Gallium Arsenide MarketThis is the first time any of our markets have gone into correction. Overstock appears to have been largely addressed and is now reflecting actual demand.. Overall, we look forward to 2024 with optimism.

We believe the trends that have driven revenue and customer expansion remain intact, with new catalysts such as AI providing strong incremental opportunities.. AI will increase the need for large-scale data transmission requirements with increased bandwidth, lower attenuation, and lower distortion. We believe this will increase the demand for indium phosphide, which is the best platform for rapid data transfer.

On the conference call, management guided for first-quarter 2024 earnings above consensus estimates at the time.

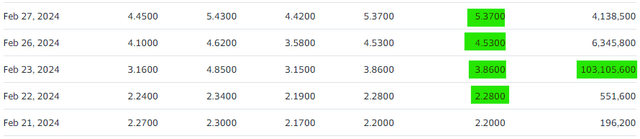

The better-than-expected results and outlook, combined with AI referencing, provided the perfect setup for a momentum rally that saw the stock surge 70% on heavy trading volume.

yahoo finance

The stock continued to rise in subsequent sessions before peaking at $5.64 two weeks ago.

yahoo finance

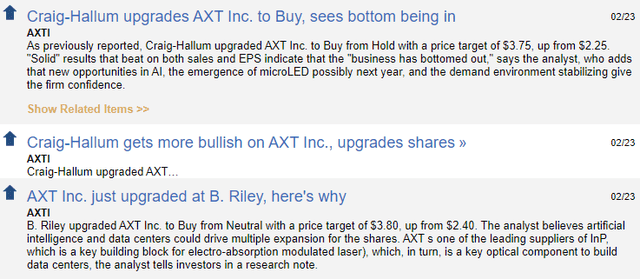

Analysts have also taken a bullish stance on the company, as evidenced by two upgrades following its fourth-quarter earnings release and conference call.

TheFly.com

Earlier this week, Northland Capital increased its price target to $6.

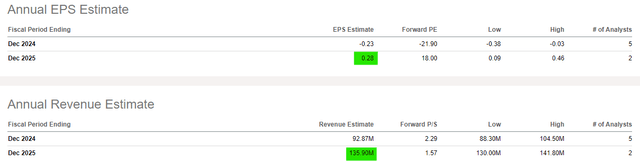

Looking more closely, analysts are predicting a full-fledged recovery next year, with sales rising nearly 50% and AXT returning to profitability.

pursue alpha

I’m somewhat perplexed by JCapital’s decision to target AXT as the business is in the early stages of a potentially multi-year recovery. But to be fair, their bet paid off big time.

But at least in my view, the panic caused by the report presents an opportunity for risk-taking investors to secure shares of recovering companies with exposure to hot markets such as data centers and AI.

If AXT gets close to where analysts currently expect it to be next year, we expect the stock to get close to and potentially surpass Northland Capital’s $6 price target.

Additionally, profitability is likely to return in the near future, allowing the company to finally execute the Tongmei IPO.

I took advantage of Thursday’s sell-off to secure an early position in AXT and would not hesitate to average down if no significant new information is revealed and the stock experiences further selling pressure over the next few sessions.

That said, despite signs of an early recovery in the company’s market, AXT is still losing money, and if regulators reject the company’s IPO application outright, it would trigger what JCapital describes as private equity investor redemption rights.

Given these issues, only speculative investors with the ability to tolerate the stock’s short-term volatility should consider buying the dip in AXT stock.

conclusion

Uncertainty caused by numerous claims in a new short-seller report sent AXT, Inc.’s stock price tumbling.

However, given that the key risks of a Tongmei IPO failure have already been adequately disclosed by the company for several years, and that the business is in the early stages of a potential multi-year recovery, we viewed Thursday’s sell-off as a buying opportunity and acquired our initial investment. Position at AXT, Inc.

If the recovery occurs as analysts currently expect, we wouldn’t be surprised to see the stock approaching Northland Capital’s market-high $6 price target next year.

Additionally, if regulatory approval is granted for Tongmei’s IPO, the stock price is likely to rise further.

At this time, shares of AXT, Inc represent a high-risk/high-reward investment for speculative investors with the ability to withstand expected near-term volatility.