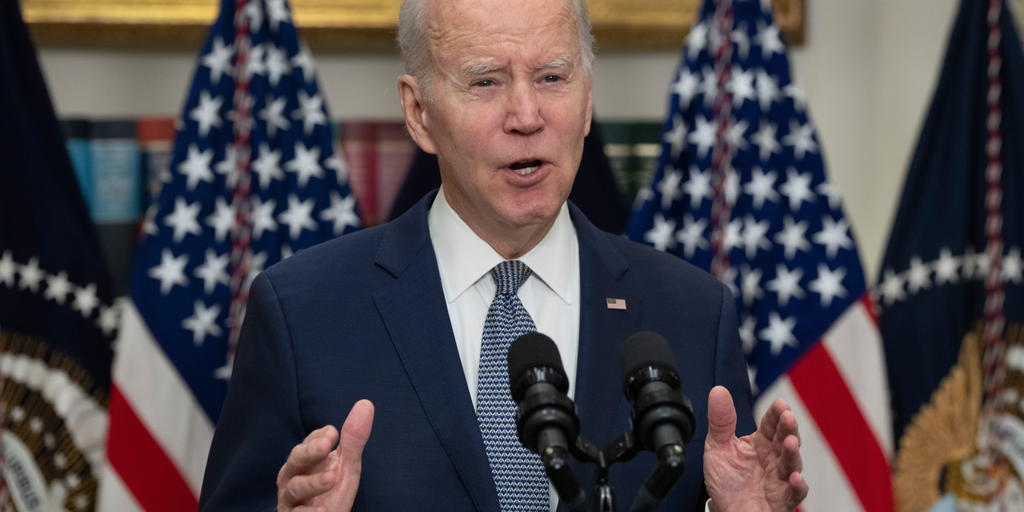

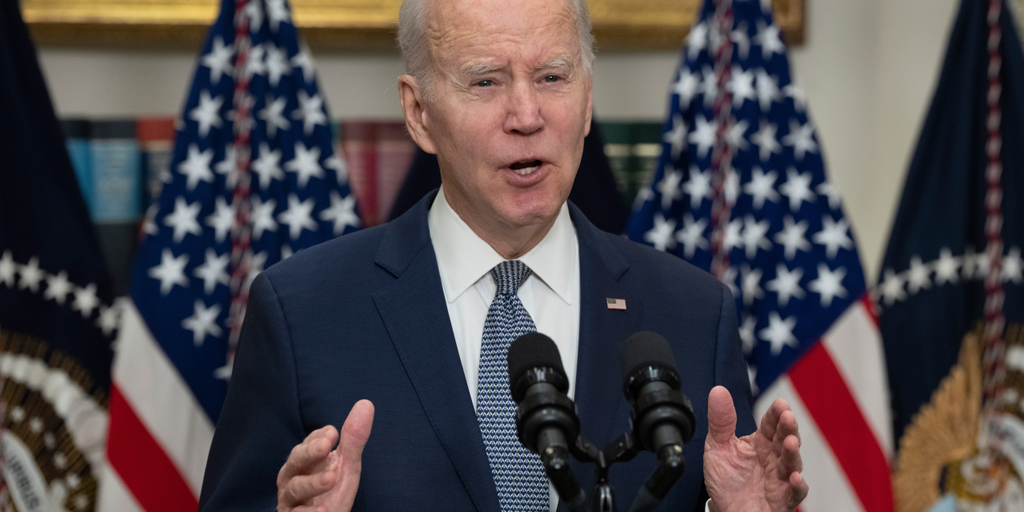

President Joe Biden is “against” the Financial Innovation and Technology for the 21st Century Act (FIT21), the cryptocurrency market structure bill that will be voted on by the House of Representatives on Wednesday. But he did not threaten to veto it, potentially signaling a change in administration.

Biden previously announced that he would veto the Securities and Exchange Commission’s (SEC) bill eliminating regulations on banks’ custody of cryptocurrency. A bill to repeal the SEC’s Employee Accounting Bulletin (SAB) 121 pass In the House and Senate, Biden has yet to veto it.

White House said We oppose the FIT21 bill because it lacks sufficient protection for consumers and investors participating in cryptocurrency. Meanwhile, this stance echoed the words of SEC Chairman Gary Gensler, who sounded the alarm in written remarks Wednesday.

in letterThe agency’s leader warns that enacting new rules to regulate cryptocurrencies could undermine the strength of U.S. capital markets and leave investors in the dark about information that should be disclosed, “putting (both) at immeasurable risk.” I did.

This afternoon the House of Representatives is scheduled to vote on FIT21. The bill, which has bipartisan support from Democrats and Republicans, would create a federal framework for the SEC and Commodity Futures Trading Commission to regulate digital assets.

Among the complaints, Gensler lamented that the bill would remove so-called investment contracts from the legal definition of securities. The SEC previously stated that many tokens are similar to securities in that investors allocate money to them in the hope of receiving benefits derived from the efforts of others. Changing the name of a cryptocurrency is telling, Gensler argued.

“This bill implies what courts have repeatedly ruled but cryptocurrency market participants have attempted to deny: that many cryptocurrency assets are being offered and sold as securities under existing law,” he wrote.

Gensler’s warning comes as political winds are shifting on Capitol Hill.

Experts pointed to former President Donald Trump. accept cryptocurrency This is the driving force behind the urgency to enact new cryptocurrency rules. News that the Trump campaign is now accepting cryptocurrency donations broke yesterday after lawmakers voted to eliminate the SEC’s cryptocurrency custody rules that limit banks’ ability to protect their assets.

Given how decentralized cryptocurrencies are, the bill would provide a path for project issuers, “or anyone,” to self-certify their assets as “digital goods,” Gensler wrote. Gensler, who left the SEC with only 60 days left to review and challenge the certification, expressed doubts that the agency would be able to keep up, citing limited resources.

Gensler noted that the SEC is being asked to do more without additional funding. And if the agency fails to challenge the certification during the aforementioned time period, “the majority of the market will be able to avoid even limited SEC oversight,” he said.

Gensler argued that excluding cryptocurrency asset trading platforms like Coinbase from the exchange definition could harm investors. That’s because companies can theoretically mix funds or bet against customers.

He believes that if non-cryptocurrency companies pursue a framework that Gensler described as a “light touch,” allowing companies to pick and choose which regulatory regime applies to them could be disastrous. Penny stock pushers and pump-and-dump schemers are among those who could, Gensler said.

“Many players in the cryptocurrency industry do not follow the rules,” Gensler concluded, pointing to scammers and bankruptcies. “We must make policy choices that protect the investing public rather than promoting the business models of non-compliant companies.”

Editor: Andrew Hayward

daily report newsletter

Start your day today with top news stories, original features, podcasts, videos and more.