Baidu: A possible partnership with Apple adds another plus to the AI narrative (BIDU).

Yongwon Dai

My thoughts on the Apple x Baidu Gen AI partnership

On March 22, news broke that Apple (AAPL) was negotiating with Baidu.Nasdaq:Bidou) To utilize Gen AI of Chinese companies Platform for iPhone in China. Such a deal would still be speculative, but it would make a lot of sense for both sides. In my opinion, the odds that the Chinese government will allow Western Gen AI tools to operate in mainland China are close to zero. This paper is based on the observation that data-intensive application products developed by software companies such as Meta Platforms and Google are not permitted in China. In fact, OpenAI’s ChatGPT is also currently not allowed to operate in China. What this means for Apple is that the company will likely have to source its Gen AI technologies/applications locally. In that regard, the act of giving up or delaying use My guess is that Gen AI for iPhones sold in China won’t really be an option. Investors should consider that the ongoing Gen AI revolution is likely to be the most significant technological change of the 21st century (personal opinion). In that context, if Apple were to sell iPhones in China without this technology, Chinese phone manufacturers, especially Huawei, would certainly gain a huge competitive advantage by offering Gen AI in their products. disrespectIt’s advantageous for Apple. This means Apple could lose market share in one of the company’s most important markets.

Referring to news reports that Apple is looking for a Gen AI partner in China, I emphasize that discussions are still in the early stages. Moreover, it is unclear whether Apple is also considering partnerships with other domestic AI companies. But choosing Baidu as the company’s key partner to develop and adopt Gen AI technologies in China makes sense for Apple. I consider Baidu to be the strongest AI player in the Chinese Internet sphere. In a previous article covering Baidu, I argued that the company’s LLM model, Ernie Bot, is “as good as ChatGPT and can grow as fast,” highlighting the following:

Baidu CTO Wang Haifeng recently revealed that Ernie Bot has more than 100 million users. Notably, successfully passing this milestone comes less than five months after the Chinese government granted mass access to this technology to its citizens. The latest version of the bot, Ernie 4.0, can handle a variety of Gen AI-powered tasks, including text generation, document summarization, and code generation. In this regard, Baidu has been working on this technology since 2019 and, as Baidu CEO Robin Li claimed, it should support a similar level of sophistication as OpenAI’s GPT-4. Real-world tech testers made similar comments, CNN reported:CNN gave ERNIE and GPT some simple tasks. Takeaway: You can’t go wrong either way.” ((In addition) “ERNIE beat GPT-4 on certain prompts, such as current events. The Chinese bot knew that Taylor Swift is now a billionaire, that China recently fired its defense minister, and that ‘Friends’ star Matthew Perry has died.

Assuming Apple will ultimately partner with Baidu to develop and deploy Gen AI applications in China, I am optimistic about the associated commercial impact for Baidu for the reasons highlighted above. At a broader level, we estimate there are about 240 to 260. 1 million iPhone users in China. Needless to say, this means Baidu’s huge user base. And even Baidu likely won’t derive a direct revenue contribution from its partnership with Apple, an important step toward widespread adoption of Ernie LLM, as a potential collaboration with Apple would validate Baidu’s AI capabilities and strengthen the company’s leadership position. It will be. Moreover, for Gen AI in the Chinese market, Baidu is ready to access a lot of valuable usage/user data, which can not only be leveraged for educational applications, but also for cross-selling to other Baidu products (e.g. Baidu search advertising). It can be utilized.

A brief look at Baidu’s broad Gen AI outlook

Baidu reported in its fourth quarter that the company’s AI Cloud revenue reached 5.7 billion yuan, up 11% year-on-year. In additional comments, CEO Robin Li shared that approximately 4.8% of AI Cloud’s total revenue is attributable to the company’s Gen AI and foundational models. When calculated, this suggests that Baidu’s Gen AI business generated approximately 250 million to 280 million yuan in revenue during the period from September to the end of December 2023. It may not seem like a lot at first glance, but investors should note that with Baidu’s Ernie Bot only launching in August 2023, the product’s growth and commercialization are still in the early stages. In that respect, it is reasonable to assume that, apart from the aforementioned collaboration with Apple, the commercial momentum of Baidu’s Gen AI business will increase significantly in 2024 and maintain a high growth rate in the coming years. In fact, Baidu CEO Robin Li suggested in a conference call with analysts after announcing fourth-quarter results that the additional revenue generated from Gen AI would “already increase to billions of yuan” in 2024.

Looking to 2024, we believe this incremental revenue will grow to billions of yuan, primarily through advertising and AI cloud deployment. As we begin to commercialize Gen AI and its underlying models, we see tremendous monetization potential in this groundbreaking technology. We leverage ERNIE as a future-based system, serving as the foundation for millions of AI native applications developed by third parties and Baidu. This paradigm allows us to create an ecosystem that opens up revenue streams around ERNIE.

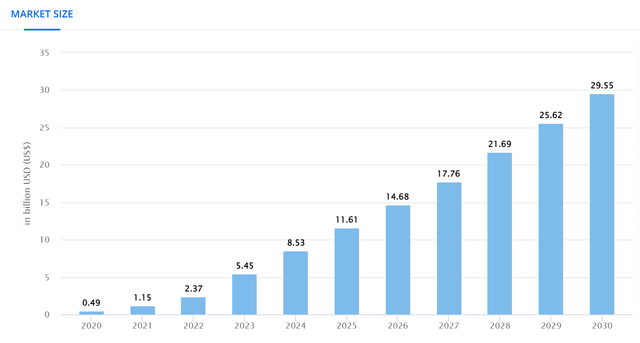

While it is difficult to pinpoint the “billions” reference to a more precise number, I would argue that investors can expect Gen AI revenue contribution to reach 5 to 10 billion yuan in 2024 and 2023. After 2024, a peak CAGR of up to 25% may be possible as the Chinese Gen AI market expands to reach $29.5 billion SAM by 2030.

politician

The demand for shareholder distributions is controversial

Amid slowing top-line growth and increasing profitability of Chinese Internet companies, some companies, such as Tencent (OTCPK:TCEHY), Alibaba (BABA), and JD (JD), are distributing capital to shareholders based on expected total stock returns in 2024. We are more committed to doing this. (Redemptions and Dividends) range from 5-7%. Meanwhile, Baidu has been quite reluctant to distribute cash to shareholders, despite the company’s massive cash reserves of 205.6 billion yuan, with free cash flow for fiscal 2023 amounting to about 25.4 billion yuan. In fiscal 2023, Baidu distributed only 4.8 billion yuan to shareholders. This suggests a return of 1.7% compared to the company’s market capitalization of 267 billion yuan as of April 2024.

While it would be desirable to provide shareholders with a higher return on capital, Baidu’s conservative approach to payouts may be justified given Generative AI’s growth prospects. Given the enormous potential of generative AI and the uncertain competitive environment, regulatory hurdles, and capital requirements, Baidu’s decision to preserve cash could enable the company to be more nimble and responsive to opportunities and challenges. Therefore, Baidu’s current lack of share buybacks or dividends should not be viewed as an inherent disadvantage.

Investor Implications

Apple is reportedly in talks with Baidu to use its Gen AI platform for iPhone in China. This partnership will provide Baidu with a large user base and valuable data to strengthen the company’s Gen AI business. From a broader perspective on Baidu’s Gen AI business, I note that the company’s CEO suggested that Baidu’s Gen AI business generated approximately 250 million to 280 million yuan in revenue during the fourth quarter of 2023. I emphasize. According to additional CEO commentary, I estimate that these revenues could increase to approximately 5 billion to 10 billion yuan in fiscal 2024 and then achieve a compound annual growth rate (CAGR) of 25% over the next few years until 2030.

Looking ahead to fiscal 2024, Baidu’s total revenue is expected to reach 145 billion yuan, up about 7% year-on-year, assuming strong performance in its cloud business and a macroeconomic recovery supporting Baidu’s advertising revenue at a reasonable 5%. % YoY growth. In terms of profitability, I expect Baidu’s adjusted net income to be relatively flat compared to fiscal 2023. About 29 billion yuan (we model that the higher topline in fiscal 2024 and fiscal 2023 should be largely offset by a gradual increase in R&D expenses).

Despite healthy commercial momentum in Baidu’s legacy business (advertising/search) and explosive upside potential in the Gen AI space, Baidu stock is trading very cheaply. ~20-25x for US tech companies like Google (GOOG) and Meta (META). In that regard, I continue to argue that Baidu stock is trading too cheap to ignore. I previously calculated that Baidu’s intrinsic value could be around $179 per share. And I continue to think that that estimate is reasonable. “Buy”.