Best Cryptocurrency Staking Rates – Bitcoin Market Journal

Cryptocurrency staking is exploding in popularity as investors can earn more interest on their cryptocurrencies by staking the most popular proof-of-stake tokens. As you can see below, the interest rates are much higher than those of regular banks.

(If you’re just starting out, see our cryptocurrency staking guide here.)

What Most Investors Want to Know Which cryptocurrency is best for staking? and Where can I find the best rates?. Our editors evaluate and review the best tokens and staking platforms every week to keep this chart the best source of information. Best Staking Tokens and Best staking ratio.

Ethereum (ETH)

Ethereum (ETH)

ETH has the potential to become the best cryptocurrency for staking. Investors have already secured $21 billion in the Ethereum 2.0 staking pool. This is mainly due to the confidence that Ethereum inspires. Ethereum has a large ecosystem and widespread adoption.

However, ETH staking still carries risks. Staking your ETH today will lock you in until the “Shanghai” upgrade, currently scheduled for 2023, but it could take longer.

If you have some ETH in cold storage and don’t plan on cashing it out for a few years, entering a staking pool may be a good option. After all, this is one cryptocurrency we believe in for the long term.

Binance Coin (BNB)

Binance Coin (BNB)

Binance is the world’s largest cryptocurrency exchange. Its native token, BNB, is an excellent long-term staking option due to its growth potential. Additionally, staking is very easy using the Binance platform with its user-friendly interface.

The minimum threshold for delegator staking is very low, at 0.0001 BNB ($0.048). BNB Vault on the Binance platform is a good choice for beginners who want to stake BNB.

Cardano (ADA)

Cardano (ADA)

Cardano launched in 2015 as a layer 1 blockchain platform competing with Ethereum. It shares many features with ETH, including smart contracts, and also has the advantage of having a PoS algorithm built in from the beginning.

Over the years, Cardano has grown into one of the leading layer 1 blockchain platforms, with a market capitalization of $37 billion at the time of this writing. Of course, it is smaller than BTC and ETH. However, Cardano and its sister token ADA have strong communities and forward-looking development roadmaps.

APRs are very competitive and often have no lock-up period.

Solana (SUN)

Solana (SUN)

Solana is positioned as a younger, more sophisticated version of Cardano and Ethereum. As a result, Layer 1 has seen tremendous growth since its launch in April 2020. As of this writing, Layer 1 sits in the top 10 most valuable cryptocurrencies, with a market capitalization of nearly $12 billion.

With its unique “proof-of-history” consensus mechanism and excellent support for smart contracts, DeFi, and NFTs, Solana has attracted significant attention from developers and institutional investors. Like its competitor Cardano, SOL is Layer 1 to watch.

Its competitive APR makes it a solid choice for cryptocurrency staking. Additionally, there is no minimum SOL token amount required for delegator staking.

Algorand (ALGO)

Algorand (ALGO)

Algorand is another layer 1 to become an “Ethereum killer”. It has a robust development team led by a respected MIT professor, smart contracts, and an enhanced consensus protocol called Pure Proof of Stake.

ALGO, Algorand’s native token, offers competitive interest rates. And Algorand’s speed and low cost could make it an investment worth holding for the long term.

Tezos (XTZ)

Tezos (XTZ)

Don’t be fooled by the market cap being “only” $1 billion. Tezos has been around longer than most tokens. However, after a successful ICO in 2017, internal difficulties and instability hindered growth.

The APR for Tezos XTZ tokens is quite reasonable. Additionally, as of this writing, the asking price is around $2, and there is no minimum stake or lock-up period for delegators, making it an option for those new to cryptocurrency staking.

FULL

FULL

Celo focuses on DeFi, smartphones, and sustainability. The Valora payments app has gained wide acceptance in the mobile money transfer space. With strong backing from several high-profile investors, Celo is a cryptocurrency startup with a potentially exciting future.

The low percentage of tokens staked makes Celo an excellent option for cryptocurrency staking. As of this writing, the APR is relatively high, there is no minimum stake and the lock-in period is short at just 3 days.

MY

MY

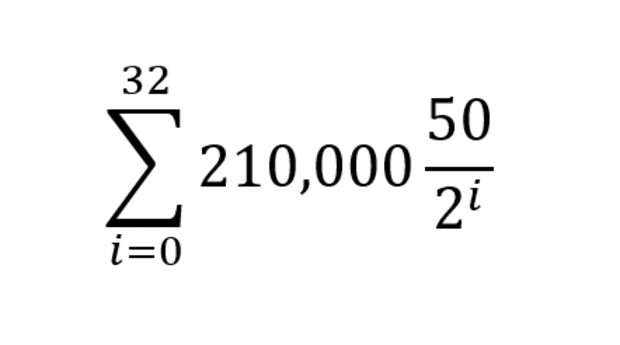

With a total blockchain size of only 22kb, Mina has the lightest cryptocurrency codebase on the market. (By comparison, the Bitcoin blockchain is currently growing to 350GB.) The focus on minimalism has the potential to speed up cryptocurrency transactions, an area where larger digital assets have struggled.

Originally called the Coda protocol since its launch in 2017, Mina was rebranded in 2020 and has a high APR.

avalanche

avalanche

One of the newest cryptocurrencies on the list, Avalanche prides itself on being one of the fastest smart contract cryptocurrencies in the blockchain industry in terms of time to final completion. Avalanche currently has a market cap of around $5 billion and is one of the top 20 cryptocurrencies.

Avalanche has the potential to become one of the best smart contract platforms. Considering its proof-of-stake model, Defi application suite, and high-profile backers, the currency could be at the top of its game when the time comes. Avalanche Blockchain’s recent private equity tokenization trend allows investors to start investing in private markets without needing professional connections or huge amounts of cash.

polka dot

polka dot

Polkadot, which was created with the intention of competing with contemporary cryptocurrencies such as Ethereum, is the 11th cryptocurrency by market capitalization, reaching $7.6 billion. The ability to support parachains (short for ‘parallel chains’) is attractive to developers because it allows blockchains to run alongside each other to speed up transactions.

These technological innovations allow Polkadot to often return high interest rates. Along with the greater risk, there is also potentially more to gain for investors.

Polkadot’s new on-chain governance model, called “Gov2,” means more good news for investors. Gov2, which replaces the parliament-led governance model, will establish a more open and decentralized structure.

polygon

polygon

Polygon is considered one of the most promising projects in the cryptocurrency space. Polkadot, launched as MATIC in 2017, is a layer 2 scaling solution supported by Binance and Coinbase. Its appeal lies in improving the scalability of many blockchains, thereby promoting mass adoption of cryptocurrencies.

Similar to Polkadot and Avalanche, Polygon comes with the ability to create multi-chain networks. The only difference is that this blockchain network runs on Ethereum, so Polygon is included in Ethereum’s robust security and open ecosystem.

Cosmos

Cosmos

Since its launch in 2017, Cosmos has set out to solve a pressing problem in the industry: the inability of blockchains to interact with each other. Described as “Blockchain 3.0,” Cosmos’ native ATOM token has held up well through the cryptocurrency winter of 2022.

Cosmos not only acts as a bridge to blockchains, but also allows developers to quickly create complex blockchains within the Cosmos ecosystem. Because of this, Cosmos is steadily growing in dapp developers and users.

tron

tron

Tron incentivizes content creators to upload data to the blockchain by being rewarded with TRX coins. As a result, Tron is largely decentralized.

TRX staking comes with a decent APR. And considering the token price of less than $1, TRX may be worth buying and holding for the long term.

short range protocol

short range protocol

Near’s uniqueness lies in its sharded version. This technology, called “Nightshade,” improves the overall capacity of the blockchain by allowing individual validators to process transactions simultaneously across multiple sharded chains.

Near boasts a market capitalization of approximately $3 billion as of this writing. With the platform likely to reach ATH in the next five years, now may be a good time to buy and stake for the long term.

flow

flow

Perhaps Flow’s biggest selling point is its target audience: mainstream users. From NBA Top Shot to Bud Light, blockchain is powering many of the best NFT projects aimed at the general public.

Flow may seem like a smaller Layer 1, but given its significant APR, stability from well-known investors, and traction among casual users, it could be a worthwhile long-term investment.

Investor Implications

The main focus of cryptocurrency staking is to generate profits from dormant assets. Instead of looking for the cryptocurrency asset with the best staking yield, it is important to balance it with long-term profit potential.

Starting from this “HODL perspective”, you can prioritize large, well-established staking coins over obscure cryptocurrencies with double-digit APRs.

Subscribe to the Crypto Investor Newsletter for the latest staking strategies.