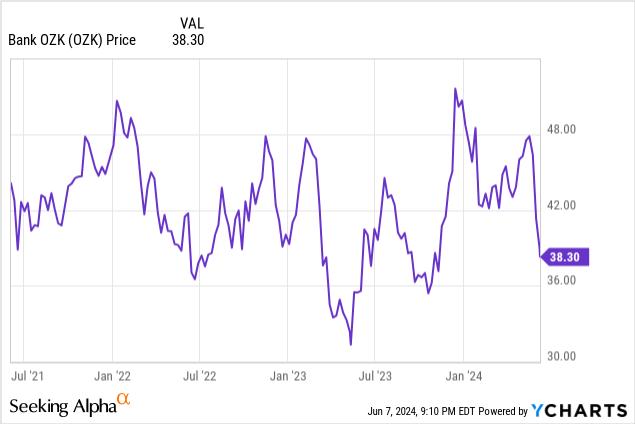

Bank OZK: Interesting 7.3% yield preferred stock, excessive CRE risk (OZK)

Bank OZK

introduction

Bank OZK(NASDAQ:OZK), along with fellow author Mark Dockray, said Citigroup has had a tough time recently as markets continue to focus on the negative impact of commercial real estate on the bank’s loan book. (Seed) Torpedo OZK. While Bank OZK clearly overweights CRE as part of its total loan book, the average LTV ratio for the sector remains low. In fact, despite the expansion of the loan size in the first quarter of this year, the total amount of delinquent loans actually decreased. Meanwhile, banks are looking closely at preferred stocks while also considering common stocks for investment as they drive record performance this year.

Yes, the balance sheet is exposed to CRE.

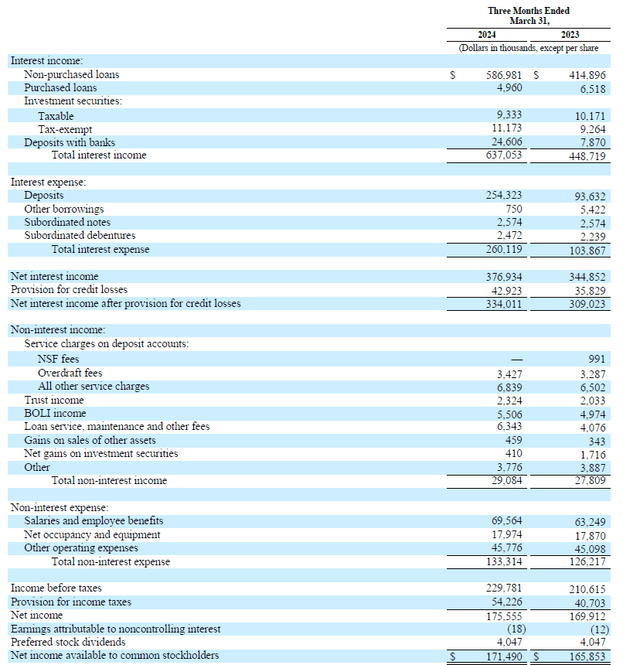

Before discussing bank balance At Sheets, we think it’s important to first take a closer look at the revenue profile. After all, the higher the revenue, the higher the potential loan loss reserves the bank can set aside to cover potential losses.

This is where Bank OZK is succeeding. As you can see below, the bank’s interest income increased from less than $450 million to more than $637 million in the first quarter of this fiscal year compared to the first quarter of 2023. Total interest expense also increased, but net income increased. Interest income increased $32 million, from less than $345 million to nearly $377 million.

Bank OZK Investor Relations

Another outstanding achievement is OZK’s ability to control other operating costs. Non-interest income only increased by $1.2 million, and total non-interest expenses increased by only $7 million. This allowed Bank OZK to report pre-tax and loan loss provision income of almost $273 million. Bank OZK recorded a net profit of just over $175 million, with a loan loss provision of $43 million and a tax bill of $54.2 million.

From this amount, we must deduct the quarterly preferred dividend payment of $4.05 million, which results in a first quarter net profit attributable to Bank OZK shareholders of $171.5 million. This represents $1.51 per share, a 6% increase over Q1 2023 EPS of $1.42. It goes without saying that the preferred dividend is very well covered, as the bank needed less than 3% of its net profit in the first quarter. To cover preferred dividends

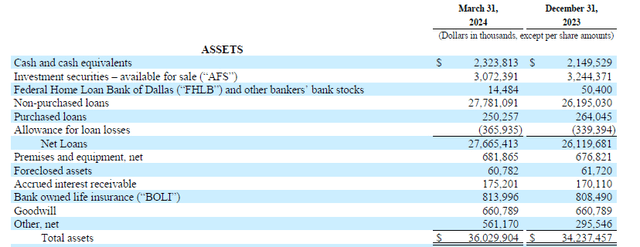

Therefore, one of the most commonly heard arguments for investing in Bank OZK is its exposure to commercial real estate. There is no denial or sugarcoating. It absolutely is. Let’s look at the asset side of the balance sheet. As you can see below, the bank’s balance sheet has grown to just over $36 billion. Liquidity levels are good, with close to $5.4 billion in cash and marketable securities available for sale.

Bank OZK Investor Relations

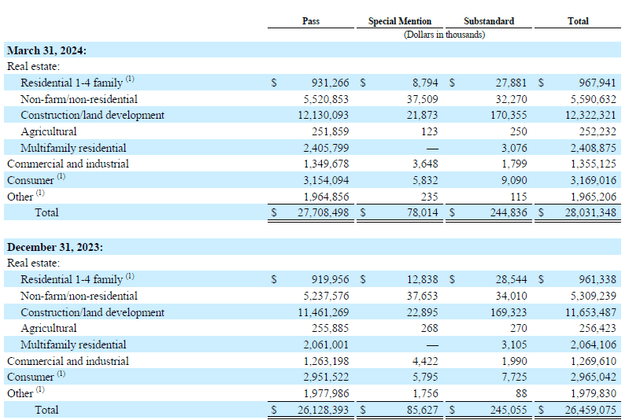

I’m obviously more interested in the $27.7 billion loan book. As you can see below, the majority of our loan book is comprised of commercial real estate. Of the $28 billion in loans (before provisions are taken into account), less than $325 million are classified as special mention or substandard loans.

Bank OZK Investor Relations

Although the bank has a very high level of exposure to commercial real estate, there are two important factors that play to OZK’s advantage.

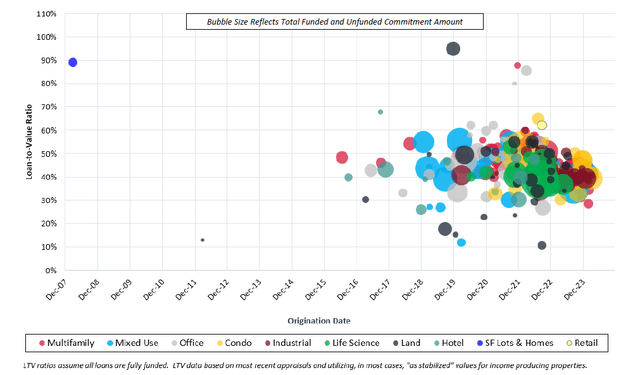

First of all, the average LTV ratio is quite low. The bank’s real estate specialty group is a leader in CRE construction and development finance. The RESG division accounts for a total of $18 billion of the overall loan book, and with an average loan-to-cost ratio of 52% and an average LTV ratio of about 43%, OZK’s CRE loan division is clearly keeping an eye on loan quality. As the bank explains, loans in that category are typically the ‘last dollar to finance a project’ and the first dollar to be repaid. Meanwhile, some loans include mezzanine debt and preferred equity, both of which are subordinate to the senior secured loans provided by the bank.

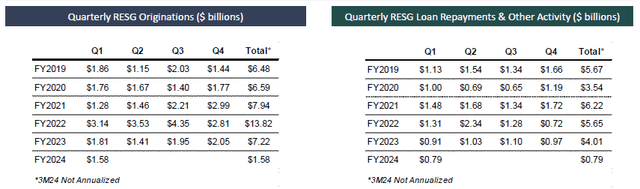

The image below shows the total impact of repayment. As you can see, the bank issued about $1.6 billion in new loans, but also received $0.79 billion in repayments. This means that in practice the CRE loan book is still growing, but at a moderate pace, and that newer loans will be issued using more conservative valuation parameters.

Bank OZK Investor Relations

That means the roughly $9 billion in CRE loans originated since early 2022 are likely to be of lower risk than ‘traditional’ loans, and the $4.8 billion in cumulative loan payments since the beginning of last year are likely to be tied. This is for loans where the value of the underlying building has already declined.

The image below provides some clarity on the acquisition process. As you can see, the LTV ratio of most loans issued over the past three years was in the 40-60% range. And the biggest problem, office-related CRE, also has a relatively low LTV ratio (excluding one office loan issued in fiscal year 2022 with an LTV ratio close to 90%).

Bank OZK Investor Relations

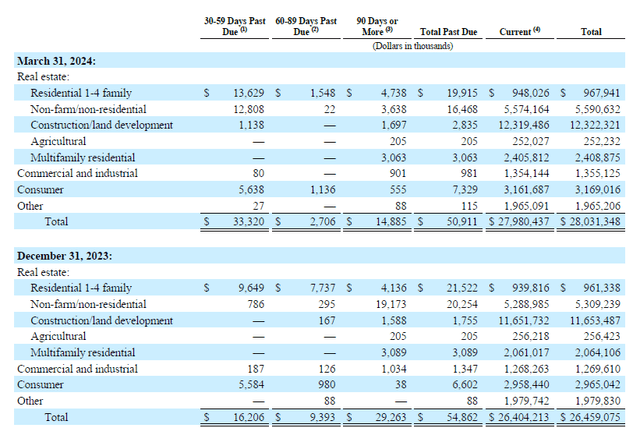

The relatively low LTV ratio explains why the bank’s loan quality remains high. In fact, in the first quarter of this year, the net delinquent loan amount decreased compared to the previous quarter. As you can see below, out of total loans exceeding $28 billion, loans worth less than $51 million were classified as ‘delinquent.’

Bank OZK Investor Relations

This means that the amount of delinquent loans decreased by $4 million, even as the size of the loan book increased by more than $1.5 billion.

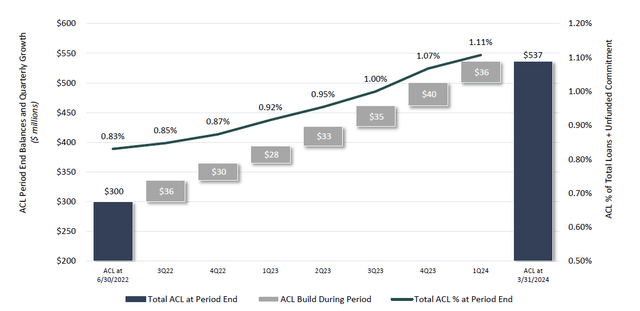

Meanwhile, the bank continues to add provisions, bringing its total provisions for credit losses to $537 million over the past two years. This represents 1.11% of total funded and unfunded loan commitments and approximately 10 times the total amount of loans currently delinquent.

Bank OZK Investor Relations

Of course, OZK Bank lost its entire investment not because of poor lending. If the assets are seized and sold, the bank will always be able to recoup a significant portion of its investment. That’s why the RESG division was highlighted in the first quarter earnings call for ‘generating exceptional returns with below-average risk.’

Let’s take a closer look at preferred stocks again.

As explained in a previous article, Bank OZK holds a series of preferred shares.NASDAQ:OzCop) as the ticker symbol. Preferred stock offers a preferred dividend yield of 4.625% based on a par value of $25.

With 14 million preferred shares issued, OZK Bank will have to pay preferred dividends of $16.2 million per year, or $4.05 million per quarter. As explained earlier in this article, the payout ratio is a low single-digit percentage of net income. Preferred shares can be offered starting in November 2026.

pursue alpha

Last Friday, preferred stock closed at $15.84, representing a yield of approximately 7.30% based on the current stock price.

investment thesis

OZK Bank is expected to report record profits this year (which is supported by consensus estimates calling for EPS of over $6 this year) and exceed $7 by 2026, but the market is likely still reluctant to see growth. This comes primarily from real estate specialist groups, meaning the total amount of commercial real estate on the balance sheet is likely to increase. Exposure to CRE is ok. Because even if the exposure is a multiple of total balance sheet equity, what matters most is how risky the loan is. The RESG sector has strict underwriting standards and the LTV ratio is less than 50%, so OZK Bank appears to have the upper hand. That’s right. CRE will be painful for some investors. However, it will be the mezzanine and equity tranches that suffer the most. Banks whose projects have LTV ratios of 40-50% should be able to handle this fallout.

I have a long position in OZK Bank’s preferred shares, but I am also interested in its common shares. Although the stock has fallen following Citibank’s recent rating downgrade, the bank’s earnings profile remains solid, and the stock currently trades for less than 7 times earnings. I understand the market’s concerns about the CRE portfolio, but as long as risk management is prioritized over growth, I think Bank OZK’s risk/reward ratio at its current share price, which is just above its tangible book value, is quite interesting.