Bitcoin (BTC) rose 5% after reaching US$45,000 and the French bank listed its stablecoin on Bitstamp.

Major cryptocurrencies rose strongly again this Wednesday (6) in good spirits among stock traders after data showing a slowdown in the US job market.

Bitcoin rose 5.4% in 24 hours to $43,964.25, according to data from Coingecko.

BTC is also up 5%, trading at R$217,506.95, according to the Bitcoin Portal Index (IPB).

According to a report from Portal do Bitcoin, Kucoin customers in the Brazilian market have recently encountered problems with withdrawals and deposits and are frustrated with the community due to the lack of advance notice.

Part of the current rally has been driven by expectations of the launch of a spot Bitcoin index fund (ETF). However, managers are also leveraging these flows to bring spot Ethereum ETFs to market. However, the SEC, the US CVM, once again postponed the decision to convert the Grayscale Ethereum fund into a spot ETF.

Ethereum (ETH) recorded an increase of 3.4% in 24 hours to US$ 2,280.76.

The largest altcoins also traded in the black, including BNB (+1.7%), XRP (+3.6%), Solana (+9%), Cardano (+8%), TRON (+0.4%), and Toncoin (+0.1). It is becoming. %), Chainlink (+3.7%), Polkadot (+6.8%), Polygon (+5.1%), Shiba Inu (+10%).

Avalanche surges 18%, while billionaire Elon Musk’s pet token Dogecoin rises 15.5% in 24 hours. Memecoin’s gains accelerated as Musk-backed artificial intelligence startup X.AI plans to raise $1 billion from investors in exchange for equity in the company, according to a filing with the SEC.

Bitcoin Today

Bitcoin started Tuesday (5) without strength, but gained momentum throughout the day, reaching the USD 45,000 level on Coinbase.

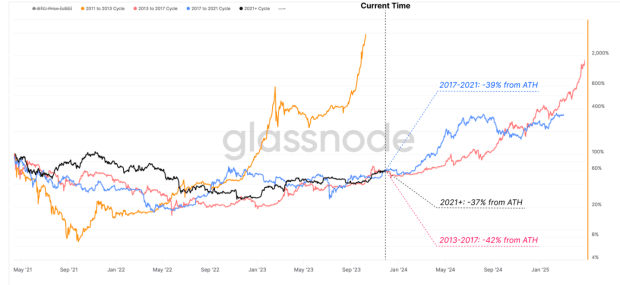

The three pillars most cited by experts for benefits are the prospect of an interest rate cut in the U.S., a Bitcoin “halving” in 2024 when rewards to miners will be halved, and the potential launch of funds with exposure to the U.S. market. From the largest cryptocurrencies to the so-called spot ETFs.

In this context, the FOMO factor (short for “Fear of Missing Out”) also looms large and tends to influence asset negotiations in rallies.

If Bitcoin remains above US$44,000, traders holding short positions, i.e. those betting on the cryptocurrency falling, could suffer losses due to liquidation.

BTCM Chief Economist Youwei Yang identified $45,000 as the next important resistance level for Bitcoin and told The Block that a “selling squeeze” is likely to occur above this level.

The world’s largest cryptocurrency has already seen gains of more than 150% this year, largely driven by institutional investors. However, despite the current euphoria, some analysts advise caution as trading volumes remain low.

The seven-day moving average of daily trading volume was $27 billion on Dec. 4, below this year’s peak of $47 billion, according to data from The Block.

SocGen lists stablecoins on Bitstamp.

Société Générale has decided to launch its own stablecoin on a cryptocurrency exchange, becoming the first major bank to list this type of digital asset to its broad investor base, according to the Financial Times.

France’s third-largest bank will begin trading stablecoins pegged to the euro EUR CoinVertible from Luxembourg-based Bitstamp this Wednesday (6).

“The cryptocurrency ecosystem is highly concentrated in a few existing stablecoins, with 90% denominated in the US dollar. . . We definitely think there is a place for banks in this space and there is a place for euro-denominated stablecoins,” Jean-Marc Stenger, CEO of SocGen Forge, the bank’s digital asset arm, told the FT.

The stablecoin market has not been immune to the recent cryptocurrency rally, recording its first expansion since May 2022.

Meanwhile, Binance suspended trading in the euro-backed stablecoin AEUR, citing “abnormal volatility.” CoinDesk reported that the token rose 200% on Tuesday after being listed on the exchange.

New Binance CEO Avoids Questions at Conference

At a Financial Times event in London on Tuesday (5), Binance’s new CEO Richard Teng refused to answer questions about where the world’s largest cryptocurrency exchange is headquartered.

Teng replaced Changpeng “CZ” Zhao as Binance’s CEO last month after Binance pleaded guilty to violating U.S. money laundering regulations and international sanctions. CZ also pleaded guilty to failing to comply with anti-money laundering regulations and resigned.

According to the FT, Teng said Binance had been audited in regulated jurisdictions but failed to identify the audit firms involved.

Interviewed via video conference during the “FT Cryptocurrency and Digital Asset Summit,” Teng asked, “Why do you think you deserve these answers?” Management said the broker had already provided regulators with the information they needed. “Do we need to share all this information publicly? “No,” he added.

Kristin Johnson of the Commodity Futures Trading Commission (CFTC), who also attended the event, said the US$4.3 billion fine imposed on Binance was increased to serve as a warning to other players who do not follow the rules.

Other Cryptocurrency Highlights

Coinbase, the largest U.S. cryptocurrency exchange, has launched a service that allows customers from various countries to send money for free through messaging apps and social networks. “We’ve made it easy to send money to messaging apps like WhatsApp, iMessage, Telegram, social media platforms like Facebook, Snapchat, TikTok, Instagram, and even anywhere you can share a link via email,” the company said in a statement. .” . Both parties must have a Coinbase wallet to send money.

According to The Block, Helium Mobile, the self-described “world’s first cryptocurrency carrier,” has announced a U.S. plan offering unlimited data, texting, and calling plans for $20 per month. Helium Mobile’s service combines the “peer-to-peer” Helium network (an Internet of Things project using the Solana blockchain) with a nationwide 5G network. The launch follows testing in Miami earlier this year.

To support transparent innovation and responsible development in artificial intelligence, technology giants led by IBM and Meta have come together in a new organization called the AI Alliance. The AI Alliance aims to prioritize security, collaboration, diversity, economic opportunity and benefits for all, IBM and Meta said in a joint statement.

Want to make more money with Ethereum? Open an account with Mercado Bitcoin, the safest broker in Brazil and start staking today.

Crypto Morning: Bitcoin (BTC) Rises 5% After Reaching US$45,000, Bitstamp’s French Bank-Listed Stablecoin appeared first on Portal do Bitcoin.