Bandwidth: 2024 Will Be a Year of Strong Execution (NASDAQ:BAND)

John Lamb/DigitalVision via Getty Images

Even in the technology industry, good companies come and go periodically. It is not a continuously upward path. This can be a tough pill to swallow for investors accustomed to consistent growth stocks. Consistently delivering double-digit growth rates (but with inflated valuation multiples to compensate). But you can also find great investments in cyclical technology stocks, and this is the case with Bandwidth.Nasdaq:Band), and its much larger competitor Twilio (Touro).

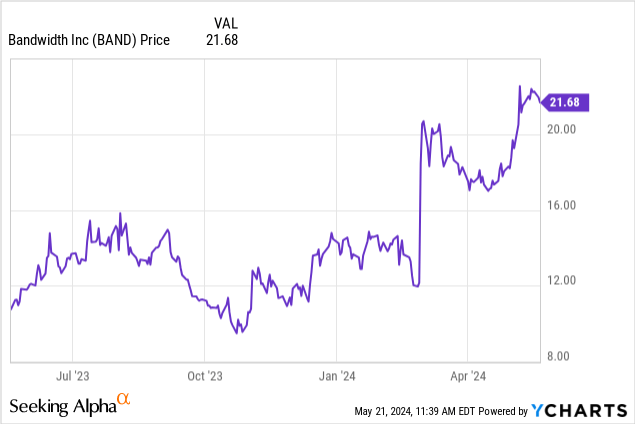

But while Twilio has been struggling this year with slowing growth, executive turnover, and poor performance at its Segment subsidiary, Bandwidth is soaring, with its stock up more than 50% year to date.

Some of these jumps are periodic. The company promised that would happen in 2024. It’s been a year of even stronger growth, with election cycle traffic driving a significant portion of our business. But management is also executing stronger, retaining customers with a higher net revenue retention rate than Twilio and generating significant adjusted EBITDA gains from prior year layoffs.

I last wrote a neutral opinion on Bandwidth in February, when the stock was trading close to $20 per share. Since then, the company has announced outstanding first quarter results that demonstrate a rapid acceleration of growth and an improvement in the company’s full-year guidance. Because of these factors, I now optimistic In this stock.

Here’s my long-term upside story for bandwidth:

- Significant TAM of $17 billion. Bandwidth estimates the 2023 market opportunity at $17 billion (quoted from its most recent investor presentation), which represents only 4% penetration of this expansive market with annual sales of $700 million.

- The reacceleration of sales is encouraging. Bandwidth is confident of its ability to grow in the mid-teens through 2026, finally surpassing larger rival Twilio (which continues to cite headwinds from the cryptocurrency industry and its segment subsidiaries).

- Land and expand. The company achieves a net revenue retention rate of close to 110%. Additionally, average revenue per customer is increasing approximately 10% year-over-year, reflecting the company’s ability to encourage greater customer usage over time.

- Austerity measures have resulted in meaningful improvements in profitability. Although not yet fully profitable from a GAAP perspective, Bandwidth’s layoffs and focus on profitability coupled with a disciplined growth path have allowed the company to generate much better adjusted EBITDA.

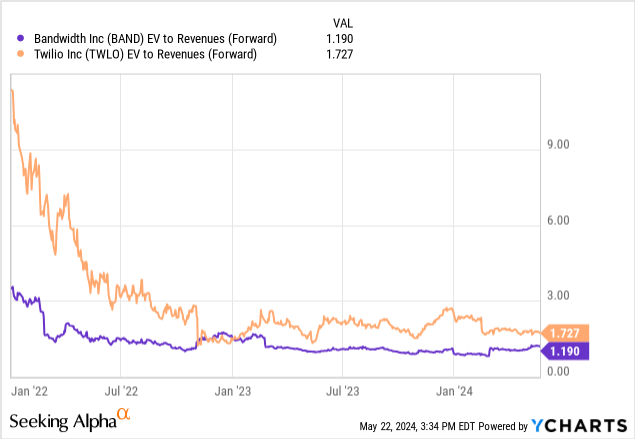

Valuation remains one of the biggest incentives to hold on to this stock. The current stock price is close to $22, and even after Bandwidth stock is up about 50% this year, Bandwidth still has a market cap of just $586.9 million. After stripping out $147.2 million in cash and $419 million in convertible notes in Bandwidth’s most recent balance sheet, here’s the result: The enterprise value is $858.7 million.

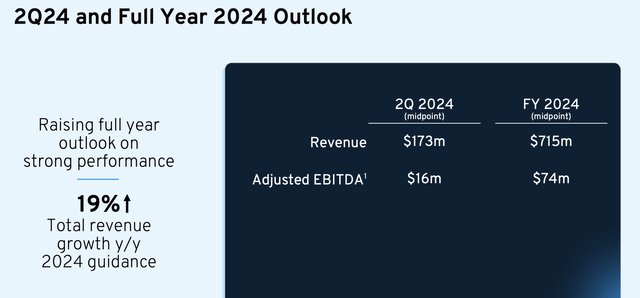

Bandwidth recently raised its full-year outlook to $715 million (+19% y/y). This is 3 points higher y/y growth than the previous view of $700 million (+16% y/y). Meanwhile, the adjusted EBITDA outlook was $74 million, a 10% margin (compared to the previous forecast of $72 million).

Bandwidth Outlook (Bandwidth Q2 Shareholder Deck)

This results in Bandwidth’s valuation multiple being:

- 1.2x EV/FY24 revenue

- EV/FY24 adjusted EBITDA 11.6x

My target prices for bandwidth are: $30This indicates: 1.5x EV/FY24 revenue There is approximately 35% upside from current levels. Despite its current stellar growth, Bandwidth is still trading lower than its only pure competitor, Twilio, at ~1.7x sales, making the 1.5x target feel quite achievable.

Of course, there are risks here. Election traffic may not play out as expected as we get closer to the polls in November, and how Bandwidth’s revenue holds up post-election is always a wild card. But I think the company has enough growth momentum toward app-based messaging to outweigh these risks.

Stay here for a long time and continue to ride the recent upward trend.

Q1 Downloads

Now let’s take a closer look at Bandwidth’s latest quarterly results. The first quarter performance summary is as follows.

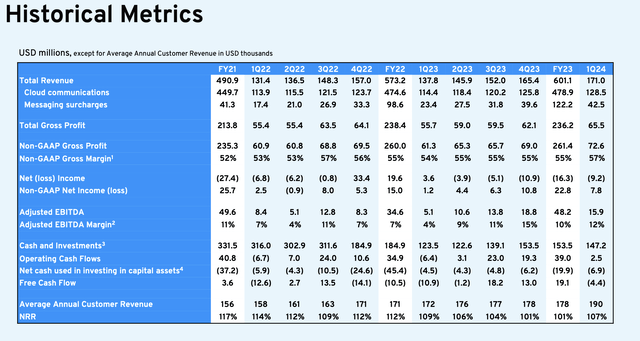

Bandwidth Trend Results (Bandwidth Q2 Shareholder Deck)

In the first quarter, Bandwidth’s revenue grew at a stellar 24% year-over-year to $171 million. This figure is well ahead of Wall Street’s expectations of $165 million (+20% y/y) in Q4. Much of this growth was driven by messaging surcharges, which nearly doubled year-over-year to $42.5 million.

While it would be easy to write off the quarter as a quarter driven by political campaign messages, the company estimates that the U.S. election cycle contributed only $3 million to the first quarter results, or about 2 points compared to the previous year.

CFO Daryl Raiford commented on key strengths during the first quarter earnings call:

Global communications plan revenue growth in the first quarter increased 4% year-over-year, reflecting improvements in usage trends from last year. Our Programmable Services category grew year-over-year, reflecting strong demand for messaging, driven by continued healthy demand from commercial customers in the e-commerce, financial services and healthcare sectors and the $3 million tailwind from the aforementioned political cycle. It grew by 49%. Campaign message.

In our Direct Enterprise Customers segment, we grew revenue 20% year-over-year, reflecting Bandwidth’s ability to solve complex communications challenges for global enterprises and our ability to continue executing the company’s go-to-market strategy. Our pipeline is full of new opportunities across industries and geographies. In terms of operational metrics, our Q1 net retention rate was 107%, an improvement of 6 percentage points over Q4 2023. Customer name retention once again exceeded 99%. “It’s a testament to the reliability and breadth of the Global Communications Cloud combined with an unwavering focus on customer success and continuous innovation.”

In terms of profitability, it’s worth noting that Bandwidth’s gross margin increased 300bps year-over-year to 57% (although management reminded investors that gross margin is a lumpy metric for the company). This is well ahead of the company’s annual margin expansion target. 100bps. Meanwhile, Adjusted EBITDA more than tripled to $15.9 million, or a 12% margin (again, this is well ahead of the company’s 10% margin target for the year, and Q1 was the lowest quarterly adjusted EBITDA margin for FY23 bandwidth). It was a low point). ).

Key Takeaways

With accelerated growth, shorter election cycles, larger TAM, and improved profitability, there are plenty of reasons to feel confident again in Bandwidth’s performance, especially as competitor Twilio continues to falter. Stay here for a long time.