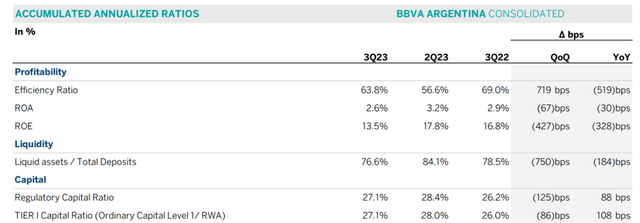

Banco BBVA Argentina: Caution Required Before Further ‘Shock Therapy’ (NYSE:BBAR)

Editorial by Natalia SO/iStock via Getty Images

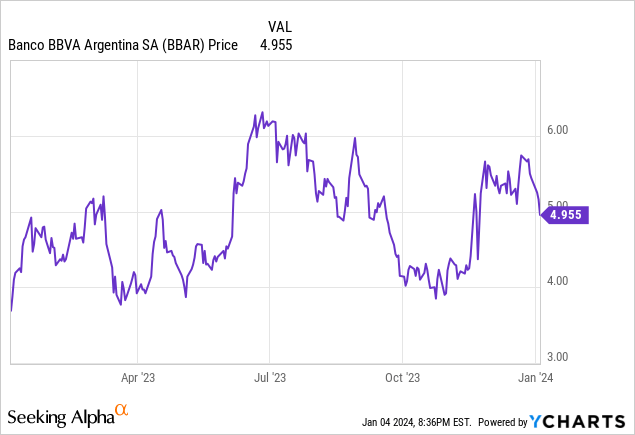

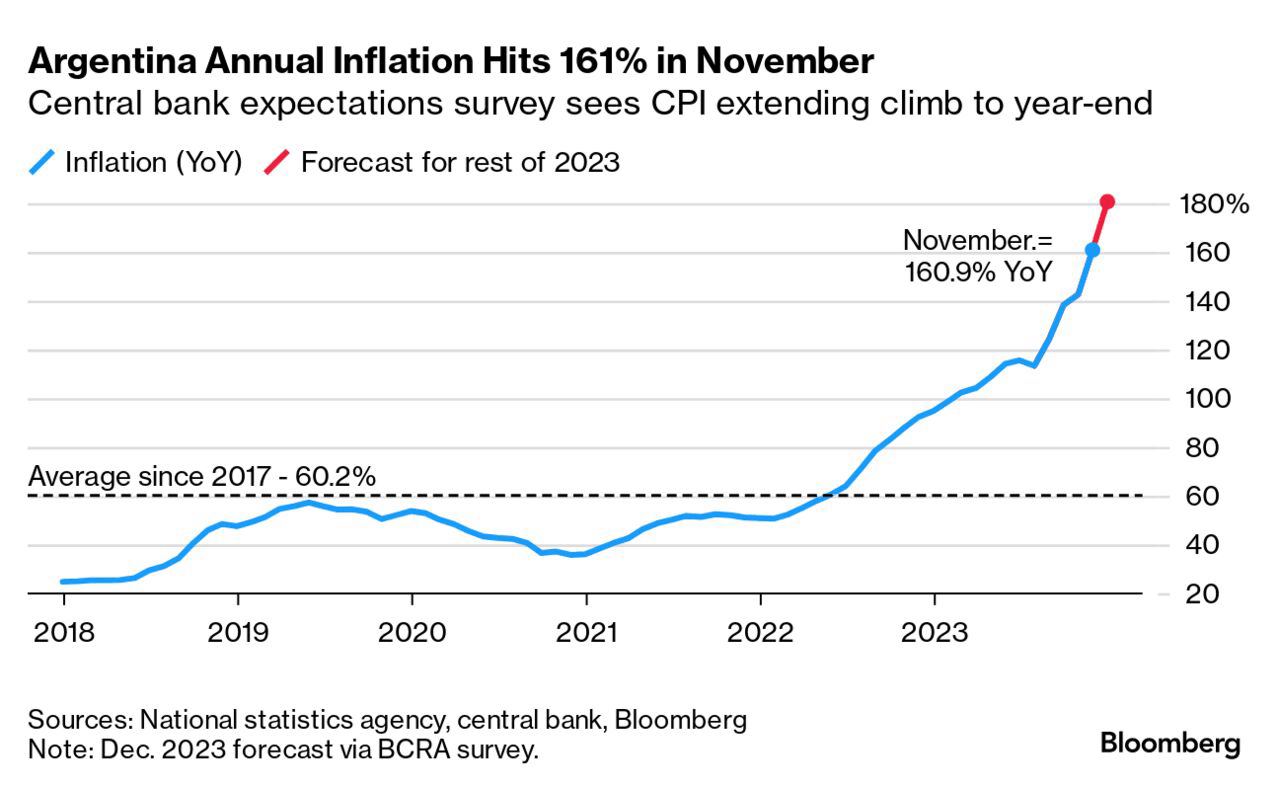

After the election of new President Javier Millais, ‘shock therapy’ began in Argentina. The new government announced deep cuts in fiscal spending while also unveiling a one-time peso devaluation of the ARS800. per dollar – almost in line with the parallel exchange rate. While positive for companies with dollarized revenue streams, the impact is more challenging for banks such as: BBVA Bank of Argentina SA (NYSE:Baba). Meanwhile, banks will benefit to some extent from foreign exchange depreciation through their dollar-linked asset portfolios. However, not all equity is dollar hedged, so the positive aspects of the P&L may not completely outweigh the negative aspects. Moreover, there is a secondary effect of increased inflationary pressures following the devaluation. Inflation has already been a significant drag on the bank’s net monetary position in recent quarters.

Despite short-term uncertainty, Argentine banks has been re-evaluated. There’s probably a good reason for that. While a more market-friendly government means risk premiums will decline over time, Milei’s willingness to implement painful spending cuts bodes well for ultimate macro stabilization. Also positive is that fewer regulatory constraints allow for more optionality, which could open up new fee-related revenue streams in the future.

That said, the road ahead won’t be easy, and we expect a particularly difficult near-term outlook on both sides of the balance sheet as Milei pursues a major financial overhaul. BBVA Argentina may be well-equipped to weather the volatility, but it’s likely that the market has already factored in the underlying upside to its current premium. On balance I would be left out of this.

Latest Peso Devaluation Puts and Takes

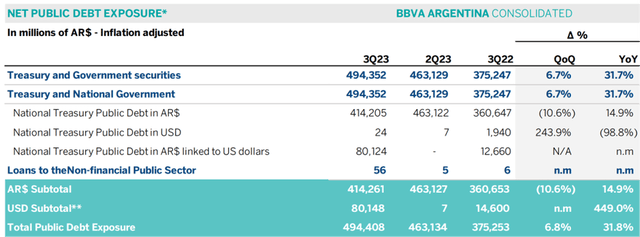

Among the initial “shock therapy” measures imposed by Argentina’s new government, a significant devaluation of the official exchange rate was the most relevant to banks. On the one hand, BBVA Argentina will see some P&L benefits from foreign exchange gains in its dollar-linked portfolio. However, compared to other sectors, banks are not hedged against currency movements due to regulatory restrictions on direct dollar exposure. Argentine banks are also not fully hedged against inflation, which is likely a short-term result of a one-time reset. BBVA Argentina’s large inflation-linked dual bond portfolio (i.e., bonds that pay the higher of inflation or peso depreciation) certainly helps, but in the fallout there are more profit/loss headwinds than tailwinds.

BBVA Bank of Argentina

Another major concern is the fate of Argentina’s Central Bank (i.e. “BCRA”). Ultimately, Milei spoke out against repealing the BCRA in the run-up to the election. However, a complete phase-out scenario seems unlikely given the following: a) Central banks are protected by the Constitution. b) Milei has no control over the council. Instead, a more likely scenario might be a disabled BCRA with fewer regulatory functions and much less control over the monetary side, especially with regard to central bank bonds (“Leliqs”). Less Leliq issuance may or may not be a good thing, but given the many restrictions on banks’ ability to hedge their currency exposures at the moment, any easing of the regulatory environment would be an unconditional positive.

In any case, the pressing issue for the bank is managing its Leliqs exposure following the Milei win. According to its third quarter report, BBVA Argentina, like its peer banks, is already well on its way to de-risking its Leliq exposure. However, there is still reinvestment risk. That’s because the P&L impact could be significant in the fourth quarter, depending on how quickly you use up your remaining Leliq (ideally in favor of inflation- or dollar-linked securities). Additionally, the (substantially positive) ROE target for next year is a high bar in the context of ongoing triple-digit % inflation pressures, so a mistake here could add downside risk to the current target.

BBVA Bank of Argentina

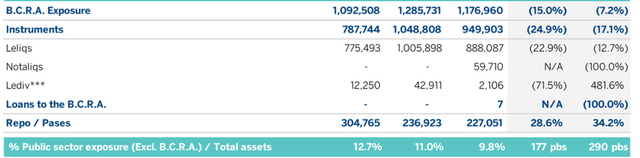

Solid fundamentals, but mindful of post-election uncertainty

The good news is that the underlying fundamentals are stronger than ever, according to monthly BCRA data on the banking system. Despite the decline in loan growth, BBVA Argentina’s third quarter was resilient. This is because inflation-adjusted ROE was maintained in the low 10% range due to the switch to public securities. A new government may add uncertainty to banks’ capital deployment options, but the combination of strong capital ratios, intact asset quality and efficiency levers means there is ample cushion to withstand any negative “shock therapy” impacts in the future.

BBVA Bank of Argentina

To be clear, this does not mean the bank meets the inflation-adjusted ROE guidance criteria. It remains difficult to know what will happen to near-term P&L guidance as fiscal consolidation typically hurts loan growth and adds to borrower stress and provisions. Do not reset lower. Argentine banks will also not get any hope of capital returns as they are merely normalizing dividends again after COVID-related restrictions. The current schedule is conservative (approximately 40% return payout) and there is ample room for an upside reversal, but returns will probably remain relatively low given the importance of capital buffers ahead of an uncertain operating environment.

light at the end of a long tunnel

Short-term headwinds aside, there are strong long-term choices here for owning a bank. After all, credit inherently tracks the overall economy, a factor that has worked against BBVA Argentina over the past decade. Argentina’s (inflation-adjusted) lending decline continued to worsen last year as the macroeconomic situation deteriorated with rising inflation and interest rate pressures.

bloomberg

Reversing these systemic trends is not simple, but more market-friendly governments offer hope for a reversal. If successful, the options for Argentine banks will be enormous. Credit penetration levels are still the lowest in Latin America at 9% of credit to GDP, which implies massive untapped growth for banks in the long term. New fee revenues could also potentially increase if Milei further delivers on its election promises of deregulation and greater private sector participation (such as the recent privatization of state-owned Banco Nación de Argentina). But the road to macro stability will not be easy, and until there are signs of a broader transition, I would not yet endorse this part of Argentina’s banking thesis.

Caution is required before additional ‘shock therapy’

Argentina may have a new market-friendly government, but it is far from a given path to macro stability. For banks, reading is more difficult. To be clear, the sector is fundamentally in a good position. Strong profitability, a well-capitalized balance sheet, and a strong liquidity position bode well for resilience. But much of this is reflected in the price, with even the cheapest BBVA Argentina shares in the sector currently priced at a premium to book.

This leaves Banco BBVA Argentina SA investors vulnerable to near-term profit and loss risks from peso devaluation and inflation headwinds, as well as a possible credit slowdown as fiscal consolidation occurs. There is light at the end of this tunnel, but I don’t think the risk/reward is particularly attractive here.