Best Cryptocurrencies to Buy Now December 17 – Maker, TG.Casino, EOS

join us telegram A channel to stay up to date on breaking news coverage

‘Best Cryptocurrencies to Buy Now‘ is one of the most searched cryptocurrency-related terms on Google, and InsideBitcoins lists several options every day.

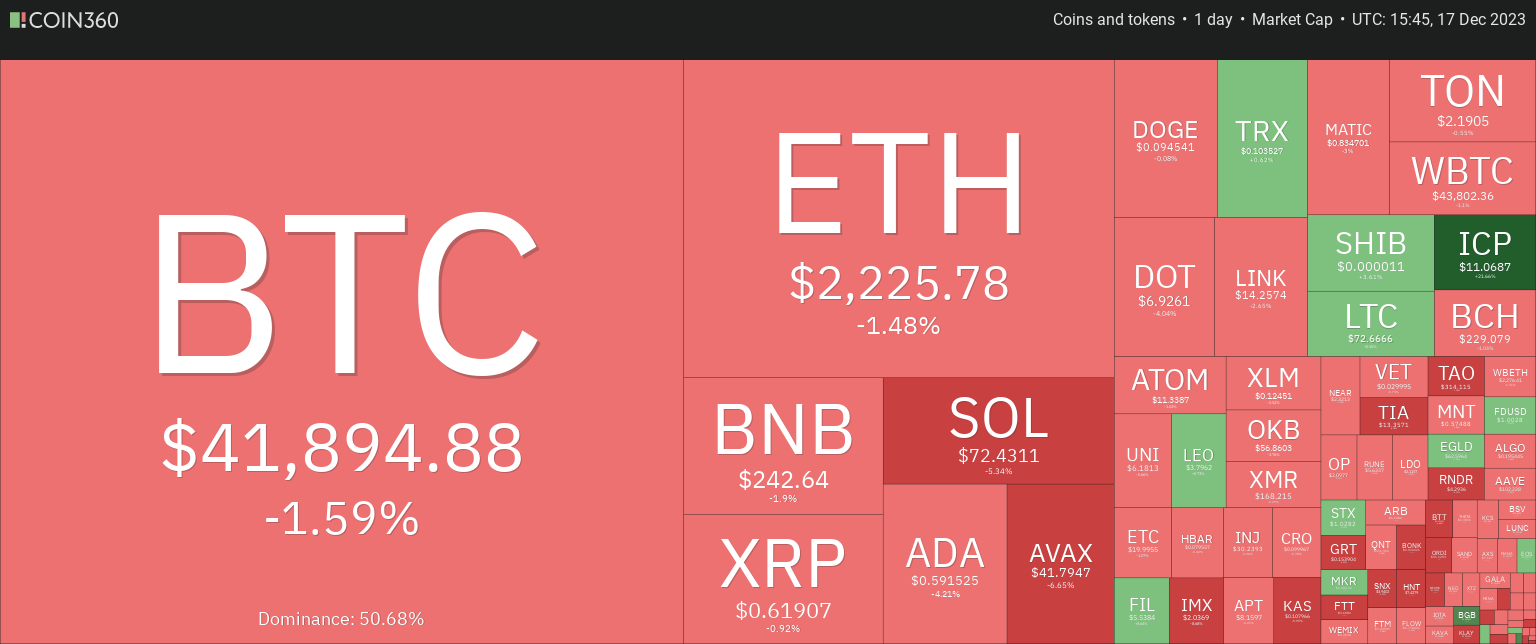

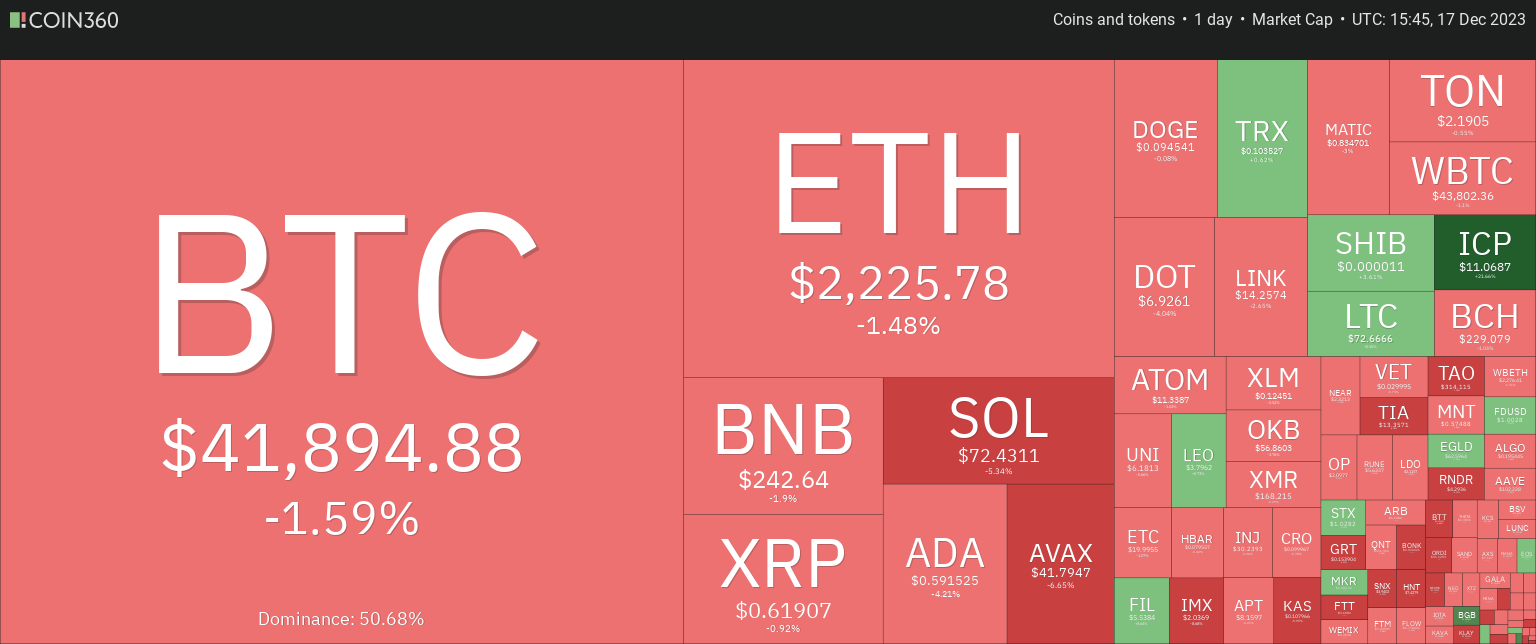

According to a recent analysis, the cryptocurrency market is poised for significant upside in 2023. Bitcoin rose more than 107%, and Solana surged more than 650%. However, despite this success, many best cryptocurrency It remains about 70% below its all-time high from two years ago, raising questions about the sustainability of the positive trend.

In this scenario, Avalanche and Chainlink stand out as potential deals. The Avalanche offers unique features, so it’s worth exploring its current value. Likewise, Chainlink’s current market position leads us to consider its future potential in the broader blockchain ecosystem.

Best Cryptocurrencies to Buy Now

The decentralized finance (DeFi) sector contributed $7.07 billion, accounting for 14.90% of the cryptocurrency market size. However, stablecoins stood out significantly, with a trading volume of $41.81 billion, accounting for 88.16% of the total cryptocurrency market activity during the same period.

1. EOS

EOS Labs and the EOS Network Foundation (ENF) recently collaborated on the EOS Stable Coin Chain (ESCC). ESCC is an Ethereum-based blockchain deployed as a smart contract on the EOS network using the custom EOS EVM architecture. The goal is to strengthen the EOS ecosystem by creating a faster platform for stablecoin transactions.

ESCC is the first to use stablecoins as gas fees, providing users with a unique experience on the blockchain. This innovation aims to make interactions more reliable, efficient and user-friendly. ESCC plans to join forces with EOS to change the way stablecoins are traded.

They want to use high-performance EOS EVM technology to make transactions more efficient. They also aim to transform financial transactions on blockchain using the advanced EOS EVM architecture. EOS has shown a positive trend since this consolidation.

ENF& @EOSNetworkLabs We are proud to announce our partnership with . @ESCCio 🤝

This partnership #EOS We build an ecosystem by providing a platform optimized for high-speed compatible stablecoin transactions 🚀

📚 Notice 👇https://t.co/zeXDBTXeQ1 pic.twitter.com/AbCWN1q0pd

— EOS Network Foundation (@EOSnFoundation) December 14, 2023

It is currently trading above the 200-day simple moving average. EOS also has high liquidity relative to its market capitalization. Of the last 30 days, 19 were green days, representing a positive trend of 63%. Looking at the EOS numbers, there are currently 1.11 billion EOS tokens out of a maximum supply of 1.06 billion EOS.

2. NEAR Protocol (NEAR)

NEAR Protocol has partnered with Pyth Price Feeds to integrate real-time market data into the NEAR blockchain. This collaboration is significant as Pyth is a significant player serving over 40 blockchains and is trusted by renowned companies such as Jane Street, CBOE, Binance, OKX, and Bybit.

Previously, Pyth fed NEAR’s EVM chain, Aurora. Now fully compatible with the NEAR protocol. This is great news for the growing DeFi community in NEAR. That’s because Pyth’s best-in-class financial market data, updated every 300 milliseconds, is now at your fingertips.

Currently, NEAR Protocol is trading at $2.31, with a 24-hour trading volume of $515.46 million. Last year, NEAR’s price soared 67%, outperforming half of the top 100 cryptocurrency assets.

The open web concept has been near and dear to the ecosystem’s vision since 2017.

Innovation is accelerating.

Founders who build on NEAR are empowered to reach a broader market and deliver more user-centric experiences.

Watch here: https://t.co/YFngoipMSo pic.twitter.com/e6CSNtoExN

— NEAR Protocol (@NEARProtocol) December 13, 2023

Over the past 30 days, the NEAR protocol has had 18 green trading days, accounting for 60% of the total. Due to its solid liquidity based on market capitalization, NEAR Protocol ranks 22nd in the Layer 1 category.

This collaboration between Pyth Price Feeds and NEAR Protocol is a win-win. NEAR gets high-quality market data, and Pyth expands its reach. This move is in line with trends in blockchain and DeFi, making NEAR the best cryptocurrency to buy right now.

3. TG. Casino (TGC)

TG Casino‘s pre-sale campaign garnered attention from the cryptocurrency community, raising over $4,260,014 toward its $5,000,000 goal. The $TGC token is attracting attention with its unique 25% cashback on betting losses.

The project uses innovative staking and redemption methods to increase rewards and reduce token supply. This aims to increase the TGC token value as the platform grows. Analysts are closely watching how these strategies affect supply and demand for TGC.

that much $TGC The airdrop event is here!

16 million tokens (16% of supply)

Step 4Please refer to Community TG for more details!

Beware of scams! No billing required! pic.twitter.com/ZG42DHmdYj

— TG Casino (@TGCasino_) November 20, 2023

Additionally, pre-sale participants will enjoy a 1,500% Annual Percentage Yield (APY) on TGC tokens. Early investors are promised exclusive rewards once the platform is officially launched on Telegram.

Simply put, T.G.C. It stands out with its unique staking and redemption mechanisms and has a solid showing in pre-sales. These unique features offer a new approach to staking rewards and token value. As the project progresses, experts will closely monitor how the mechanism will affect the supply and demand of TGC.

4. Maker (MKR)

Maker’s recent upward trend makes it one of the best cryptocurrencies to buy right now. The current price of MKR is $1,335.91, up 0.55% intraday. This is accompanied by a trading volume of $94.37 million. The market capitalization is $1.23 billion and the market dominance is 0.08%.

Additionally, Maker is trading above its 200-day simple moving average, indicating a positive trend. In the last 30 days, Maker had 15 positive days, which accounted for 50% of the period. The coin’s liquidity is solid based on its significant market capitalization.

However, the highest MKR price since the last cycle low was $1,635.29, highlighting the coin’s price volatility. Sentiment towards Maker’s price prediction is currently neutral, as reflected by the Fear and Greed Index of 73 (Greed). Additionally, the token has grown 145% in the past year, outperforming 73% of the top 100 cryptocurrency assets during this period.

Note: Spark’s only official account is: @sparkdotfiNow confirmed ✅

Don’t be fooled by scammers!

⚡️

— Spark (@sparkdotfi) December 14, 2023

Maker’s circulating supply is 918,878 MKR out of the maximum supply of 1.01 million MKR. The current annual supply inflation rate is -6.01%, resulting in a net decline of 58,753 MKR over the past year. Additionally, Maker ranks 8th in DeFi coins and 17th in Ethereum (ERC20) tokens by market capitalization.

5. KLAY

Can Klaytn regain its spot as the best cryptocurrency to buy right now? Over the past year, Klaytn’s price has risen 64% and is consistently trading above its 200-day average. Over the past month, 18 out of 30 days have seen positive gains, or 60% of the total. KLAY currently has a circulating supply of 3.28 billion out of 10.95 billion KLAY.

0 Last year, approximately 256.19 million new KLAY units were introduced with an average annual supply inflation rate of 8.48%. Nonetheless, Klaytn’s market sentiment regarding its price prediction remains neutral. The Fear and Greed Index is 73, indicating that there is some greed in the market.

🚀 Are you ready to experience Klaytn v1.12.0? Update now to take advantage of exciting new features and optimizations. Together we are ready to redefine blockchain development! 🔥

Check out the release notes for more details👇⚙️https://t.co/9184EnAPox— Klaytn Developer (@BuildonKlaytn) December 11, 2023

However, Klaytn has shown positive growth, good liquidity, and steady market position over the past year. Sentiment and Fear & Greed indices provide a balanced outlook. These factors can be helpful to investors who want to understand Klaytn’s current status in the cryptocurrency market.

Learn more

A new cryptocurrency mining platform – Bitcoin Minetrix

- Thanks to Coinsult

- Decentralized, secure cloud mining

- Get free Bitcoin every day

- Native token currently in pre-sale – BTCMTX

- Staking Rewards – APY 100% or more

join us telegram A channel to stay up to date on breaking news coverage