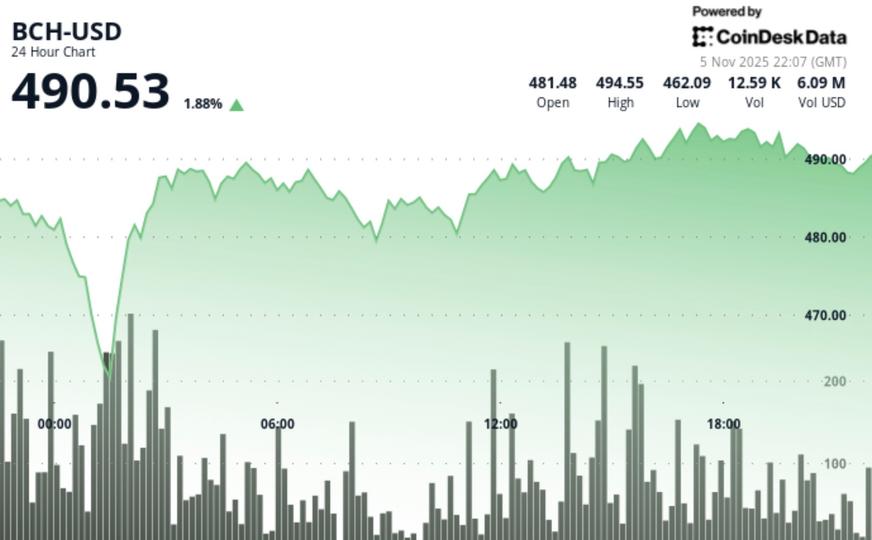

BCH surged above the $487 resistance level and then rose to $491.80.

BCH rose 3.3% to $491.80 after hitting a $33.36 range after clearing $487 on above-average European session volume and briefly retreating from a $495.30 high where buyers quickly dissipated, according to CoinDesk Research’s technical analysis data model.

(All timestamps are in UTC.)

Technical Analysis Highlights

- The price rose 3.3% from $476.10 to $491.80.

- The intraday range was measured at $33.36.

- Higher lows were set at $462.67, $474.27 and $479.03.

- Continued buying interest led to a break above $487.00 during the European session.

- The price peaked at $495.30, then fell $3.20 to $490.14 before rebounding to $492.99.

- Between 16:00 and 17:00 on 5 November, multiple attempts were made to compromise $495.00.

- Trading volume peaked at 33,795 units at 21:00 on November 4, a 78% surge over the 24-hour average of 13,478 units.

- It fell 0.65% from session highs before recovering above $491.00.

Pattern Description

The report describes an upward trend accompanied by a clean breakout. Buyers continued to break into higher lows, and the price broke through $487 with stronger participation, then the small decline was quickly absorbed to keep the momentum intact.

Support vs. Resistance Map

- Apply: A psychological level test of $490.00 for 60 minutes. $487.00 breakout zone; $479.03 higher and lower

- resistance: Area $495.00 after multiple rejections; $495.30 Session Highest

Framing goals and risks

- Target: Immediate upside target of $495.30 with possible breakout above $500.00.

- Void/Danger: Defend $487.00 to maintain the bullish structure

- context: Risk/reward favors continuation of the 7.0% daily range, indicating strong volatility.

disclaimer: Portions of this article were generated with the help of AI tools and reviewed by our editorial team to ensure accuracy and compliance. Our standards. For more information, see: CoinDesk’s full AI policy.