Bitcoin and Benjamin Franklin

New natural enemy

There is no doubt that the last cycle of global elections, especially in the United States, has revealed some of the last cycle of global elections. “Elephant in the room” Full of hypocritical actions, psychological experiments that apply proletaria to new forms of manipulation, and through control according to the appearance of wrong information. The world after the Cold War moved to the world of enemies needed to feed the west in good and evil fairs. Establishment of military industry politics. In such a void Illuminati In power, we found new natural enemies to ensure power -based continuity. The new opponent has become a populus itself.

What can be overlooked is that this verse, which dominates the proletarian, began a long time before the end of the Cold War. It is a seed of many self -help efforts to improve Western educational systems, to prevent “non -elaborate” investors from making their own financial decisions, and to save Kuma democracy, dollar and market systems.

False Fiat Victory

today, Establishment of military industry politics He claimed that he won a total of 99 percent based on a series of battles that dates back to the 1980s. They were an era of deregulation Wall wolfAnd as an alternative, financial engineering that can call perestroika with money. I see the 1980s a turning point in Western civilization. This era seemed so good in the 1970s, filled with scaflation, economic and political decline, war and hostage. However, later, the social-monetary battle aimed at squash Flebian It is to dominate education means, wealth creation, transportation, meals and work habits and thoughts and other areas.

If the 1980s did not accept the fact that we had imposed such a vast social change, I heard that the public is the future of traveling with the airline, taking into account the birth of the first cheap airline, Peoplexpress. There is no longer a reserved seat or meal. Ten years have been seen as the No. 1 area of research selected by college students. Graduates have forgotten the “true” work as the future rotates only about moving money from A to B. Our food chain jumps over the cliff and continues innovation such as “Olestra” and innovation such as local substitutes. It not only claims that it is to reduce your calorie intake, but also provides abdominal cramps and loose chairs as printed on the warning label of all products that contain it. And for those who read this tree, I saw the disappearance of glass bottles for 10 years with Tetra Pak Plastic Generation.

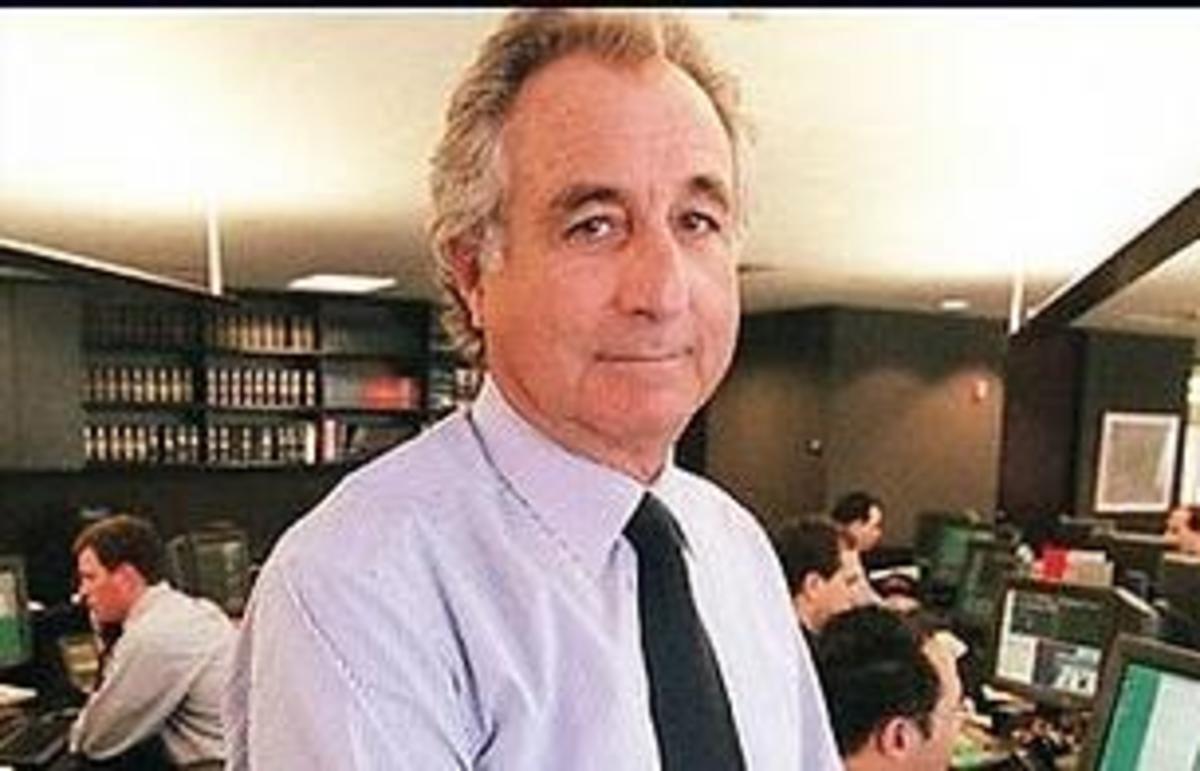

One of the most important movements in the 1980s mentioning the shaking behavior on the ground is the annoying of our educational system. This imposition resulted in a long -lasting negative consequences in the ability of an individual to make reasonable thinking, to express tolerance and show decision -making ability. teaching “pride” At school, it was a manner without income. Just providing rewards for “attempts” has become 35%of the university lecture plan grade. The California Crusaders inferred that raising people’s self -esteem can reduce crime, poverty, pollution, global warming and most social evils. But they “fix money” “Fix the world”. Instead of teaching the public about practicality and rationality, the public teaches the public to lightly. Changes in ways of thinking, amendments to social and educational order in the 1980s have had the impact of global social norms, values, and financial literacy.

“The loser is a true winner.”

In the next decades, the movements I emphasize have affected the next generation. Financial literacy Among other social norms. We now have a good intention to cause our frustration as we try to educate not only young people but also adults, but we can see the results of the wrong program. Bitcoin.

I remember the phrase I heard once on TV sitcom. “The loser is a true winner.”

Is this the present world we want?

I’m sorry for my anger, but as Shakespeare said: “I am Rant, therefore I”. If you are depressed at this point, take medicine, take a nap, or raise a pair.

“Rotten” orange… .. Pilling

What is the problem with investors and markets today? They are Tiktok Investor Creation Anyone who decides to make an investment decision and make a quick money after spending 14 hours a day consumes 14 hours a day by scrolling the apps that are replaced by the “education” of “education” of the university in practical finance. Today’s investors think that there is an immunity in the past. They know everything. Somehow learned in history is no longer a problem beyond five years of work at the Big-4 consulting firm after earning a double business/4th-century art history from $ 200,000 student loans.

that Wall-Political Media Industrial Complex It has been added to the investor “Dumin”. They did this through the same tribulation Libor’s manipulation, gold market collusionand Madoff ponzi It led to pure unbelief of all financial or mathematical stimuli established regardless of the foundation or potential learning circle. The wrong information that was politically motivated was further supplied with a fire that advocated it. Inflation is “good for you” And as recently known, there is no economic downturn. The world political power also added a bit that says “green or death.”

“Fools and his money will soon break up.” It was a proverb. But today’s fools are rational sacrifices to earn income.

Since the 1980s, the world’s central bank funding printor has added drugs by creating liquidity of liquidity. weapon Tiktok investor In terms of liquidity Alan Greenspan “Irrational urge” result. Investors misrepresent that they are portfolio theory, risk management and investment experts. The liquidity glut is widespread faster through the tiktok generation. The metropolitan area/gate inspired the virus..

In other words, this rotten orange has created today’s irrational money management spirit for decades. DUNNING -Kruger effect was incentive to throw money into “shitcoins” rather than Bitcoin.

Moneyzine.com The percentage of American adults with poor financial literacy accounted for 25%in 2023, and the Z generation and the Gen Y generation have the lowest financial literacy at 38%and 45%, respectively, and 48%of the teenagers are social media of social media Learn about personal finance.

Aleksandr Solzhenitsyn said: “Humans are born with different abilities. If they are free, they are not equal. And if they are equal, they are not free. ”

But can value proposals and monetary revolutions overcome such dilemma?

Have you ever hypothesized that ALEKSANDR Solzhenitsyn could be applied to our desire to escape Fiathegemon?

Can Bitcoin provide humans with great equalizers and personal freedom at the same time?

From rotten orange flowers to orange flowers

Not only to educate a new generation Bitcoin Also, re -educating the public about financial common sense should be a priority. Practicality should be prioritized with the same thing obtained from Instagram. Today’s Robinhood ‘s should stop learning financing for tiktok and study historical context. Concerned Bitcoin Bold Greg Force said “Just mathematics”.

“Soft Speaker” Max Keizer also said: “We must truly drain the Kleptocratic Swamp, which continues to educate the public and encourages the savings of Bitcoin and dominates the financial system.”

Even the Bank of God was inevitable to be anger of the Fiat world, which is commonly sensitive to non -commonly sensitive Fiat world with his death too far from one leg.

Without the compromised financial sense Benjamin Franklin Inside “Road“,

“We are three times by our idle state, pride, and four times more taxes by foolish.”

Are you ready to wake up again with the necessary reality or to be taxed four times?

This is the guest post of ENZA Coin. The expressed opinions are entirely their own opinion and do not necessarily reflect the opinions of BTC Inc or Bitcoin magazines.