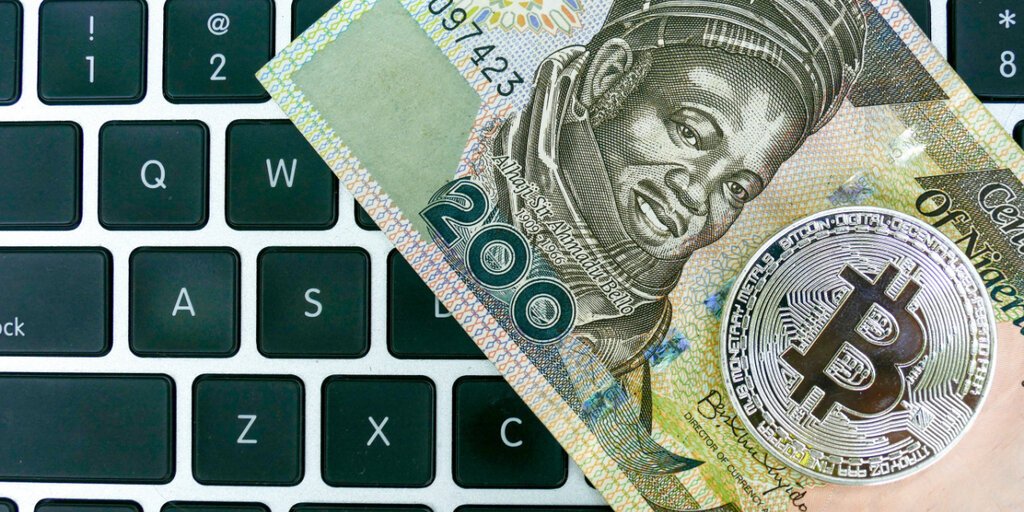

Nigeria has stepped up its investigation into global cryptocurrency exchange Binance by demanding the names and transaction details of the top 100 Nigerian users, according to news reports.

It has been three weeks since the Nigerian government detained two senior Binance executives. The government’s move highlights its intention to stabilize Nigeria’s currency, the naira, which has come under severe pressure due to recent devaluation.

According to documents confirmed by police: Financial TimesThe Office of Nigeria’s National Security Adviser is also asking the exchange to settle its outstanding tax debt.

President Bola Tinubu’s administration said the rise of cryptocurrency platforms such as Binance presented challenges, including providing an alternative exchange rate for the naira and facilitating speculation.

Nadeem Anjarwalla and Tigran Gambaryan, key figures in Binance’s Africa operations, are being detained without charge in the Nigerian capital, Abuja. Their detention, seen by some as a tactic to pressure Binance into compliance, has heightened diplomatic tensions with the executives’ home countries, Britain and the United States.

“While it would be inappropriate to comment on the substance of the claims at this time, we can say that we are working with Nigerian authorities to return Nadeem and Tigran to their families,” Binance said. FT From the statement.

The situation highlights the complex dynamics at play as Nigeria navigates economic challenges while trying to regulate the cryptocurrency sector without stifling innovation or alienating international partners. Critics argue that while regulation is necessary, focusing on Binance may not address the broader economic problems facing Nigeria, suggesting a more nuanced approach is needed to ensure stability and growth.

Cryptocurrency trader Ozioma Okechukwu told local news outlets: punch Binance said the delisting of naira from its exchanges has left it worried about what will happen to other exchanges.

“I know of other cryptocurrency exchange platforms operating in Nigeria, but many of us are familiar with Binance. Any way you look at it, it is a huge blow to the market.”