Binance CEO Changpeng Zhao pleads guilty and resigns

The following is an excerpt from the latest edition of Bitcoin Magazine Pro, Bitcoin Magazine’s premium markets newsletter. To be the first to get these insights and other on-chain Bitcoin market analysis delivered to your inbox, Subscribe now.

In a shocking development to the international Bitcoin community, Binance founder and CEO Changpeng Zhao has stepped down from his role as part of a guilty plea to criminal and civil charges in the United States.

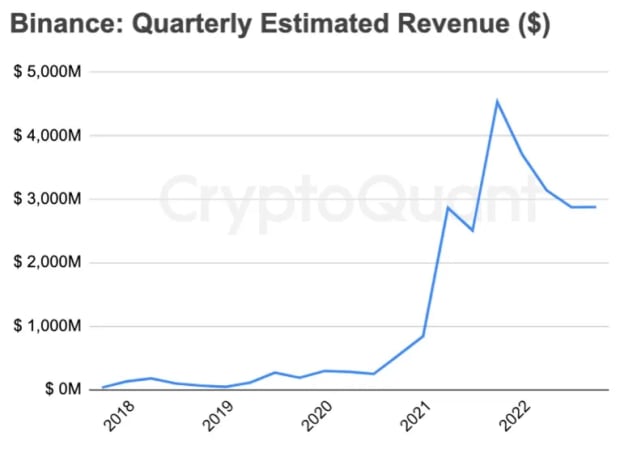

Binance, the world’s largest digital asset exchange by size, has its future uncertain as a result of its legal battle with the U.S. Department of Justice (DoJ). Founder and CEO Changpeng Zhao, also known as CZ, pleaded guilty to money laundering offenses on September 21, resigning from his position and agreeing to pay a $50 million fine. Fines may be reduced. Binance will also pay a whopping $4.3 billion fine, which appears to have been confirmed. The agreement follows a months-long legal battle in which the Justice Department charged him with several serious violations. Not only did it facilitate transactions with sanctioned groups, such as Russian mercenaries fighting in Ukraine, but it also encouraged users to cover their tracks for potential money violations. Laundry method.

Bitcoin Magazine Pro is a reader-supported publication. To receive new posts and support our work, please consider becoming a free or paid subscriber.

Since its founding in 2017, Binance has grown steadily over the years to become the most popular Bitcoin exchange in the world. The company was initially founded in China, but has moved locations several times to several continents over the years and currently has no official headquarters. It has become infamous despite the fact that another platform, Binance.US, is needed to provide all kinds of services within the United States. But the biggest windfall came when it absorbed FTX customers following the exchange’s apocalyptic collapse. CZ has long been one of the largest players in the industry, but Binance has become undisputed the largest player in the industry, especially since FTX fell. And now CZ’s deal appears to be a final move to keep the company afloat.

“Binance will be fine,” CZ said in his resignation letter, released a day after pleading guilty in Seattle. I will have to suffer a little, but we will survive. There will be some changes in structure, but we will get through this. “Looking back a few years from now, I don’t think it would be that bad,” he said. “I needed a break anyway.” In public, he tried to put on his upbeat face, expressing confidence in his staff and encouraging a smooth transition for his new chief, Richard Teng. Despite this confident exterior, new challenges still face CZ and his company.

First, Binance.US is not strictly subject to the initial plea agreement with the Department of Justice, as Binance had to spin off its subsidiaries to operate within the United States. In fact, as of November 27, the Securities and Exchange Commission (SEC) is actively investigating the US branch for misuse of consumer funds and possible backdoors that CZ may use to maintain access to Binance.US assets. Binance lawyer Matthew Laroche argued that the company was “daunted by the stress and costs of the SEC litigation.” The average monthly value of Binance.US assets has decreased by nearly 90%, and Binance.US has lost nearly half of its monthly users since the SEC filed its lawsuit.”

In addition to these ongoing attempts to limit CZ’s potential resources, his movements are also being curtailed. Changpeng Zhao has established ties with many countries. He was born in China, his family immigrated to Canada when he was young, and he has Canadian citizenship. Additionally, he is a citizen of the United Arab Emirates and resides there with his wife and his children. Given that the latter country does not have an extradition treaty with the United States and that CZ has access to vast resources, Seattle District Court Judge Richard Jones labeled him a flight risk. As part of his bail agreement, CZ was temporarily prohibited from leaving the United States. That’s because the government insists that billionaires with foreign citizenship who could plead guilty and face prison terms will be detained “in most cases.” In other words, the fact that he was released from prison in the United States makes it impossible for him to leave the country, let alone leave the country.

Clearly, the assumption that a company’s founders and presidents would engage in this kind of behavior does not bode well for business. Already, one of its main competitors is seeing a major uptick in the same way that Binance benefited from FTX’s collapse. After CZ announced his resignation, exchange Coinbase’s stock price rose about 20% in five days. This rise for Coinbase comes amid an extremely profitable year, as the company’s overall stock value has risen nearly 90% in the past six months. Coinbase is even engaged in a legal battle with the federal government, but it’s clearly better in this regard.

Still, despite all these challenges, the company is looking forward. New CEO Richard Teng told media that the company has a “firm timeline” to drive compliance. He said, “Binance is a company that has been established for 6 years. “It’s a relatively young company by all accounts,” he said, asserting that he plans to usher in a change from the “disruptor” attitude of many tech startups and position the company as part of the world of traditional finance. . Teng, a former banking regulator, hopes to bring this coordination experience to Binance’s future. Solidarity also exists even when other companies may benefit from the failures of their competitors. Former BitMEX CEO Arthur Hayes said CZ’s treatment was “unreasonable” compared to other money laundering offenders such as former Goldman Sachs CEO Lloyd Blankfein. , questioned what these developments could mean for all digital asset exchanges.

Beyond Coinbase itself, it’s important to consider how Bitcoin as a whole is taking these developments. That means it was okay. This means that the price rally that started in October is continuing unabated. Compare this to the five alarms raised when FTX collapsed and it’s easy to see how the industry has matured. Commentators have noted the general confidence that Bitcoin is here to stay. Some of the biggest crashes in Bitcoin history have coincided with the downfall of major exchanges, but headlines have been filled with general optimism and Bitcoin’s rally has not faltered. The situation in 2023 seems clear. Although individual companies can have their ups and downs, Bitcoin has gained enough adoption and notoriety that more than one company has suffered serious harm. Binance may well recover from a setback like this, and if it does, there will be a busy industry waiting for it.