BHP: The positives aren’t enough yet

BeyondImage

Since writing about Australian multi-commodity miner BHP (New York Stock Exchange: BHP) Prices were up 16.4% in July and total returns were a further 19.7%. There were cases where it was in stock at the time. This is due to its lower market valuation compared to the materials sector and its solid TTM (12 months) dividend yield of 9.4%.

However, at the time, I maintained a Hold rating due to weak fundamentals. Not only have profits plummeted for the year ending June 30 (FY23), but the outlook has been weak. Especially since the outlook for China is not as positive as previously expected. But things have changed somewhat since the optimism arose. But the real question is whether enough has changed to justify a bigger price rise for BHP.

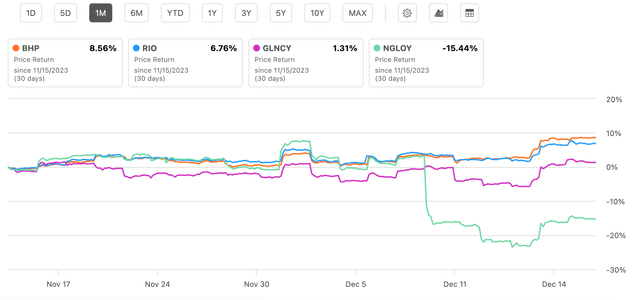

price chart (Source: Pursuit Alpha)

Why did the price rise?

A key reason investors are bullish on BHP is rising iron ore prices following China’s improving outlook. Iron ore prices are currently up more than 26% YTD, with most of the gains occurring only since October. These products are particularly important to BHP, contributing 46% to revenue in FY23 and accounting for a higher share of EBITDA and EBIT of 60% and 64% respectively.

It’s probably no coincidence that Rio Tinto (RIO), which relies heavily on iron ore, has also been on the rise recently. In contrast, other miners, such as Anglo American (OTCQX:NGLOY), which has a small iron ore presence, and Glencore (OTCPK:GLNCY), which mines no iron ore, are lagging (see chart below).

Comparison with colleagues (Source: Seeking Alpha)

smooth production

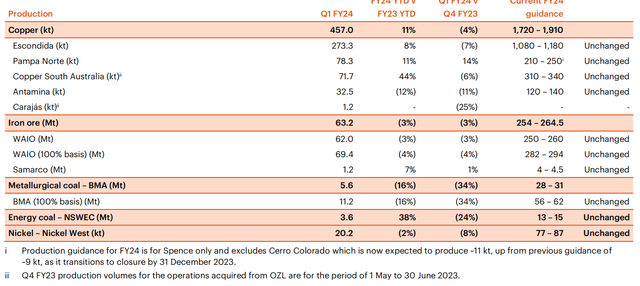

The company’s first quarter operating review (quarter ended September 2023, Q1 FY24) further confirmed that BHP is on track with no changes to guidance for each product (see table below). Importantly, copper, the second largest contributor to both BHP’s revenue and profits, saw production increase by 11% year-on-year during the quarter. Sales of iron and copper also increased by 9% and 3% in volume terms, respectively.

Source: BHP

improved outlook

Continued production and a better outlook for iron ore prices are particularly important for BHP this year due to a weak outlook following a poor FY23. Last year, the company’s revenue fell 17%, and underlying attributable profits fell a further 37%. Accordingly, dividends were also reduced by 48%.

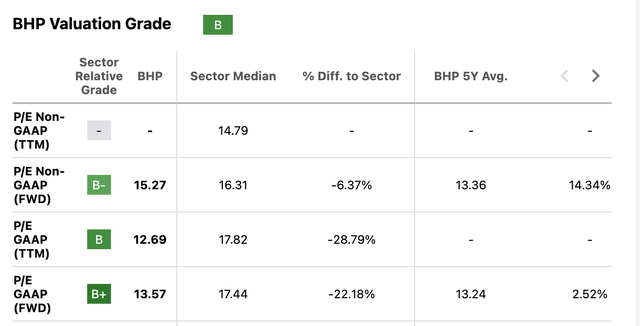

Not surprisingly, the outlook for BHP has improved. Last time I checked, analysts on average expected sales to decline by 2.5%. In contrast, they now expect revenue growth of 2.5%. Assuming net attributable margin remains the same as FY23 at 23.8% and underlying attributable margin remains at 24.7%, BHP’s forward GAAP price-to-earnings (P/E) ratio is 12.5x and non-attributable margin is 12.5x. GAAP P/E is 12x.

Both forward ratios are competitive compared to materials sector ratios and below BHP’s own five-year average (see table below). However, note that my forecast is more optimistic than the average of analysts’ future forecasts, which is higher than the five-year average.

Source: Seeking Alpha

danger

If the risks to BHP are limited I’d be willing to base my rating on my own estimates. But that is not the case. First, it remains to be seen how much more iron ore prices can rise. As I pointed out in the recent article about Rio Tinto linked above, the Chinese government is ready to intervene to curb the runaway price rises of iron ore. In other words, it cannot be assumed that the recent price rise will continue. This could ultimately limit your potential profits for the year.

Next, the company is at risk of a strike. It began last October when train drivers planned a strike at Australia’s Pilbara iron ore operations to protest employment conditions. They later withdrew that action after the company proposed updated terms.

But uncertainty has grown as 80 open cut coordinators at Queensland coal mines, who oversee the mine’s compliance with safety regulations, are preparing to strike over redundancies and accident compensation. The situation is still ongoing while BHP is negotiating with workers.

The bigger point here is that the company, like many others, from automakers to Hollywood, has experienced labor unrest this year. At least for now the situation at BHP is under control, but the risk of further industrial action cannot be ruled out at this point. If a strike goes ahead, the consequences could be particularly damaging for companies already in a raw materials downturn.

What’s next?

There’s no denying that there’s good reason why investors have been feeling positive about BHP recently. Not only has the price of iron ore risen, but its own production is also progressing smoothly. Additionally, my estimates of future market value also reflect the strengthening competitiveness of the materials sector and its average over the past five years.

But there are also clear downside risks. First of all, the rise in iron ore may not continue if the Chinese government intervenes and secondly, if the price of copper, the most important commodity, does not move anywhere this year. In any case, even now, there is not much upside to BHP’s sales in FY24.

You may be affected if planned industrial action takes place. A strike has been avoided at the iron ore mine, but the possibility of a strike at the coal mine is still being discussed. The bigger point here is that strikes are dangerous now and in the near future.

Meanwhile, the forward dividend yield was 4.9%, down 0.5 percentage points from the last check. Normally I give great weight to my own estimates of market multiples, but in this case I’d like to make an exception. There’s a lot of risk around and the upside isn’t big enough yet to overcome the risk if things go south. It doesn’t help that I’m in the minority when it comes to predicting a stock’s upside.

I do not rule out a continued positive turnaround for BHP. It’s just that it hasn’t yet gathered enough momentum to justify continued price increases.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.